web3.0

web3.0

Bitcoin ETF has a single-day net outflow. Why is it so important to monitor ETF water pipes?

Bitcoin ETF has a single-day net outflow. Why is it so important to monitor ETF water pipes?

Bitcoin ETF has a single-day net outflow. Why is it so important to monitor ETF water pipes?

How to check the net inflow/outflow data of Bitcoin $BTC spot ETF?

【Don’t Ask for Help Series】

Farside data: https://farside.co.uk/?p=997

The Block Data: https://theblock.co/data/crypto-markets/bitcoin-etf/spot-bitcoin-etf-flows

Q: Why should you care about knowing bits What are the inflows and outflows of currency ETFs?

Bitcoin spot ETFs play a key role in U.S. stock funds and are the main channel for funds to enter the cryptocurrency market. As long as this channel remains stable, Bitcoin’s performance won’t be too bad.

Q: Really? How much money does the ETF pipeline bring?

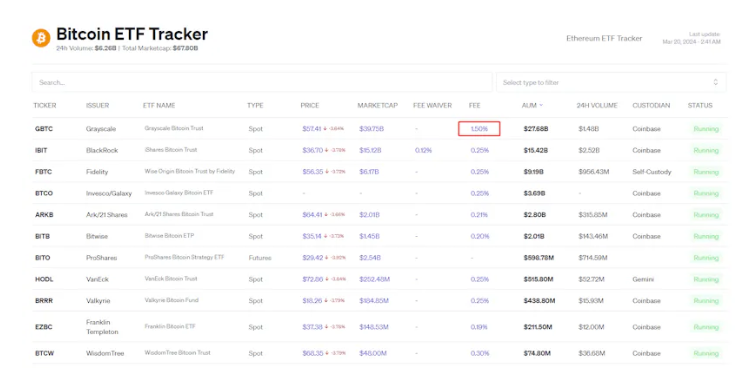

BlackRock and Fidelity have been leaders in the ETF market. Together, they hold more than 500,000 bitcoins, which has brought more than $30 billion in capital inflows to the entire industry. These funds are real funds, not virtual currencies. It is worth mentioning that the inflow of these funds has had a profound impact on the Bitcoin market and brought an important impetus to the development of the digital asset market.

Data source: https://coinglass.com/bitcoin-etf

Q: Why emphasize “net” inflow?

A: Because Grayscale $GBTC investors are continuing to redeem BTC, that is, "outflow". Including GBTC outflows, net inflows into the 11 ETFs still exceeded $12 billion.

Q: Have many ETFs begun to flow out? A: Basically only grayscale is constantly flowing out.

Some data:

Before the ETF was approved, Grayscale’s “small ETF” had accumulated 600,000 Bitcoins;

After more than two months of ETF approval, Grayscale still had Place 380,000 Bitcoins.

Q: Grayscale is the main contributor to the ETF’s approval. Why does it keep flowing out?

A: Two reasons.

(1) Migration requirements: Grayscale’s management fee is very expensive, and the annual management fee is 1.5%. Other institutions generally charge 0.2%-0.25%, and some even waive the fee.

(2) Exit demand: Grayscale was established very early. $GBTC investors opened an average position of about $27.8 (from: webull). The current price is $57.4, which has doubled.

$Big investors in GBTC include the bankrupt 3AC and FTX, which have strong motivation to ship.

As for BlackRock’s $iBTC, the average cost is probably around $30, but now it’s only $36, so there is relatively little incentive to exit.

Q: Why doesn’t Grayscale lower its fees?

Grayscale: There are plans to gradually reduce fees in the next few months.

Grayscale CEO’s defense: We have the historical performance to prove that we dare to charge this fee. Other companies have no historical performance, so they naturally have to reduce fees and promote promotions.

PS1: This sophistry is a bit humorous. Putting aside the fact that GBTC and iBTC rose and fell at the same time, Bitcoin’s K-line is the common “historical performance” of all ETFs.

PS2: This kind of vague rhetoric ≈ no plan, just take it step by step.

