web3.0

web3.0

Multiple review decisions have been postponed again. Is it a certainty that the Ethereum spot ETF will be rejected?

Multiple review decisions have been postponed again. Is it a certainty that the Ethereum spot ETF will be rejected?

Multiple review decisions have been postponed again. Is it a certainty that the Ethereum spot ETF will be rejected?

Author: Nian Qing, ChainCatcher

On March 19, local time, the U.S. Securities and Exchange Commission (SEC) announced another postponement in two notification documents The decision-making time of two Ethereum spot ETFs is extended the decision-making time for the Hashdex Nasdaq ETH ETF application to May 30, 2024, will ARK 21Shares Ethereum ETF The application resolution has been postponed to May 24, 2024.

The U.S. Securities and Exchange Commission (SEC) said in a notice: "The Commission believes that in order to ensure sufficient time to consider the proposed rule changes and related issues, specifying a longer period for issuing approval or disapproval An order approving the proposed rule change is appropriate." The SEC emphasized the importance of the deliberative process to ensure that all aspects are fully considered. Such an initiative could help the Commission more fully assess the impact of potential rule changes on the market and investors, thereby making decisions with greater depth and breadth. The SEC previously reported that on March 4, the SEC postponed its decision on BlackRock’s application for iShares ETH Trust and Fidelity’s application for its Ethereum ETF.

Although this postponement was expected, it still had a certain impact on market sentiment and prices. According to RootData market data, Ethereum fell below $3,200, with an intraday drop of more than 10%.

According to Bloomberg’s ETF analyst James Seyffart, he said on social media that at least three more Ethereum ETFs are expected to be postponed in the next two days. VanEck, Ark/21Shares, Hashdex, and Grayscale all plan delayed launches within the next approximately 12 days. Seyffart previously noted that the postponement of all ETF review decisions may last until May 23.

In addition, He also said: “In recent months, my cautiously optimistic attitude towards the ETH ETF has changed. We now believe that these applications will eventually be accepted in the May 23rd round. Denied. The U.S. SEC has not yet communicated with the issuer on specific matters regarding Ethereum. It is completely opposite to the situation when the Bitcoin spot ETF application was made last fall. ”

In the past few weeks, the market has Optimism about the approval of the Ethereum spot ETF application continues to decline. Bloomberg ETF analyst Eric Balchunas also recently lowered the likelihood of an Ethereum spot ETF being approved in May to 30% from about 70%. Data shows that Ethereum’s one-month bullish-bearish skewness has turned negative, suggesting relative strength in put options. Previously, Ethereum’s 60-day indicator also had a bearish bias, while the 90-day and 180-day indicators remained positive. In its latest market insight article, QCP Capital explains that investor interest in near-term Ethereum put options may stem from the diminishing likelihood of the U.S. SEC approving an Ethereum spot ETF in May.

It is understood that Ethereum spot ETF has four review periods (45 days, 45 days, 90 days and 60 days). Once an institution submits a new ETF application, the SEC will register the application in the federal registration On the Federal register, the 240-day cycle starts from the day of registration. When the deadline for each stage comes, the SEC must respond: pass, deny, or delay review. If there is no resolution on the first date, it will be postponed to the second date. Until the deadline is reached, the SEC must make a final resolution. In other words, As the earliest deadline for VanEck to apply for the Ethereum spot ETF, May 23 will be a key date, and whether it is passed or not will also directly affect the resolution results of other applications .

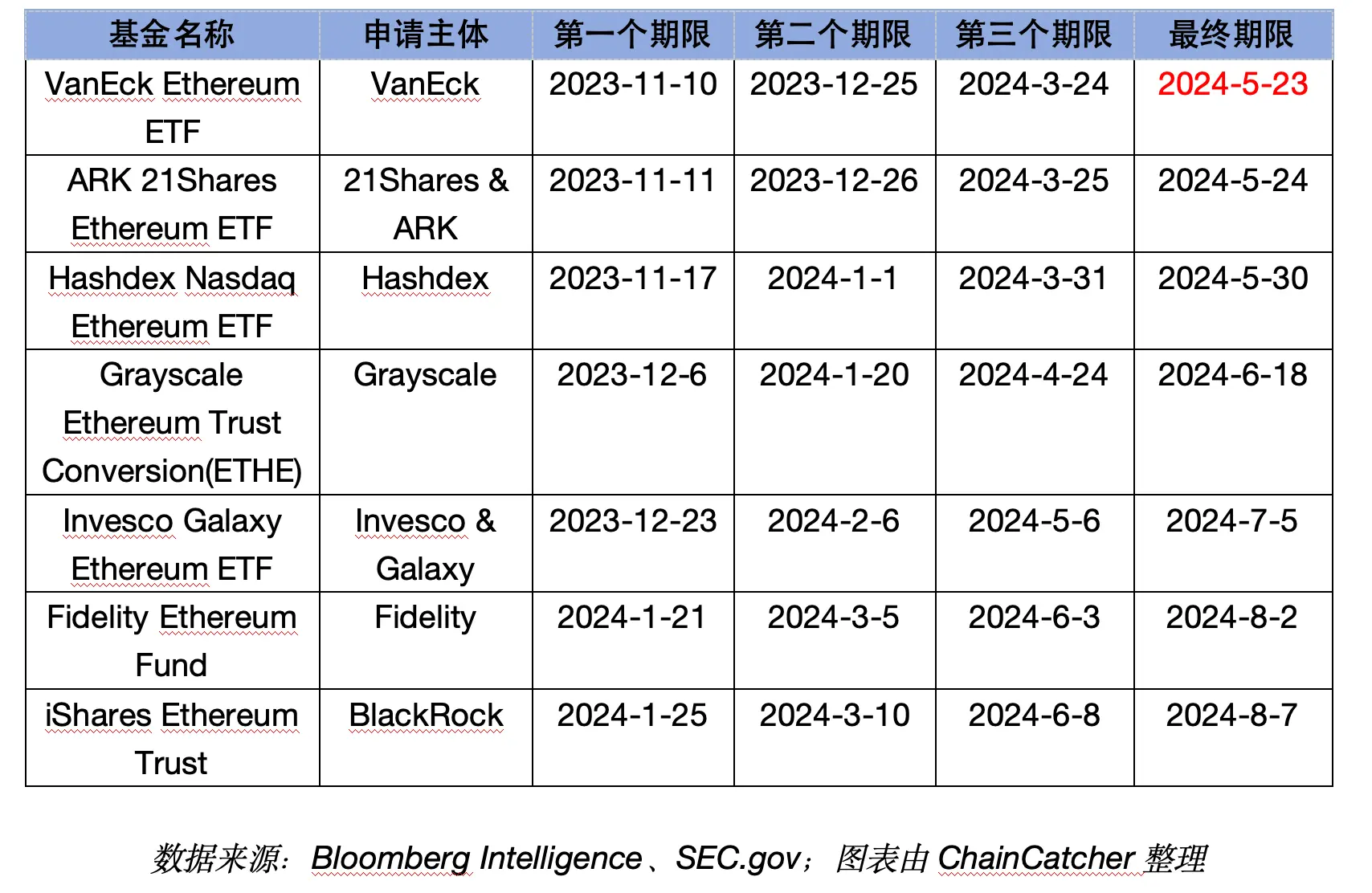

Currently, seven entities are applying for Ethereum ETFs, namely: BlackRock, Fidelity, Invesco&Galaxy, Grayscale, VanEck, 21Shares &Ark and Hashdex. The SEC approval period for each fund is as shown in the following table:

Although other sources such as Matt Hougan, global head of research at Bitwise, have previously predicted that the likelihood of the Ethereum spot ETF being approved in May is close to 50% or even higher, and has already Compared with the listed Bitcoin spot ETFs, the Ethereum spot ETFs still have certain "risks". In public filings, the SEC has said: “There are unique concerns about whether certain characteristics of Ethereum and its ecosystem, including its proof-of-stake consensus mechanism and the concentration of control or influence of a few individuals or entities, make Ethereum susceptible to fraud and manipulation. point?"

As BloFin recently released " Should we be prepared for the rejection of Ether spot ETF? " mentioned in "Compared with spot Bitcoin ETFs, the negative impact of the PoS mechanism, price manipulation risks and securitization risks significantly reduce the probability of approval of spot ETH ETFs.

The continuous rise in the crypto market some time ago may have raised our expectations for this result. This decline can somewhat allow us to return to calmness, and at least be prepared for the rejection of the Ethereum spot ETF.

The above is the detailed content of Multiple review decisions have been postponed again. Is it a certainty that the Ethereum spot ETF will be rejected?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

Top 10 secure cryptocurrency trading platforms rankings in 2025 The latest rankings of cryptocurrency trading platforms

Apr 21, 2025 am 10:21 AM

Top 10 secure cryptocurrency trading platforms rankings in 2025 The latest rankings of cryptocurrency trading platforms

Apr 21, 2025 am 10:21 AM

The top ten secure cryptocurrency trading platforms in 2025 are: 1. Binance, the world's largest, with a leading trading volume; 2. Bybit, the market share has increased, second only to Binance; 3. OKX, comprehensive service, covering spot and derivatives; 4. Coinbase, the largest in the United States, with high ease of use; 5. Kraken, the oldest in the United States, with strong security; 6. Huobi (HTX), the Asian market has a great influence; 7. Gate.io, low fees, multi-language support; 8. KuCoin, user-friendly, suitable for investment in emerging projects; 9. Crypto.com, innovative features and reward plans; 10. BitMEX, focusing on Bitcoin futures, suitable for professional traders.

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

How to distinguish between altcoins and mainstream coins? Which one is more worth investing in? Learn about the coin circle in one article

Apr 21, 2025 am 11:18 AM

The difference between altcoins and mainstream coins is mainly reflected in: 1. Market value and liquidity: The mainstream currency has a large market value and strong liquidity; the altcoins have a small market value and poor liquidity. 2. Technology and innovation: The mainstream currency technology is mature and has extensive innovation; innovation or replication based on altcoin technology. 3. Application scenarios and communities: mainstream coins are widely used and active in the community; altcoins are narrow and small in the community. Investment choices require risk tolerance and goals.

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

How to choose the Bitcoin trading platform that suits you

Apr 21, 2025 am 11:42 AM

When choosing a Bitcoin trading platform that suits you, you need to consider the following factors: 1. Security: Choose a platform that uses advanced security technologies such as multi-signature and cold storage, such as Coinbase. 2. Transaction fees: Research the charging standards of the platform, such as Binance's low handling fees. 3. Regulatory compliance: Choose a platform that complies in your region to protect your legitimate rights and interests. 4. Trading functions and services: Choose a platform that provides rich trading functions and good customer service, such as Huobi.com. 5. Ease of use: For beginners, choose a platform with a friendly interface and simple operation, such as Coinbase. 6. Liquidity: Choose a platform with high liquidity, such as Binance, to ensure timely transactions.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.