End of 2024: In 2024, Bitcoin ETFs may begin trading and multiple new Bitcoin ETFs will be launched. This could trigger a crypto bull run that would be doubly beneficial for the $BTC ETF. We expect a year-end price of $0.30. End of 2025: Bitcoin ETF tokens may experience another token burn as the price of Bitcoin reaches $100,000. We expect the price of the $BTCETF to rise to $0.40.

Bitcoin ETF Token is a new crypto project that builds on the excitement surrounding the first spot Bitcoin ETF in the United States. The project created a new token, $BTCETF, with a massive token burn tied to the milestone of a Bitcoin ETF launch.

The Bitcoin ETF Token has generated a lot of buzz since the pre-sale began. So how high can this token go? In our Bitcoin ETF Token Price Prediction, we will explore the potential of the $BTCETF from its imminent launch to 2030.

Here are our predictions for Bitcoin ETF Token Price in 2024, 2025 and 2030 A brief summary of the predictions:

| year | low potential | average meal budget | high potential |

| 2024 | $0.10 | $0.30 | $0.75 |

| 2025 | $0.15 | $0.40 | $0.65 |

| 2030 | $0.05 | $0.50 | $0.80 |

Bitcoin ETF Token began pre-sale on November 5 at a first-stage price of $0.00050. The project raised over $35,000 in the first 48 hours, demonstrating widespread investor enthusiasm for the $BTCETF token.

Currently, the $BTCETF is priced at $0.0056 per token — and has raised over $1.4 million in a matter of weeks. The pre-sale is divided into 10 phases, with the price gradually increasing from $0.0050 to $0.0068 in the final phase. The pre-sale has a hard cap of $4,956,000 and will sell 40% of the total supply of 2.1 billion $BTCETF tokens.

Bitcoin ETF Token is getting ready for an even more exciting 2024.

The first Bitcoin ETF will most likely be traded in the spring or summer of 2024. Meanwhile, other spot Bitcoin ETFs may receive approval from the U.S. Securities and Exchange Commission (SEC). Blackrock, ARK Investment and Fidelity have filed a lawsuit with the U.S. Securities and Exchange Commission (SEC) to launch a spot ETF tracking the prices of the largest cryptocurrencies.

This craze for Bitcoin will have 2 important impacts on Bitcoin ETF tokens.

First off, a bull run for Bitcoin is usually good news for top altcoins. In the crypto market, a rising tide lifts all boats, and that includes the $BTC ETF. Investors may pile into the token, pushing its price even higher.

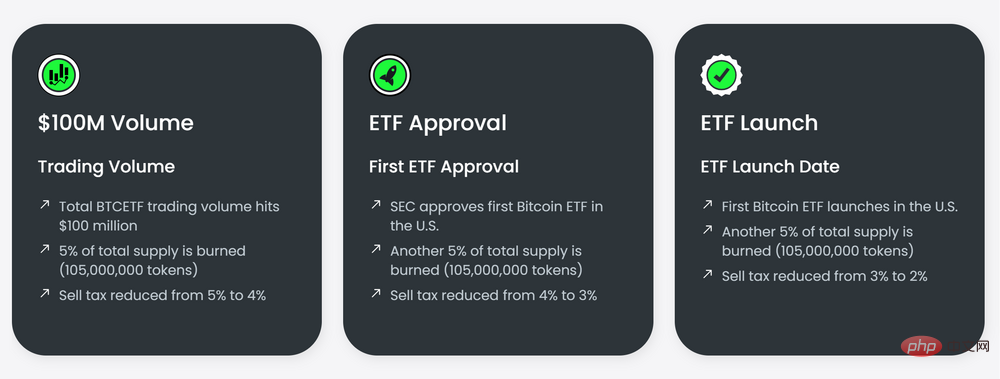

This excitement over altcoin and crypto trading could broadly trigger a milestone for the Bitcoin ETF token: hitting $100 million in daily trading volume. When this milestone is reached, the Bitcoin ETF token will burn 5% of the $BTCETF token supply, sending its price soaring.

Secondly, the launch of the new Bitcoin ETF may achieve multiple milestones, each of which will trigger the burning of 5% of the $BTCETF token supply. The first spot Bitcoin ETF to start trading is a milestone. Bitcoin ETF hitting $1 billion in assets under management is another.

Overall, the Bitcoin ETF token may consume 15% of its total supply in 2024 due to these project milestones. This could have a huge positive impact on the $BTCETF token price, especially as investors and traders are looking for the best coins to buy during altcoin season.

Given the confluence of these events, we predict 2024 will be an explosive year for Bitcoin ETF tokens. We forecast a $BTCETF price of $0.30 by the end of the year, with a potential high price of $0.75. Our forecast is $0.30, a 6,000% upside from today’s price, and a market cap of approximately $22 million.

The Bitcoin ETF Token could reach another important milestone in 2025: Bitcoin price climbs above $100,000.

Crypto industry insiders like Unchained CEO Joe Kelly have predicted that Bitcoin could hit $100,000 sometime in mid-2025. When that happens, Bitcoin ETF tokens will Experience a final burn of 5% of the token supply, further significantly increasing the price.

While the scale of this increase remains uncertain, it is unlikely to be as large as the initial surge the $BTCETF experienced during the recurring burning event in 2024. This is because the final burn will also eliminate the selling tax on the token, allowing some investors to sell the news and add the token to the market.

Nonetheless, we expect the Bitcoin price boom to have a net positive impact on the $BTCETF in 2025. Based on our estimates, we expect prices to be around $0.40 by the end of the year.

After reaching all burning milestones for Bitcoin ETF tokens and removing the sale tax, the main motivation for token holders to continue holding $BTCETF is Staking rewards. The Bitcoin ETF has set aside 25% of its token supply as staking rewards, so it should be able to pay out rewards long into the future.

As the final burn approaches, the team behind the Bitcoin ETF may also create additional incentives for token holders to stay connected to the project. For example, the project could introduce giveaways, higher reward tiers for locked tokens, and more.

As a result, we expect the growth of the $BTCETF to slow, but not stop. By the end of 2030, we predict that the price of this token will be $0.50. To put that into perspective, that’s 100 times higher than the pre-sale price for the first phase.

Here is a review of our Bitcoin ETF Token Price Prediction for 2024-2030:

| year | low potential | average meal budget | high potential |

| 2024 | $0.10 | $0.30 | $0.75 |

| 2025 | $0.15 | $0.40 | $0.65 |

| 2030 | $0.05 | $0.50 | $0.80 |

The Bitcoin ETF token launched its pre-sale just 48 hours ago, so crypto analysts have had relatively little time to weigh in on the project. However, one prominent cryptocurrency influencer, Jacob “Crypto” Bury, has endorsed the $BTCETF to his followers.

Burry announced that he believes the Bitcoin ETF token could rise 10x after its launch in a video on his YouTube channel, which has more than 23,000 subscribers. Bury pointed to the project’s generous staking rewards and potential 25% token destruction as reasons why he is optimistic about the Bitcoin ETF token.

Bitcoin ETF Token is a new crypto project that allows traders and investors to speculate around the potential launch of the first spot Bitcoin ETF in the United States.

This project stands out because it offers token burning tied to real-world milestones in the development of a Bitcoin ETF. There are 5 milestones, including:

When each milestone is reached At , the Bitcoin ETF token will automatically destroy 5% of the total token supply. Therefore, after all milestones are reached, the project will burn 25% of all $BTCETF tokens.

On top of that, sales tax on Bitcoin ETF tokens starts at 5%. All tokens collected from sales tax will be burned. Sales tax will be reduced by 1% for each milestone, dropping to 0% after all milestones are met.

Bitcoin ETF tokens also provide investors with staking rewards. 25% of the total $BTCETF supply has been set aside as rewards, although the project has not yet specified a reward rate.

Investors interested in purchasing the $BTC ETF during the presale can check out our guide on how to purchase Bitcoin ETF Tokens.

Here are the investments An overview of everything investors need to know about the Bitcoin ETF Token:

| Cryptocurrency | Bitcoin ETF Token |

| Stock Code | $BTCETF |

| Pre-sale starts | November 2023 |

| Pre-sale price | $0.0050 |

| Tokens available during pre-sale | 840,000,000 |

| Pre-sale hard cap | $4,956,000 |

There are several factors that will have a significant impact on the price of Bitcoin ETF tokens. Let's take a closer look.

The Bitcoin ETF token burning event is closely related to the launch and adoption of the US spot Bitcoin ETF. In fact, 3 out of 5 burns (15% of the total $BTCETF supply) were related to the approval, launch, and adoption of Bitcoin ETFs.

The faster a Bitcoin ETF is launched, the more likely it is that the price of the $BTCETF will rise. This is simply because demand for the token is likely to be higher when it is new and exciting, and the launch of the Bitcoin ETF token should roughly coincide with the first Bitcoin ETF approval.

If the SEC further delays approval of a Bitcoin ETF, which remains a possibility, then speculators may sell their $BTC ETFs. This would still result in a token burn due to the sales tax, but the price of the token could still drop as the number of tokens available to meet demand increases.

The price of Bitcoin is another major factor that affects the price of Bitcoin ETF tokens. While the two coins are not exactly correlated, Bitcoin climbing above $100,000 does trigger a $BTCETF burn event.

The bottom line is that Bitcoin’s price is one of the best indicators of whether the overall crypto market is bullish or bearish. Altcoins like the $BTCETF typically perform better when Bitcoin rises and investors are willing to take more risk in the crypto market. Therefore, Bitcoin’s bull run could be good news for Bitcoin ETF tokens.

The team behind Bitcoin ETF Token has not yet announced a reward rate for investors who stake their $BTCETF tokens. Therefore, it is unclear whether staking requires a lock-up period or whether staking rewards will change over time.

Generally speaking, a higher staking reward rate will incentivize more investors to buy and hold $BTCETF tokens, thereby reducing supply and driving up the price. If staking rewards are variable, then any increase in the reward rate could have a significant upward impact on the price of the token.

The Bitcoin ETF Token is one of the most promising new cryptocurrencies available to investors. According to our price prediction, by the end of this year, the price of the token may be nearly 10 times higher than the pre-sale price of the first phase. 2024 could bring more gains as the first spot Bitcoin ETF could be launched and Bitcoin enters a new bull market.

The above is the detailed content of Bitcoin ETF Token Price Prediction 2024-2030. For more information, please follow other related articles on the PHP Chinese website!