BTC dropped by 64,000! 10x Research: Bitcoin may fall to $59,000

Bitcoin has experienced a significant price correction in recent days, falling sharply below the $67,000 level again this morning, with the lowest hitting $64,628. As of now, the price has temporarily fallen back to $65,000, and there is no obvious sign of a strong rise.

10x Research: Bitcoin may fall to $59,000

Markus Thielen, founder of the research institution 10x Research, pointed out in the latest report that he warned about the continuous decline in BTC currency prices. According to the report, if inflows into the Bitcoin spot ETF this week are lower than market expectations, the price of BTC may fall to $59,000.

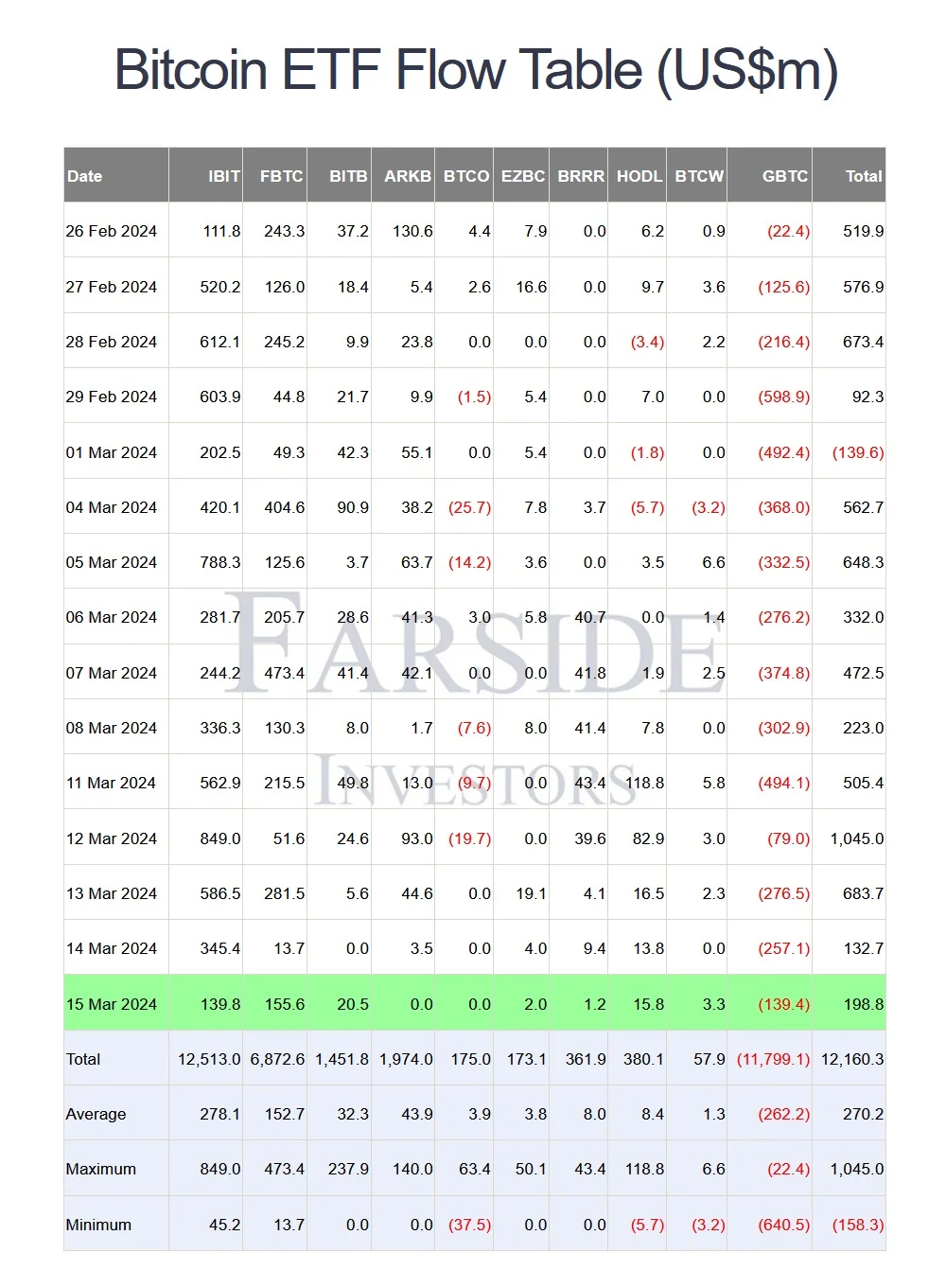

According to Coindesk reports, in the week last week (3/11~3/15), the total inflow of U.S. Bitcoin spot ETFs hit a record high, reaching $2.6 billion. Notably, most of these net inflows occurred from Monday to Wednesday, a situation that pushed Bitcoin prices above $73,000 to a new all-time high.

On Thursday and Friday last week, spot ETFs only recorded net inflows of US$133 to US$198 million respectively, and BTC subsequently fell below US$65,000 over the weekend.

Markus Thielen reported on Monday that Bitcoin’s “real test” will come on Monday and Tuesday, if ETF inflows disappoint, Bitcoin’s correction Likely to continue, a drop to $59,000 is estimated to be possible, suggesting that BTC will fall by more than 10% from its current price.

While this view may not be widely accepted, inflows are expected to slow after the large price swings. According to our reversal indicator, the price may retrace to the $59,035 level, which would provide investors with a more attractive risk-reward ratio.

The report added that despite the possibility of a deeper correction, the cryptocurrency bull market is not over yet, "We can still believe that Bitcoin will rise significantly in the coming months, as the bull market is likely to continue. . If BTC recovers above $70,000, the rebound could open the door to a significant price increase."

Bloomberg Analyst: The popularity of Bitcoin spot ETFs is mainly driven by retail investors

Another It is worth noting that Bloomberg ETF senior analyst Eric Balchunas told Coindesk that most of the current demand for Bitcoin spot ETFs comes from retail investors rather than large institutions. He pointed out: "There may be some investment advisors out there, but for the most part, retail investors are definitely an important factor based on the size of the transaction."

According to data provided by Balchunas, the world's largest asset management giant BlackRock's Bitcoin spot ETF "IBIT" has an average of 250,000 transactions per day, with an average transaction size of 326 shares, about $13,000. Another issuer confirmed to him that the main demand is driven by retail investors.

BlackRock declined to comment. BlackRock’s IBIT has attracted more than $14 billion in assets in just two months after its listing in mid-January, making it the biggest winner among Bitcoin spot ETFs.

If the current capital inflows of Bitcoin spot ETFs mainly come from retail investors, then the recent sharp correction in BTC prices may make these retail investors unable to resist selling, which may push the price of Bitcoin to further fluctuate and fall.

The above is the detailed content of BTC dropped by 64,000! 10x Research: Bitcoin may fall to $59,000. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience