ArkStream Capital: Why we invest in IO.Net

Why invest in IO.Net: Invest in the new oil in the AI era, decentralize the mining of human computing power

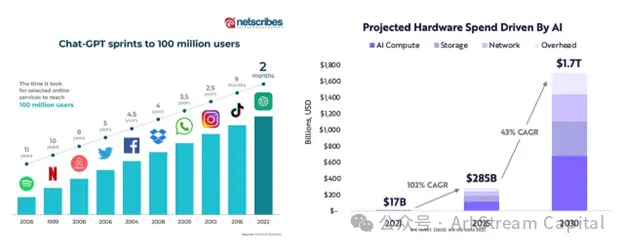

##Image source: NetScribes, Ark Invest

IO.Net’s Unique Solution

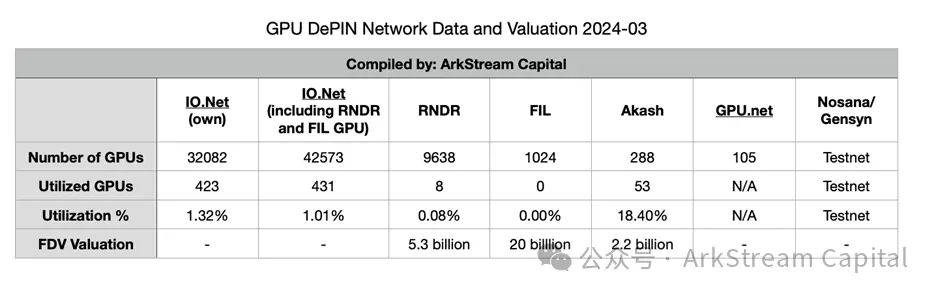

IO.Net not only provides customers with relevant Compared with centralized cloud service providers' low prices of 10-20% off and instant online services without permission, more computing power providers provide additional startup incentives through the upcoming IO tokens to jointly help connect 1 million GPUs. The goal. Compared with other DePIN computing projects, IO.Net focuses on GPU computing capabilities, and the scale of its GPU network is more than 100 times ahead of similar projects. In addition, IO.Net is also the first in the blockchain industry to integrate the most advanced ML technology stack (such as Ray cluster, Kubernetes cluster and giant cluster) into the GPU DePIN project and put it into large-scale practice, which makes it not only the number of GPUs , and is in a leading position in technology application and model training capabilities.

With the continuous development of IO.Net, its The engineering team will increase the GPU capacity of the network to 500,000 concurrent GPUs across the entire network to compete with centralized cloud service providers, thereby providing services similar to Web 2 at a lower cost. Through close partnerships with major DePIN and AI players, including Render Network, Filecoin, Solana, Ritual, and more, IO.Net is gradually establishing its core position in the field. We believe that IO.Net will become the leader and settlement layer of decentralized GPU networks in the medium to long term, bringing vitality to the entire Web 3xAI ecosystem.

Conclusion

ArkStream Capital’s investment is not only a recognition of the future development potential of IO.Net, He is also firmly optimistic about the future direction of AI, DePIN and broader technology fields. As an industry pioneer and supporter, ArkStream Capital will continue to provide computing infrastructure and ecological connection support for IO.Net, and jointly create a new era of AI and decentralized networks.

View the original English text of this announcement: https://x.com/ark_stream/status/1766494990862303553?s=20

Appendix: The complete list of IO.Net Series A investors includes:

Hack VC, Multicoin, 6th Man Ventures, OKX Ventures, M13, Mo and Avery from Aptos, Aptos Labs, Toly from Solana, Matty Taylor, Ian Krotinsky, MH Ventures, Amber Group, Arkstream Capital, Modular Capital, Continue Capital, Foresight, Longhash, SevenX, Delphi Digital, Animoca Brands, Yat Siu, The The Sandbox, Sebastian Borget from The Sandbox, Solana Ventures, Web3 Ventures

The above is the detailed content of ArkStream Capital: Why we invest in IO.Net. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

What are the hybrid blockchain trading platforms?

Apr 21, 2025 pm 11:36 PM

Suggestions for choosing a cryptocurrency exchange: 1. For liquidity requirements, priority is Binance, Gate.io or OKX, because of its order depth and strong volatility resistance. 2. Compliance and security, Coinbase, Kraken and Gemini have strict regulatory endorsement. 3. Innovative functions, KuCoin's soft staking and Bybit's derivative design are suitable for advanced users.

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

What are the digital currency trading apps suitable for beginners? Learn about the coin circle in one article

Apr 22, 2025 am 08:45 AM

When choosing a digital currency trading platform suitable for beginners, you need to consider security, ease of use, educational resources and cost transparency: 1. Priority is given to platforms that provide cold storage, two-factor verification and asset insurance; 2. Apps with a simple interface and clear operation are more suitable for beginners; 3. The platform should provide learning tools such as tutorials and market analysis; 4. Pay attention to hidden costs such as transaction fees and cash withdrawal fees.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

Popular science in the currency circle: What is the difference between decentralized exchanges and hybrid exchanges?

Apr 21, 2025 pm 11:30 PM

The difference between decentralized exchanges and hybrid exchanges is mainly reflected in: 1. Trading mechanism: Decentralized exchanges use smart contracts to match transactions, while hybrid exchanges combine centralized and decentralized mechanisms. 2. Asset control: Decentralized exchange users control assets, and mixed exchange ownership centralization and decentralization. 3. Privacy protection: Decentralized exchanges provide high anonymity, and hybrid exchanges require KYC in centralized mode. 4. Trading speed and liquidity: Decentralized exchanges are slower, liquidity depends on user pool, and hybrid exchanges are more fast and liquid in centralized mode. 5. Platform governance: Decentralized exchanges are governed by community governance, and hybrid exchanges are jointly governed by communities and centralized teams.

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum chains can be traded on the following exchanges: 1. Binance: One of the world's largest exchanges, with large trading volume, rich currency and high security. 2. Sesame Open Door (Gate.io): a large exchange, providing a variety of digital currency transactions, with good trading depth. 3. Ouyi (OKX): operated by OK Group, with strong comprehensive strength, large transaction volume, and complete safety measures. 4. Bitget: Fast development, provides quantum chain transactions, and improves security. 5. Bithumb: operated in Japan, supports transactions of multiple mainstream virtual currencies, and is safe and reliable. 6. Matcha Exchange: a well-known exchange with a friendly interface and supports quantum chain trading. 7. Huobi: a large exchange that provides quantum chain trading,

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The latest updates to the oldest virtual currency rankings

Apr 22, 2025 am 07:18 AM

The ranking of virtual currencies’ “oldest” is as follows: 1. Bitcoin (BTC), issued on January 3, 2009, is the first decentralized digital currency. 2. Litecoin (LTC), released on October 7, 2011, is known as the "lightweight version of Bitcoin". 3. Ripple (XRP), issued in 2011, is designed for cross-border payments. 4. Dogecoin (DOGE), issued on December 6, 2013, is a "meme coin" based on the Litecoin code. 5. Ethereum (ETH), released on July 30, 2015, is the first platform to support smart contracts. 6. Tether (USDT), issued in 2014, is the first stablecoin to be anchored to the US dollar 1:1. 7. ADA,