Software Tutorial

Software Tutorial

Mobile Application

Mobile Application

How to declare special additional deductions for personal income tax in 2024_Overview of the steps for filing special additional deductions for personal income tax in 2024

How to declare special additional deductions for personal income tax in 2024_Overview of the steps for filing special additional deductions for personal income tax in 2024

How to declare special additional deductions for personal income tax in 2024_Overview of the steps for filing special additional deductions for personal income tax in 2024

php Xiaobian Xigua explains in detail how to declare special additional deductions for personal income tax in 2024. Understanding the steps for filing special additional deductions for personal income taxes in 2024 can help you declare more accurately and avoid tax problems caused by filing errors. In this article, we will introduce you step by step the relevant content of the 2024 special additional tax deductions to help you easily complete the declaration process.

How to declare special additional deductions for personal income tax in 2024

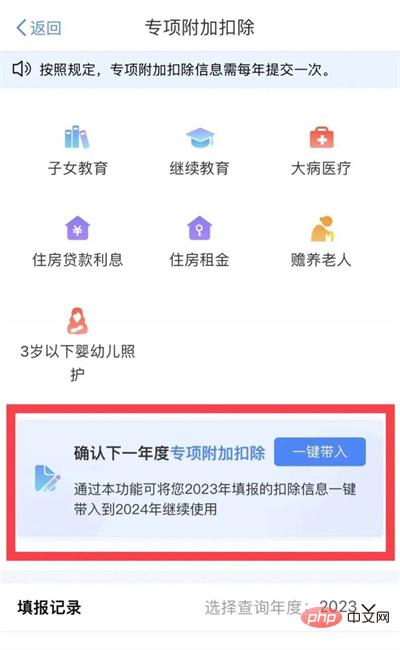

1. Open the personal tax APP, select "Common Business" on the homepage, and then select "Fill in Special Additional Deductions"

2. The scope of special deduction items: children’s education, continuing education, serious illness medical treatment, housing loan interest, housing rent, support for the elderly, and infant care.

#3. At the bottom of the page, you can select [One-click import], so that you can fill in last year's declaration information with one click.

#4. Then verify that the information filled in is correct. If there is any information that needs to be modified, the user can also choose to fill in and declare it by himself.

5. Finally, after filling in all the information correctly, click "One-click Declaration" in the upper right corner. Submit for review and wait for the declaration to be completed.

The above is the detailed content of How to declare special additional deductions for personal income tax in 2024_Overview of the steps for filing special additional deductions for personal income tax in 2024. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

Photoshop Is Officially Available on iPhone

Mar 06, 2025 am 09:56 AM

Photoshop Is Officially Available on iPhone

Mar 06, 2025 am 09:56 AM

Photoshop officially logs on to iPhone! Say goodbye to the limitations of mobile image editing! Photoshop, a benchmark software in the field of image editing, has finally officially landed on iPhone! Photoshop has been the industry standard for more than three decades, but in the field of mobile phone image editing, users have had to rely on other applications. This situation has changed with the release of Photoshop iPhone version on February 25. You can now search for "Photoshop" on the App Store to download this free app. In addition to core imagery and design tools, numerous features are available for free: Selections, layers and masks Click Select Tool Stain Repair Painting

How to Sideload Android Apps (and What to Watch Out For)

Mar 01, 2025 am 10:27 AM

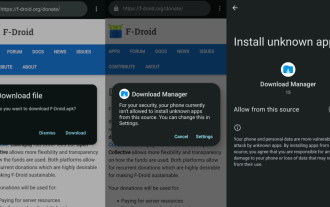

How to Sideload Android Apps (and What to Watch Out For)

Mar 01, 2025 am 10:27 AM

The Android system, unlike some mobile operating systems, allows users to install software from outside the default app store (even if you don't live in Europe). This is great because there are a lot of great software you can't get on Google Play. The game Fortnite is a prominent example – Epic, the developer of the game, didn’t want to split up sales to Google, so the game couldn’t be used in Android’s main app store. Other apps are unavailable due to Google’s interests—for example, there is an ad-free, privacy-respecting YouTube client that you cannot find on Google Play. But, if you've never been

How to Take Photos on Android Without All the Post-Processing Junk

Mar 13, 2025 pm 01:09 PM

How to Take Photos on Android Without All the Post-Processing Junk

Mar 13, 2025 pm 01:09 PM

Your phone's camera does so much filtering, processing, and AI adjustments, it can make you question reality itself. In a world where Google can put you into photos you take, what's even real? If you'd rather avoid letting your phone decide what

Completely Uninstall Xiaomi Game Center: No Leftovers!

Mar 18, 2025 pm 06:00 PM

Completely Uninstall Xiaomi Game Center: No Leftovers!

Mar 18, 2025 pm 06:00 PM

The article details steps to completely uninstall Xiaomi Game Center, remove residual files, prevent auto-reinstallation, and verify the app's removal from a device.

I Tried Yope, Gen Z's New Favorite Photo-Sharing App

Mar 05, 2025 am 10:41 AM

I Tried Yope, Gen Z's New Favorite Photo-Sharing App

Mar 05, 2025 am 10:41 AM

Yope: A Gen Z Photo-Sharing App Review – Is It Worth the Hype? I'm always eager to explore new social media apps, especially those focused on photo sharing. Yope (iOS and Android), the current trendy app, launched in September 2024 and boasts impres

The Fastest Way to Uninstall Xiaomi Game Center (2025)

Mar 18, 2025 pm 06:03 PM

The Fastest Way to Uninstall Xiaomi Game Center (2025)

Mar 18, 2025 pm 06:03 PM

Article discusses the fastest way to uninstall Xiaomi Game Center in 2025 using built-in settings, with optional third-party tools for efficiency.Character count: 159

How to Uninstall Xiaomi Game Center

Mar 18, 2025 pm 06:01 PM

How to Uninstall Xiaomi Game Center

Mar 18, 2025 pm 06:01 PM

The article provides a detailed guide on uninstalling Xiaomi Game Center, discussing standard and alternative methods, and potential performance improvements post-uninstallation.

Instagram Won't (Usually) Snitch If You Screenshot

Mar 07, 2025 am 09:56 AM

Instagram Won't (Usually) Snitch If You Screenshot

Mar 07, 2025 am 09:56 AM

Instagram Screenshot Notifications: The Complete Guide Ever wondered if taking a screenshot of someone's Instagram Story or post alerts them? Let's clear up the confusion. While screenshots of regular posts and Stories don't trigger notifications,