web3.0

web3.0

How to obtain JUP coins? Detailed tutorial on how to obtain JUP coins by buying on Eureka Exchange

How to obtain JUP coins? Detailed tutorial on how to obtain JUP coins by buying on Eureka Exchange

How to obtain JUP coins? Detailed tutorial on how to obtain JUP coins by buying on Eureka Exchange

JUP coin is the Jupiter platform currency of the Solana ecological DeFi protocol. Jupiter is a one-stop service platform for DeFi on the Solana public chain. It was established in October 2021. Its core is to integrate various DeFi applications and optimize the user experience. The product was originally positioned as an exchange engine, and was iterated to support more related functions, such as cost averaging strategies, limit orders, perpetual trading, etc. As a platform currency, the JUP coin has naturally attracted the attention of investors. Especially in the past few days, the JUP coin has been listed on the two major exchanges of Eureka and Binance at the same time. This has made investors wonder how to obtain the JUP coin? And I can’t wait. Currently, the main way to obtain JUP coins is to buy them on the exchange. The editor below will give you a detailed tutorial on how to buy and obtain JUP coins.

#How to get JUP coins?

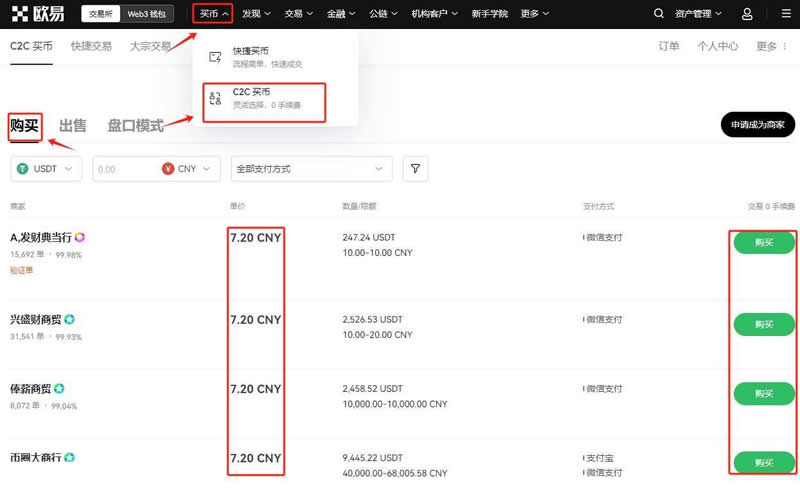

JUP coins are mainly obtained by purchasing them on the exchanges on which they are listed. Currently, the online exchanges include Eureka, Binance, Open Sesame, Huobi, Matcha Exchange, etc. The following is on the Eureka exchange. Tutorial on obtaining JUP coins:

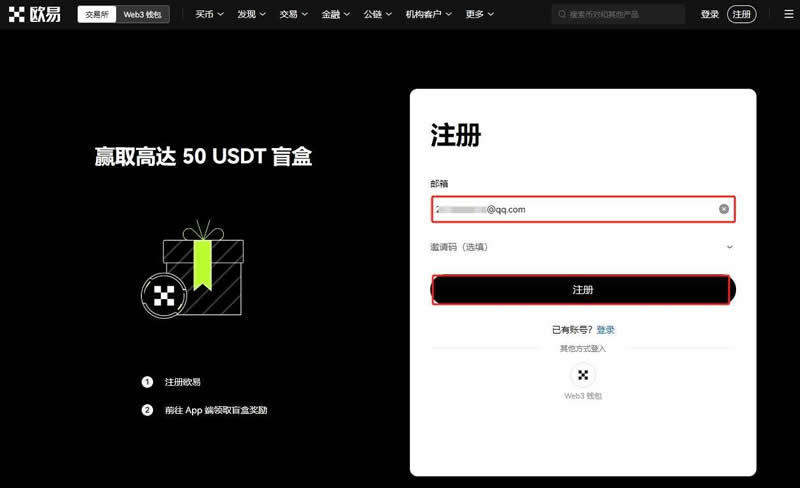

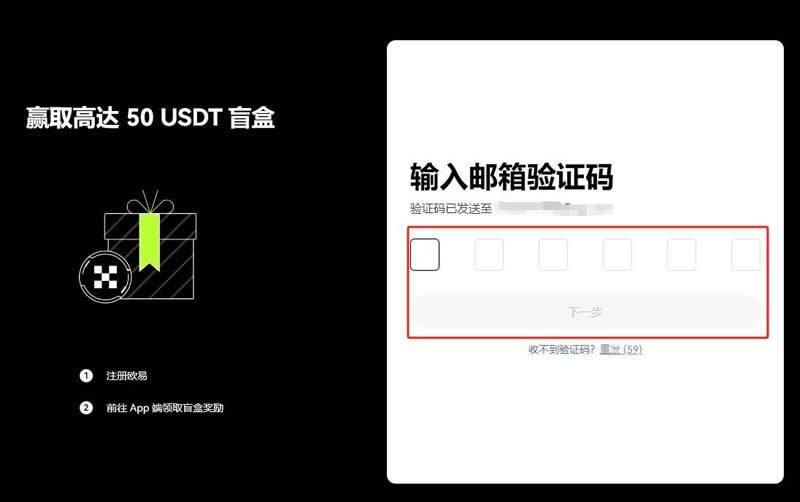

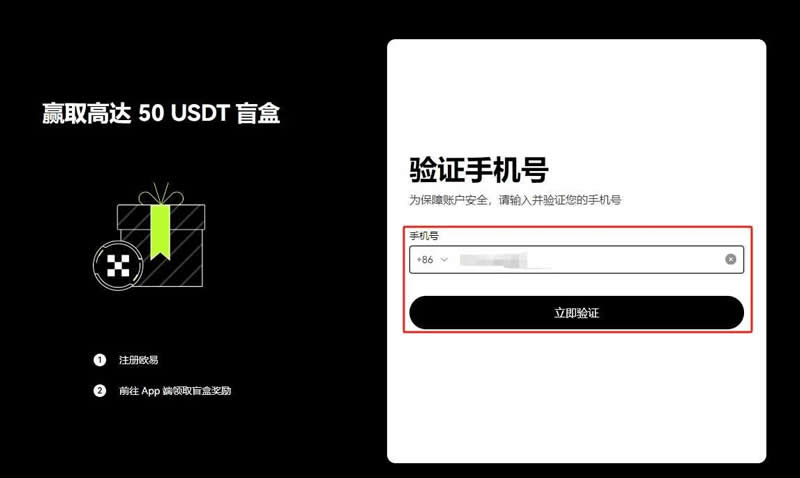

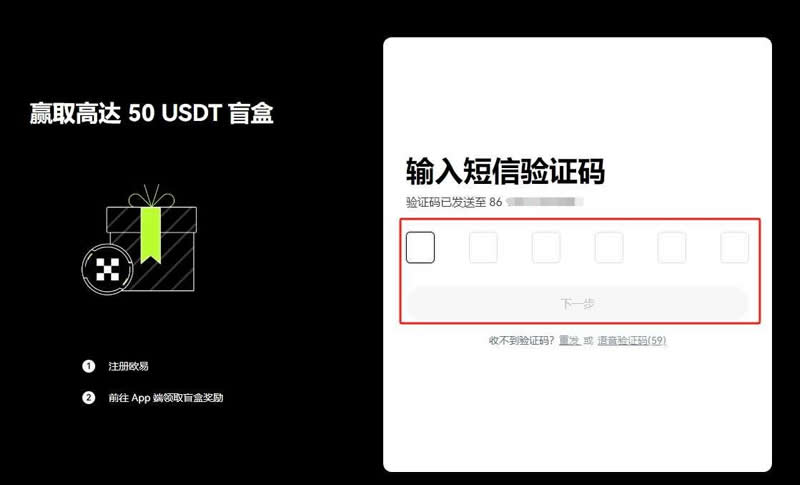

1. Click here to open the official website of OKX Exchange, enter your email address on the homepage, and click "Register"

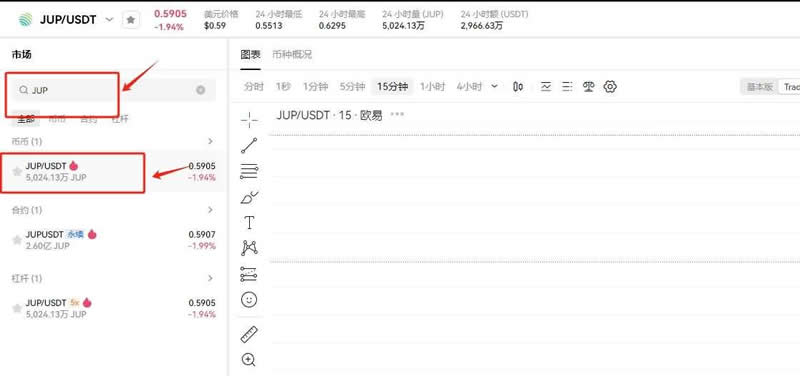

##10. Enter JUP in the search box, select the JUP/USDT trading pair, and you can see the real-time market price of JUP

##10. Enter JUP in the search box, select the JUP/USDT trading pair, and you can see the real-time market price of JUP

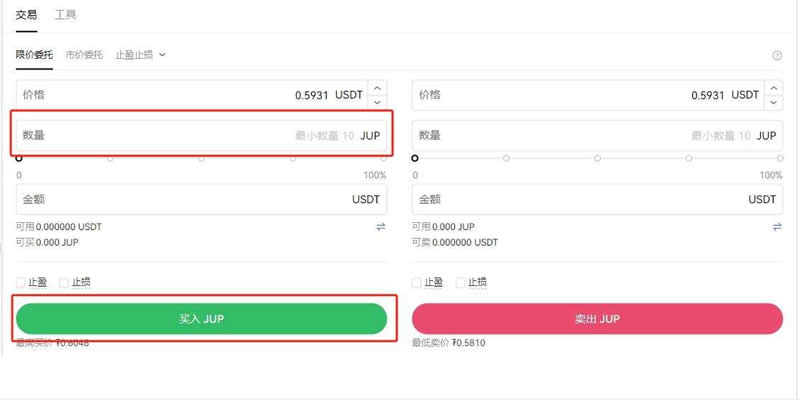

11. Enter the amount of JUP you want to buy and click Buy JUP.

11. Enter the amount of JUP you want to buy and click Buy JUP.

Can I buy JUP coins?

Can I buy JUP coins?

JUP coins can be bought. According to official data, the current price of JUP coins is US$0.58, which is US$2 lower than the historical high price. The issuance price is unknown. The current circulation is 1,350,000,000 coins and the market value is US$796,294,641. The total Judging from the current development of JUP currency, it is not bad.

JUP coin is the token of the Jupiter project. The Jupiter project is the core liquidity aggregator of the Solana ecosystem, providing the most extensive token index and the optimal path for any trading pair. As the crypto space continues to grow and innovate, liquidity aggregators are increasingly in demand as they help users find the best trading prices and speeds across different decentralized exchanges (DEXs), saving time and cost, and improve efficiency and profitability. As the liquidity aggregator of the Solana ecosystem, the Jupiter project can make full use of Solana's high performance, low latency and low fees to provide users with a better trading experience and more trading opportunities.

The Jupiter project adopts an innovative technology called Nebula Routing, which can realize the optimal path for any transaction pair, whether within the Solana ecosystem or across chains to other ecosystems. The core of Nebula Routing is a machine learning-based algorithm that can dynamically adjust and optimize transaction paths based on market data and user behavior to achieve optimal liquidity and price. In addition, the Jupiter project also provides a cross-chain solution called NebulaBridge, which can achieve seamless interoperability between Solana and other mainstream public chains, expanding Jupiter's liquidity scope and user base.

The Jupiter project has received strong support from the Solana ecosystem, including the Solana Foundation, Serum, Raydium, Orca and other well-known projects and platforms. The Jupiter project works closely with these partners to jointly promote the development and prosperity of the Solana ecosystem and provide users with more value and services. The Jupiter project also plans to cooperate with other ecological projects and platforms to achieve wider cross-chain interconnection and liquidity sharing.

The above is the detailed content of How to obtain JUP coins? Detailed tutorial on how to obtain JUP coins by buying on Eureka Exchange. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance's big move: The margin collateral ratio of multi-currency combinations will be adjusted in April

Apr 21, 2025 am 11:36 AM

Binance made several adjustments to the margin collateral ratio of multi-currency combinations in April 2025. 1. Adjustment on April 4: In the multi-asset margin mode, FLOW and COMP have dropped from 80% to 70%, 1INCH has dropped from 70% to 65%, HOT and RVN have dropped from 70% to 60%, IOTX has dropped from 70% to 55%; in the unified account mode, CRV and UNI have dropped from 85% to 80%, ALGO has dropped from 85% to 75%, KSM has dropped from 80% to 70%, XTZ has dropped from 75% to 60%, and XEC has dropped from 70% to 55%. 2. Adjustment on April 11: In the combination margin mode, ICP dropped from 80% to 70%, SNX dropped from 80% to 65%, and MANA dropped from 75% to 6

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance is about to remove 14 cryptocurrencies, causing market turmoil! Binance, the world's leading cryptocurrency exchange, announced that it will remove 14 cryptocurrencies on April 16. The move is the result of the Binance community vote and reflects the exchange's new project screening criteria, aiming to improve the overall quality of the platform. This major change marks a transformation in Binance's strategy, focusing more on the actual performance and long-term value of the project. The 14 tokens to be removed include: Badger (BADGER), Balancer (BAL), BetaFinance (BETA), CreamFinance (

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance has adjusted the collateral ratio of several assets, involving FLOW, COMP, etc., which has generally declined. 1. FLOW and COMP have been reduced from 80% to 70%. 2. 1INCH dropped from 70% to 65%. The move is designed to manage risks and ensure market stability, and investors need to adjust their positions to cope with increased margin requirements and potential forced closing risks.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

After the USDT transfer address is incorrect, first confirm that the transfer has occurred, and then take measures according to the error type. 1. Confirm the transfer: view the transaction history, obtain and query the transaction hash value on the blockchain browser. 2. Take measures: If the address does not exist, wait for the funds to be returned or contact customer service; if it is an invalid address, contact customer service and seek professional help; if it is transferred to someone else, try to contact the payee or seek legal help.

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

When choosing a blockchain asset that suits you, you need to comprehensively consider the following factors: 1. Clarify investment goals and risk tolerance, short-term speculation or long-term investment determine asset choices; 2. Research project fundamentals, including team background, technological innovation and application scenarios; 3. Analyze market trends and trends, pay attention to price trends, market hotspots and macroeconomic environment; 4. Assess liquidity and transaction costs, and choose assets with good liquidity and low transaction costs.

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Factors of rising virtual currency prices include: 1. Increased market demand, 2. Decreased supply, 3. Stimulated positive news, 4. Optimistic market sentiment, 5. Macroeconomic environment; Decline factors include: 1. Decreased market demand, 2. Increased supply, 3. Strike of negative news, 4. Pessimistic market sentiment, 5. Macroeconomic environment.