web3.0

web3.0

Examining the crypto market from the perspective of website traffic: This bull market is still gathering momentum

Examining the crypto market from the perspective of website traffic: This bull market is still gathering momentum

Examining the crypto market from the perspective of website traffic: This bull market is still gathering momentum

Original title: What does Web Traffic tell us about the Blockchain Market?

##Original author: Tiger Research

Compiled by Shenchao TechFlow

##Abstract of this article

##Abstract of this article

- Network traffic is often overlooked in analyzes of the blockchain market, but it is actually an important factor. Recent data suggests that web traffic has not grown significantly during the current period compared to past boom periods, raising concerns about the market's vitality.

- While network traffic on centralized exchanges and DeFi platforms has remained stable, overall cryptocurrency prices have seen significant increases. Unlike previous market situations dominated by retail investors, this rise is likely to stem from the influx of external institutions such as ETFs. This indicates that institutional investors’ interest in the cryptocurrency market is increasing and their participation may have a significant impact on the market landscape. As more traditional financial institutions and investors enter the space, cryptocurrency price volatility and market size are likely to expand further. This trend also reflects the disparity between crypto

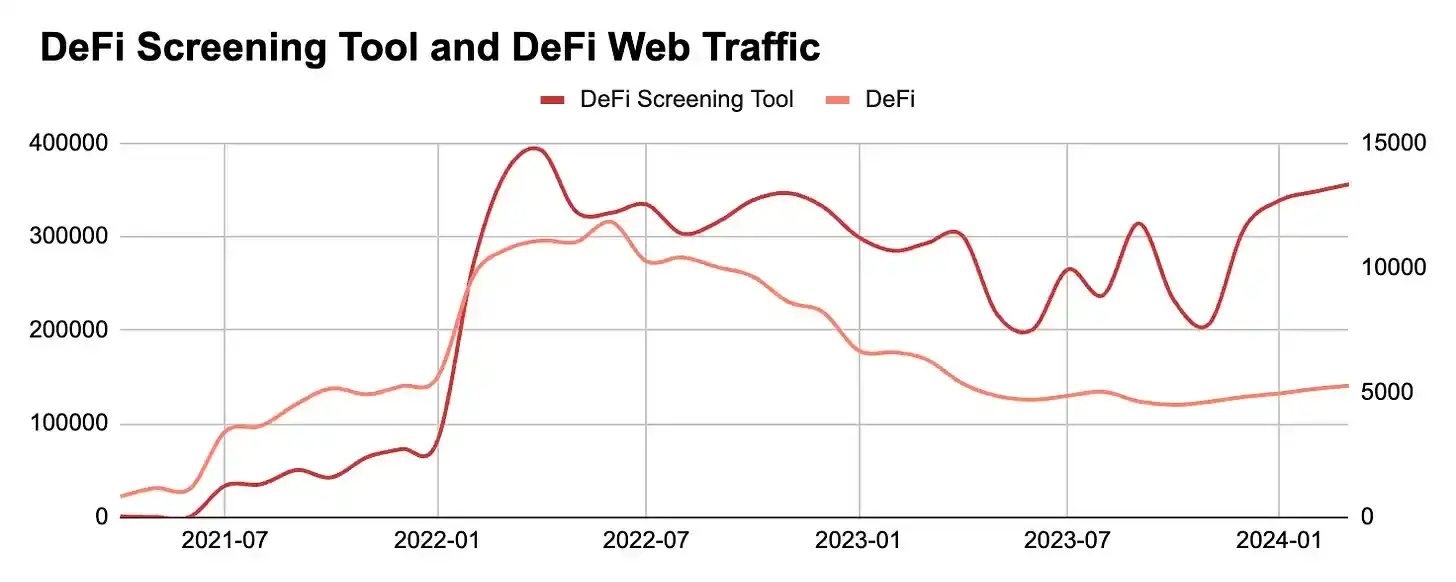

- DeFi analytics tools and DeFi network traffic: While analytics tools like DEX Filter have seen steady growth in traffic, traditional DeFi services The network traffic is relatively low. This suggests that investors prefer to be more selective when actually making trading or investment decisions, rather than frequently accessing analytical tools for market information.

- Text

The rise in cryptocurrency prices has sparked the belief among many that the market has re-entered a bull cycle. However, rising prices do not necessarily mean increased market activity. To accurately assess market activity, a variety of factors must be considered.

