What is the logic behind the heavy positioning in the modular bull market?

After conducting in-depth research on the sector, it is confirmed that modularization is a must-have position in the bull market.

The key to this bull market lies in widespread application. Whether it is the large-scale adoption of layer2 technology, the upgrade of the Cancun network, or the development of high-performance public chains such as Sui and APT, all are to attract more Many Web2 users are involved.

Modularization is the infrastructure for large-scale applications and is also essential. In the 21st century, Cosmos proposed the concept of Appchain, a vision that will be realized through modularity. Modularity reduces the cost of creating a chain, simplifies the process, and allows for flexible creation based on demand.

Raas's service provider can maintain a modular public chain for a monthly fee of 3000U, and also provides various infrastructure, including blockchain browsers, cross-chain bridges, data APIs, etc., without even having to Write code.

As mentioned in the article "Modularization is Rising", more and more Dapp developers are currently choosing to build independent blockchains as the basis for their applications. The reason behind this trend is not only the ability to customize exclusive public chains for applications, but also the fact that it helps build an independent ecosystem. From a profit perspective, the growth potential of the market value of an independent public chain far exceeds the market value of a single Dapp.

What is the logic behind the heavy positioning in the modular bull market?

1. Celestia (Tia)

Celestia is one of the most important roles in modular architecture. Celestia focuses on the DA layer and consensus layer. Developers can let Celestia be responsible for DA, let Ethereum or other public chains be responsible for consensus and settlement, and execute it themselves. Or let Celestia act as DA and consensus, and itself act as settlement and execution. Celestia Labs has launched Blobstream, which delivers Celestia’s modular data availability layer to Ethereum. The promise of using on-chain light clients to relay Celestia data roots enables Ethereum developers to create high-throughput L2s as easily as they develop smart contracts.

Among the four layers: consensus layer, execution layer, settlement layer, and data availability layer, the DA layer has the greatest demand. Otherwise, Ethereum would not go to great lengths to do the Cancun upgrade to reduce the cost of DA. According to other people's tests, even if Blob greatly reduces the gas cost of Layer 2 after the Cancun upgrade, it is still dozens of times more expensive than using Celestia.

From a practical point of view, Celestia, as the DA layer with the highest product integrity, highest reputation, and largest market value, is the first choice of many layer2s, and Celestia pledged users are targeted for airdrops, allowing Celestia to start a positive spiral.

2. Dymension (DYM)

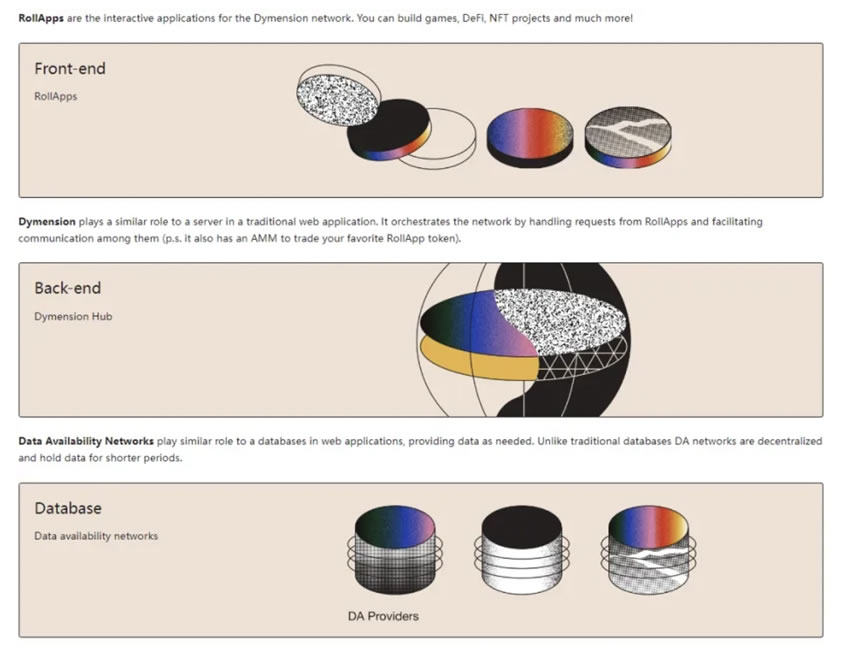

Dymension is usually regarded as a settlement layer module, but it can also be used as a Raas service provider. Through Dymension, RollApp’s public chain can be built.

The core product Dymension RDK is the Cosmos SDK customized for RollApps. The Cosmos SDK is a development kit that comes pre-installed with several modules to speed up the build process. Additional smart contract frameworks have also been developed and deployed, produced under different licenses:

Ethermint: EVM Smart Contracts

CosmWasm: The Wasm framework built by Confio and Cosmos contributors

Dymension has an embedded AMM that acts as a centralized liquidity layer for the RollApp ecosystem. The AMM supports features such as cross-RollApp swapping, efficient token bootstrapping, and provides access to protocol incentives.

Compared with other modularizations, Dymension is more difficult to develop, especially for the Ethereum-based layer 2, which is not dominant, but it is more malleable. Judging from the results, although officially more than 1,000 RollApps have been deployed. However, according to our investigation, the TVL of the leading Rollapp is only a few million US dollars, and the daily activity is only double digits. Therefore, there is still a lot of room for progress in the development of the Dymension ecosystem.

3. Fuel

At the execution level, Fuel plays a very important role. Through its original FuelVM, Fuel implements improvements proposed over the years to the Ethereum VM (EVM) without sacrificing backwards compatibility, including parallel transaction execution and support for multiple native assets. Fuel enables parallel execution of transactions in the form of a UTXO model using strict state access lists. As a result, Fuel can deliver more computation, state access, and transaction throughput than its single-threaded counterpart.

4. Eclipse

Eclipse is another important role in execution layer modularization. Its plan is to bring Solana Virtual Machine (SVM) into Ethereum so that Ethereum can have the functions of Solana. performance. Its specific structure is:

Settlement layer - Ethereum: Eclipse will settle to Ethereum (i.e., the embedded verification bridge on Ethereum) and use ETH as its Gas consumption, and the fraud proof will also Submitted on Ethereum;

Execution layer - Solana Virtual Machine (SVM): Eclipse will run a high-performance SVM as its execution environment, a fork of the Solana Labs client (v1.17);

Data availability layer - Celestia: Eclipse will publish data to Celestia to achieve scalable data availability (DA);

Proof mechanism - RISC Zero: Eclipse will use RISC Zero for ZK fraud proof (no need Intermediate state serialization);

Communication protocol - IBC: Complete bridging with non-Eclipse chains through Cosmos' inter-chain communication standard IBC;

Cross-chain protocol - Hyperlane: Eclipse and Hyperlane cooperate to integrate Hyperlane's permissionless interoperability solution Introducing a blockchain based on Solana Virtual Machine (SVM).

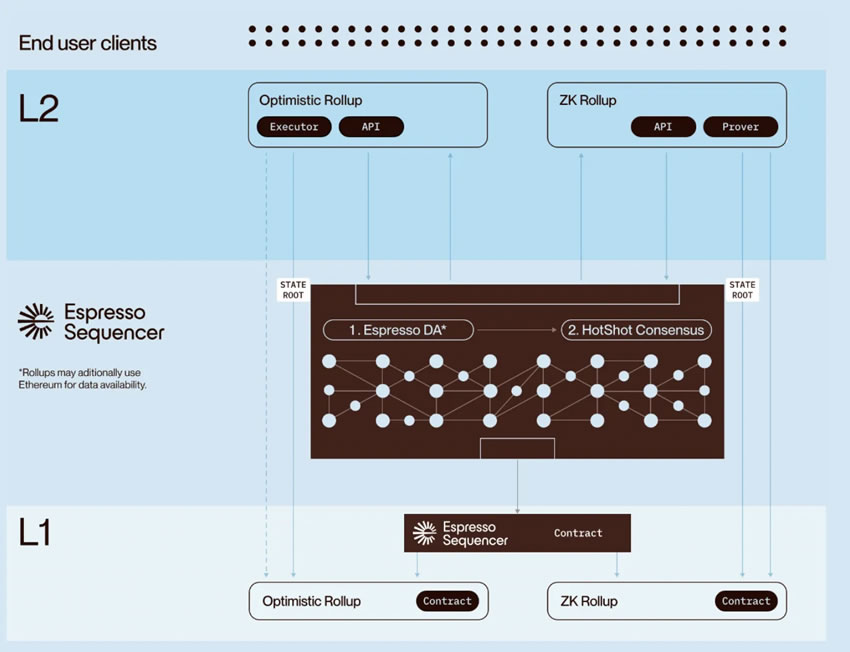

5. Espresso

Espresso is a decentralized sorter, although it is not one of the four major modules. But it's also very important. We know that the core of Layer2 is to uniformly package transaction rollup to Layer1. Then the sorting of transactions on Layer 2 is completed by the sorter, and the sorter has the right to let a transaction be packaged first, or not packaged. Now the sorter is basically controlled by the layer2 project side, which obviously violates the principle of decentralization. In the future, the use of decentralized sorters will become an inevitable trend.

#Espresso is a decentralized sequencer using the HostShot consensus mechanism. This may consist of thousands of heterogeneous nodes, with their own DA layer to store data. Espresso can achieve

1) Fast response to Rollup and final confirmation of transaction

2) The HostShot consensus mechanism used by Espresso can be expanded to tens of thousands of nodes and ensures strong performance.

3) Espresso’s Layer2 can realize express delivery and low-cost cross-chain communication.

6. Raas service provider

Raas service provider integrates modularization and allows customers to issue chains on demand. It greatly simplifies the process of modular chain development and plays an important role in promoting large-scale modular application. The more important ones include Conduit, AltLayer, Caldera, Gelato, and Lumoz. Among them, Altlayer has the highest degree of integration. It integrates almost four major modular layers, as well as decentralized sequencers, interoperability protocols, etc. Conduit and Caldera are mainly on layer 2 and mainly support OP Stark and Arbitrum Orbit. But their advantages are very convenient and simple, and the price is also very low. And there are already some very well-known modular public chains, such as Conduit used by ZORA, AEVO, and Lyra, and Caldera used by Manta, Loot, and Injective.

The above is the detailed content of What is the logic behind the heavy positioning in the modular bull market?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.