PS3: Mainly economic accounts. 1.5% to 0.25% is too much. Even if Grayscale’s share drops to 1/6, which means another 300,000 BTC will flow out, it will still make more money without reducing fees.

PS4: It’s a pity that investors are lazy. If it is already in the ETF, it is too lazy to take it out; if it is already taken out, it is too lazy to put it back. Therefore, many of the huge GBTC redemptions "accidentally" turned into real selling pressure.

Q: How big is the selling pressure on GBTC?

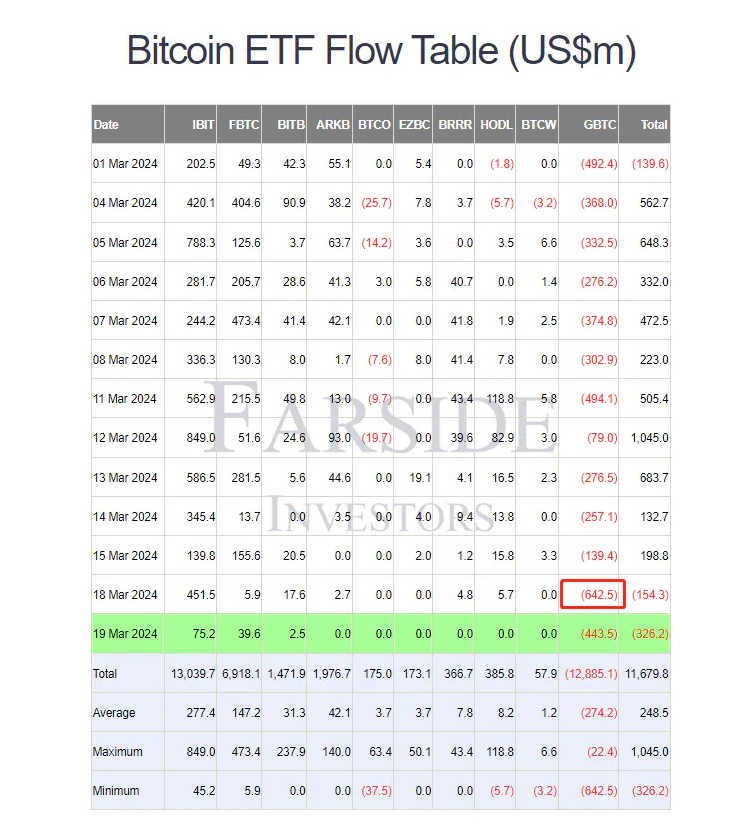

A: On March 18, GBTC withdrawals broke the record, with 640 million US dollars withdrawn in one day, resulting in one of the few net outflow days in the history of BTC ETF, with the net outflow amount reaching 150 million US dollars.

This may also be an important reason for yesterday's sharp drop.

PS: Make a small comparison.

Now $BTC is mined 6.25 * 144 = 900 BTC every day; it will become 450 BTC after the halving in one month. In other words, the halving reduced the daily selling pressure by US$28 million.

Q: How many BTC does Grayscale have?

A: 380,000 pieces, disclosed on the official website. https://etfs.grayscale.com/gbtc

Q: So how was last night (March 19)?

A: Grayscale once again redeemed 440 million US dollars in BTC, while BlackRock was slightly weak, with only 75 million US dollars flowing in, resulting in an outflow of 300 million US dollars, which was larger than yesterday.

Finally, pay attention to emotions and data. Treasures are often hidden in the moment of change.

I wish you all a smooth landing and a finger on the pulse.

The above is the detailed content of Bitcoin ETF has a single-day net outflow. Why is it so important to monitor ETF water pipes?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

What Google searches are monitored?

Apr 08, 2025 am 12:01 AM

What Google searches are monitored?

Apr 08, 2025 am 12:01 AM

Google monitors users' search keywords, times, devices, cookies and IP addresses to optimize search and advertising. Users can protect privacy through privacy mode, VPN or proxy server.

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience