Ultra-low risk return strategy - Cryptocurrency Funding Fee Arbitrage

Only need to understand two concepts.

Concept 1: Funding fee

Concept 2: U standard/coin standard

Funding fee: The funding rate is the exchange’s purpose to maintain a balance between the contract price and the underlying asset price The rate charged or paid to position holders for the difference. It is difficult to understand when reading, but you can intuitively understand that this is an adjuster that adjusts the price difference between spot and contract prices.

The funding fee rate can be positive or negative. The final value is confirmed by the exchange through algorithms and is a value that changes in real time. Pay three times a day according to the current node rate value (00:00, 08:00, 16:00).

Positive funding rate, those who are long will pay those who are short.

Negative funding rate, short sellers will be charged for long positions.

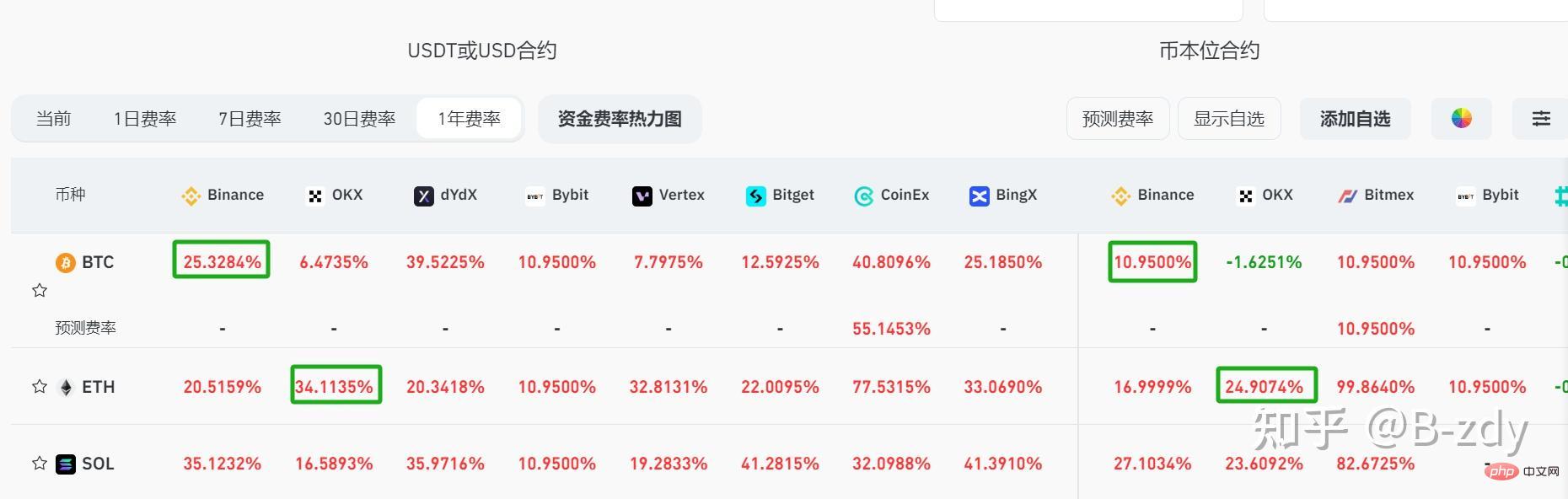

Our arbitrage strategy is to earn this fee. Statistics show that there are many more people who are long than short in the cryptocurrency market. As a result, the funding rate is positive all year round. The following figure shows the statistical data of funding rates in the past year:

Since there is a positive expected return from this funding rate, we can do the following strategy:

Divide the cash on hand into two parts, each with 50%, one part will buy more spot goods, and the other part will Buying the contract of the corresponding product is empty and no leverage is added. For example: 100,000 RMB, 50,000 RMB to buy ETH spot (spot can only be long), 50,000 ETH/USTD contract to open short. At the same time, set a profit stop of 95% to close the position for spot ETH, and set a 95% loss close for the short contract. With such a configuration and a hedge, we have no risk no matter whether ETH rises or falls. A short contract of 50,000 yuan will contribute 33% of annual capital fee income to us. Take the OKX exchange pictured above as an example.

This hedging strategy ignores any fluctuations, pins, shocks, and big and small fluctuations. Note that for capital fee arbitrage, it is best to use mainstream stablecoins: such as Big Pie, Auntie, SOL, and XPR. Don’t get involved with altcoins.

After finishing the strategy logic, let’s talk about the concepts of U standard and currency standard.

"U standard" and "coin standard" are two different pricing methods.

U standard (Unit of Account) :

U standard refers to using a specific currency unit as the unit of measurement, and the value of other objects is expressed relative to this unit. In the cryptocurrency market, USDT is the pricing unit of all currencies, referred to as U standard. For example, a BTC/USDT contract is 70,000 USDT.

Currency of Account:

Currency standard refers to using a certain currency as the unit of account. Most spot virtual currencies in the cryptocurrency market can be used as the unit of account. It is common. The ones are BTC and ETH. For example, a BTC/USDT contract is 1 BTC.

The purpose of mentioning these two concepts is to explain: arbitrage can be done using U-standard contracts or currency-based contracts. The arbitrage strategy we mentioned earlier is U-standard contract arbitrage.

The capital utilization rate of currency-standard contract arbitrage is higher than that of U-standard.

Judging from the data in the figure below, there is a high probability that the U-standard funding rate of major exchanges is higher than that of currency-based

Overall, the annual rate of currency-standard funding fee arbitrage is higher than that of U-standard, mainly because of the high capital utilization rate.

Why is the capital utilization rate of currency-based arbitrage high?

In the previous strategy, the principal of 100,000 was divided into two parts for arbitrage. In fact, only the short contract of 50,000 generated arbitrage income, and the capital utilization rate was 50%.

As for currency-based arbitrage, we can buy the spot with all 100,000 principal, and then pledge the spot to buy a short contract of 100,000. Risk-free arbitrage can also be made, and the capital utilization rate is 100%.

Another advantage of the currency standard is that it can ignore the exchange rate fluctuations of U itself. The disadvantage of currency standard is that the operation is complicated.

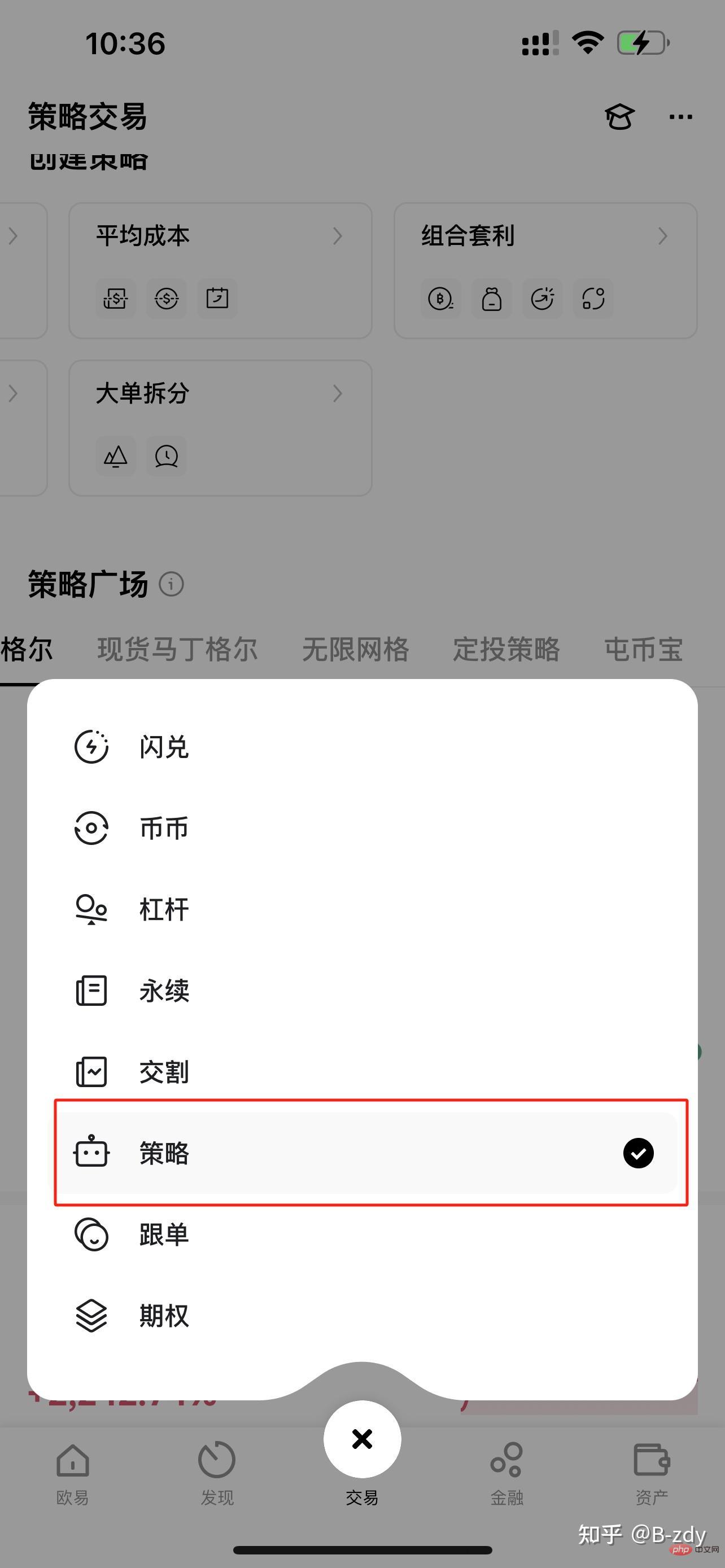

Operation method, the following screenshot takes the U-based operation of the OKX Exchange ETH contract as an example. In fact, the operation is not complicated, but few newbies pay attention to this function.

The above is the detailed content of Ultra-low risk return strategy - Cryptocurrency Funding Fee Arbitrage. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1384

1384

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them