web3.0

web3.0

Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?

Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?

Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?

Original author: Ana Paula Pereira, Sander Lutz

Original compilation: Moni, Odaily Planet Daily

Nasdaq-listed BlackRock IBIT has reached an important milestone 40 trading days after listing its spot Bitcoin ETF. The number of Bitcoins it holds already exceeds the Bitcoin holdings of Michael Saylor’s publicly traded company MicroStrategy. This achievement marks BlackRock IBIT’s strong performance in the cryptocurrency market and demonstrates its success in the field of digital asset investment. As Bitcoin holdings increase, BlackRock IBIT’s influence and status in the digital currency field is also increasing, attracting the attention of more investors

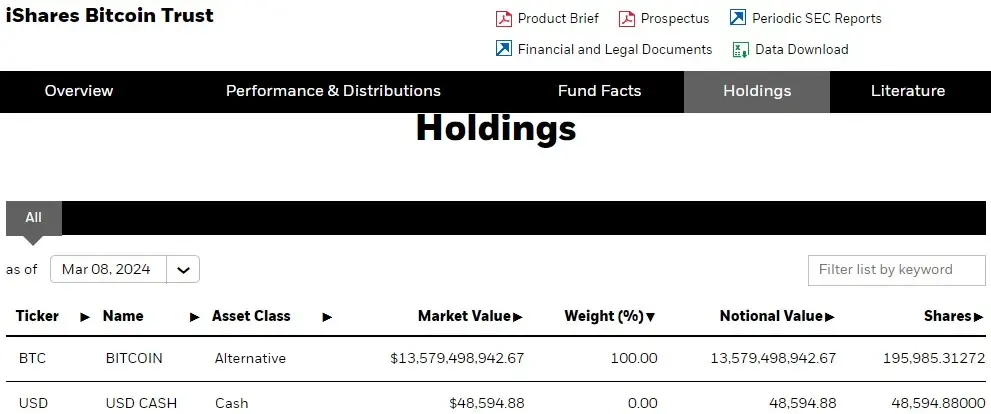

Data shows that as of March 8 , IBIT holds a total of approximately 195,985 BTC (as shown below), with a market value of more than 13.579 billion US dollars, while MicroStrategy’s Bitcoin holdings are approximately 193,000 BTC, and on the same day, Bitcoin exceeded US$70,000 for the first time in history.

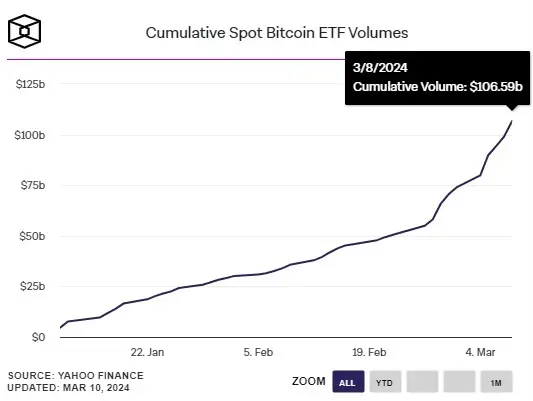

In addition, spot Bitcoin ETFs have also reached a cumulative trading volume of more than $100 billion in less than two months. According to the latest data released by Yahoo Finance on March 10, as of March 8, the cumulative transaction volume of spot Bitcoin has reached 106.59 billion US dollars.

In fact, unknowingly, a battle for Bitcoin reserves has begun among U.S. listed companies.

U.S. listed companies/funds’ Bitcoin reserves have become a “three-headed force”?

As the price of Bitcoin reaches a record high, US stock listed companies/funds are also accelerating their accumulation of Bitcoin. They are "eating" Bitcoin faster than Bitcoin is mined. According to the current market trend, US listed companies have formed a "three-headed" trend, and these "three heads" are: spot Bitcoin ETF, MicroStrategy, and Tesla (and SpaceX).

First of all, let’s take a look at the spot Bitcoin ETFs listed on the US stock market. According to data compiled by BitMEX Research, in addition to Grayscale’s GBTC, the remaining nine spot Bitcoin ETFs are The ETF has been adding to its Bitcoin reserves since it received approval from the U.S. Securities and Exchange Commission to go public on January 11.

MicroStrategy, another US-listed company, can now be regarded as a "veteran" in the Bitcoin market, and every time it adds Bitcoin, it always has the right timing.

Just three days before Bitcoin exceeded $70,000 for the first time on March 8, MicroStrategy "suddenly" issued an announcement announcing plans to sell principal to qualified institutional buyers through private placements based on market conditions and other factors. A total of US$600 million of convertible senior notes due in 2030. One day later, they announced that they planned to expand the issuance of convertible senior notes to US$700 million.

At least for now, MicroStrategy’s investment strategy seems to be successful. Since August 2020, the value of Bitcoin held by MicroStrategy has increased several times, bringing generous returns to the company’s shareholders. It is reported that MicroStrategy Chairman Michael Saylor, MicroStrategy's largest investor, owns about 12% of the company's shares, has increased his personal wealth by about $700 million after consecutive gains in his company's stock and Bitcoin prices. He also revealed that he personally owned 17,732 Bitcoins in 2020, so his holdings and positions climbed to $2.96 billion from $2.27 billion at the beginning of the week.

Finally, compared to the "high-profile" spot Bitcoin ETF and MicroStrategy, Elon Musk's Tesla and SpaceX seem to be much lower-key, although no relevant data was disclosed in the recent financial report (Note: Tesla and SpaceX have not yet disclosed (Announcement of financial report for the first quarter of 2024), but according to on-chain data analysis platform Arkham monitoring, Tesla currently holds approximately 11,510 BTC (worth approximately US$780 million) in 68 addresses, and SpaceX holds approximately 8,290 BTC in 28 addresses. BTC (worth approximately $560 million), which means Tesla currently holds approximately 1,789 BTC more than the 9,720 BTC balance reported in its last financial report.

The crypto community has speculated that Tesla has started buying back Bitcoin or whether the recent change in numbers is due to an accounting error, with some users suggesting that the company may have started buying Bitcoin after its last earnings call and New purchase information may be reported on the next financial conference call.

Why do we need to pay attention to the Bitcoin reserves of listed companies/funds?

Listed companies/funds are important participants in the market economy, and their investment behavior often has benchmark significance. The holding of Bitcoin by listed companies shows that they are optimistic about the future value of Bitcoin, which may attract more investors to pay attention to Bitcoin, thereby driving up the price of Bitcoin.

Not only that, listed companies/funds holding Bitcoin can also increase the market circulation of Bitcoin and make it easier to trade, which is beneficial to the development of the Bitcoin market and can even demonstrate its support for new technologies. open attitude and enhance the company's image.

Market analysts believe that, driven by listed companies/funds increasing their Bitcoin reserves, more crypto whales may be "stimulated" to enter the market. For example, shortly after MicroStrategy announced that it would continue to purchase Bitcoin. , HODL15Capital noticed the buying action of a mysterious whale. After recently adding positions frequently, this address now holds a total of approximately 51,064 BTC, worth approximately US$3.5 billion.

From this perspective, the investment strategies of listed companies/funds also demonstrate their confidence in the long-term value of Bitcoin, which may encourage other crypto whales to continue to hold or increase their holdings of Bitcoin, plus The successful investments in spot Bitcoin ETFs, MicroStrategy, and Tesla may attract other crypto whales to follow suit and may also lead to further increases in the price of Bitcoin.

Of course, Bitcoin is still an emerging asset class and the regulatory environment is not yet complete. Investors need to pay attention to the impact of regulatory policy changes on the Bitcoin reserves of listed companies. Overall, paying attention to the Bitcoin reserves of listed companies/funds can help us understand important information such as market trends, investment risks, company financial conditions and regulatory environment, thereby allowing ordinary investors to make more informed investment decisions.

The above is the detailed content of Keep buying, buying, buying, how many Bitcoins do U.S. listed companies and fund giants hold?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1392

1392

52

52

37

37

110

110

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

A inventory of special services for major virtual currency trading platforms around the world

Apr 22, 2025 am 08:27 AM

The special services of global virtual currency trading platforms include: 1. Comprehensive ecological platforms such as Binance and OKX, providing a variety of cryptocurrency trading pairs and ecosystems; 2. Compliance and security platforms such as Coinbase and Gemini, emphasizing regulatory compliance and user asset security; 3. Professional trading platforms such as Bitfinex and Kraken, focusing on high-leverage trading and technical support; 4. Innovative service platforms such as Crypto.com and FTX, launching innovative financial products; 5. Regional featured platforms such as Bitstamp and Huobi Global, providing localized services and compliance solutions.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

Top 10 safe and easy-to-use virtual currency trading platforms, ranking of the top ten reliable digital currency exchanges

Apr 22, 2025 pm 12:45 PM

The top ten safe and easy-to-use virtual currency trading platforms are: Binance, OKX, gate.io, Coinbase, Kraken, Huobi, Bybit, KuCoin, Bitfinex, and Bittrex. These platforms are highly praised for their high liquidity, low transaction fees, diversified trading products, global layout, strong technical support, innovative trading systems, high security, rich currency and user-friendly interface.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

Top 10 digital currency exchange apps Recommended by the top ten digital currency exchanges

Apr 22, 2025 pm 03:12 PM

The top ten digital currency exchange apps are ranked: 1. Binance, 2. OKX, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bybit, 9. Bitfinex, 10. Bittrex, these platforms were selected for their excellent performance in user experience, security, handling fees and transaction volume.

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

Top 10 digital currency exchanges Top 10 digital currency app exchanges

Apr 22, 2025 pm 03:15 PM

The top ten digital currency exchanges are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.