Interpretation of the current status and six major trends of national debt RWA projects

The tokenization of on-chain assets is becoming an important long-term trend with huge prospects. Among them, treasury bond RWA is becoming an important branch. This sector achieved nearly 7-fold growth in 2023. After experiencing a brief decline at the end of 2023, it quickly returned to the upward channel.

This Bing Ventures research article will discuss the current status and important development trends of treasury bond RWA and the entire RWA sector.

RWA Ecological Current Situation

In the current market environment, DeFi yields are relatively low and real interest rates are rising, which has promoted the growth of RWA assets such as tokenized treasury bonds. Investors prefer assets with stable, predictable returns, a trend that is particularly evident among investors seeking a balance between financial and cryptocurrency markets. Products such as tokenized treasury bonds are popular because they combine the characteristics of traditional financial markets and cryptocurrency markets. This trend indicates an increasing preference among investors for assets with lower risk and controllable returns.

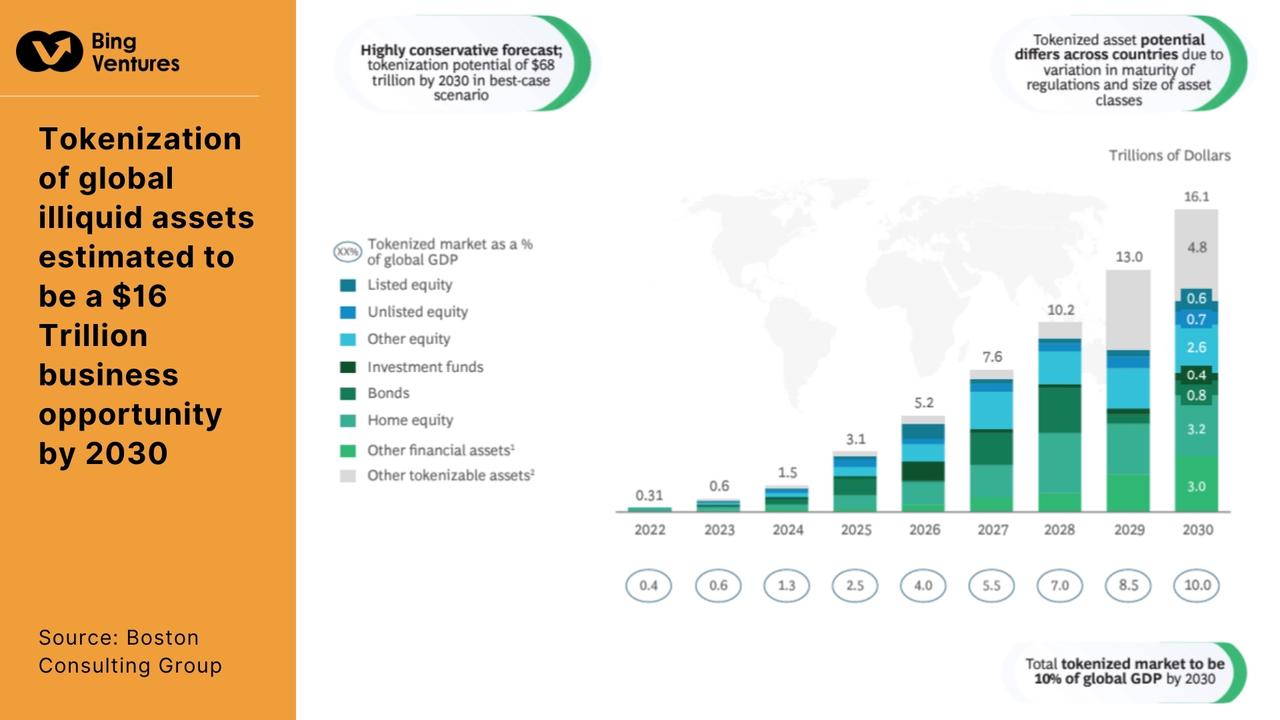

According to a BCG report, the global market size for tokenization of illiquid assets is expected to reach US$16 trillion by 2030, accounting for 10% of global GDP. This includes the tokenization of assets on the chain, as well as the sharing of original traditional assets (such as ETFs and real estate investment trust funds). For the crypto industry, capturing even a small share of this massive market represents significant growth opportunities.

Source: Boston Consulting Group

Source: Boston Consulting GroupEcological Participant

RWA Infrastructure

RWA Infrastructure, also Aptly called the RWA track, it provides the necessary regulatory, technical and operational conditions for RWA and forms the basis of the entire ecosystem. The construction of these infrastructures is crucial to the sustainable development of RWA.

Asset Provider

In addition, there are asset providers dedicated to meeting various RWA needs, such as real estate, fixed income and stocks, etc., providing a wide range of choices for the RWA market.

RWA Market Size

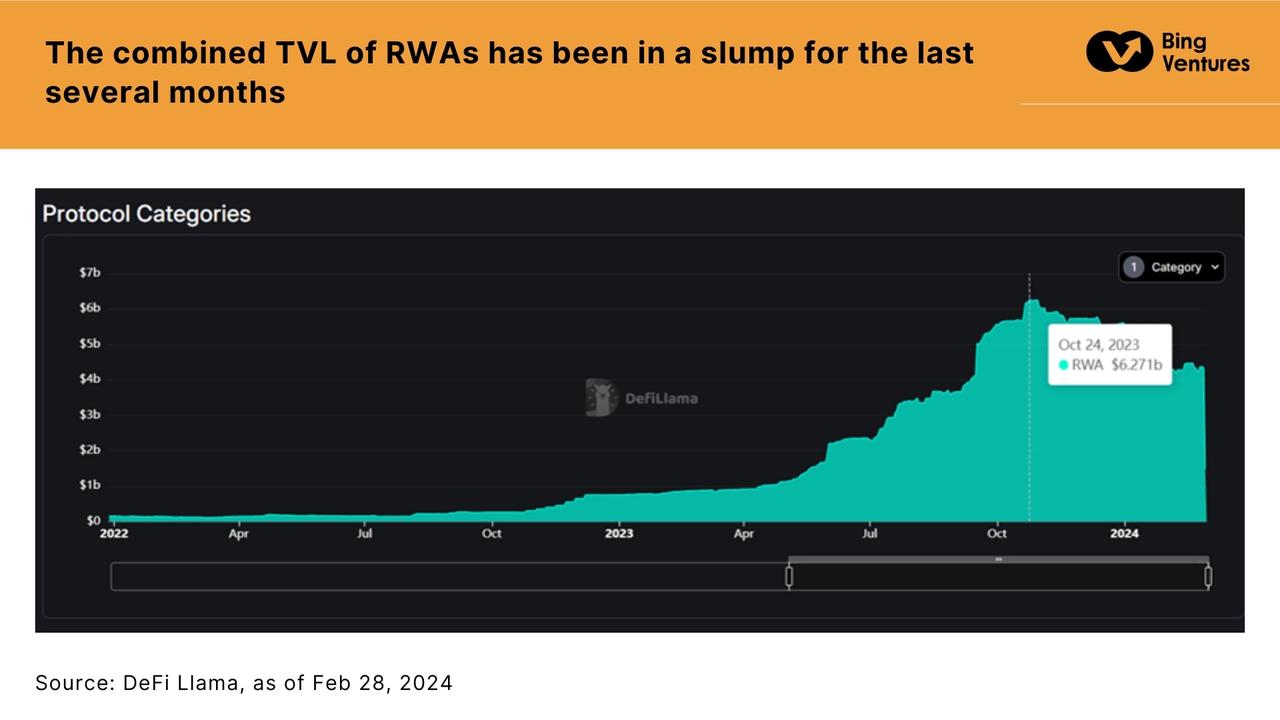

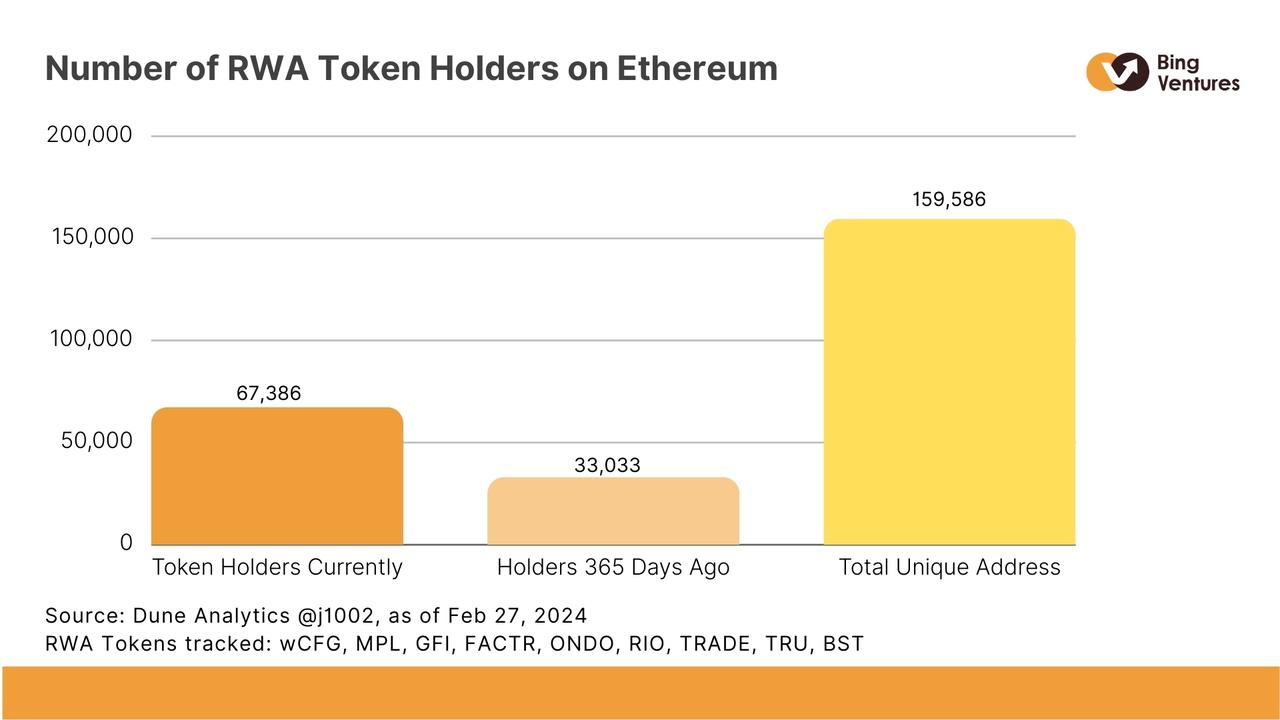

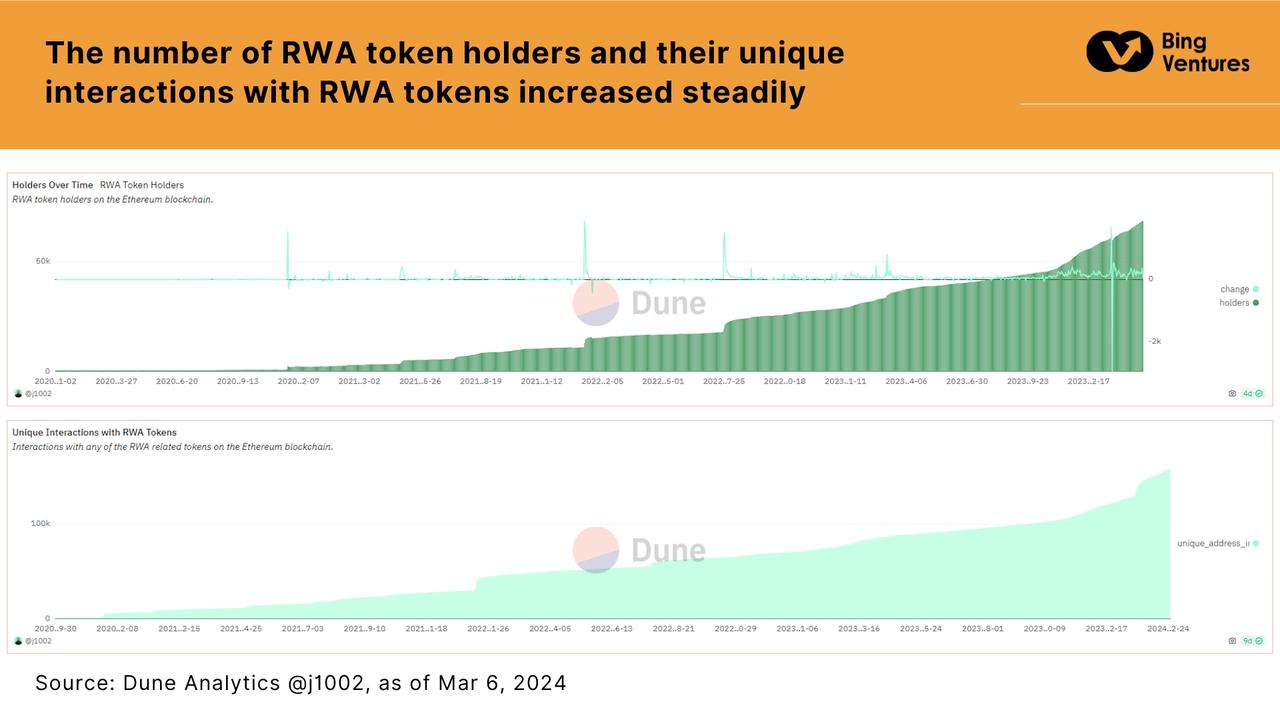

Currently, according to protocols tracked by DeFi Llama, the RWA market has now become the 11th largest category in DeFi, with a total locked-up value of more than $4 billion. According to a dashboard produced by @j1002 on the Dune Analytics platform, there are more than 67,000 holders of RWA-related protocol tokens on the Ethereum blockchain, more than doubling in the past year. In one track, according to data from the RWA track monitoring platform RWA.xyz, as of March 21, 2024, the value of the tokenized treasury bond market has grown from approximately US$379 million a year ago to US$719 million, with an average The annualized yield to maturity is approximately 5%.

