web3.0

web3.0

Comprehensive comparison of the six major liquidity re-pledge protocols, which one is more suitable for you to choose?

Comprehensive comparison of the six major liquidity re-pledge protocols, which one is more suitable for you to choose?

Comprehensive comparison of the six major liquidity re-pledge protocols, which one is more suitable for you to choose?

Original author: 0xEdwardyw

In the current bull market, re-pledge will play a key role, with more than ten liquidity re-pledges Protocols are competing for EigenLayer’s total locked value of more than $11 billion.

This article compares six major liquidity re-hypothecation protocols, aiming to provide readers with a simple and easy-to-understand way to understand the nuances between these protocols. Given the various trade-offs present in different LRT designs, investors should make their choice based on their own preferences.

The following are the key features of each liquidity staking protocol:

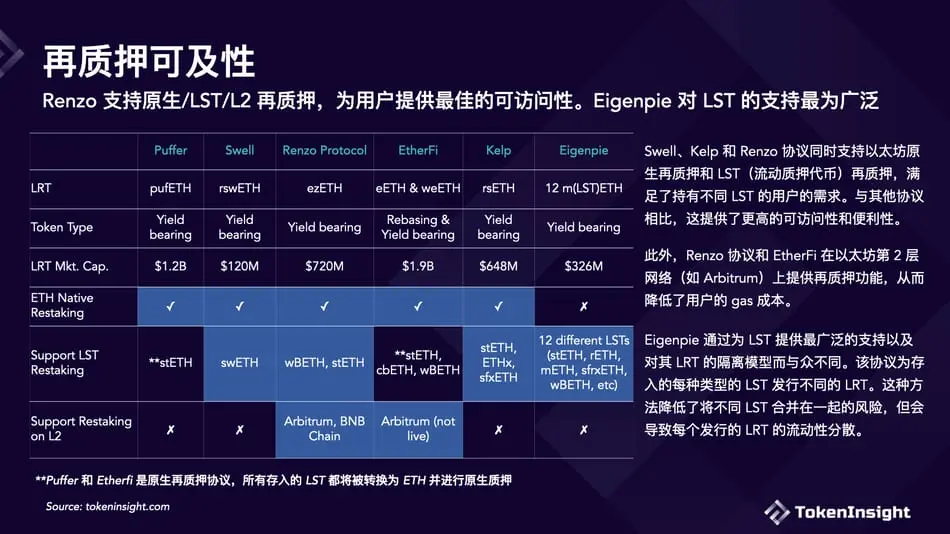

Puffer Finance and Ether.fi are the two largest liquidity staking protocols by token market cap It is calculated based on liquidity re-pledge. They all focus on native re-staking, making the risk level lower compared to LST re-staking. In addition to this, both protocols work to promote decentralization among Ethereum validators. Ether.fi has the largest number of DeFi integrations.

Kelp and Renzo protocols support native re-staking and LST re-staking. They accept major LSTs such as stETH, ETHx, and wBETH. Renzo has also extended restaking services to Ethereum Layer 2, which provides users with the convenience of lower gas fees. This feature enables users to perform re-staking operations more cost-effectively, thereby improving their experience of participating in the DeFi ecosystem.

Swell began as a liquidity staking protocol whose core token was swETH, with a market cap of approximately $950 million. Recently, Swell launched a re-staking service and launched a new liquid re-staking token rswETH. In addition, the platform also provides native re-staking and swETH re-staking functions to meet the needs of users.

Eigenpie is a sub-DAO of Magpie, focusing on the re-hypothecation of LST. Eigenpie accepts collateral from 12 different LSTs and issues corresponding 12 different LRTs. This unique model provides users with an isolated LST re-staking experience.

Different Types of Re-Staking and Liquidity Re-Staking Tokens

Two Re-Staking Types on EigenLayer

There are two types of re-staking, native re-staking and LST (Liquidity Staking Token) re-staking. For native restaking, validators natively stake their $ETH on Ethereum’s Beacon Chain, pointing to EigenLayer. LST re-staking allows holders of liquid staking tokens (such as stETH) to re-stake their assets into the EigenLayer smart contract. Because of the need to run an Ethereum validator node, native re-staking is more difficult for retail users to operate.

The advantage of native ETH re-hypothecation is that it is not restricted; EigenLayer sets a cap on LST re-hypothecation and only accepts deposited LST within a specific upper limit or within a specified time range. Native re-staking is not subject to these restrictions and can be deposited at any time. Native re-staking also has advantages in terms of security, as it does not involve the risks of the LST protocol.

Despite these differences, both native restaking and LST restaking on EigenLayer require the asset to be deposited and locked, making it unavailable for other uses.

Liquid Restaked Agreement Releases Locked Liquidity

Liquid Restaked Token (LRT) is similar to the liquidity pledged token on Ethereum and is deposited into EigenLayer The tokenized representation of assets effectively releases the liquidity that was originally locked.

The services provided by the liquidity re-pledge protocol are divided into native re-pledge services and LST re-pledge services. Most liquidity re-staking protocols offer native re-staking to users without requiring them to run an Ethereum node. Users simply deposit ETH into these protocols, which handle Ethereum node operations behind the scenes.

Meanwhile, the largest LST stETH is accepted by almost all liquid re-staking protocols, while some LRT protocols can accept multiple different LST deposits.

It is worth noting that Puffer Finance is essentially a native re-pledge protocol. Currently in the pre-mainnet phase, it accepts stETH deposits. After the mainnet goes online, the protocol plans to exchange all stETH for ETH and perform native re-staking on EigenLayer. Similarly, Ether.fi is a native restaking protocol, but at the current stage accepts multiple types of Liquid Staked Token (LST) deposits.

Two kinds of LRT: based on a basket of LST or isolating each LST

Most liquidity re-staking protocols adopt a basket-based LST approach, allowing deposits of various liquidity pledged tokens ( LST) in exchange for the same Liquidity Recollateral Token (LRT). Eigenpie employs a unique strategy of segregating liquid staking tokens. It accepts 12 different LSTs and issues a unique LRT for each LST, resulting in 12 unique LRTs. While this approach mitigates the risks associated with pooling different LSTs, it may result in fragmentation of the liquidity of each individual LRT.

Re-staking through Ethereum Layer 2 protocol

Due to the current high gas cost on the Ethereum mainnet, several LRT protocols can already be re-staking through Ethereum Layer 2, providing users with lower costs alternatives. Renzo Protocol has launched restaking functionality on the Arbitrum and BNB chains. Likewise, Ether.fi plans to launch a restaking service on Arbitrum.

Risks and benefits of liquid re-pledge

The liquid re-pledge protocol deploys a set of smart contracts on EigenLayer to facilitate user interaction and help users Deposit and withdraw ETH or LST from EigenLayer, and mint/destroy Liquid Recollateral Tokens (LRT). Therefore, using LRT comes with the risk of a liquid rehypothecation protocol.

In addition, the risk also depends on whether the liquid re-hypothecation protocol provides LST re-hypothecation services. In native re-staking, funds are deposited into the Ethereum beacon chain. However, when using LST to re-pledge, the funds are deposited into EigenLayer's smart contract, thus introducing smart contract risks from EigenLayer. Using LST also involves smart contract risks associated with liquidity staking protocols. Users holding LRT backed by LST are therefore exposed to three types of smart contract risks: risks associated with the EigenLayer, the specific LST used, and the LRT protocol itself.

Although native re-pledge faces fewer smart contract risk layers, liquidity re-pledge protocols that provide native re-pledge services need to participate in Ethereum staking. They can choose to partner with a professional staking company, operate an Ethereum node themselves, or support individual independent validators.

Using mature liquid staking tokens such as Lido’s stETH or Frax’s sfrxETH can provide reliable staking returns. These LST protocols have spent years perfecting their Ethereum staking services, and they are more experienced at maximizing staking rewards and minimizing slashing risks.

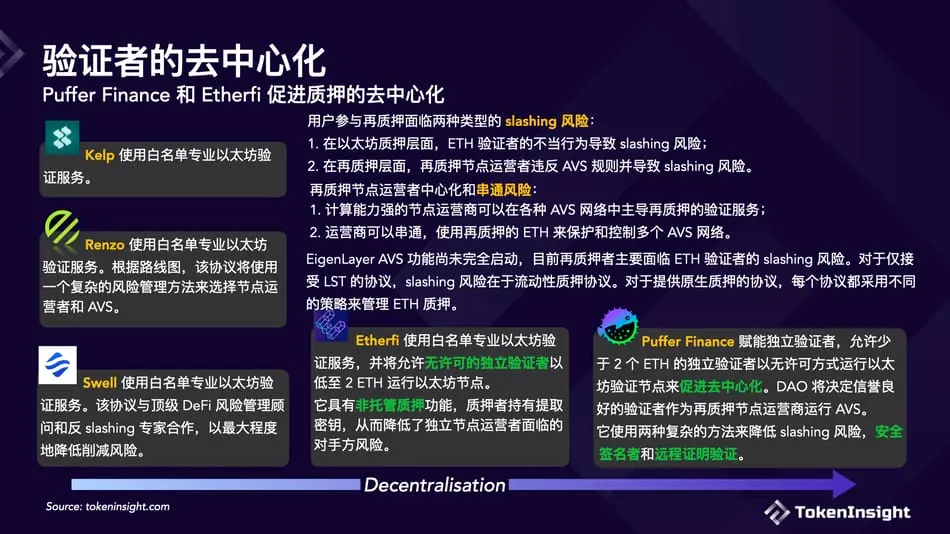

Decentralization of Validators

When ETH/LST is deposited into EigenLayer, these assets are assigned to a staking operator. This operator is responsible for performing verification services on Ethereum, as well as on AVS, the active verification service they choose to secure. In addition to Ethereum staking rewards, stakers will also receive rewards from these AVS. If an operator violates the rules set by AVS, then the staked assets are at risk of being slashed.

If the re-hypothecation market is dominated by a few large operators responsible for securing the majority of AVS, then centralization and potential collusion risks will arise. These operators with huge computing power may dominate re-staking in many AVS networks and collude to use the re-staking ETH to influence or directly control these AVS.

EigenLayer's Active Authentication Service (AVS) feature has not yet been activated, and only a limited number of AVS will be available initially. Most liquid re-hypothecation protocols do not disclose detailed information about how they will select the re-hypothecation operator and AVS. At this stage, stakers are mainly exposed to the risk of slashing at the Ethereum level. For re-staking via LST, this risk stems from the LST protocol itself. The native liquid re-staking protocol uses various methods for Ethereum staking. Some rely on large staking providers like Figment and Allnodes, while others are developing infrastructure to facilitate independent validators.

DeFi Integration

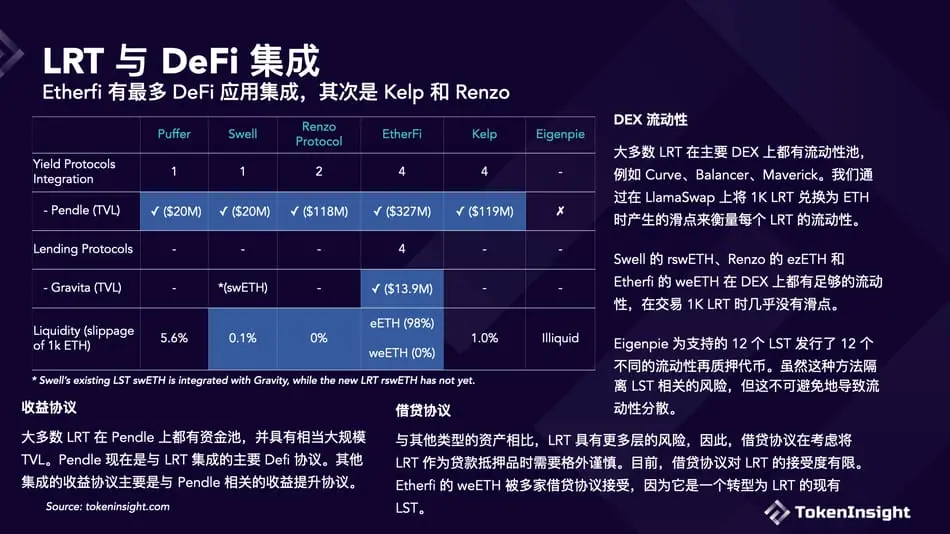

The sole purpose of Liquidity Recollateral Tokens (LRT) is to unlock liquidity for use in DeFi. Every liquidity restaking protocol is working hard to integrate various types of DeFi protocols. Currently, there are three main categories of defi integration: income protocols, DEX and lending protocols.

Yield Protocol

Pendle Finance, a leading protocol in the space, has launched an LRT pool that allows users to speculate on EigenLayer earnings and points. Most LRT protocols are integrated with Pendle.

DEX Liquidity

Most LRTs have liquidity pools on major DEXs, such as Curve, Balancer, Maverick. We measure the liquidity of each LRT by the slippage when exchanging 1K LRT for ETH on LlamaSwap. It’s important to note that this is only a rough measure, as most LRTs are revenue-accumulating tokens whose value increases over time as staking revenue accumulates. Since many LRT protocols are still in their infancy, the returns accumulated to date have been relatively small compared to the principal.

Swell’s rswETH, Renzo’s ezETH, and Etherfi’s weETH all have sufficient liquidity on the DEX with virtually no slippage when trading 1K LRT.

Eigenpie has taken a unique approach by issuing 12 separate liquid re-collateralized tokens, corresponding to each of the 12 supported LSTs. While this strategy effectively isolates the risks associated with any single LST, it also results in fragmented liquidity among different tokens.

Lending Agreement

LRT has more levels of risk than other types of assets. Lending agreements therefore exercise extreme caution when considering LRT as collateral for loans. Currently, lending protocols have limited acceptance of LRT. Etherfi's weETH is accepted by many lending protocols because it is an existing LST transformed into LRT.

The above is the detailed content of Comprehensive comparison of the six major liquidity re-pledge protocols, which one is more suitable for you to choose?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

How long does it take to recharge digital currency to arrive? Recommended mainstream digital currency recharge platform

Apr 21, 2025 pm 08:00 PM

The time for recharge of digital currency varies depending on the method: 1. Bank transfer usually takes 1-3 working days; 2. Recharge of credit cards or third-party payment platforms within a few minutes to a few hours; 3. The time for recharge of digital currency transfer is usually 10 minutes to 1 hour based on the blockchain confirmation time, but it may be delayed due to factors such as network congestion.

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

Bitcoin outbreak Sparks crypto chaos: What traders must know now

Apr 21, 2025 pm 07:12 PM

Bitcoin outbreak Sparks crypto chaos: What traders must know now

Apr 21, 2025 pm 07:12 PM

The plunge in Bitcoin has caused turmoil in the crypto market, and the digital finance field is facing severe tests. Bitcoin (BTC) price has fallen nearly 4% recently, dragging down the overall cryptocurrency market. As of press time, Bitcoin fell 3.9% in 24 hours to $77,816.41, after hitting a high of $83,778.12. Bitcoin price trend chart (1 day): Chart: TradingView Relative Strength Indicator (RSI) Analysis: The RSI indicator is used to measure the recent price fluctuations and determine whether asset prices are overbought or oversold. The RSI value is between 0 and 100. Generally speaking, an RSI value above 70 means that the asset is overbought and may be a pullback; a lower than 30 means that it is oversold and may be a rebound. Currently, the Bitcoin RSI value is 7

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,