Software Tutorial

Software Tutorial

Mobile Application

Mobile Application

Personal income tax deduction standard table - personal income tax payment standard

Personal income tax deduction standard table - personal income tax payment standard

Personal income tax deduction standard table - personal income tax payment standard

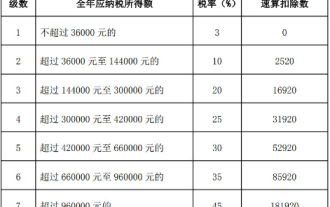

php Editor Banana will give you a detailed explanation of the personal income tax deduction standard table, which is an important content about personal income tax payment standards. By understanding and familiarizing yourself with various deduction standards, you can help taxpayers plan their finances reasonably, reduce their personal income tax burden, and allow you to better understand how to correctly declare personal income tax and avoid unnecessary tax risks. In this article, we will introduce the relevant knowledge of personal income tax in detail, help you better understand the payment standards and deduction policies of personal income tax, and provide guidance for your financial planning.

1. If the salary range is between 1-5,000 yuan, including 5,000 yuan, the applicable personal income tax rate is 0%;

2. If the salary range is between 5,000-8,000 yuan, including 8,000 yuan, the applicable personal income tax rate is 3%;

3. If the salary range is between 8,000 yuan and 17,000 yuan, including 17,000 yuan, the applicable personal income tax rate is 10%;

4. If the salary range is between 17,000-30,000 yuan, including 30,000 yuan, the applicable personal income tax rate is 20%;

5. If the salary range is between 30,000-40,000 yuan, including 40,000 yuan, the applicable personal income tax rate is 25%;

6. If the salary range is between 40,000 yuan and 60,000 yuan, including 60,000 yuan, the applicable personal income tax rate is 30%;

7. If the salary range is between 60,000-85,000 yuan, including 85,000 yuan, the applicable personal income tax rate is 35%;

8. If the salary range is more than 85,000 yuan, the applicable personal income tax rate is 45%.

Personal income tax payment standards:

The calculation formula of the full month’s taxable income is: (wage payable-four funds)-3500, where the “four funds” refer to insurance and welfare expenses such as social security, provident fund, medical insurance, and unemployment insurance. Individual tax payment is made based on the full month's taxable income. The formula is: tax payment = full month's taxable income × tax rate - quick calculation deduction. Tax rates and quick calculation deductions are stipulated by the state. Specific standards and calculation methods can be viewed on the government’s tax disclosure website.

In an enterprise, the amount of personal income tax is calculated from the total amount of tax paid; the total amount of tax paid by the enterprise includes value-added tax, sales tax and surtax and income tax. The rate of value-added tax is 17%, and the rate of sales tax and surtax is 17%. The tax rate is 12% and the income tax rate is 25%.

In addition, there is a standard tax deduction when personal income is taxed, also known as an expense deduction. It refers to the limit on expenses that are allowed to be deducted when taxing personal income. For business entertainment expenses of an enterprise, according to regulations, 60% of the amount incurred can be deducted, but the maximum cannot exceed 5‰ of the sales (operating) income of the year. Eligible advertising and business promotion expenses incurred by an enterprise that do not exceed 15% of the current year's sales (business) income are also allowed to be deducted, and the excess is allowed to be carried forward for deduction in subsequent tax years. Finally, the amount of public welfare donation expenditure incurred by the enterprise does not exceed 12% of the total annual profit and is allowed to be deducted.

The above is the detailed content of Personal income tax deduction standard table - personal income tax payment standard. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

'Personal Income Tax' Tax Rate Table Latest in 2024

Mar 05, 2024 pm 07:20 PM

With the continuous development of the times, personal income tax rates are also constantly adjusted. The latest personal income tax rate table for 2024 has been released, which is an important reference for every taxpayer. Let us take a look at the latest personal income tax rate table for 2024! The latest personal income tax rate table for 2024 I, tax rate table 1, comprehensive income tax rate table 2, salary and salary tax rate table 3, transitional salary and salary tax rate table 4, withholding and prepayment tax rate for residents’ personal labor remuneration income table 2, annual personal income tax Calculation formula 1. Personal income tax payable = taxable income × applicable tax rate - quick calculation deduction 2. Taxable income = annual income - allowed deduction 3. Allowed deduction = basic deduction fee of 60,000 yuan + special items

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

Personal income tax rate calculator

Mar 05, 2024 pm 11:40 PM

The calculation of personal income tax is very complicated. Most players do not know how to calculate personal income tax. Click on the link https://www.gerensuodeshui.cn/ to enter the tax rate calculator. Next, the editor will bring it to users. Personal income tax rate calculator online calculation portal, interested users come and take a look! Personal Income Tax App Tutorial Personal Income Tax Rate Calculator Tax Rate Calculator Entrance: https://www.gerensuodeshui.cn/ 1. Personal tax calculation formula 1. Payable income = pre-tax salary income amount - five insurances and one fund (individual Payment part) - expense deduction amount 2. Tax payable = payable income × tax rate - quick calculation deduction number two

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax app How to declare personal income tax app

Mar 12, 2024 pm 07:40 PM

How to declare personal income tax on the app? Personal Income Tax is a very practical mobile software. Users can declare some businesses on this software, and can also make tax refunds on this software. As long as the user downloads this software, he or she does not have to wait in line offline, which is very convenient. Many users still don’t know how to use personal income tax software to file returns. The following editor has compiled the reporting methods of personal income tax software for your reference. Personal income tax app declaration method 1. First, open the software, find and click the "I want to file taxes" button on the homepage; 2. Then, find and click "Annual Comprehensive Income Summary" in the tax declaration here.

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

How to fill in the special additional deduction declaration for personal income tax in 2024

Apr 01, 2024 pm 04:01 PM

In the process of filing personal income tax, special additional deductions are an important policy measure, which provide taxpayers with more opportunities for tax reduction and exemption. Therefore, in this article, the editor has prepared the step-by-step process for filing special additional deductions for personal income tax. Let’s learn together. Steps and procedures for claiming special additional deductions for personal income tax 1. Open the personal tax APP, select [Common Business] on the homepage, and then select [Fill in special additional deductions] 2. Scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest , housing rent and support for the elderly, infant and child care. According to the relevant policies and regulations of the national tax department, the Personal Income Tax Law determines the scope of the following special deduction items: Children’s Education 3. At the bottom of the page, you can select [One-click import], so that you can fill in last year’s declaration with one click.

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the tax refund declaration on the personal income tax app? The process of canceling the tax refund declaration on the personal income tax app

Mar 12, 2024 am 11:50 AM

How to cancel the personal income tax refund application? Personal income tax is a very popular mobile phone software. The functions on this software are very powerful. Users can perform many operations in this software. For example, they can declare on this software, and then they can also do it on this software. For tax refunds or a series of other operations, many users want to know how to cancel a declaration on this software. The editor below has compiled the methods for canceling a declaration for your reference. Personal Income Tax App Tax Refund Declaration Cancellation Process 1. Enter the Personal Income Tax Mobile App and click to declare annual income calculation. 2. A declaration prompt pops up on the page, click on the declaration details. 3. Then click Done. 4. Click on the submitted withdrawal

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

How to correct declaration records in personal income tax app

Mar 14, 2024 pm 03:04 PM

The Personal Income Tax App is an official app that facilitates users to conduct tax enquiries, payments, registrations and even business transactions. In our lives, this app can help us understand our tax situation in real time. So if we use the Personal Income Tax App If an error is found in the declaration record, how to correct it? This tutorial guide will provide you with a detailed step-by-step guide. First of all, we first enter the personal income tax app, click on the handle & check option, and then in the handle & check option, you can see the query of the declaration record and find it in the record. Click on the record we want to correct and pull the page to You can see the correction button at the bottom, click Correction to make corrections

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

How to get a personal income tax refund in 2024_A complete introduction to the personal income tax refund operation process

Mar 20, 2024 pm 07:26 PM

Have you filed personal income tax returns? You can make an appointment on March 1st. Make an appointment in advance and declare in advance. If you see that you have to pay taxes, your worries will finally die. So how to refund the personal income tax refund? Friends in need, please come and take a look below. How to get a personal income tax refund in 2024. After installing and registering the personal income tax APP, you can click "Income Tax Detail Inquiry" on the homepage to view the income and declared tax amount of the previous year. Select "Annual Comprehensive Income Summary", the system will automatically fill in the relevant data, and the user needs to check whether the information is accurate. If you need to modify it, you can click "Standard Declaration" to make adjustments. 3. Check the basic personal information, remittance place, amount of tax paid and other information, and submit the declaration after confirming that it is correct. 4. Then you need to select the corresponding card to ensure that it can

How to apply for tax refund for personal income tax

Mar 25, 2024 pm 02:45 PM

How to apply for tax refund for personal income tax

Mar 25, 2024 pm 02:45 PM

1. Open the personal income tax app, click [Start Declaration] at [2023 Comprehensive Income Annual Summary] on the homepage. 2. Read the simple declaration instructions and click [I have read and understood] to enter the simple declaration interface. 3. After ensuring that the basic personal information, settlement place, and tax paid are correct, click [Next]. 4. In the pop-up window, check [I have read and agree], click [Confirm], and select [Apply for tax refund]. 5. Click [Continue Tax Refund] in the pop-up window, add bank card information or select a bank card directly. 6. Click [Submit], and in the pop-up