Source: RWA. Locked value has continued to decline over the past few months. At the same time, the value of the tokenized treasury bond market has also fallen from US$771 million at the end of November last year, but the tokenized treasury bond sector has returned to an upward trend since February this year. The reason may be that with the recovery of the overall cryptocurrency market, some investors have begun to turn to the fields of DeFi lending and liquidity re-pledge with higher returns.

Source: RWA. Locked value has continued to decline over the past few months. At the same time, the value of the tokenized treasury bond market has also fallen from US$771 million at the end of November last year, but the tokenized treasury bond sector has returned to an upward trend since February this year. The reason may be that with the recovery of the overall cryptocurrency market, some investors have begun to turn to the fields of DeFi lending and liquidity re-pledge with higher returns.

Source: DeFiLlama, as of Feb 28, 2024

User portraits and behaviors

We try to profile and behave RWA users Conduct analysis to gain a clearer insight into the changes in user needs behind these market changes. In fact, the majority of RWA users in DeFi are native to the cryptocurrency ecosystem, indicating that early adopters of RWA are not converting from traditional investment paths. This is evidenced by the trend that the average creation date of user addresses interacting with RWA tokens predates the introduction of the RWA asset on the blockchain. These are signs that RWA is currently more of a natural evolutionary step within the cryptocurrency community than a sudden influx of traditional investors into the asset. RWA users tend to have a strong grasp of blockchain technology, and many users have been into DeFi long before RWA became popular.

Source: Dune Analytics @j1002, as of Feb 27, 2024

We use the number of RWA token holders as a reference indicator , to measure the adoption of RWA from a side perspective. It can be seen that despite the recent decline in the overall TVL of the RWA sector, the number of RWA token holders and independent wallet address interactions has steadily increased. We believe this reflects the strengthening of RWA’s awareness and positive expectations among investors.

Source: Dune Analytics @j1002, as of Mar 6, 2024

After time series analysis of RWA currency holder wallet addresses, We found that most addresses already have a long history of use and various blockchain activity records. This illustrates that the participants in the RWA space come from a very healthy base of long-term crypto users.

