Glassnode: ETF demand inflows versus supply released by profit-taking

Summary

Bitcoin price surprises the market by hitting ATH again, rallying strongly even before the widely expected halving event.

We saw a sudden spike in the average transaction size interacting with Coinbase, which highlights the scale of new institutional capital entering Bitcoin.

Long-term holders have begun to increase allocation pressure, reaching a monthly payout rate of 257,000 BTC, with GBTC accounting for 57% of that.

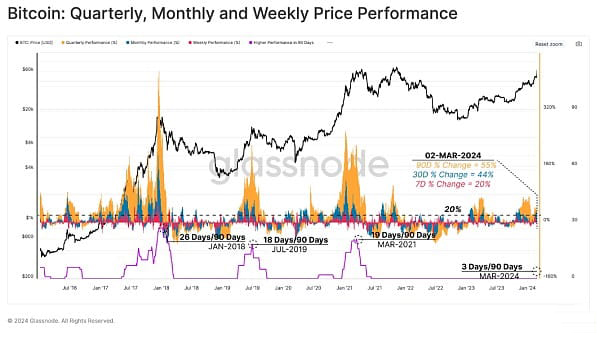

The beginning of 2024 has already gone down in Bitcoin history, and even before the halving event in April, the Bitcoin market was already rising to ATH.

The article mentions rolling performance in weekly, monthly and quarterly time frames, reaching 20%, 44% and 55% respectively. If we count the number of trading days that exceeded 20% last quarter, we can see that last weekend's rally was the strongest since the 2021 bull market.

Spot ETF Demand

Many observers expect strong demand following the SEC’s approval of a spot ETF for the U.S. market. At the same time, many are skeptical and believe that ETF news is already priced in and therefore expect a sell news correction. At the time of writing, Bitcoin is trading at $68,000, 58% higher than the $42,800 it was at when the ETF was approved, and the sell-off news camp finds itself overside.

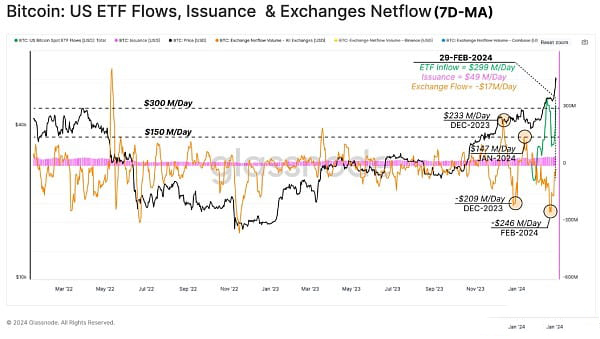

To better gauge total demand inflows, the chart below shows the weekly average of USD flows through the following regions:

Network Release (Blue): Miners Daily network rewards (assuming sellers) have increased from $22 million/day in September 2023 to $49 million/day today.

All exchange net flows (orange): Focusing on the months leading up to the ETF approval date, centralized exchanges witnessed both positive (sellers) and negative (buyers) Significant fluctuations between capital flow waves. The metric shows continued outflows or buying pressure as high as $246 million per day since the ETF began trading. As of the end of last week, total net outflows from the exchange were $17 million per day.

US Spot ETF Net Flows (green): Despite significant initial sell-side pressure from existing GBTC holders, total net flows into US Spot ETFs averaged $299 million /sky.

Overall, this indicates that Bitcoin is experiencing net capital inflows of approximately $267 million per day. This represents a meaningful phase shift in market dynamics and is a valid explanation for the market rally toward a new ATH.

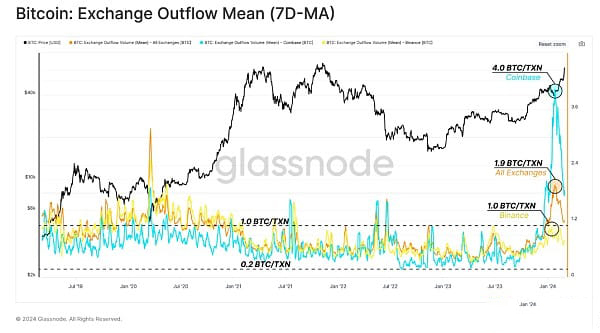

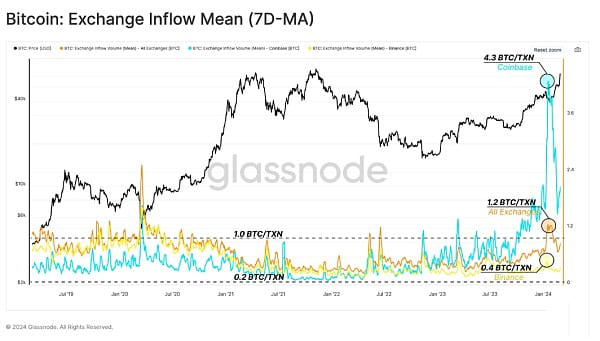

# We can also isolate fund flows associated with specific exchanges (such as Coinbase) to identify any changes in overall market dynamics. The chart below shows the average deposit volume in and out of [BTC]:

All Exchanges (Red)

Coinbase (Blue)

Binance (Yellow)

The results show that the average incoming and outgoing transactions for Coinbase in particular have reached quite high values. When the ETF was approved, the average trade size peaked at 4.3 BTC/Tx.

These values are noteworthy compared to the historical range, which has been between 0.2 BTC/Tx and 1.0 BTC/Tx since 2019.

Diamond Hand Profit

As the market approaches ATH, both unrealized profits and distribution pressure held by long-term investors increase accordingly.

One way to measure the market profitability of any given group of investors is to take their on-chain cost basis (or the average price at which each group received a token) and compare it to the spot price.

Long-term holders (blue) = $207,000

-

Short-term holders (red) = $458,000

Market realized price (orange) = $244,000

The transaction price is $68,000, and the average unrealized profit for long-term holders is approximately 228% .

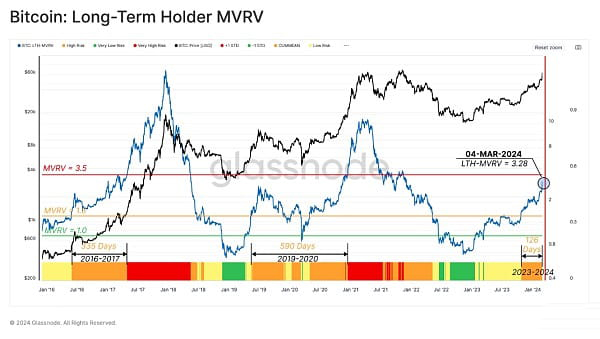

We can plot the multiple of unrealized profits held by long-term holders using the LTH-MVRV indicator, which is the ratio between price and its cost basis. The ratio currently stands at 3.28, between the two historically significant threshold levels that separate the stages below a typical cycle.

Bottom found (green) (LTH-MVRV

Bear-Bull Transition (yellow) (1

Equilibrium (orange) 1.5

Euphoria (Red) (3.5

Based on current values, these investors are approaching their euphoric state and have higher incentives to spend and profit. Historically, as new market ATHs are reached, this group increases spending and accelerates allocations until they help form a cycle macro top.

Long-Term Players in Action

Now that we have determined the size of unrealized profits for long-term holders, we must evaluate How do these entities respond to this shift in profitability.

A quick and direct way is to look at the supply from long-term holders. As shown in the chart below, long-term investors have allocated approximately 480,000 BTC since December 2023, when LTH-MVRV was still in equilibrium. That means some of these investors are paying out, on average, 50% to 200% of their profits before the ETF even launches.

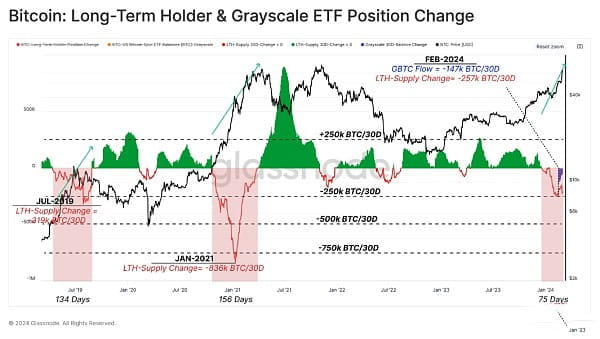

To evaluate a distribution system for long-term holders, we consider two factors: distribution rate and duration.

The chart below shows the monthly changes in long-term holder supply. Looking closely at the last two major market expansions in mid-2019 and early 2021, we can see that LTH distribution rates peaked at 319,000 BTC/month and 836,000 BTC/month respectively.

The distribution rate for this cycle has so far peaked at 257 BTC/month, with GBTC outflows accounting for approximately 57% of that.

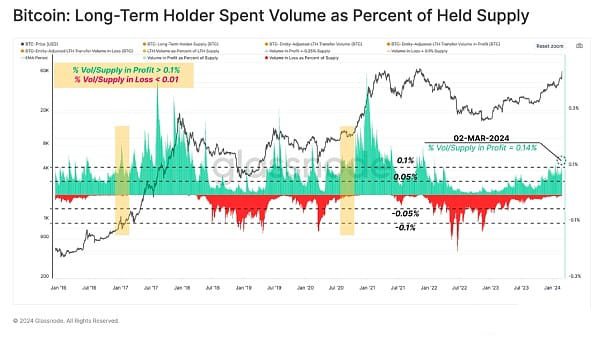

As the LTH allocation increases, the size of the locked realized profits also increases. To monitor this dynamic, we measure the proportion of LTH transfer volume in profit and loss relative to its overall balance.

As of this writing, the indicator shows that LTH is making profits at a rate equivalent to 0.14% of its total daily supply. The indicator is approaching levels consistent with early euphoric phases and previous breakouts of market ATH.

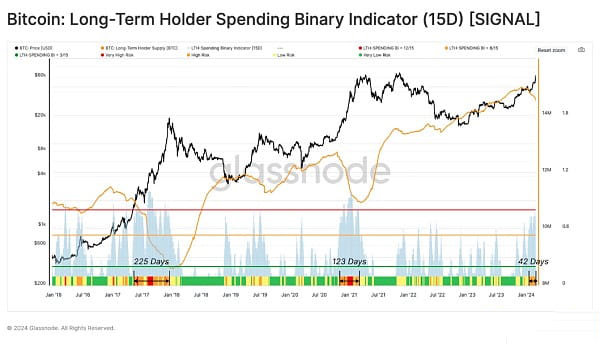

In the final part of this investigation, we created a binary indicator that identifies periods when LTH spending is large enough to deplete its total balance within a 15-day duration . This spending represents the release of long-dormant supply back into the liquidity cycle, thereby acting as a balance to offset new demand.

In the figure below, we use several thresholds to classify spending regimes. Since late January 2024, the market has reached a stage where binary indicators have shown declining supply from long-term holders on at least 8 of the last 15 days.

If we look at the 2017 and 2021 cycle peaks, we see a similar structure lasting from 123 to 225 days. The current phase has been in this state for 42 days so far, which may indicate that demand inflows may offset LTH spending in the coming months (if history is any guide).

Conclusion

Bitcoin surprised investors again, rallying to its last ATH before the halving event, the first time this has happened Condition. The new U.S. spot ETF introduces a significant new source of demand into the market, somewhat offsetting daily issuance and recent sell-side pressure on exchanges.

Long-term holders are accelerating their distribution cycles, a trend we have seen in all previous cycles as ATH is challenged. This allows us to compare these new demand vectors with allocation pressure from existing holders via ETFs and explain Bitcoin’s rapid return to all-time highs.

The above is the detailed content of Glassnode: ETF demand inflows versus supply released by profit-taking. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1389

1389

52

52

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Asset Manager Canary Capital is seeking SEC approval to launch SUI Exchange Trade's fund with points

Apr 21, 2025 pm 02:36 PM

Share this article! CanaryCapital Asset Management plans to launch its first spot cryptocurrency exchange-traded fund (ETF) that tracks the price of SUI (Sui). The company has filed an application with the U.S. Securities and Exchange Commission (SEC) seeking approval to issue its SUIETF. This will be the first ETF to track the performance of a well-known Layer-1 network. The ETF plans to leverage some of its positions through trusted staking providers. “The issuer may utilize or motivate all or part of the SUI of the Trust Fund to participate in Staking through one or more trusted Staking providers. Considering any of the Trusts’ possible participation in any

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

Popular science in the currency circle: How much can a Bitcoin be exchanged for? Where to redeem?

Apr 21, 2025 pm 12:00 PM

Popular science in the currency circle: How much can a Bitcoin be exchanged for? Where to redeem?

Apr 21, 2025 pm 12:00 PM

In China, transactions of Bitcoin exchange for domestic money are not allowed. In other countries and regions where transactions are allowed, exchanges can be carried out through the following platforms: 1. Binance, 2. Ouyi (OKX), 3. Huobi (Huobi).

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

The top ten leading virtual currency trading apps in the world in 2025 are: 1. Binance, 2. Gate.io, 3. OKX, 4. Huobi Global, 5. Bybit, 6. Kraken, 7. FTX, 8. KuCoin, 9. Coinbase, 10. Crypto.com.

How to choose a virtual currency exchange app? 2025 Crypto Circle App Exchange Authoritative Ranking

Apr 21, 2025 pm 12:33 PM

How to choose a virtual currency exchange app? 2025 Crypto Circle App Exchange Authoritative Ranking

Apr 21, 2025 pm 12:33 PM

Against the backdrop of the rapid development of today's digital currency market, choosing a reliable exchange app has become the top priority of every investor. The authoritative rankings of the 2025 CNY App Exchange provide you with a detailed guide to help you find the platform that suits you the most among the many options. We will evaluate from multiple dimensions such as security, user experience, handling fees, and transaction volume to ensure that you can find a safe, convenient and efficient trading platform. Next, let’s take a look at what are the top three exchange apps.

Binance Binance Exchange official app v2.98.6 latest version download (with registration tutorial)

Apr 21, 2025 pm 12:45 PM

Binance Binance Exchange official app v2.98.6 latest version download (with registration tutorial)

Apr 21, 2025 pm 12:45 PM

As the world's leading cryptocurrency trading platform, Binance Binance Exchange has powerful features and excellent user experience. The latest version of v2.98.6 brings more functional optimization and security improvements, ensuring that you are smoother and safer during the transaction process. This article will introduce in detail how to download and install the official app v2.98.6 of Binance Exchange, and comes with a registration tutorial to help you get started quickly.

How to download OK Exchange? The official latest version of the OK Exchange APP download tutorial

Apr 21, 2025 pm 12:51 PM

How to download OK Exchange? The official latest version of the OK Exchange APP download tutorial

Apr 21, 2025 pm 12:51 PM

OK Exchange is a world-renowned digital asset trading platform that is trusted by users. It provides a variety of digital currency trading services, supports a variety of fiat currency trading pairs, and meets the trading needs of different users. OK Exchange's APP has powerful functions, a friendly interface, supports multiple languages, and is convenient for users around the world. In order to enable everyone to quickly and safely download and install the OK Exchange APP, this article will provide you with detailed download and installation tutorials.