Gartner releases key trends impacting technology providers in 2024

#Gartner has released the major trends that will impact technology providers in 2024.

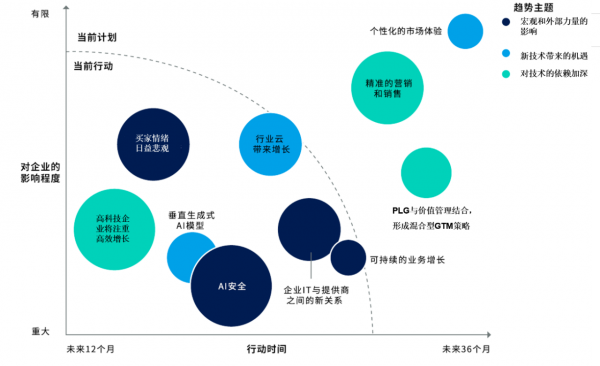

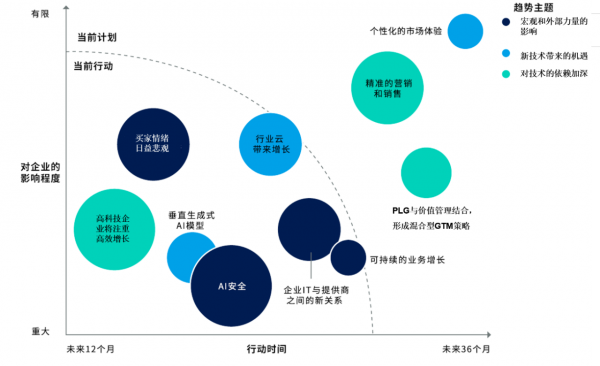

Eric Hunter, executive vice president at Gartner, said: “Generative artificial intelligence (GenAI) is beginning to dominate the technology and product development processes of nearly all technology providers. From growth and product strategy to the tools employees use every day, GenAI is transforming technology. Providers are transformed. But despite its potential, the technology is not the only factor impacting technology leaders. Other factors include new friction points in growth plans and changes in marketing and sales activities. New convergence points, new relationships that technology and service providers (TSPs) can build, etc.” seize short-term opportunities, gain long-term advantages, and strategize based on economic conditions. Gartner’s top trends for 2024 illustrate this dual consideration (see Exhibit 1 for details).

As business and technical requirements increase, enterprise IT departments must expand the scope of support, increase the speed and depth of services, and thus As a result, its own resources and capabilities are stretched thin. This opens up new opportunities for product leaders at technology providers, with the potential to build new relationships within customer enterprises and open up new revenue streams. Examples include expanding the provider's role in enterprise IT and business units, establishing results-focused relationships between providers and the enterprise, and becoming a tier one provider for the entire enterprise.

Sustainable Business Growth

In the past, the management and control of environmental, social and governance (ESG) impacts of sustainable development projects and corporate activities only focused on reducing internal risks and ensuring compliance. regulation. Product leaders must keep pace with the times, embrace the principle of simultaneous dual materiality and leverage the full range of emerging technologies to achieve sustainability goals. AI SafetyResponsible AI and AI safety are not new concepts, but as GenAI technology develops at an unprecedented speed, people are increasingly focusing on risk management and how to solve content sources, hallucinations, etc. Serious issues were discussed lively. Product leaders must build solutions that incorporate security principles, focusing on areas such as model transparency, traceability, explainability, and explainability. In the dynamic GenAI market, addressing regulatory and compliance issues up front to build trust is critical to staying competitive. Buyer Sentiment Is Increasingly Pessimistic Over the past three years, technology providers have experienced poor sales performance as their aging go-to-market (GTM) strategies did not align with new buyer behaviors. It’s becoming less and less ideal. If they don't adjust their sales and marketing strategies to detect and respond to buyer pessimism, technology providers' sales performance will continue to decline from both an internal and external perspective.Vertical GenAI Model

While general models perform well in a variety of GenAI applications, such models may not be suitable for many enterprise use cases that require domain-specific data. Technology providers must explore industry-focused models to more efficiently leverage existing resources to meet specific user needs. Otherwise, the cost and complexity of creating and using the model will increase.

Personalized market experience

Specialized, niche digital trading platforms are emerging to help buyers solve complex problems in the process of sourcing, implementing and integrating solutions. If product leaders do not provide services through such exchanges, it will be difficult to easily connect with target customers. Gartner predicts that by 2025, 80% of sales interactions between suppliers and buyers will be completed through digital channels.

