Hedera (HBAR) is showing signs of recovery, correlating with broader crypto market trends. The coin has gained over 75% since its 2022 closing price. Despite the recent gains, HBAR is still down more than 88% from its all-time high.

Therefore, many buyers are looking for Hedera price prediction 2024. This article delves into Hedera’s price history and provides forecasts through 2030.

It explores the factors affecting its value, from in-network developments to global market sentiment, providing a comprehensive look at Hedera's price potential.

| year | low potential | Average price | High potential |

| 2024 | 0.1 USD | 0.16 USD | 0.2 USD |

| 2025 | $0.19 | $0.24 | 0.33 |

| 2030 | $0.5 | $0.62 | 0.7 USD |

Measuring a coin’s upside potential requires understanding its price history and its Reactions to past market events. It's important to remember that past performance is not a reliable indicator of future results, but it does provide valuable context.

Initial stability and gradual increase (2019-2020): The price of Hedera was relatively stable after its launch, fluctuating between US$0.01 and US$0.08. This period is characterized by the initial development phase of the project and the gradual development of the community.

2021 – High Volatility:

2022 – Economic Downturn:

Recently, HBAR found support near the $0.057-$0.06 level, a break above which could signal a stronger bearish trend.

Quick Highlights Summary of Hedera Price Action History:

Looking ahead to 2024, the cryptocurrency market is showing signs of improvement and investors are actively looking for the best cryptocurrencies to trade. .

#2024 could be crucial for Hedera, influenced by some in-network developments and broader market trends. Its focus on improving technology infrastructure and broader market recovery are key drivers of its potential price increase.

Hedera plans to modularize its services, aiming to simplify development, troubleshooting and deployment. This may lead to more efficient network operations and attract developers looking for a user-friendly environment.

In addition, enhancements to Hedera’s network infrastructure designed to improve uptime and resiliency are also critical. These improvements hint at a commitment to network stability, a key factor in enterprise adoption.

Developer tools and integrations in the pipeline:

#These technical improvements could significantly impact Hedera’s adoption and use case scenarios and attract more users.

Given these factors and a return to broader market sentiment, HBAR could reach around $0.20 by the end of 2024. On the other hand, well-known cryptocurrency analysis platform Digital Coin Price predicts that HBAR may reach around $0.14 by the end of 2024.

Going into 2025, Hedera The growth seems bright.

Hedera will continue its journey towards further decentralization. They plan to introduce permissioned, community-run mainnet nodes. The move further decentralizes the network and instills more trust between users and developers, potentially increasing participation and adoption of the network.

# Additionally, another important upgrade involves enabling Hedera mirror nodes to display verified source code of deployed smart contracts.

This transparency is important for security and increases developer and user confidence. It ensures a safer environment for development and retail experiences.

Hedera enables developers to track, diagnose and improve deployed smart contracts, thereby Become a more developer-friendly environment. This can increase the number and quality of applications built on Hedera, further driving its adoption and usage.

Given these strategic upgrades and their potential to boost the Hedera network, HBAR is likely to gain more attention among investors.

By the end of 2025, the price of Hedera may reach a high of around $0.33. On the other hand, CoinCodex, a well-known cryptocurrency analysis platform, has also adopted a slightly optimistic attitude, predicting that HBAR may exceed $0.2 by 2025.

#It is important to remember that these predictions are dependent on the successful implementation of the aforementioned upgrades and continued positive sentiment in the broader cryptocurrency market.

As we look ahead to 2030, understand Hedera’s potential growth in the rapidly expanding blockchain industry Crucial.

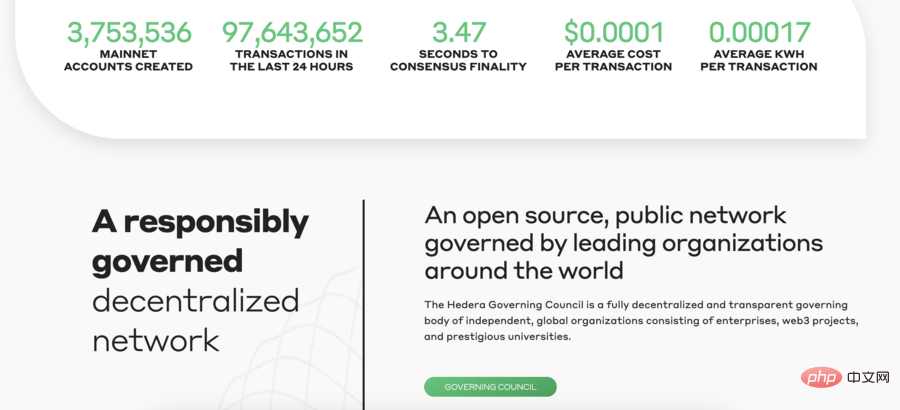

The global blockchain technology market is worth US$11.14 billion in 2022, is expected to soar to US$469.49 billion by 2030, with an expected compound annual growth rate (CAGR) Close to 60%. This explosive growth provides a solid foundation for platforms like Hedera to expand their utility and market share.

It’s significant that Hedera provides best-in-class support for its platform using popular Ethereum Virtual Machine (EVM) tools like Hardhat and Foundry.

This integration will allow developers familiar with the Ethereum ecosystem to seamlessly transition and build on Hedera, potentially increasing the platform’s appeal and user base.

