web3.0

web3.0

A weekly overview of the crypto market: crypto undercurrents are surging, traditional funds may enter RWA

A weekly overview of the crypto market: crypto undercurrents are surging, traditional funds may enter RWA

A weekly overview of the crypto market: crypto undercurrents are surging, traditional funds may enter RWA

A. Market View

1. Macro Liquidity

This week’s Federal Reserve meeting showed a dovish stance, planning to cut interest rates three times throughout the year. Betting on market easing is high. The Federal Reserve is expected to begin gradually slowing down its quantitative tightening policy in May until the end of February next year. This period will be the best opportunity to invest in the market. At the same time, the Bank of Japan raised interest rates for the first time in 17 years. Although U.S. stocks continue to fluctuate at high levels, the cryptocurrency market rebounded after the correction of U.S. stocks. These monetary policy adjustments and market fluctuations will bring new challenges and opportunities to investors.

2. Whole Market Quotes

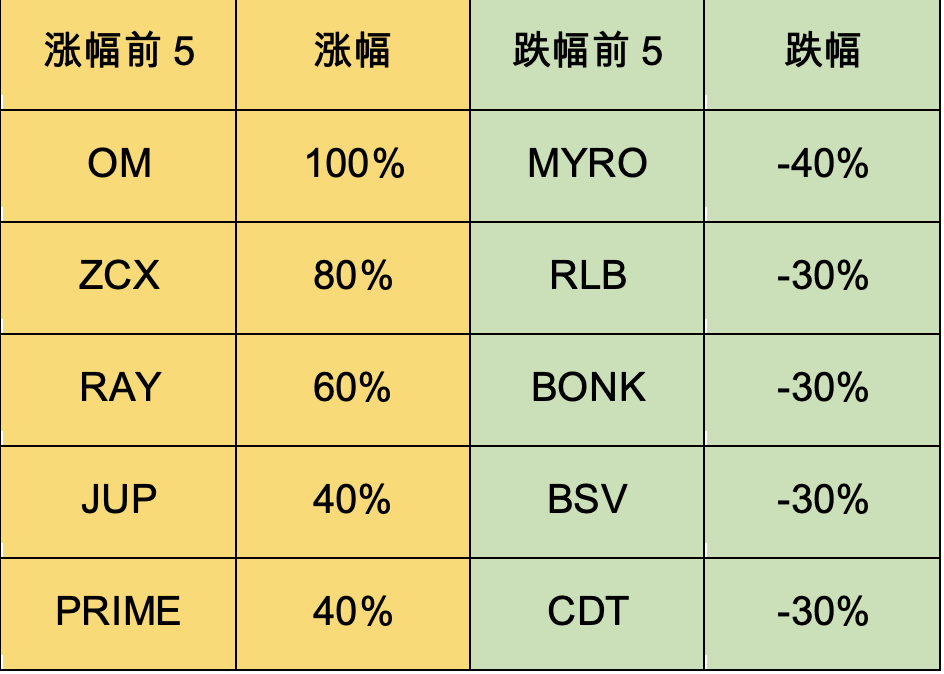

Top 100 Gainers by Market Value:

The price of Bitcoin fell sharply this week, resulting in spot ETFs There was a net outflow of funds. The market focus is gradually turning to Meme and SOL ecology. The Solana network is similar to Ethereum’s ICO boom in 2017, which attracted some Bitcoin investors to invest in altcoins. The current popular cryptocurrency project Tugo represents a small preview of animal-themed projects in this bull market.

The BOOK OF MEME released by Pepe Meme artist Darkfarm increased 1,000 times within three days of listing and was listed on the Binance exchange, triggering a craze for Meme pre-sales on the Solana chain. BOME is a permanent storage library for Meme, and will expand multiple Meme creation functions in the future. The phenomenon of local dogs running away on the Solana chain is increasing. If Meme cannot enter the mainstream platform, it may evolve into a PVP model of copying each other.

JUP’s trading volume has been boosted on the Solana network, benefiting from the boom in native dog trading. Jupiter is a trading aggregation platform built on the Solana network, which attracts more than half of the trading volume. The agreement also launches launch platforms and incubators to facilitate horizontal development.

BlackRock Fund launched POLYX, the first tokenized fund on the ETH chain, and plans to expand into the real estate RWA field. Polymesh is a public chain built on Substrate and focuses on the application of securities tokenization. However, it is strictly restricted by the supervision of various governments and it is difficult to take full advantage of global liquidity.

3. BTC Market

1) On-chain data

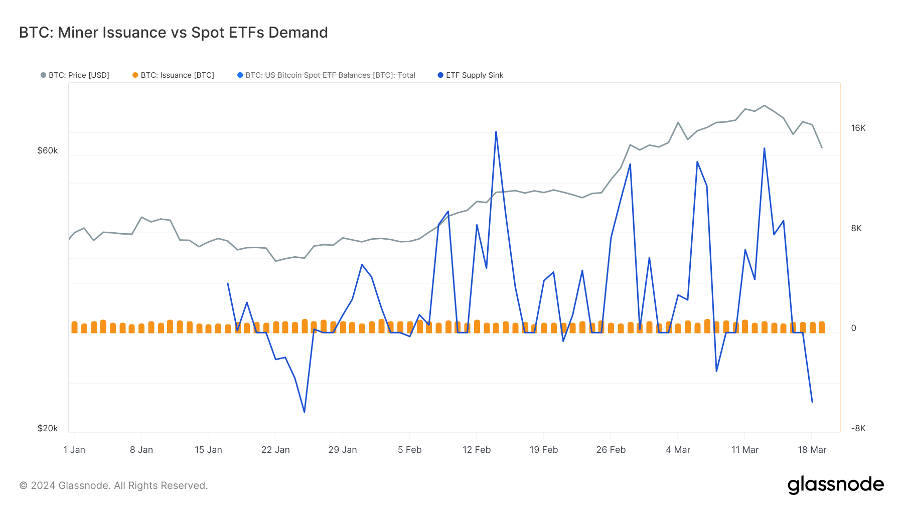

What are the differences in this cycle of BTC? As the halving approaches, the impact of newly mined BTC and released into circulation becomes smaller and smaller compared to the growing demand for ETFs. The amount of ETFs taken off the market is several times the amount of BTC minted every day. Miners currently bring approximately 900 BTC to the market every day. It will drop to 450 BTC after the halving, which under past market conditions may have exacerbated BTC’s scarcity and pushed the price higher.

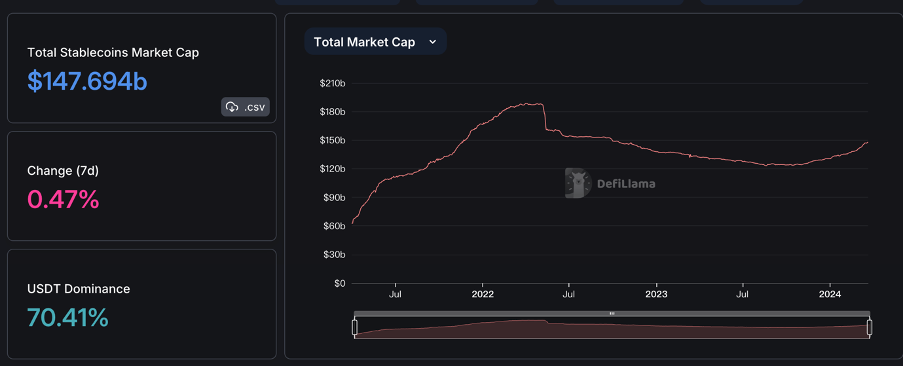

#The market value of stablecoins remained unchanged month-on-month, and the inflow of over-the-counter funds slowed down. The supply of USDE is stable and quickly exceeds 1 billion US dollars, mainly because the staking yield is as high as 60%.

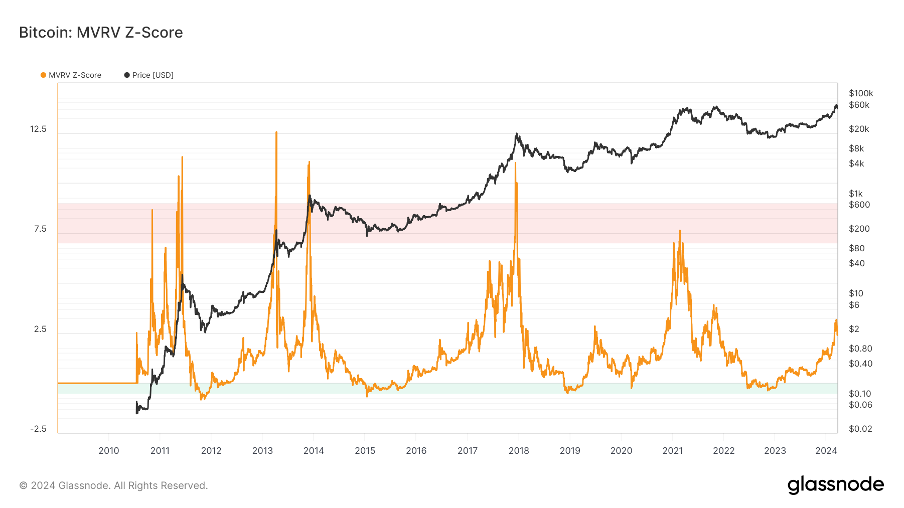

The long-term trend indicator MVRV-ZScore is based on the total market cost and reflects the overall profitability of the market. When the indicator is greater than 6, it is the top range; when the indicator is less than 2, it is the bottom range. MVRV fell below the key level 1 and holders were in the red overall. The current indicator is 2.8, entering the intermediate stage.

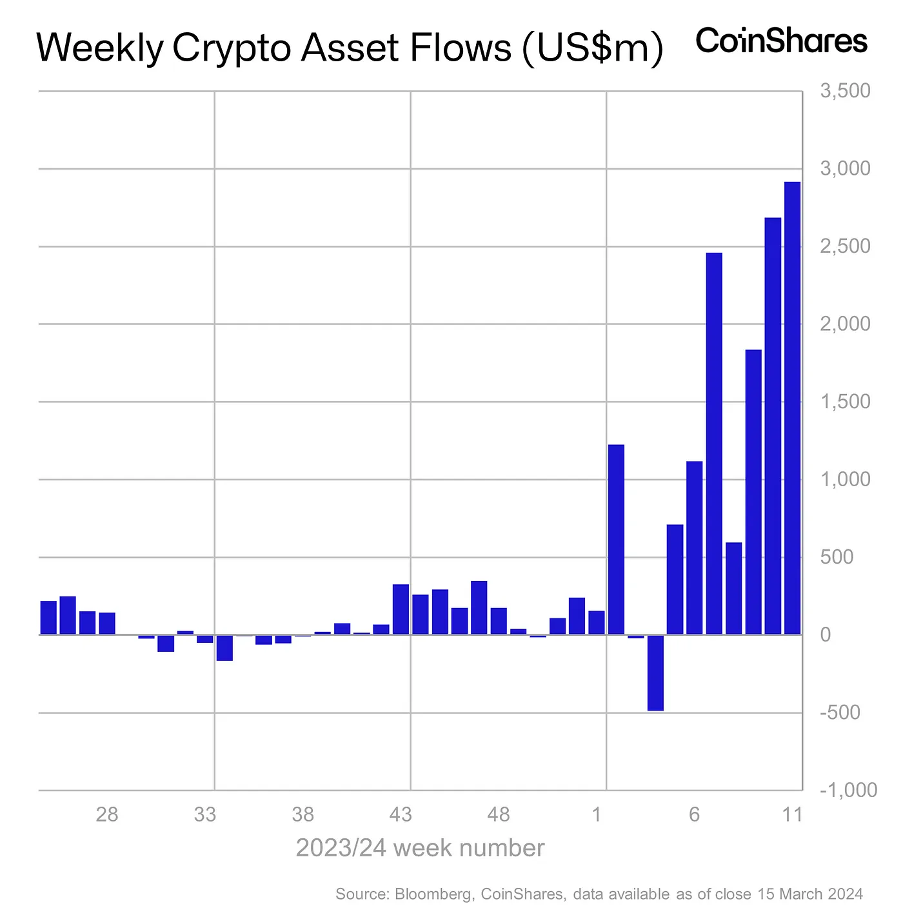

The net inflow of institutional funds continued, and the weekly net inflow reached a new high.

2) Futures market

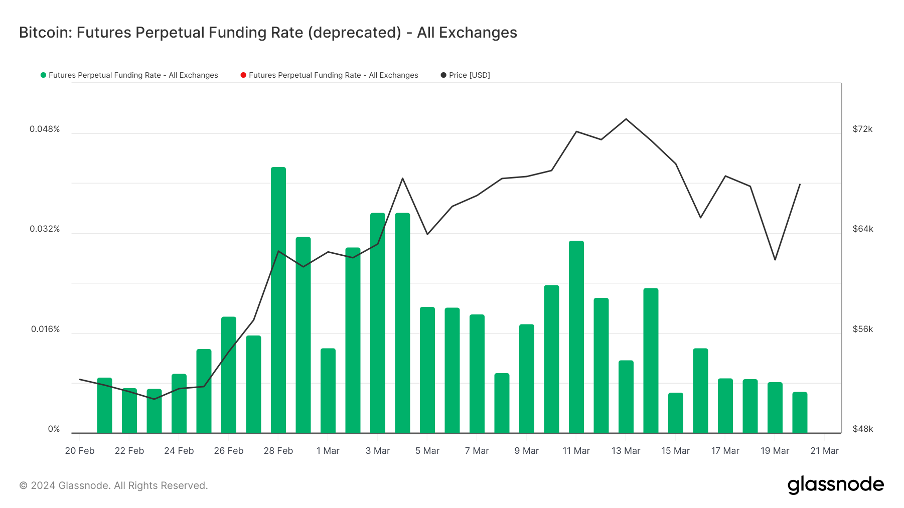

Futures funding rate: The rate returned to normal levels this week. The fee rate is 0.05-0.1%, and the long leverage is high, which is the short-term top of the market; the fee rate is -0.1-0%, the short leverage is high, and it is the short-term bottom of the market.

