Technology peripherals

Technology peripherals

It Industry

It Industry

JD.com reduces its stake in Yonghui Supermarket and expects to cash out more than 200 million yuan

JD.com reduces its stake in Yonghui Supermarket and expects to cash out more than 200 million yuan

JD.com reduces its stake in Yonghui Supermarket and expects to cash out more than 200 million yuan

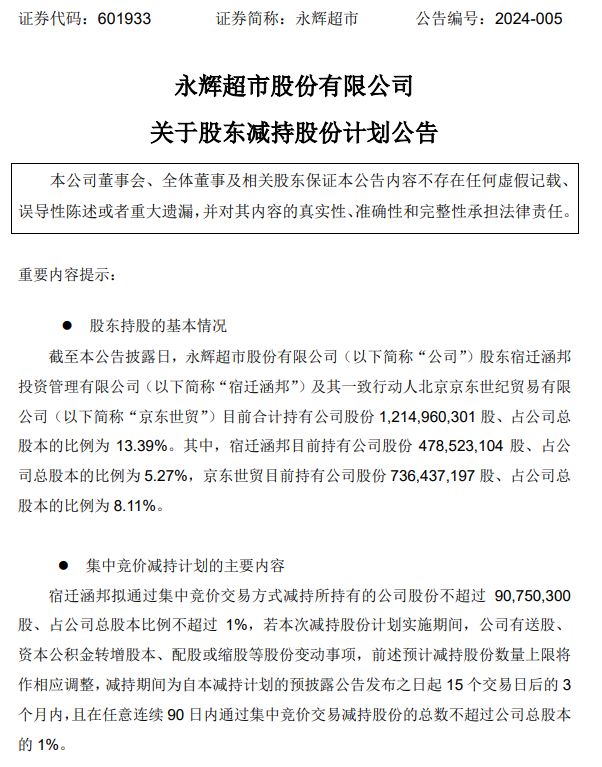

According to news from this site on March 22, Yonghui Supermarket Co., Ltd. issued an announcement on March 20 regarding the plan for shareholders to reduce their shareholdings. The announcement shows that Suqian Hanbang Investment Management Co., Ltd. plans to reduce its holdings of Yonghui Supermarket shares to no more than 90,750,300 shares through centralized bidding transactions, accounting for no more than 1% of the total share capital.

This site inquires and learns that Suqian Hanbang Investment Management Co., Ltd. was established on January 27, 2016. It is owned by Shanghai Sheng, a subsidiary of JD.com. Dayuan Information Technology Co., Ltd. holds 100% of the shares. The company holds a total of 478,523,104 shares of Yonghui Supermarket, accounting for 5.27% of the total share capital. The reduction is expected to be carried out at market price within three months after 15 trading days from the date of the announcement.

On March 21, Yonghui Supermarket fell 4.71%. As of the close, the company's share price was 2.43 yuan, with a total market value of 22.05 billion yuan. Based on the closing price on that day, JD.com is expected to cash out a total of about 220 million yuan after the reduction of holdings is completed.

Public information shows that from 2020 to 2022, Yonghui Supermarket achieved net profits attributable to the parent company of 1.794 billion yuan, -3.944 billion yuan, and -2.763 billion yuan, respectively, and non-net profits attributable to the parent company were 5.8 billion, -3.833 billion yuan, -2.565 billion yuan. According to Yonghui Supermarket’s 2023 annual performance pre-loss announcement, Yonghui is expected to lose 1.34 billion yuan in net profit attributable to its parent company in 2023. Since 2021, Yonghui Supermarket has suffered losses for three consecutive years, totaling more than 8 billion yuan.

It is worth mentioning that there were rumors that JD.com was in contact with Yonghui regarding acquisition matters, intending to acquire Yonghui wholly, but was quickly denied by JD.com: "There is no such intention at present." .

The above is the detailed content of JD.com reduces its stake in Yonghui Supermarket and expects to cash out more than 200 million yuan. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the benefits of 'JD.com' plus membership?

Feb 27, 2024 am 08:10 AM

What are the benefits of 'JD.com' plus membership?

Feb 27, 2024 am 08:10 AM

JD Plus members enjoy many preferential benefits, such as free trials, exclusive discounts, free shipping, etc. Let me introduce you to the specific benefits of JD Plus membership in detail, so that you can worry more and save money when shopping. What are the benefits of being a JD Plus member? 1. The lowest price of the year: Members can enjoy the lowest price and get more discounts when purchasing goods. 2. Free to use: Some free trial products will be distributed to members, so they can try different things. 3. Delivery priority: It can have faster delivery speed and can get the goods faster than ordinary users. 4. Dedicated customer service: We can provide an exclusive customer service who can answer users’ questions promptly if they have any questions.