Industry cloud brings growth

Service providers, hyperscale cloud service providers, independent software vendors (ISVs) and software as a service (SaaS) providers are beginning to use vertical solution delivery customer results to drive business growth. Gartner predicts that by 2027, more than 50% of technology providers will use industry cloud platforms to deliver business results, compared with less than 5% in 2023.

PLG is combined with value management to form a hybrid GTM strategy

The product-led growth (PLG) strategy focuses on showing product value to users to stimulate purchase intentions, thereby supporting the product launch (GTM) team Communicate with interested buyers. But most companies that adopt this strategy have begun to realize that in most cases, a completely self-service approach to market expansion is not advisable. At some stage, the sales team must step in to close the deal. Whether developing new business or expanding existing business, buyers need to generate business value and prove return on investment, so providers will combine PLG strategies with value management and realization initiatives to form a hybrid GTM strategy.

Precision Marketing and Sales

Rapidly evolving technological advancements, such as GenAI, digital procurement, and the Metaverse, are rewriting the way technology providers approach technology marketing and sales. Without new strategies, technology providers will simultaneously face lower overall deal quality, decoupling from the market, and limited sales growth to existing customers.

The above is the detailed content of Gartner releases key trends impacting technology providers in 2024. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance is about to remove 14 cryptocurrencies, causing market turmoil! Binance, the world's leading cryptocurrency exchange, announced that it will remove 14 cryptocurrencies on April 16. The move is the result of the Binance community vote and reflects the exchange's new project screening criteria, aiming to improve the overall quality of the platform. This major change marks a transformation in Binance's strategy, focusing more on the actual performance and long-term value of the project. The 14 tokens to be removed include: Badger (BADGER), Balancer (BAL), BetaFinance (BETA), CreamFinance (

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

How to download OK Exchange? The official latest version of the OK Exchange APP download tutorial

Apr 21, 2025 pm 12:51 PM

How to download OK Exchange? The official latest version of the OK Exchange APP download tutorial

Apr 21, 2025 pm 12:51 PM

OK Exchange is a world-renowned digital asset trading platform that is trusted by users. It provides a variety of digital currency trading services, supports a variety of fiat currency trading pairs, and meets the trading needs of different users. OK Exchange's APP has powerful functions, a friendly interface, supports multiple languages, and is convenient for users around the world. In order to enable everyone to quickly and safely download and install the OK Exchange APP, this article will provide you with detailed download and installation tutorials.

Top 10 virtual currency app exchanges Ranking of the world's top 10 cryptocurrency trading platforms

Apr 20, 2025 pm 11:00 PM

Top 10 virtual currency app exchanges Ranking of the world's top 10 cryptocurrency trading platforms

Apr 20, 2025 pm 11:00 PM

Top 10 virtual currency app exchanges: 1. OKX, 2. Binance, 3. Gate.io, 4. Kraken, 5. Bybit, 6. Coinbase, 7. Bitget, 8. KuCoin, 9. MEXC, 10. HTX, each platform has its own advantages in Bitcoin trading, contract trading, secure storage, fiat currency deposits and innovative gameplay.

Ranking of the top ten currency exchanges in the currency circle in 2025, ranking of the top ten Bitcoin trading platforms

Apr 20, 2025 pm 11:24 PM

Ranking of the top ten currency exchanges in the currency circle in 2025, ranking of the top ten Bitcoin trading platforms

Apr 20, 2025 pm 11:24 PM

The rankings of the top ten currency exchanges in the 2025 are: 1. OKX, the advantage is that it has strong global compliance and supports full ecological trading; 2. Binance, the largest number of users but is subject to regulatory restrictions; 3. Gate.io, the fast speed of placing new coins, suitable for short-term speculation; 4. Bybit, the main focus on contract trading, good depth; 5. KuCoin, a rich variety of small coins, suitable for potential projects; 6. Bitget, the specialty is order-based trading; 7. MEXC, the fastest placing new coins, suitable for high-risk trading; 8. HTX, the old exchange, the liquidity is acceptable; 9. Kraken, the European and American compliance, suitable for institutional users; 10. Coinbase, the strongest compliance, suitable for American users.

Top 10 trading platforms for cryptocurrency speculation

Apr 20, 2025 pm 11:45 PM

Top 10 trading platforms for cryptocurrency speculation

Apr 20, 2025 pm 11:45 PM

Recommended by the top ten trading platforms for cryptocurrency speculation: 1. OKX, 2. Binance, 3. Gate.io, 4. Kraken, 5. Bybit, 6. Bitget, 7. MEXC, 8. KuCoin, 9. Coinbase, 10. HTX, their respective advantages include compliance, trading volume, currency selection, security, etc., which are suitable for different types of investors.