In addition, improvements to simplify the process for users to associate tokens with their accounts are designed to improve the retail and enterprise user experience. Simplifying this process can increase adoption and usage of Hedera Token services.

Given these strategic developments and the overall growth of the blockchain industry, Hedera shows significant potential for appreciation. Hedera shares are likely to reach highs around $0.70 by 2030, in line with its expected progress and market trends.

On the other hand, more conservative estimates, such as Coinpedia’s prediction of $0.363, show cautious optimism amid potential market volatility and technical challenges .

Finally, it's important to consider broader market and Bitcoin sentiment, as well as other macroeconomic factors, when looking for the best long-term investments.

Here’s a quick overview of the Hedera price forecast from 2024 to 2030:

| year | low potential | Average price | High potential |

| 2024 | 0.1 USD | 0.16 USD | 0.2 USD |

| 2025 | $0.19 | $0.24 | 0.33 |

| 2030 | $0.5 | $0.62 | 0.7 USD |

When exploring the different views of various analysts on Hedera's future, it is important to realize that these views are based on educated analysis of past trends and potential future developments.

However, as with any predictions in the volatile cryptocurrency market, these should be viewed as possibilities rather than certainties.

Digital is known for its data-driven predictions Coin Price provided detailed predictions for Hedera:

CoinCodex’s View:

ChangellyFocuses on technical analysis, providing insights into:

Coinpedia’s year-by-year forecast:

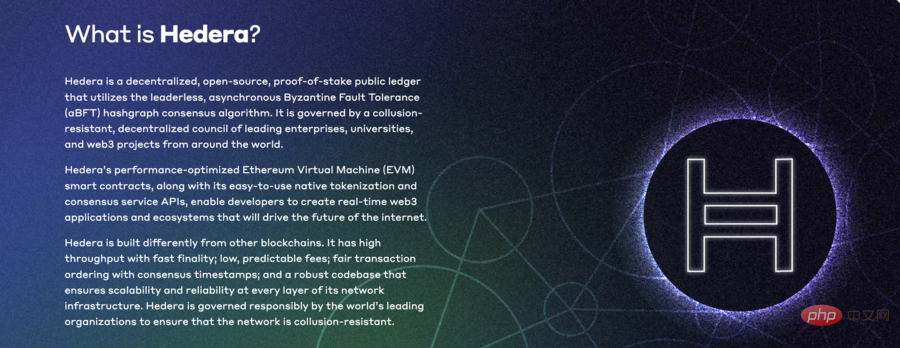

Hedera is a public network and management organization that aims to meet the needs of the mainstream market through its innovative hashgraph technology. Its vision revolves around creating a trusted and secure cyberspace that reduces reliance on centralized entities that exert undue influence.

Compared to traditional blockchains that only maintain one blockchain, Hedera’s “hashmap” mechanism integrates each transaction container into its classification account, thus improving efficiency.

#This means that unlike blockchain, which has branches to maintain a single chain, a hashgraph weaves all growth into the ledger. This approach guarantees efficiency and supports stronger mathematical guarantees and fairness.

Hedera’s governance is particularly unique, with its Board of Directors comprised of leading global companies from across industries and geographies. The committee represents Hedera’s commitment to a decentralized but structured approach, ensuring that no one member or small group has disproportionate influence.

The Hedera Board of Governors is a term-limited, rotating membership that oversees key decisions regarding the platform.

Technological Innovation

Stability and legal control

Technical and legal control are highlighted Improve the stability of Hedera. Technically speaking, hash map technology can prevent network nodes from forking the ledger, thereby ensuring the integrity of the platform.

Hedera’s codebase governance and anti-fork measures maintain platform consistency, which is critical for mainstream adoption.

Regulatory Compliance

Hedera’s technical framework includes functionality for controlled variability of the network state and the possibility to trade additional data.

These features address future needs, such as personal data erasure and optional verification of identity mechanisms, and are aligned with regulatory compliance and consumer protection.

| Cryptocurrency | HBAR |

| stock code | HBAR |

| Price | $0.0648 |

| ##24 hour price Change | 5.2% |

| Market value | $2,176,415,555 USD |

| Cycling supply | 33,562,400,522 |

| Trading Volume | $58,409,682 USD |

| History New High | $0.569 |

| All time low | $0.0098 |

#As with any cryptocurrency, Hedera’s price is affected by specific project characteristics and broader market dynamics. Some key factors affecting Hedera’s value:

Hedera’s unique hash graph technology, governance model and focus on security and regulatory compliance A commitment to compliance gives it an edge over its competitors. However, its price history also reflects its vulnerability to broader market dynamics and investor sentiment.

Investors who wish to purchase Hedera should consider the above forecasts as well as current market conditions, the continued development of Hedera, and the crypto market before making any purchase decision. Inherent unpredictability.

#Because of this unpredictability, investors should consider diversifying their portfolios to reduce overall risk. However, finding promising cryptocurrencies in a market with over 10,000 active projects can be difficult.

Therefore, on our Best Cryptocurrencies page, we highlight some of the most promising cryptocurrencies that are known for their utility and ever-expanding user base . You can click on the links below to learn more about these projects.

The above is the detailed content of Hedera (HBAR) Price Forecast 2024—2030. For more information, please follow other related articles on the PHP Chinese website!