JD.com further upgrades its 'free door-to-door return and exchange” freight insurance service, which is expected to be fully launched by the end of August

Aug 14, 2024 am 10:09 AM

JD.com further upgrades its 'free door-to-door return and exchange” freight insurance service, which is expected to be fully launched by the end of August

Aug 14, 2024 am 10:09 AM

This website reported on August 13 that in order to improve consumers’ shopping experience and provide merchants with more convenient and efficient after-sales service order management tools, JD.com launched a “free door-to-door return and exchange” service in April this year. Note on this site: The "free door-to-door return and exchange" service means that after the merchant has signed up for "freight insurance (upgraded version)" to activate the "free door-to-door return and exchange" service, the consumer initiates a return or exchange for the goods with the "free door-to-door return and exchange" logo displayed at the front desk. When requesting goods, the insurance company provides insurance services for the one-way shipping fee incurred for returns and exchanges. When the freight insurance is met (including seller's freight insurance and buyer's freight insurance), the delivery person will not charge freight to the customer when picking up the package, nor will the merchant charge freight after picking up the package. Instead, the insurance company will pay the compensation directly to Beijing Delivery , the details page will prompt that the shipping amount is 0. Now

How to close Baitiao on 'Jingdong'

Feb 27, 2024 am 09:22 AM

How to close Baitiao on 'Jingdong'

Feb 27, 2024 am 09:22 AM

You can close JD Baitiao through the following steps: 1. Open JD APP; 2. Click on the "My" page; 3. Select "JD Baitiao"; 4. Click "Repay"; 5. Select "Close Baitiao"; 6. According to Prompt to complete the operation. This way you can easily close Jingdong Baitiao. How to close Jingdong Baitiao 1. First, we open Jingdong, click on My in the lower right corner, and then click on the Baitiao as shown in the picture. 2. Let’s click on My in the lower right corner, as shown in the picture. 3. Then we click on More Settings as shown in the picture. 4. We click Other in More Settings. 5. Then we click the logout white bar at the bottom. 6. Finally, we select the reason and click Continue to log out to close Jingdong Baitiao.

How to check express logistics on 'JD.com'

Mar 11, 2024 pm 01:52 PM

How to check express logistics on 'JD.com'

Mar 11, 2024 pm 01:52 PM

JD Express Logistics is a well-known express delivery company. In order to facilitate users to check the logistics status of orders, JD provides a variety of query methods. The following will introduce several commonly used query methods, allowing you to easily track the latest developments of your package. How to check JD Express Logistics: Go to the website [https://www.jdl.com/orderSearch/?waybillCodes=] to query details: Method 1 [Website Query] 1. Open the website [https://www.jdl. com/orderSearch/?waybillCodes=】. 2. Enter the logistics order number in the box and click [Check Now]. 3. The waybill number and logistics information will be displayed below. Method 2

JD Express Inquiry Portal

Feb 23, 2024 pm 03:43 PM

JD Express Inquiry Portal

Feb 23, 2024 pm 03:43 PM

In the JD Express Inquiry Portal, we can easily check our current express delivery status through the website and learn the corresponding information. You can query through [https://www.jdl.com/orderSearch/?waybillCodes=]. This introduction to the express query portal website URL can tell you how to operate it. The following is a detailed introduction, come and take a look! JD Express Inquiry Entrance Answer: [https://www.jdl.com/orderSearch/?waybillCodes=] Details: 1. Go to the website [https://www.jdl.com/orderSearch

Jingdong online glasses fitting process

Nov 08, 2023 pm 03:19 PM

Jingdong online glasses fitting process

Nov 08, 2023 pm 03:19 PM

JD.com’s online glasses matching process is: 1. Select frames; 2. Select lenses; 3. Customize lenses; 4. Confirm order; 5. Pay order; 6. Wait for delivery; 7. Inspect and try on; 8. Confirm receipt. goods. Before wearing glasses, it is best to go to a hospital or a professional optical shop for an optometry test to learn about your myopia, interpupillary distance and other information so that you can choose appropriate lens parameters. JD.com’s optical services may vary, and information such as specific procedures and prices can be found on its official website.

How to operate Jingdong's refund only

Feb 24, 2024 am 11:49 AM

How to operate Jingdong's refund only

Feb 24, 2024 am 11:49 AM

How does Jingdong only refund? Jingdong can set the purchased items to be refund only, but most friends don’t know how to operate Jingdong’s refund only. Next is the Jingdong refund only method brought by the editor to users. There is a graphic tutorial on how to do this. Interested users can come and take a look! Jingdong usage tutorial How to operate Jingdong only refund 1. First open the Jingdong APP and enter the [My] area in the lower right corner of the main interface; 2. Then select the [My Order] function in the My area; 3. Finally, select only For refund orders, click [Apply for Refund] to complete the operation.

BOE and JD.com signed a strategic cooperation agreement

Mar 01, 2024 pm 10:55 PM

BOE and JD.com signed a strategic cooperation agreement

Mar 01, 2024 pm 10:55 PM

This website reported on March 1 that BOE Technology Group and JD.com signed a "Strategic Cooperation Framework Agreement" in Beijing today. Based on the good cooperation foundation of the previous "Double Beijing Empowerment Plan", they have reached a comprehensive strategic partnership. According to the agreement, the two parties will build on their deep accumulation in their respective advantageous industries, strategic layout in emerging high-tech fields, and effective practices in diversified cooperation to drive value extension. Carry out comprehensive strategic cooperation in logistics, Internet of Things innovation and other fields. BOE Chairman Chen Yanshun, BOE President Dr. Gao Wenbao, JD Group CEO Xu Ran and other core executives from both parties attended the signing ceremony. This site learned from the announcement that in this strategic signing, the two parties will work on smart terminals, warehousing logistics, and medical and health care.