These include common market metrics like DAU and MAU, as well as blockchain-specific metrics like cryptocurrency transaction volume, number of active wallets, and TVL. Many market analyzes exploit these factors. Solana Networks, which surpassed $4 billion in TVL and reached its highest level in two years, is one example of this.

"Network traffic" is rarely used as an analysis factor. Due to the nature of blockchain services, real user activity is very important, so network traffic, including visitors, is used as an internal reference metric for the project, but not as an analysis factor.

However, network traffic analysis can help in analyzing the market in depth as it can reveal public interest in services and their detailed regional information. In this report, we will use network traffic to analyze the blockchain market status in 2024, provide a different perspective from other reports on an industry basis, and help you understand the market from a realistic perspective.

1.CEX

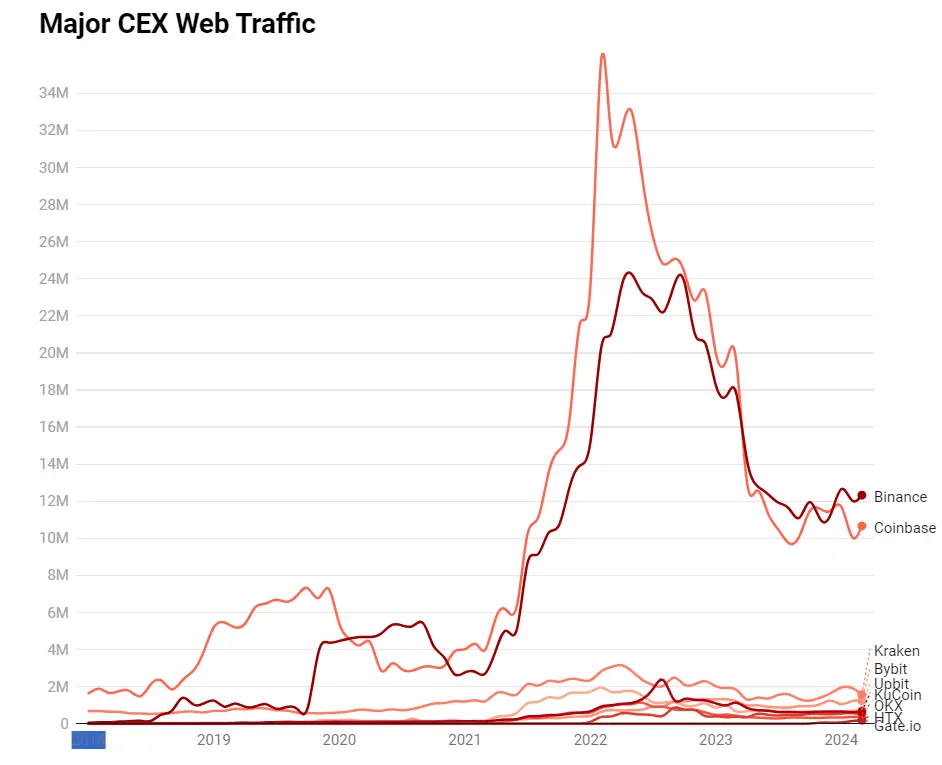

With the recent surge in cryptocurrency prices, the area of greatest concern is undoubtedly cryptocurrency exchanges. By analyzing the network traffic of major cryptocurrency exchanges like Binance, we can see that the current market is not as exuberant as previous periods.

With the recent surge in cryptocurrency prices, the area of greatest concern is undoubtedly cryptocurrency exchanges. By analyzing the network traffic of major cryptocurrency exchanges like Binance, we can see that the current market is not as exuberant as previous periods.

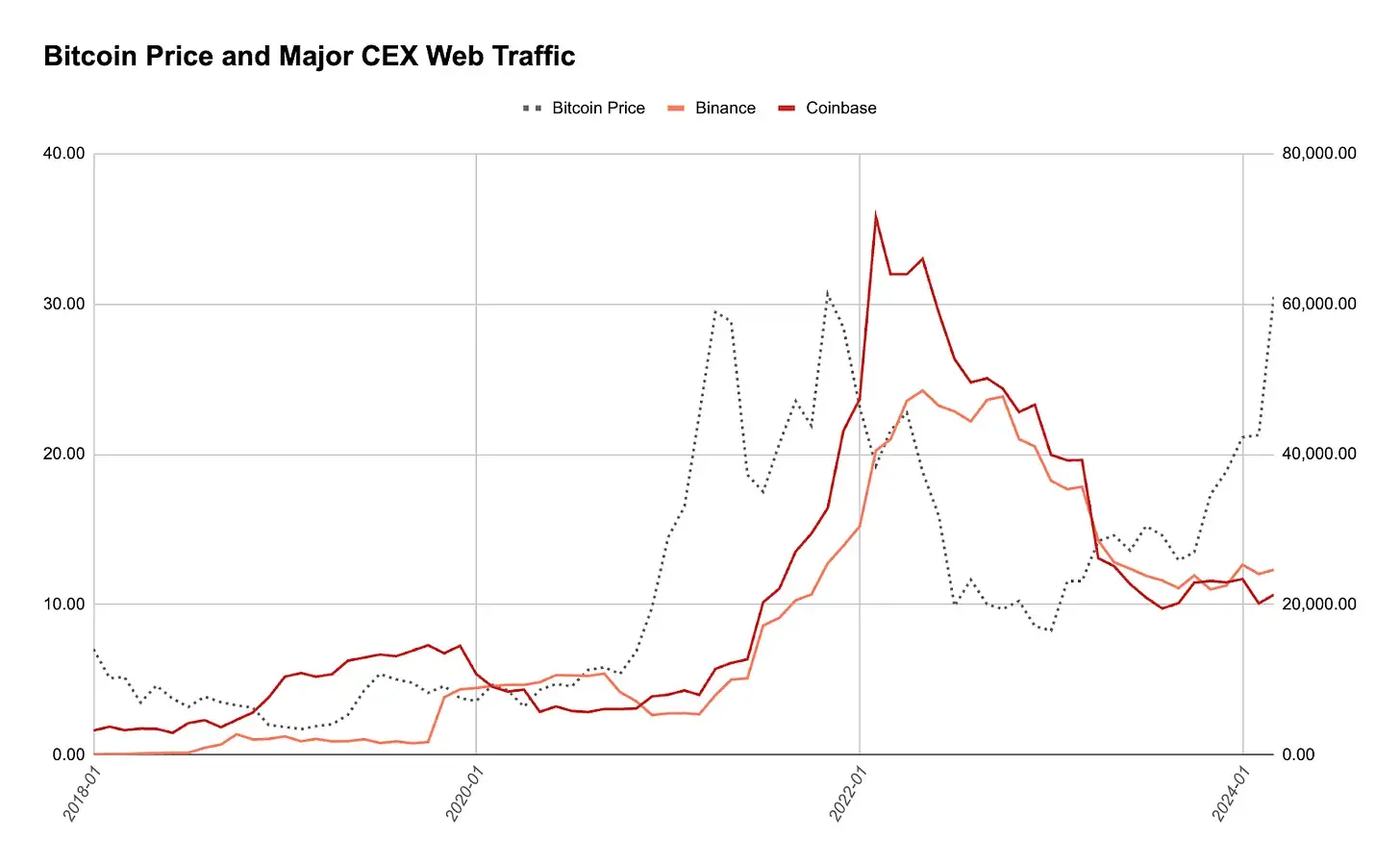

Comparing Bitcoin price and trading volume with each exchange’s network traffic further illustrates the differences from past booms. Bitcoin prices have surged while trading volumes and exchange network traffic have remained low, suggesting it may be transactions outside of cryptocurrency exchanges such as ETFs that are influencing the price increase.

If this trend accelerates, we believe retail investors will play a smaller role during this period than in the past, with ETFs and other traditionally traded financial products likely to play a larger role.

2. Cryptocurrency Ranking Websites

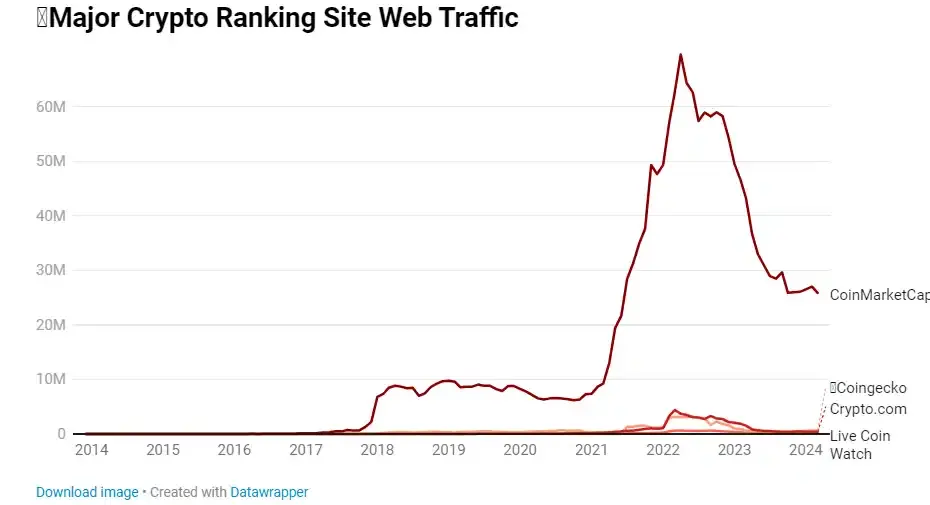

CoinMarketCap dominates the web traffic ranking of cryptocurrency ranking portals, followed by Coingecko. The difference in network activity between CoinMarketCap and Coingecko is huge.

Web traffic for all cryptocurrency ranking sites has remained stable rather than rising, which is also different from previous market booms.

3.DeFi

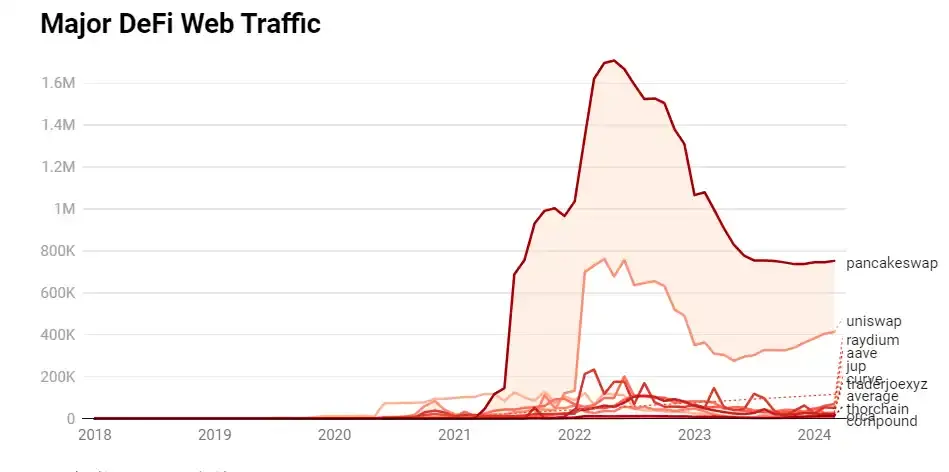

When looking at the network traffic of major DeFi projects, PancakeSwap dominates, followed by Uniswap, Raydium, etc. PancakeSwap’s high traffic is likely due to various features, including games and NFTs. These are not core features, but they are user attraction factors that are hard to find in other DeFi platforms.

When looking at the network traffic of major DeFi projects, PancakeSwap dominates, followed by Uniswap, Raydium, etc. PancakeSwap’s high traffic is likely due to various features, including games and NFTs. These are not core features, but they are user attraction factors that are hard to find in other DeFi platforms.

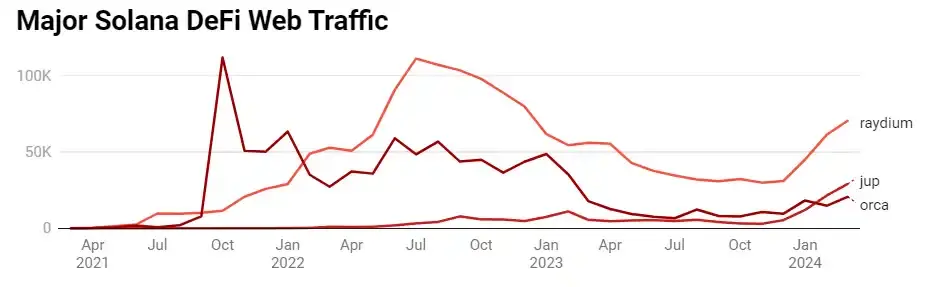

Among the recently popular Solana DeFi, Raydium leads the pack, followed by Jup and Orca. After the FTX bankruptcy, we can see that trading volume first dropped and then rebounded, which is in line with the trend of actual trading volume.

4.DeFi Screening Tool

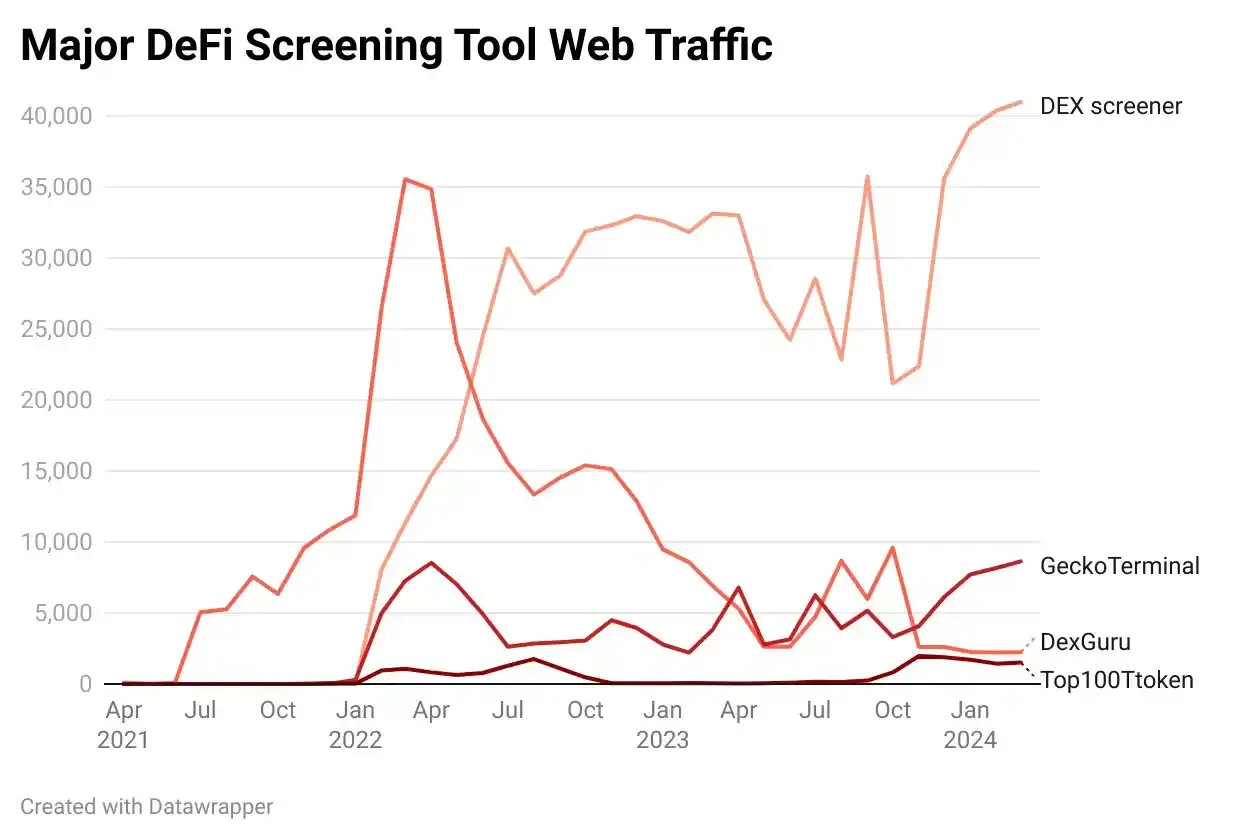

#With so many tokens being listed every day, it’s crucial to have a tool that can view and analyze them at a glance . Currently, DEX screeners dominate web traffic, while DexGuru has been trending downward since peaking in early 2022.

When comparing the average network traffic of DeFi screening tools to the network traffic of each major DeFi project, the gap is driven by differences in usage processes. Typical DeFi investors use analytics tools to track their crypto assets and access these tools frequently. Typical DeFi tools lack additional features, so traffic may only be focused on making investment decisions. In addition, some DeFi analysis tools also support transactions such as swaps, which also adds more reasons for users to stay.

Conclusion

In this article, we examine the blockchain market using the often-overlooked network traffic, which is one of the various factors used when analyzing the blockchain market. The most impressive finding is that, unlike in the past, the market is not currently experiencing an explosion in traffic. Even taking into account the evolution of services and the fact that many have been released as applications, the numbers are still low, so it is difficult to conclude based on this indicator alone that the cryptocurrency market has reached a period of prosperity.

We hope this analysis will allow many market participants to gain a more comprehensive understanding of the blockchain market through the lens of network traffic activity.

The above is the detailed content of Examining the crypto market from the perspective of website traffic: This bull market is still gathering momentum. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages