On March 22, Frax Finance founder Sam Kazemian released Frax’s future roadmap, planning to launch 23 L3s in the next year and achieve the goal of over $100 billion in Fraxtal TVL by the end of 2026. As an established player, Frax Finance has established a diversified product matrix from the original single currency agreement, and its business covers many popular tracks such as LSD, lending, cross-chain bridges, RWA and L2. This article PANews will review the latest developments and market data of Frax Finance.

Judging from this year’s market dynamics, Frax Finance is not limited to asset issuance, it is accelerating product functions and narrative routes iterative upgrade.

On the one hand, Frax Finance officially launched the FXB (Frax Bond) module in mid-January this year, officially completing the design of FRAX v3 and the deployment of all new functions. This version aims to eliminate dependence on USDC, create a new decentralized stable currency mechanism, and officially enter the RWA track. Among them, FXB is a utility token that can be converted into 1 FRAX stablecoin without trust when it expires. It is denominated in FRAX stablecoin. Simply put, it allows holders to purchase the future stablecoin FRAX at a discount. The bond yield Will correspond to U.S. Treasury yields of similar maturities and have specific timestamps. Judging from the multiple updated versions of Frax Finance, its narrative has achieved a multi-dimensional upgrade from calculation stability to LSD to RWA.

On the other hand, similar to the previous fee switch proposal on the Uniswap protocol, Frax Finance is also planning to provide this type of reward mechanism for token holders. A recent proposal called "Reactivating the Fee Switch" was proposed to veFXS Holders are allocated 75% of the protocol fee income. Kazemian also proposed in the latest roadmap to reopen the protocol fee switch, flow 50% of the proceeds to veFXS, and use the other 50% to repurchase FXS and other Frax assets, and proposed to reduce the conversion rate from FPIS to veFXS by 67%. , with a new conversion rate of 1 FPIS -> 1.33 veFXS, for a period of four years. According to DeFiLlama data, as of March 22, Frax Finance’s annual revenue is expected to be $47.93 million. In order to accelerate the expansion of asset coverage, Frax Finance recently launched the FRAX stablecoin on NEAR, and revealed in its latest plan that it will also issue new assets such as frxTIA and frxMetis.

In addition, dYdX developed the Layer1 blockchain dYdX Chain, Synthetix deployed SNX Chain, MakerDAO planned to launch Newchain, etc., and later Frax Finance also adopted chain launch as a new strategy. In February this year, Frax Finance announced the launch of Fraxtal, a modular Layer 2 blockchain built on OP Stack, aiming to become a blockchain driven by technical papers and encourage others to build and develop on its platform.

Compared with other Layer2, Fraxtal adopts a unique block space incentive mechanism (called Flox) for the block space incentive mechanism (called Flox), which can award FXTL points based on the usage of the Fraxtal chain. Also earned by staking veFXS, these points can be tokenized. FXS is Fraxtal’s sequencer staking token used to capture sequencer revenue. Fraxtal is the focus of the development of Frax Finance in 2024. In the future, all Frax assets including FRAX, sFRAX, frxETH (and new Frax assets) will be prioritized for issuance on Fraxtal. As the only protocol with 4 independent tokens/assets among the top 200 projects by market capitalization, as Fraxtal matures in the future, all Frax assets will be available as Gas tokens on Fraxtal.

It is worth mentioning that Frax Finance is also targeting Layer 3. This track is generally considered to bring strong application construction capabilities to Layer 2 and has room for explosive growth. Frax Finance plans to launch 23 official L3s in the next 365 days to kick-start the Fraxtal Nation community. Currently, 2 L3s have been officially built, and the remaining ones are expected to be completed in the next few months. According to the official introduction, the L3 chain can not only earn FXTL points through Flox, but 23 L3 chain slots are reserved for official partners, who will receive additional support from Fraxtal core developers and allocate a large amount of FXTL.

Although Frax Finance’s competitiveness in the stable currency field is limited, judging from multiple data, in LSD and RWA The field has great growth potential.

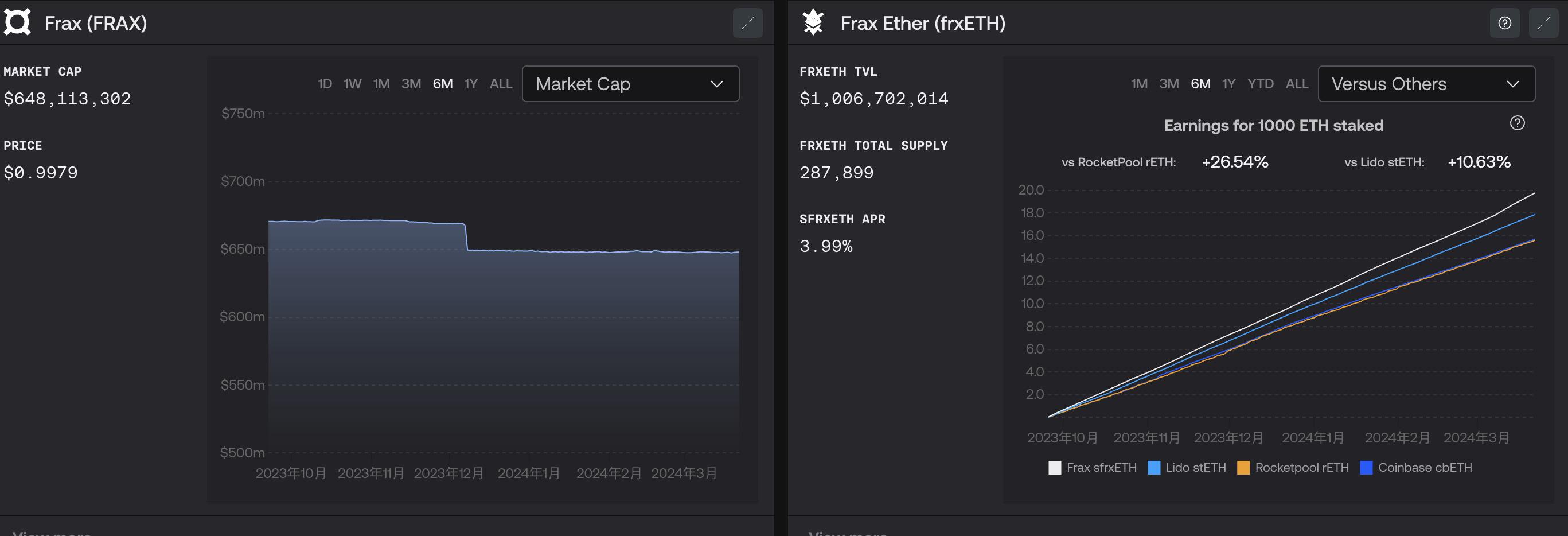

Looking at the stablecoin track, CoinGecko data shows that as of March 22, Frax Finance’s stablecoin FRAX ranked eighth with a market value of US$640 million, but only accounted for 0.4% of the overall market value. Although it is only inferior to DAI on the decentralized stablecoin track, it is only a fraction of the latter’s market value. Judging from the current stablecoin market structure, the monopoly of the leader is difficult to break.

