web3.0

web3.0

Bitcoin hits new high in 1 minute, flash crash pulls back $10,000, is the bull still there?

Bitcoin hits new high in 1 minute, flash crash pulls back $10,000, is the bull still there?

Bitcoin hits new high in 1 minute, flash crash pulls back $10,000, is the bull still there?

Author: Nan Zhi, Odaily Planet Daily

At 23:00 yesterday, BTC broke through 69,000 USDT in the short term, reaching a maximum of 69,080 USDT, surpassing the previous high of 69,040.1 USDT set in November 2021.

OKX market conditions show that BTC only broke through the previous high for less than 1 minute, and then the entire crypto market experienced a rapid decline. At 3:55 in the morning, BTC once fell to 59,000 USDT, ETH dropped to as low as 3179 USDT. As of the time of publication, the decline has been recovered. BTC is now trading at 63,300 USDT, with a 24H drop of 7.8%. ETH is now trading at 3,524 USDT, with a 24H drop of 3.5%.

CoinGecko data shows that the total market value of cryptocurrency fell to 2.47 trillion, a 24H drop of 5.9%. Alternative data shows that crypto users’ trading enthusiasm has dropped significantly compared with yesterday. Today’s Panic and Greed Index is 75, with a rating of “Greedy” , while yesterday’s Greedy Index was 90, with a rating of “Extreme Greed”. A new high since February 2021.

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the entire network liquidated $1.154 billion, of which long orders liquidated $888 million, short orders liquidated $266 million; BTC liquidated $323 million, ETH liquidation hit $208 million. The open position of Binance BTC contract is 6.66 billion US dollars, a 24H decrease of 10.9%, and significant deleveraging.

Downward force - profit-taking by early profiteers

Why did it fall back sharply after hitting a new high? Or it may be related to profit-taking by early profiteers:

According to CryptoQuant data, when Bitcoin plummeted after hitting new highs, an address with a history of more than 10 years transferred 1,000 Bitcoins to Coinbase. . After CryptoQuant’s analysis, it was found that there is a correlation between the address and the miner.

In the interview, CryptoQuant analyst Bradley Park pointed out: “According to exchange order data, the trading volume is about 5-10 Bitcoins per $100 price range, while if there are 1,000 Bitcoins Being sold off may cause the price to fall sharply. Especially during periods like Tuesday, traders generally hold short positions, and it is expected that the price of Bitcoin may be under pressure."

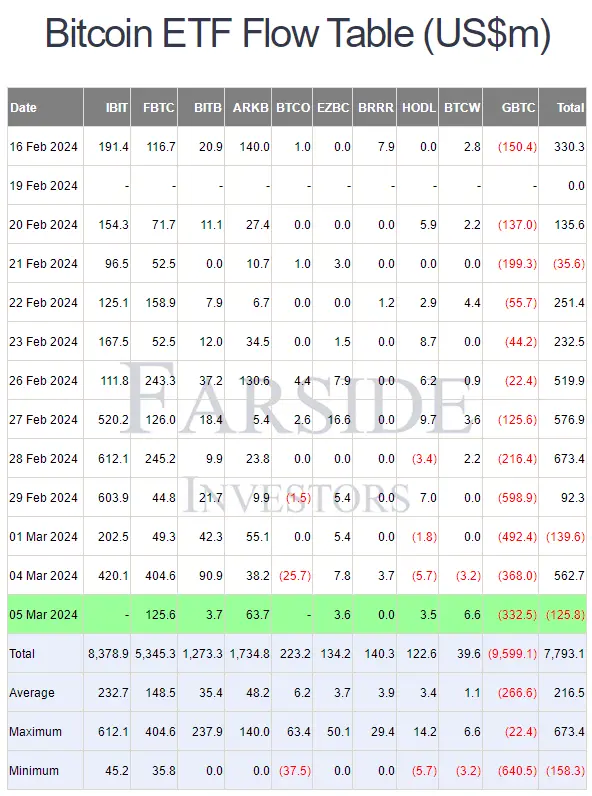

ETF market trading enthusiasm is still showing With rising prices, the daily trading volume of Bitcoin spot ETF reached US$10 billion yesterday, setting a new single-day trading volume record. Farside Investors data shows that GBTC had an outflow of US$332.5 million yesterday. There are currently three ETFs whose net flow data have not been disclosed. Some have disclosed a net outflow of US$125.8 million yesterday, which constitutes a correction pressure on the market. The final net outflow depends on whether IBIT is still there. Like the previous few trading days, there is still heavy buying.

The fee rate returns to a healthy value

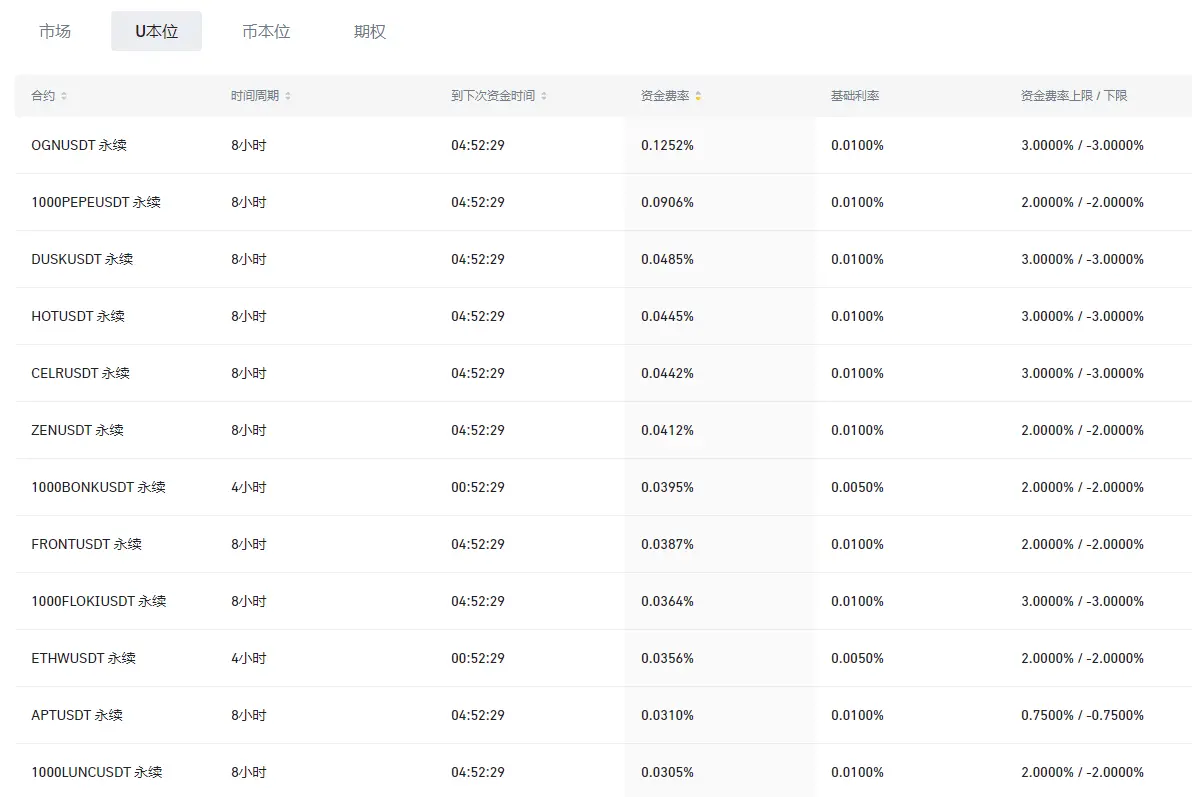

Before Bitcoin reached a new high of $69,000, the fee rate of many altcoins was as high as 0.2%~0.4%. In addition, some currencies are charged at four-hour intervals. Between March 1 and 5, the average fee for BTC was as high as 0.06%, demonstrating the high leverage and fanaticism of the market.

After the decline, the rates have returned to rationality to a certain extent. Currently, only one OGNUSDT perpetual contract rate exceeds 0.1%, the rate of 12 currency contracts exceeds 0.03%, and the rate of BTC It has also recovered to 0.0207%.

Greeks.Live researcher Adam posted on the Derivatives data represented by futures basis stalled completely, and the bull market FOMO crashed at its peak. In terms of options, against the backdrop of a 10,000-point plunge, the options IV of each major period fell slightly, and ultra-short-term options were all declining. , which is obviously different from the past market."

Which currencies are not affected?

The Binance gain list shows that there are currently only 10 tokens that have increased by more than 1% today, mainly small market capitalization currencies, namely:

SYN (28.7%), ERN (16.2 %), WIF (12.6%), JST (8.2%), STRK (5.8%), AR (5.4%), FIS (4%), LSK (3.3%), CELR (2%), BICO (2%) .

Is the cow still there?

According to LD Research staff @kanazawa0x0, a series of funds have allocated IBIT issued by BlackRock. The allocation weight of Germany’s AV Balanced Fund, which holds the largest position, has reached as high as 5%. Although The scale is less than 10 million U.S. dollars, but this is just the beginning, especially when the ETF allocation of passive strategies has the characteristic of not referring to prices.

The giants are also continuing to apply for Ethereum spot ETFs. Today, the US SEC postponed its decision on the Fidelity Ethereum spot ETF application. Yesterday, it postponed its decision on the BlackRock spot Ethereum ETF, but it may also For example, Bitcoin spot ETF brings sustained expected imagination and the power of capital inflow after approval.

The long leverage has been basically cleared after yesterday’s plunge. Funds in the traditional market are still continuing to flow in. Major events such as halving and BTC L2 are imminent, and the bull market may have just begun.

The above is the detailed content of Bitcoin hits new high in 1 minute, flash crash pulls back $10,000, is the bull still there?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1393

1393

52

52

37

37

110

110

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

The special services of global virtual currency trading platforms include: 1. Comprehensive ecological platforms such as Binance and OKX, providing a variety of cryptocurrency trading pairs and ecosystems; 2. Compliance and security platforms such as Coinbase and Gemini, emphasizing regulatory compliance and user asset security; 3. Professional trading platforms such as Bitfinex and Kraken, focusing on high-leverage trading and technical support; 4. Innovative service platforms such as Crypto.com and FTX, launching innovative financial products; 5. Regional featured platforms such as Bitstamp and Huobi Global, providing localized services and compliance solutions.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Where to look at the ratio of long and short data in the currency circle

Apr 22, 2025 am 08:39 AM

Where to look at the ratio of long and short data in the currency circle

Apr 22, 2025 am 08:39 AM

The ten apps that can view the long-short data ratio in the currency circle are: 1. CoinMarketCap, providing comprehensive information; 2. Binance, trading platform, high liquidity; 3. OKX, world-leading, supports multiple trading; 4. TradingView, chart platform, rich technical analysis tools; 5. Kraken, European platform, high security; 6. Bitfinex, suitable for professional traders; 7. Bitstamp, stable and reliable; 8. Huobi, rich trading functions; 9. Coinglass, focusing on the contract market, friendly interface; 10. Delta, integrating market data, supporting long-short analysis.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Binance spot trading fee is 0.1%, and holding BNB can be reduced to 0.025%; OKX rate is 0.1%-0.2%, with a minimum of 0.02%; Gate.io rate is 0.2%, with a minimum of 0.10%; FTX rate is 0.02%-0.05%, but has filed for bankruptcy; Coinbase Pro rate is as low as 0.05%, ordinary users; Kraken rate is 0.16%-0.26%, with a minimum of 0.10%; Bitfinex rate is 0.1%-0.2%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%; Bithumb rate is 0.15%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%;