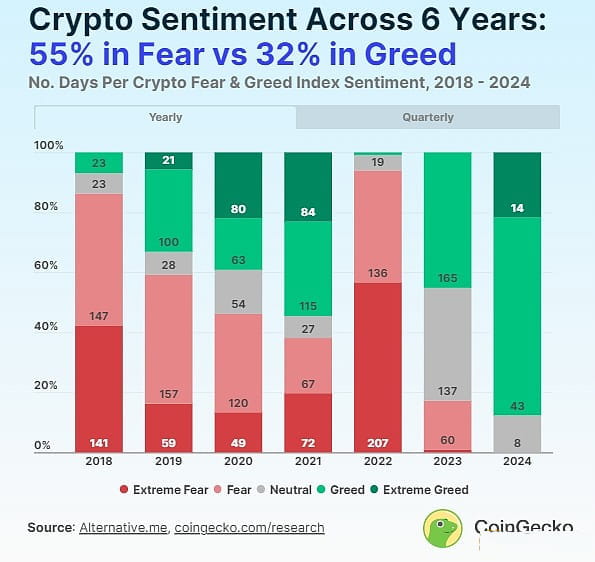

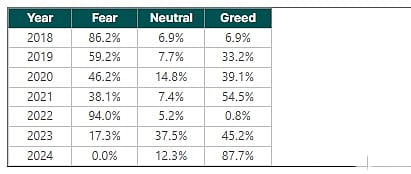

Over the past six years from 2018 to 2024, cryptocurrency market sentiment has been fearful 54.7% of the time, greedy 32.0% of the time, and greedy the remaining 13.3% of the time. Time is neutral. During this period, the Fear and Greed Index averaged a score of 45, indicating fear sentiment was close to neutral. This suggests that cycles of optimism in cryptocurrencies are shorter than cycles of panic and negativity, or that expectations of only rising markets are more short-lived compared to bearish expectations. It's also worth noting that the Fear & Greed Index has tracked market sentiment in more bearish years than bullish years.

Between November 2023 and February 2024, the Cryptocurrency Fear and Greed Index did not show any “fear” sentiment for four consecutive months, which shows that market sentiment overall remains optimistic. The future trend of the cryptocurrency market requires further observation, especially before Bitcoin’s halving in April.

The Fear and Greed Index was near record levels between November 2020 and February 2021, when Bitcoin prices topped $40,000 for the first time. Several days of greed were broken by a day of fear as Bitcoin pulled back slightly before setting new highs.

During the cryptocurrency bear market of 2018-2019, the Fear and Greed Index ranked second and third respectively on the “fear” sentiment scale. The number of three high days has been recorded.

In 2018, according to data tracking 334 cryptocurrency markets, there were 288 days (86.2%) when markets were in a state of extreme fear, with extreme fear (42.2%) and just fear (44.0 %) is almost the same number of days. It is worth noting that the total cryptocurrency market capitalization reached a new high of $0.85 trillion on January 7, but then fell sharply due to the bursting of the ICO bubble, falling to $0.13 trillion by the end of the year.

The crypto bear market continued into 2019, with concerns about the index showing up on 216 out of 365 days (59.2%). The Fear & Greed Index recorded its largest overnight drop of 45 points this year, with the index falling from 61 points (greed) on July 14 to 16 points (extreme fear) the next day. Nonetheless, cryptocurrency market sentiment was buoyed by a slight mid-year recovery and recorded 121 days of greed (33.2%) in 2019, which was an improvement over the previous year.

The sentiment mix in 2020 was more balanced, with fear accounting for 46.2% and greed accounting for 39.1%, reflecting the market’s consolidation and steady recovery . Especially in the second half of the year, during the DeFi summer, the cryptocurrency market experienced 80 days of extreme greed (21.9% of the year) and 0 days of extreme fear.

During the 2021 bull run, the cryptocurrency market experienced its greediest year of all years tracked to date, spending 199 out of 365 days greedy (54.5%). The Fear and Greed Index also recorded an overnight high of 40 points, rising from 38 points (fear) on March 1 to 78 points (extreme greed) the next day. This year, the total cryptocurrency market capitalization has risen from $0.78 trillion to $2.31 trillion, while Bitcoin has broken new highs, topping $69,000.

The cryptocurrency market was particularly booming in the first quarter of 2021 and experienced greed 96.7% of the time. However, sentiment became more mixed in subsequent quarters, likely due to a pullback due to volatile market conditions.

Cryptocurrency sentiment in 2022 was in stark contrast, as the market was in fear almost the entire year, 343 out of 365 days (94.0%). The number of days with extreme fear, 207, exceeded the 136 days in which fear alone was recorded. Although NFTs climbed to new highs in the form of native cryptocurrencies, the cryptocurrency market only experienced 3 days of greed and no extreme greed.

Even in the first quarter when cryptocurrency ads featured prominently in the US Super Bowl, the cryptocurrency market has been in fear 83.3% of the time. This is increasing every quarter: Fear accounted for 93.4% in Q2 as Terra Luna collapsed, then climbed to 98.9% in Q3 as contagions increased and overall market conditions worsened, ending in In Q4, fear peaked at 100.0% as FTX crashed.

Despite the persistence of the crypto bear market in 2023, market sentiment appears to be stabilizing, with 137 days (37.5%) being neutral, 165 days (45.2%) being greedy, and 63 days (17.3%) being Fear is significantly reduced. It is worth noting that there are only 3 days of extreme fear in the first quarter of 2023 and no days of extreme greed. This suggests that consolidation in the cryptocurrency market has led to milder sentiment recorded by the Fear and Greed Index.

Number of days per year the cryptocurrency market experienced fear, neutrality, and greed sentiments from 2018 to 2024 as of March 5, 2024 percentage:

The above is the detailed content of Cryptocurrency Market Hits New Highs, What Happens to the Fear and Greed Index. For more information, please follow other related articles on the PHP Chinese website!