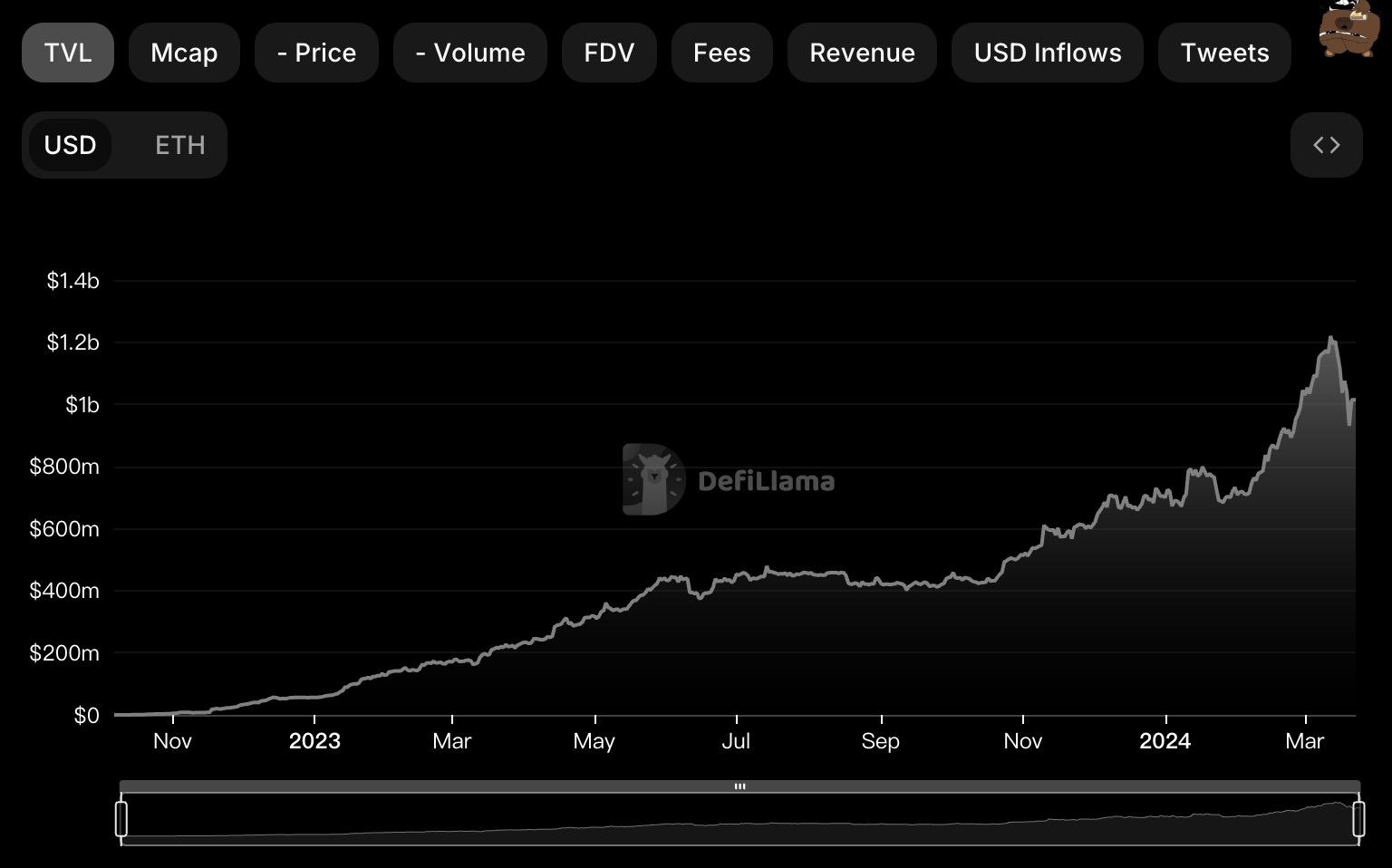

From the perspective of LSD competition, DeFiLlama data shows that as of March 22, the total TVL of the LSD track reached 48.662 billion US dollars, of which Frax Ether (frxETH) accounted for nearly 10 The proportion of US$100 million reached 2.09%, an increase of 42.5% from the beginning of the year. Compared with the top-ranked Lido, which has over US$34.5 billion, Frax Ether still has a large gap. However, the official website of Frax Finance shows that as of March 22, the APR of frxETH reached 4.08%, exceeding stETH, rETH and cbETH in the same period. The relatively higher staking yield may attract more funds to enter.

In addition, from the perspective of RWA layout, the official website of Frax Finance shows that as of March 22, the total pledged amount of sFRAX, its pledge vault that utilizes the proceeds of U.S. Treasury bonds, exceeds 28.388 million. According to DeFiLlama data, as of March 22, the total TVL of RWA track projects exceeded US$4.01 billion. Compared with the rate of return of top-ranked RWA projects such as stUSDT and Ondo Finance, sFRAX’s interest rate is 5.4%, which has certain advantages.

#The layout of the hotspot track has also caused a certain increase in the overall locked-up volume of Frax Finance. DeFiLlama data shows that Frax Finance’s TVL has increased by 30.6% since the beginning of the year, but has declined after briefly rising due to the recent fee switch news. However, there was no significant boost to the price of the governance token FXS. CoinGecko data showed that FXS fell by 15.6% from the beginning of the year.

In general, at a time when competition among various stablecoins is becoming increasingly fierce, Frax Finance is exploring differentiated development paths by integrating multiple product suites, but whether it can truly build its own growth flywheel remains to be verified by time.

The above is the detailed content of Multiple re-narratives of Frax Finance: Focus on Layer2 Fraxtal, multiple products have not yet formed a 'blood-sucking effect”. For more information, please follow other related articles on the PHP Chinese website!