web3.0

web3.0

Web3 Venture Capital a16z is rumored to raise another $6.9 billion! Establish AI artificial intelligence and game fund

Web3 Venture Capital a16z is rumored to raise another $6.9 billion! Establish AI artificial intelligence and game fund

Web3 Venture Capital a16z is rumored to raise another $6.9 billion! Establish AI artificial intelligence and game fund

According to a report by Fortune today, a16z (Andreessen Horowitz), the world’s largest Web3 venture capital fund, plans to raise another US$6.9 billion to establish a series of new funds. This move comes against the backdrop of the global investment market’s frenzied pursuit of artificial intelligence.

According to people familiar with the matter, half of the funds will be used to establish a16z’s fourth-tier growth fund, which specializes in investing in technology companies that have completed the start-up stage and are seeking further expansion and scale growth.

The other half will be used to establish multiple new funds, including:

Two funds focusing on AI artificial intelligence

A Game Fund

The Fund to Support U.S. Innovation Sectors aims to invest in companies that are working to solve pressing national problems, such as aerospace, defense and manufacturing.

It is worth noting that people familiar with the matter also said that a16z founder Andreessen Horowitz said that it will raise more cash for its cryptocurrency and biological funds next year.

a16z Investment Portfolio Section

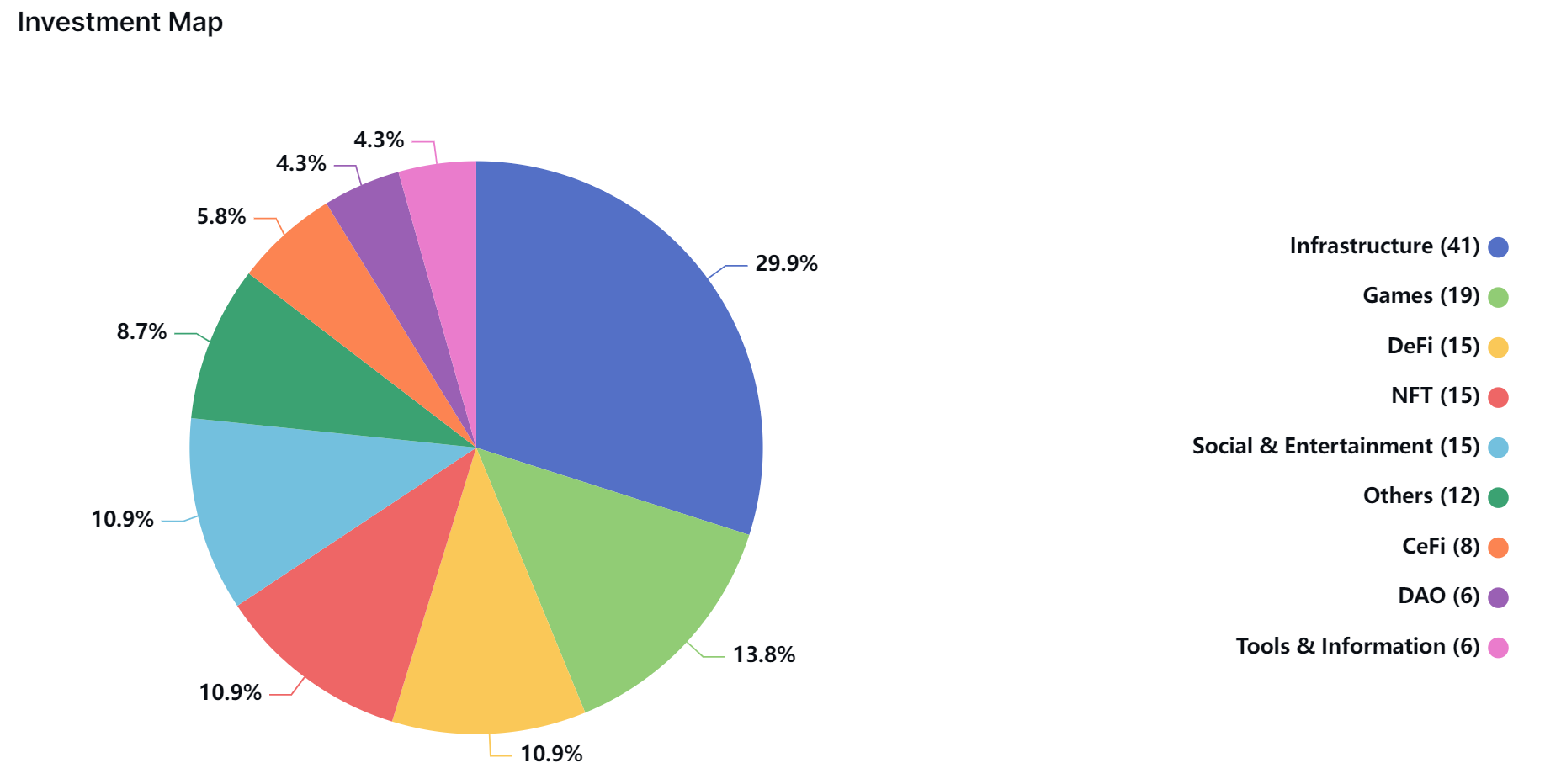

It is understood that a16z’s early investment in crypto industry projects mostly focused on infrastructure construction. In recent years, it has turned its focus to areas such as DeFi and NFT.

According to the statistical data compiled by the RootData website to the end of last year, calculated in terms of the number of investment projects:

a16z’s most important investment is still in the field of infrastructure construction, covering up to 41 Projects

ranked second in the gaming field, with 19 investment projects

, followed by DeFi, NFT, and social and entertainment games They are equally famous, each with 15 investment projects

The above is the detailed content of Web3 Venture Capital a16z is rumored to raise another $6.9 billion! Establish AI artificial intelligence and game fund. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

The advantages of Bijie.com in the fields of crypto finance and AaaS business include: 1. Crypto finance: ① Professional investment and research team, ② high-quality content ecology, ③ secure platform guarantee, and ④ rich product services. 2. AaaS business areas: ①Technical innovation capabilities, ②Data advantages, ③User base and demand insights.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance has adjusted the collateral ratio of several assets, involving FLOW, COMP, etc., which has generally declined. 1. FLOW and COMP have been reduced from 80% to 70%. 2. 1INCH dropped from 70% to 65%. The move is designed to manage risks and ensure market stability, and investors need to adjust their positions to cope with increased margin requirements and potential forced closing risks.

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

The top ten leading virtual currency trading apps in the world in 2025 are: 1. Binance, 2. Gate.io, 3. OKX, 4. Huobi Global, 5. Bybit, 6. Kraken, 7. FTX, 8. KuCoin, 9. Coinbase, 10. Crypto.com.

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Web3 trading platform ranking_Web3 global exchanges top ten summary

Apr 21, 2025 am 10:45 AM

Binance is the overlord of the global digital asset trading ecosystem, and its characteristics include: 1. The average daily trading volume exceeds $150 billion, supports 500 trading pairs, covering 98% of mainstream currencies; 2. The innovation matrix covers the derivatives market, Web3 layout and education system; 3. The technical advantages are millisecond matching engines, with peak processing volumes of 1.4 million transactions per second; 4. Compliance progress holds 15-country licenses and establishes compliant entities in Europe and the United States.