Bitcoin Ecosystem VS Ethereum Ecosystem, who will be the next leader?

Source: Vernacular Blockchain

Ethereum has risen very strongly in the recent period. After breaking through 3500U in the past few days, it hit a new high since May 2022. After that, it exceeded 4000U in the past two days, and judging from the increase in the past 30 days, Ethereum surpassed Bitcoin with a 62% increase, which was indeed unexpected by many people.

Let’s take a closer look at the ecological development of Ethereum, from the growing deflation data, the smooth testing of the Cancun upgrade that is about to be launched on the main network, to the current increase in the amount of pledged and re- pledged ETH. As well as the expected adoption of the ETH spot ETF in May, it is indeed a combination of multiple benefits, and it is reasonable for the price of ETH to soar.

So, will these benefits really be realized one by one? What is the current ecological development of Ethereum? Let’s look at the data.

Ethereum deflation situation

Bitcoin and Ethereum inflation over the past 532 days/ Deflation data trend chart, source: ultrasound.money

Since January 16, 2023, Ethereum has officially entered the deflation stage, which means that the number of newly issued ETH per day is less than The amount destroyed. Currently, ETH’s annual deflation rate is 0.239%.

Compared with the industry leader Bitcoin, the annual inflation rate is 1.716%. Although the total amount is limited, new ones are continuously produced every day Bitcoin. Therefore, when we say "the total amount of Bitcoin is limited, so every Bitcoin is very precious", it can better highlight the value of ETH in the current deflationary state.

As the Ethereum ecosystem continues to grow, the total amount of Ethereum destroyed continues to rise, leading to an increasing deflation rate, which gradually reduces the amount of Ethereum available for circulation in the market.

The re-staking track is developing rapidly

Not only is the increase in the deflation rate of Ethereum causing less and less Ethereum in circulation, but also with the liquidity staking and re-staking competition on Ethereum With the development of Tao, a large amount of Ethereum is locked on the chain, resulting in a further sharp decrease in the number of Ethereum in circulation.

OKLink Ethereum pledge contract related data shows that The total pledged amount of Ethereum currently exceeds 40 million, accounting for more than 34% of the circulating market value of Ethereum, and the total number of validators exceeds 1.26 million , although most validators come here for the appreciation and staking yield of Ethereum, but no matter what, it is a great benefit to the security of the entire Ethereum network.

Number of Ethereum pledge contracts, data source: OKLink

Moreover, according to Stakingrewards Relevant data shows that as the public chain with the largest pledge amount, Ethereum’s pledge traffic has been a net inflow in the past seven days. The contrast with the public chains at the bottom is obvious. At this stage, Ethereum’s pledge is attracting investors. The power is obvious.

List of the top five public chains by staking market value, data source: stakingrewards

Of course, the recent Ethereum The skyrocketing amount of staking volume is inseparable from the development of the restaking track.Re-staking was first proposed by the founder of Eigenlayer. Its core is to allow ETH that has been pledged on the Ethereum main chain to be pledged again on other protocols, so that other protocols can share Ether. improve the security of the chain, thereby reducing the security cost of its chain itself. Investors who participate in re-pledge can not only obtain the income from staking Ethereum, but also the income from re-pledging.

Therefore, re-pledging creates a win-win result for all three parties:

- For protocols that use re-pledge, enjoys almost the same level of security as Ethereum while reducing security costs, and attracting a large number of ETH holders to enter the ecosystem and participate. Its ecological development;

- For ETH pledgers,not only enjoy the benefits of Ethereum staking and re-pledging at the same time, but also have a large number ofAirdropexpected;

- In addition, For the Ethereum main chain, the re-pledge mechanism allows its own assets to have more enabling scenarios, and stimulates holders to lock ETH to bring greater room for appreciation.

Therefore, the re-pledge track led by Eigenlayer has developed rapidly in the past few months, and it has also attracted more and more institutional capital. Taking Eigenlayer as an example, in less than two years from May 2022 to now, four rounds of financing have been completed. The latest round of financing was injected by a16z, with a single financing reaching US$100 million. The current four rounds of cumulative financing have reached With over US$160 million, as an emerging track, re-pledge has indeed come to the fore.

Currently, Eigenlayer’s total TVL has exceeded $11 billion, ranking third among all DeFi projects in TVL after Lido and AAVE. TVL, a related project on the liquidity re-pledge track, has grown significantly, with an increase of more than 10% in the past 7 days.

TVL growth rate of projects related to the liquidity re-staking track, data source: defillama

zai The rapid development of the pledge agreement and the expectation of ecological Airdrop have stimulated more ETH holders to participate in the pledge and re-pledge of ETH, which can be seen from the rapid growth of the ETH pledge ratio and the TVL of the re-pledge agreement. These have further reduced the amount of ETH in circulation, giving ETH new room for growth.

Cancun Upgrade

Of course, the Cancun upgrade is naturally a very big positive factor for Ethereum.

Many articles about the Cancun upgrade have been written before. Friends who are interested in exploring in detail can read our historical article "What substantial benefits will the legendary Ethereum Cancun upgrade bring?" 》. For the Ethereum main network, the Cancun upgrade is an important hardware upgrade, which mainly improves the scalability, security and availability of the Ethereum main network.

Of course, the biggest perception for users is that after the Cancun upgrade of Ethereum, its Layer 2 fees will be reduced a lot. On the current basis, The reduction may reach more than 14 times, which is roughly equivalent to the gas fee level of public chains such as Solana, and will also greatly increase the throughput of Layer 2. This is mainly because the EIP-4844 in the Cancun upgrade has greatly reduced the cost of the ETH main chain for data in the Layer 2 protocol, and promoted the progress of the Ethereum sharding plan.

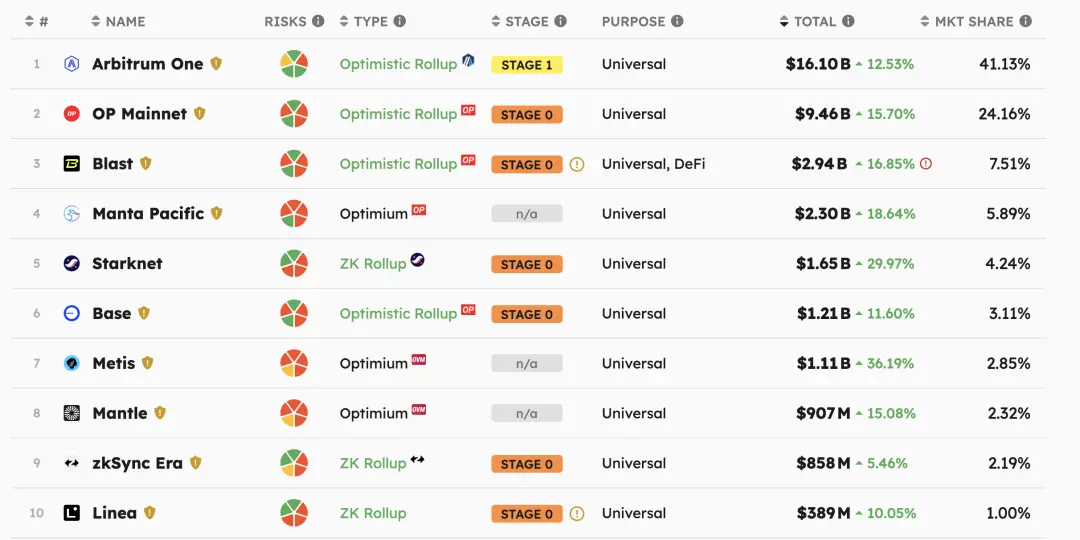

Overview of TVL growth of each Layer2 project on the Ethereum chain, data source: L2BEAT

In addition, another important upgrade in this Cancun upgrade is EIP-4788, which optimizes the information exchange problem between the Ethereum consensus layer and the execution layer. This improvement is very beneficial to liquidity staking and re-staking. Track and cross-chain bridge related projects have improved their safety and operational efficiency.

Therefore, in general, the Cancun upgrade not only greatly reduces the rate of Layer 2 and increases throughput, but also benefits the development of Layer 2 on Ethereum and facilitates the absorption of a large amount of new funds into Layer 2 to participate in the ecosystem. Construction, and it is also a big plus for the liquidity staking and re-staking track. The success of the Cancun upgrade will bring another breakthrough in the Ethereum ecosystem.

Currently, the Cancun upgrade has been successfully deployed on all testnets of Ethereum (including Georli, Sepolia and Holesky). It is planned to go online on the mainnet on March 13 this year. The launch date is very close. Ethereum The prices of ecological and ecological-related projects also reflect the expectations of Cancun’s upgrade to a certain extent.

The probability of Ethereum spot ETF passing

Since the SEC approved 10 Bitcoin spot ETFs on January 10 this year, people have begun to turn their attention to Ethereum spot ETFs.

After all, the adoption of the Bitcoin spot ETF is a great benefit to Bitcoin and the Bitcoin ecosystem. The short-term increase in Bitcoin is the best proof.

But, will the Ethereum ETF pass as planned?

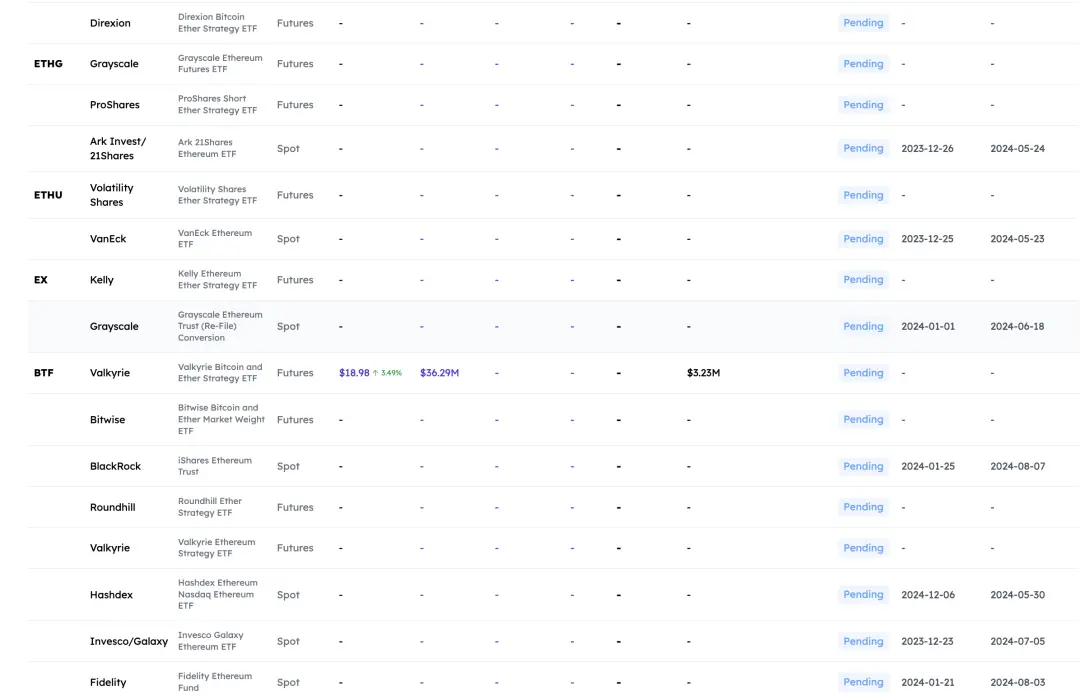

Currently, 7 institutions, including BlackRock, Hashdex, ARK 21Shares, VanEck, etc., have applied for Ethereum spot ETF. After the SEC delayed approval several times, it will be approved by May this year at the latest. Decide whether to approve the Ethereum spot ETF application from the relevant institution (see figure below).

Ethereum spot/futures ETF application status tracking chart, source: blockworks

Of course, Ethereum The key to whether the Ethereum spot ETF passes or not lies in whether the SEC recognizes Ethereum as a commodity or a security. The current disagreement is that the entire mechanism of Ethereum is very different from Bitcoin. Ethereum does not have a fixed total amount, and holders of Ethereum can pledge it in exchange for income.

This has led many people to believe that Ethereum is at risk of being recognized as a security.

However, in the SEC’s case against Ripple last June, the SEC listed 67 Tokens that were securities, and ETH was not among them. Moreover, the SEC has sued several CEXs because they listed some tokens that the SEC recognized as securities, and ETH was not included among them. In other words, the SEC has not publicly and clearly stated that ETH is a security.

More importantly, the U.S. securities regulator has approved the Ethereum futures ETF last year. This approval implies that ETH is a commodity rather than a security. Therefore, the approval of the ETH spot ETF is likely to be sooner or later. things.

The passage of the ETH spot ETF in the future will surely bring a large amount of funds and resources to Ethereum and the Ethereum ecosystem, just like the Bitcoin spot ETF, and open up the development pattern and ceiling of the entire ecosystem.

Summary

If last year was the year when Bitcoin and the Bitcoin ecosystem occupied the spotlight on the entire crypto industry stage, then the Ethereum ecosystem in 2024 will be upgraded in Cancun and spot ETFs are expected With the multiple benefits of continued deflation and the soaring number of pledges, it will definitely write a significant note.

The protagonist of this bull market is the inscription and infrastructure of the Bitcoin ecosystem, or the staking and re-staking track of the Ethereum ecosystem? We will wait and see.

The above is the detailed content of Bitcoin Ecosystem VS Ethereum Ecosystem, who will be the next leader?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.