At the same time, we also saw the growth of some new addresses. This may mean that with the entry of traditional financial institutions such as Franklin Templeton and Wisdom Tree, the RWA sector is penetrating into more traditional users.

RWAs bridge the crypto world with traditional finance, but they also carry the inherent risks and limitations of the real world. Most RWA interactions require traditional financial system checks such as KYC/AML, credit checks and minimum balance requirements. These preconditions limit RWA’s potential to expand financial inclusion.

Competitive Product Analysis

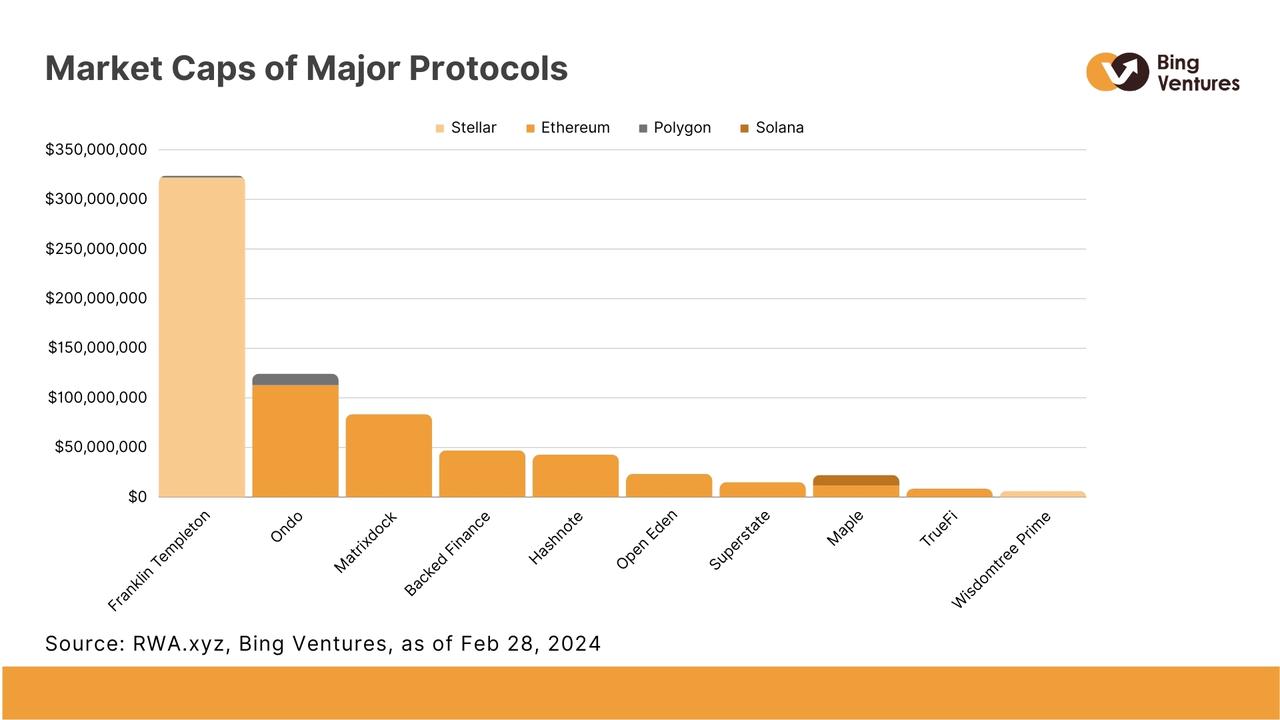

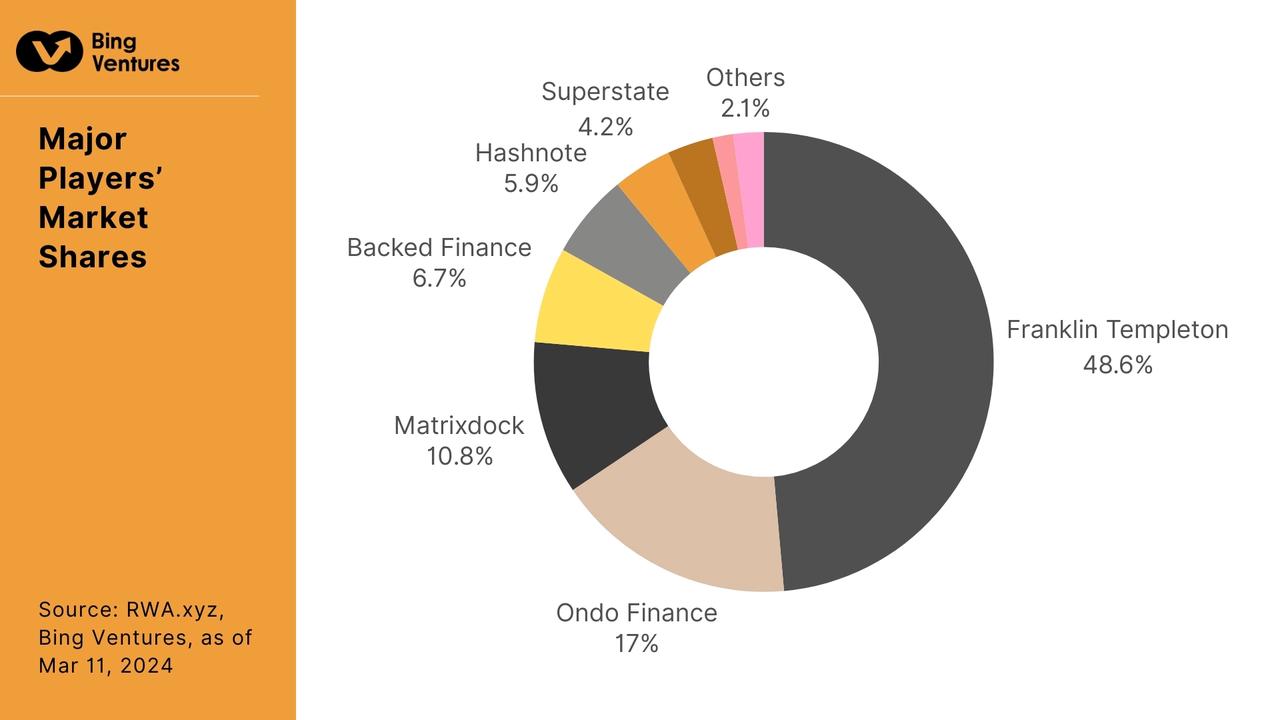

We conducted an in-depth comparison of the market share, growth rate, pricing cost and user experience of different projects to assess the competitive landscape. In the treasury bond RWA market, Franklin Templeton occupies the largest market share by virtue of its deep accumulation and brand advantages in the traditional financial field. Ondo Finance and Matrixdock show different market strategies and user groups. Emerging companies such as Hashnote and Superstate, despite their small market share, are growing rapidly, showing the vitality and diversity of the market.

In terms of pricing, the management rates of different projects vary, which reflects their different strategies for market positioning and cost control. Franklin Templeton and Ondo Finance, for example, have low management fees, which helps attract large-scale institutional investors. The management fees of Matrixdock and Maple Finance are relatively high, which may be to compensate for the revenue pressure caused by smaller market shares.

In terms of user experience, due to the nature and complexity of Treasury RWA products, providing a clear, intuitive and user-friendly interface is critical to attracting and retaining users. In addition, as market competition intensifies, improving service quality and customer support will become key factors for each project to differentiate itself.

To sum up, the treasury bond RWA project is in a stage of rapid development, and different projects have significant differences in market share, growth rate, pricing strategy and user experience. The future development of these projects will be greatly affected by the global economic environment, regulatory policies and technological innovation. To remain competitive, these projects need to continuously optimize their product features, improve user experience, and adapt to changing market and regulatory environments.

Heading Treasury Bond RWA Project

Franklin Templeton

Franklin Templeton is an American global asset management company with assets under management exceeding US$1.3 trillion. As a traditional investment company that actively focuses on the blockchain industry, Franklin has launched venture capital funds and equity funds focusing on blockchain in the past.

Market share: 48.6%

Market value of government bond products: $350,077,608

Management fee: 0.15 %

Market share change in the past quarter: -5.51 percentage points

Ondo Finance

Ondo Finance is through asset management Large-scale, highly liquid ETFs managed by giants such as BlackRock and Pacific Investment Management Company (PIMCO) have launched three tokenized U.S. Treasury bonds and bond products, namely the U.S. Government Bond Fund (OUSG), short-term investment grade bond fund (OSTB) and high-yield corporate bond fund (OHYG).

Market share: 17.01%

Market value of government bond products: $122,511,877

Management fee: 0.15 %

Market share change in the past quarter: -6.69 percentage points

Matrixdock

Matrixdock is a Singapore-based asset management platform An on-chain treasury bond platform launched by Matrixport. STBT is Matrixdock’s first product, introducing a risk-free interest rate based on U.S. Treasury securities.

Market share: 10.78%

Market value of government bond products: $77,674,902

Management fee: 0.3 %

Market share change in the past quarter: -2.11 percentage points

Backed Finance

Backed Finance is a company headquartered in The Swiss company working to bring real-world assets onto the chain has launched blB01, a tokenized short-term U.S. Treasury Bond ETF on Coinbase’s Layer2 Base.

Market share: 6.73%

Market value of government bond products: $48,485,006

Management fee: 0 %

Market share change in the past quarter: -0.4 percentage points

Hashnote

Hashnote is regulated by the CFTC (U.S. Commodities Futures Trading Commission) and CIMA (Chartered Institute of Management Accountants) regulated company, it is a fully regulated, institutional-grade DeFi asset management platform that provides consumers with comprehensive service support, zero counterparty risk, and customizable risk /return strategy.

Market share: 5.92%

Market value of government bond products: $42,613,396

Management fee: 0 %

Market share change in the past quarter: 0.2 percentage points

Superstate

Superstate is a blockchain-based asset management company. In November last year, it raised $14 million in venture capital to develop regulated on-chain fund products for U.S. investors. In February this year, it launched the first tokenized U.S. Treasury bond fund on the Ethereum blockchain.

Market share: 4.16%

Market value of government bond products: $29,985,969

Management fee: 0.15%

Market share change in the past quarter: 4.16 percentage points

Open Eden

Open Eden is a crypto startup founded in early 2022, co-founded by Gemini’s former Asia Pacific head Jeremy Ng and head of business development Eugene Ng.

Market share: 3.24%

Market value of government bond products: $23,328,886

Management fee: 0 %

Market share change in the past quarter: -1.12 percentage points

Maple Finance

Maple Finance is an institutional capital network, providing credit experts with the infrastructure to run on-chain lending operations. Maple Finance is one of the market leaders in private credit. In April 2023, it launched a new fund management pool that allows non-U.S. accredited investors and entities to invest directly in U.S. Treasury bonds with USDC.

Market share: 1.45%

Market value of government bond products: $10,428,616

Management fee: 0.5 %

Market share change in the past quarter: -3.23 percentage points

Source: RWA.xyz, Bing Ventures, as of Mar 11, 2024

Future Trend Forecast

We believe that six major trends will promote the development of the Chinese bond tokenization sector in the RWA market. These trends will bring profound changes to the treasury bond RWA market and provide new opportunities for investors.

1. Deep integration of on-chain and off-chain brings better user experience

In the future, the treasury bond RWA market will usher in the deep integration of on-chain technology and traditional financial assets. This trend will bring about a more efficient asset tokenization process and closer on-chain and off-chain data synchronization, thereby significantly improving the efficiency and transparency of transactions. This means a faster and more reliable trading experience for investors, which is expected to attract more funds to flow into the treasury bond RWA market.

2. Regulatory technology innovation brings higher compliance

As regulatory agencies pay increasing attention to the field of digital assets, the treasury bond RWA project will have to strengthen compliance. We expect to see more blockchain-based compliance innovations, such as the use of smart contracts for compliance checks, to meet increasingly stringent regulatory requirements. This will bring greater confidence to investors and encourage more institutions to participate in this market.

3. Enhanced cross-chain operability brings better accessibility

The advancement of cross-chain technology will enable treasury bond RWA products on various blockchain platforms to easily interoperate. Thereby enhancing the liquidity and accessibility of the entire market. This will provide investors with more choice and flexibility and reduce market risk. At the same time, enhanced cross-chain operability will also promote the integration of international markets and create more global investment opportunities.

4. Launch of customized and personalized financial products

The Treasury Bond RWA project is expected to launch more customized and personalized financial products to meet the specific needs of different investor groups. This includes precise positioning of risk appetite and investment objectives, allowing investors to better achieve their financial goals. This will provide investors with more diverse investment options.

5. Dual enhancement of transparency and security

Future national debt RWA projects will pay more attention to transparency and security, using the traceability and non-tamperability of blockchain technology to enhance Investors’ trust and peace of mind. This will attract more risk-sensitive investors to participate in the market and help reduce the risk of market manipulation.

6. Integrating cutting-edge financial technology

The application of artificial intelligence for market analysis and prediction, as well as the generation of automated investment strategies, will become an important innovation direction in the future of the treasury bond RWA market. The development of these innovations will allow investors to fully understand market conditions and empower investors to better seize market opportunities. This will improve the intelligence level of investment decisions and help investors better grasp market opportunities.

Types of future potential projects

Based on the above understanding, we believe that the following five types of projects are worthy of attention.

1. Strong Compliance Projects

In an environment where regulatory requirements are constantly strengthening, projects that can fully meet compliance requirements and provide a high degree of transparency will be more likely to win the trust of the market and investors. favor. These projects will establish a credible reputation in the market and attract more investors.

2. Technology-driven innovative projects

Projects that make full use of cutting-edge technologies such as blockchain, artificial intelligence, and big data, especially those platforms that can provide efficient trading and investment strategies, It is expected to occupy a place in the market. These projects will bring a faster and smarter investment experience.

3. Cross-chain compatibility projects

Treasury bond RWA projects that can achieve seamless interoperability between different blockchain platforms, especially those that provide a wider range of asset choices and optimize liquidity The platform will have obvious competitive advantages.

4. User-friendly platform

Treasury bond RWA platforms that are easy to operate and provide comprehensive customer support and educational resources will be more popular, especially for non-professional investors.

5. Low-cost and high-efficiency solutions

Projects that excel in cost control and operational efficiency, such as platforms that provide low management fees and high automation services, will compete in the fiercely competitive market. occupy a place in it.

In short, against the background of the Federal Reserve raising interest rates, investors are more inclined to look for investment opportunities with higher yields. The growth of the RWA market demonstrates that despite macroeconomic pressures, the potentially high yields it offers are attracting significant capital. As regulations improve and technology advances, we expect the treasury bond RWA market to continue to grow, especially in the context of the widespread application of digital currencies such as stablecoins and CBDC.

However, treasury bond RWA projects may face more stringent regulatory requirements in the future, especially in terms of anti-money laundering (AML) and customer identification (KYC). As the regulatory environment gradually stabilizes, it is expected that these projects will be able to better integrate into the traditional financial system, while providing investors with new investment channels and risk management tools.

In order to offset the inherent risks contained in RWA products, we believe that issuers of treasury bond RWA should adopt a decentralized mechanism for governance decisions, just like the DAO mechanism adopted by many issuers in the private credit field. This mechanism increases transparency and ensures better assessment and mitigation of risks, while also helping to reduce compliance pressure.

The above is the detailed content of Interpretation of the current status and six major trends of national debt RWA projects. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

This article provides download methods for the top ten popular Web3 digital currency trading software APPs, including OKX, Binance, Gate.io, Coinbase, Huobi (now HTX), KuCoin, Kraken, Bitget, MEXC and Bybit. Users can search for download links by visiting the official websites of each platform, or search for platform names in mainstream application stores to download and install. The article introduces the download methods of each APP in detail, so that users can quickly and conveniently find the appropriate download method. Download the Web3 trading software you need now and start your digital currency investment journey!

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.