web3.0

web3.0

Bitcoin spot ETF saw a net outflow of US$740 million in three days! Is the sell-off over?

Bitcoin spot ETF saw a net outflow of US$740 million in three days! Is the sell-off over?

Bitcoin spot ETF saw a net outflow of US$740 million in three days! Is the sell-off over?

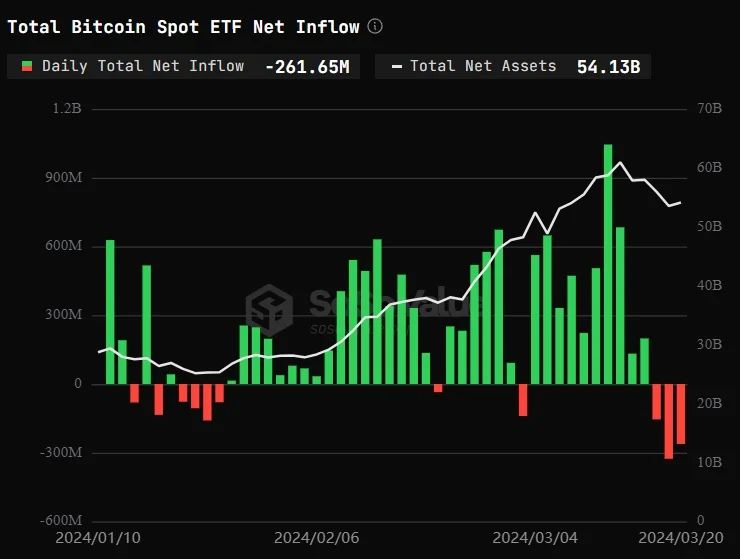

According to SoSoValue data, the Bitcoin spot ETF experienced net outflows for the third consecutive day, with a net outflow of US$261.5 million on the 20th. This shows that Bitcoin funds continue to have a net outflow, and the cumulative net outflow amount has reached 742 million U.S. dollars, compared with 154.3 million U.S. dollars and 326.2 million U.S. dollars respectively in the previous two days.

Changes in Net Inflows and Outflows of Bitcoin Spot ETF

On the 20th, Grayscale’s GBTC once again experienced a net outflow, amounting to US$386 million. , which is the largest net outflow. So far, GBTC’s historical net outflow has reached US$13.27 billion. In addition, the Invesco/Galaxy ETF also experienced a net outflow of $10.2 million on the same day.

Changes in net inflows and outflows of Bitcoin spot ETFs

On the 20th, the Bitcoin spot ETF with the largest single-day net inflows was BlackRock )'s IBIT has a net inflow of US$49.28 million. The current total historical net inflow of IBIT reaches US$13.09 billion, followed by Ark/21Shares' ARKB, with a net inflow of approximately US$23.26 million. The current total historical net inflow of ARKB reaches US$1.99 billion.

It is worth noting that BlackRock’s IBIT single-day net inflows hit the second-lowest record in history, only $4 million more than the lowest point on February 6, while Fidelity’s FBTC also hit a record The second-lowest single-day net inflow ever, at $12.9 million.

Currently, the total net asset value of Bitcoin spot ETFs is US$54.13 billion, the ETF net asset ratio (market value to the total market value of Bitcoin) reaches 4.11%, and the historical cumulative net inflow has reached US$11.41 billion.

Todd Rosenbluth, director of research at market analysis company VettaFi, previously said that funds will not always flow into ETFs, and it is reasonable for people to take profits after Bitcoin's strong rise.

Bitcoin Rising

Although spot ETFs have experienced net outflows for three consecutive days, Bitcoin stopped falling and rebounded today, breaking through $68,000 in one fell swoop. Yesterday’s decline has been fully replenished. The reason cannot be ruled out because the US Federal Reserve (Fed) announced for the fifth time at this morning's FOMC meeting that it would stop raising interest rates. The latest interest rate dot plot also predicts that interest rates will remain unchanged three times this year, which stimulated market sentiment.

However, the analysis agency 10X Research issued a report on the 19th warning that it is too early to be bullish again. It is expected that Bitcoin will fall below $60,000 before more meaningful rebound attempts will begin. Based on The previous new high signal can be expected to see Bitcoin reaching US$83,000 and US$102,000 in the future, but attention should be paid to the downward target first.

The above is the detailed content of Bitcoin spot ETF saw a net outflow of US$740 million in three days! Is the sell-off over?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

How many times will the Dogecoin ETF price rise?

Mar 28, 2025 pm 03:42 PM

The possible price increase of Dogecoin ETF after approval is 2 to 5 times, and the current price of $0.18 may rise to $0.6 to $1.2. 1) In the optimistic scenario, the increase can reach 3 times to 10 times, due to the bull market and the boost of Musk; 2) In the neutral scenario, the increase is 1.5 times to 3 times, due to moderate capital inflows; 3) In the pessimistic scenario, the increase is 0.5 times to 1.5 times, due to bear market and low liquidity.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

Will Dogecoin etf be approved?

Mar 28, 2025 pm 03:51 PM

As of March 2025, the Dogecoin ETF has not yet had a clear approval schedule. 1. There is no formal application yet and the SEC has not received any relevant application. 2. Market demand and controversy are high, and regulators are conservative. 3. The potential timeline is a 1-2-year review period, which may be observed from 2025 to 2026, but there is high uncertainty.

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

The latest summary of Ethereum formal trading platform 2025

Mar 26, 2025 pm 04:45 PM

In 2025, choosing a "formal" Ethereum trading platform means security, compliance and transparency. Licensed operations, financial security, transparent operations, AML/KYC, data protection and fair trading are key. Compliant exchanges such as Coinbase, Kraken, and Gemini are worth paying attention to. Binance and Ouyi have the opportunity to become formal platforms by strengthening compliance. DeFi is an option, but there are risks. Be sure to pay attention to security, compliance, expenses, spread risks, back up private keys, and conduct your own research.

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

What are the Ethereum trading platforms?

Mar 26, 2025 pm 04:48 PM

Want to play Ethereum? Choose the right trading platform first! There are centralized exchanges (CEXs) such as Binance, Ouyi, Coinbase, Kraken, and Gate.io. The advantages are fast speed and good liquidity, while the disadvantages are centralized risks. There are also decentralized exchanges (DEXs) such as Uniswap, SushiSwap, Balancer, and Curve. The advantages are security and transparency, while the disadvantages are slow speed and poor experience.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.