On February 23, Erin Koen, the head of governance of the Uniswap Foundation, launched a governance proposal "Activating Uniswap Protocol Governance" to allocate protocol fees to UNI token pledgers, thus motivating The UNI token quickly surged by 53% in a short period of time, and the DeFi sector saw a general rise.

The proposal "Launching Uniswap Protocol Governance" was overwhelmingly approved

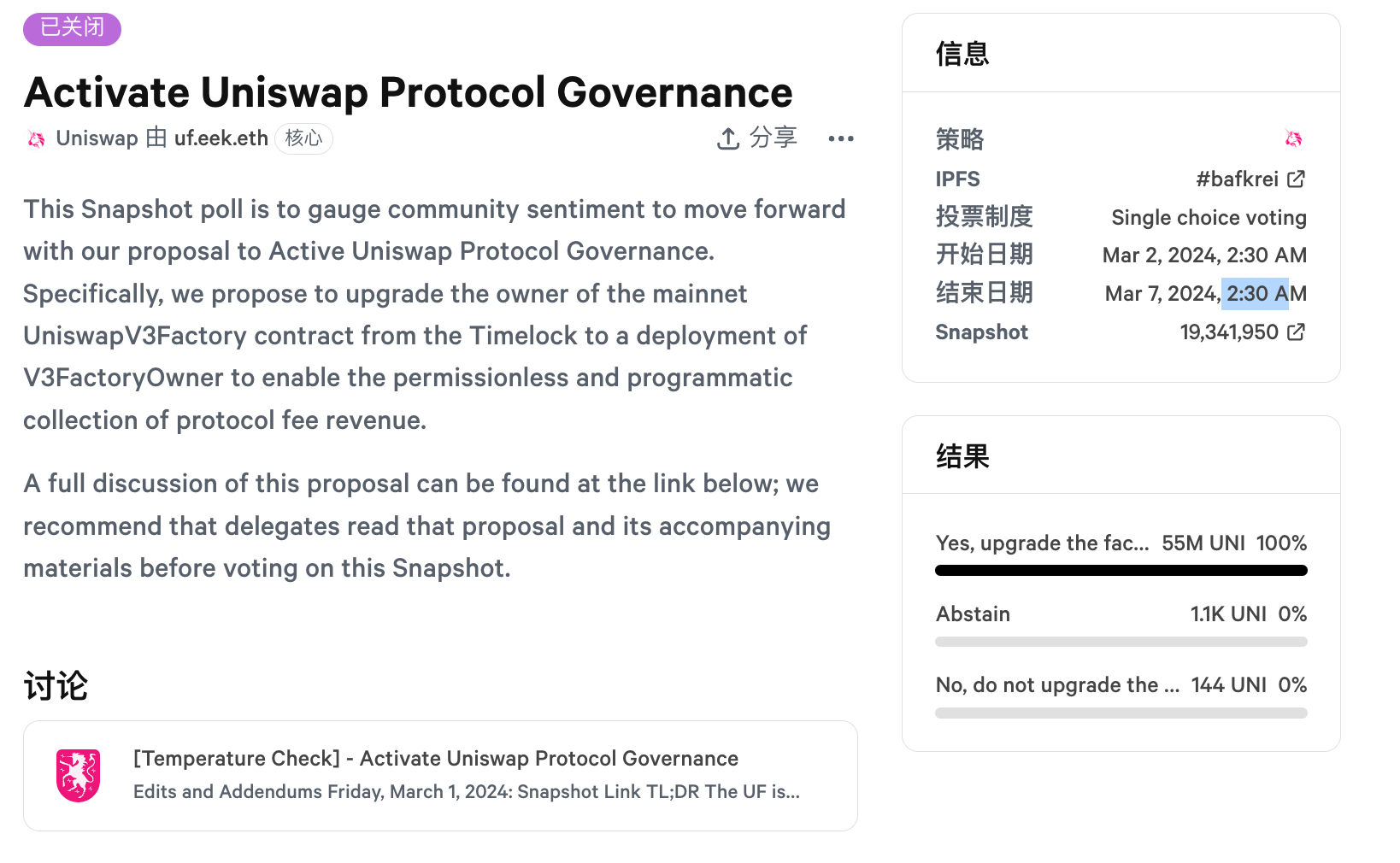

Then on the 1st of this month, the proposal conducted a community intention survey on the off-chain governance platform Snapshot, and the results were announced early this morning. , passed with an overwhelming 100% rate, with a total of 2,485 voters participating, and the number of votes in favor reached 55 million UNI. This vote is Uniswap’s most active one recently.

Subsequently, on-chain voting for the proposal will be officially launched on March 8.

$UNI soared by more than 20% and exceeded $17

Inspired by this news, Binance spot data showed that UNI rose for a time last night More than 20%, rising as high as $17.05, setting a new high since January 2022.

It fell slightly before the deadline, temporarily trading at $14.918, up 8.79% in the past 24 hours and 38.4% in the past seven days.

Proposal content: It is planned to allocate protocol fees to UNI pledgers

Previously reported that in the "Activate Uniswap Protocol Governance" proposal's upgrade plan for the protocol, the most important vision is to "protocol fees" ” Distributed to holders of pledged and delegated UNI tokens, the proposed changes include:

Upgrade Uniswap protocol governance to enable permissionless and programmatic collection of protocol fees

Prorate any protocol fees to UNI token holders who have staked and delegated their voting rights

Continue to control core parameters: which pools require Payment, and the size of the fee

According to the proposal description, the so-called "protocol fee" refers to a part divided from the liquidity provider (LP) fee, and its proportion can be 0, 1/4, 1/5, 1/6, 1/7, 1/8, 1/9 or 1/10. Currently the ratio is set to 0.

LP fee refers to the transaction fee in the Uniswap pool. The ratio is set to 0 to indicate that at the current stage, all fees generated by Uniswap will be fully allocated to liquidity providers. The adjustment of this ratio can be decided through community governance.

The annual return rate is estimated to be between 1.8% and 4.4%.

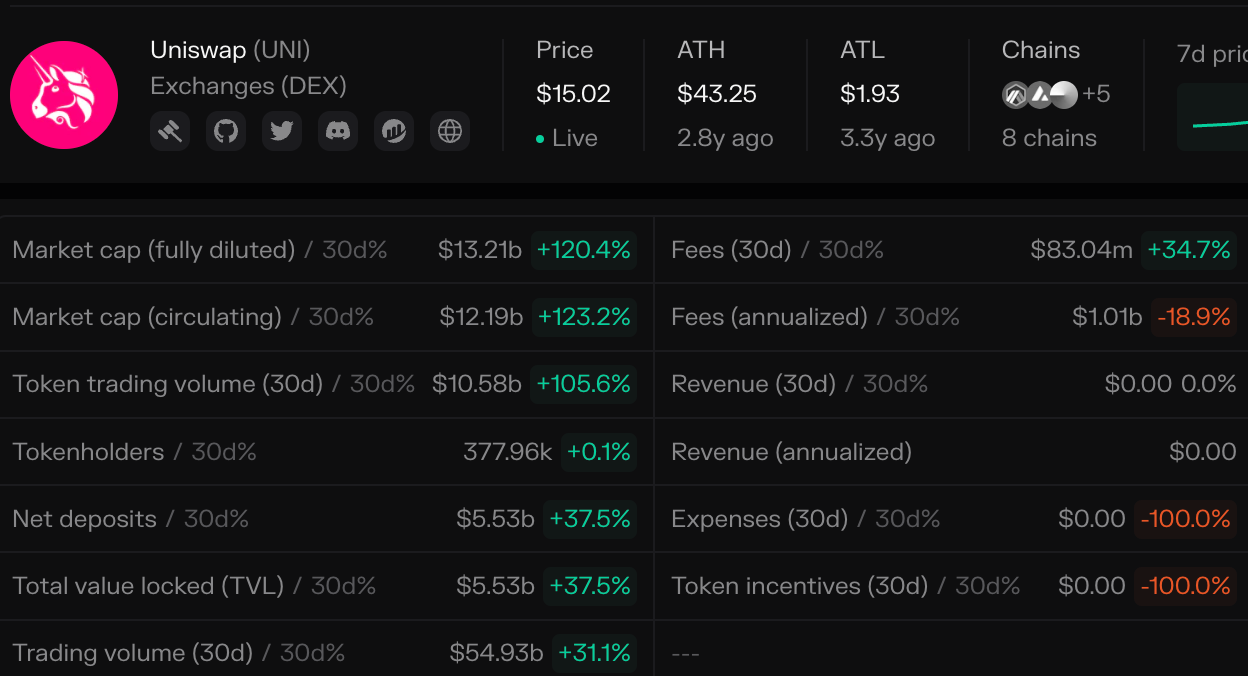

Simple estimate of the annual return rate brought by staking UNI. According to the latest data from TokenTerminal, the annual Uniswap fee is approximately US$1 billion. Assuming that the proposal is passed and 1/10~1/4 of the LP fee is allocated to UNI pledgers as protocol fees, UNI pledgers can receive approximately 100 million~ $250 million in annualized dividends.

The current market value of UNI is approximately US$11.3 billion. Assuming that half of the market value of UNI will be pledged, there will be a pledge scale of US$5.65 billion. The annualized return rate under this assumption ranges from 1.77% to 4.42%.

The above is the detailed content of Uniswap launch protocol governance proposal was overwhelmingly approved! UNI surges 20%, breaking through $17. For more information, please follow other related articles on the PHP Chinese website!