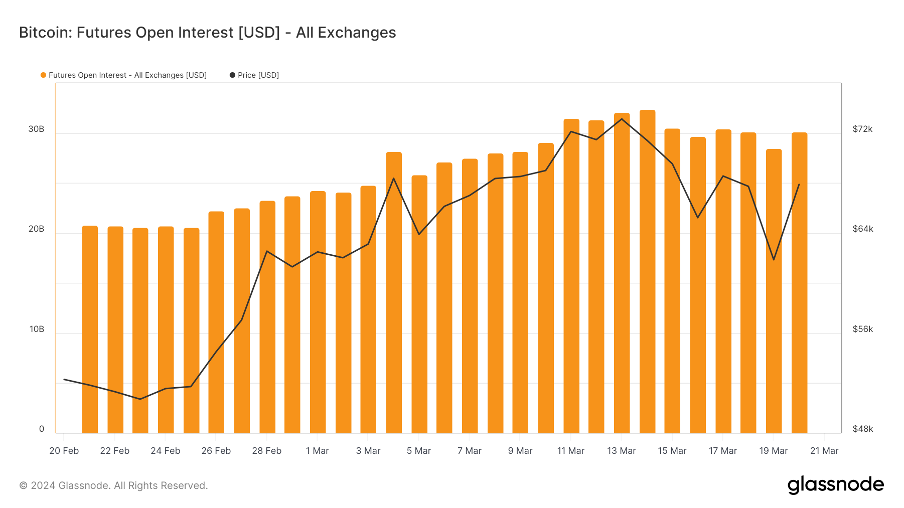

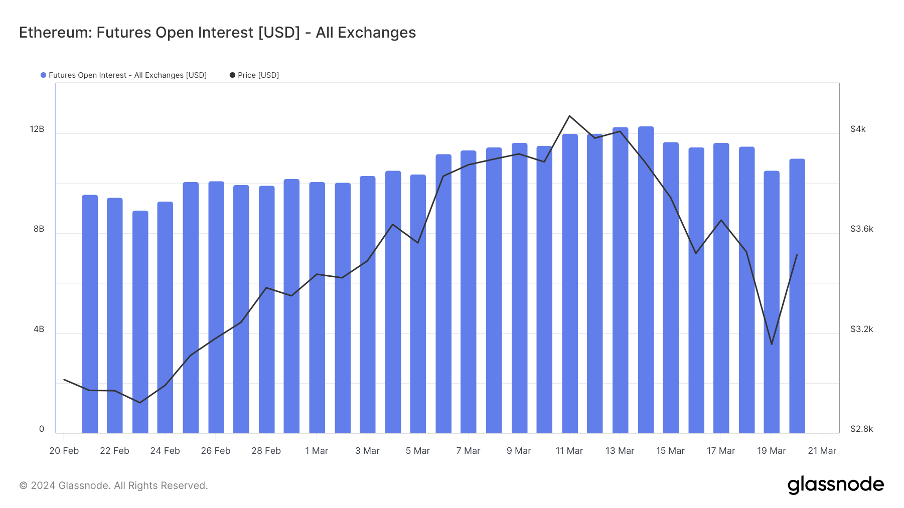

Futures positions: BTC positions followed the price correction this week.

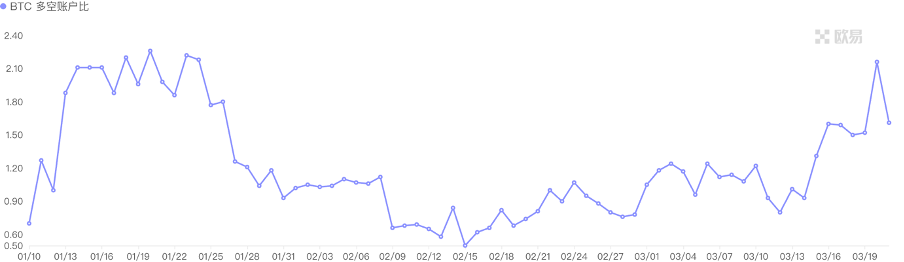

Futures long-short ratio: 0.8, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

Futures long-short ratio: 1.2, market sentiment is normal. Retail investor sentiment is mostly a reverse indicator, with a reading below 0.7 indicating panic and a reading above 2.0 indicating greed. The long-short ratio data fluctuates greatly, and the reference significance is weakened.

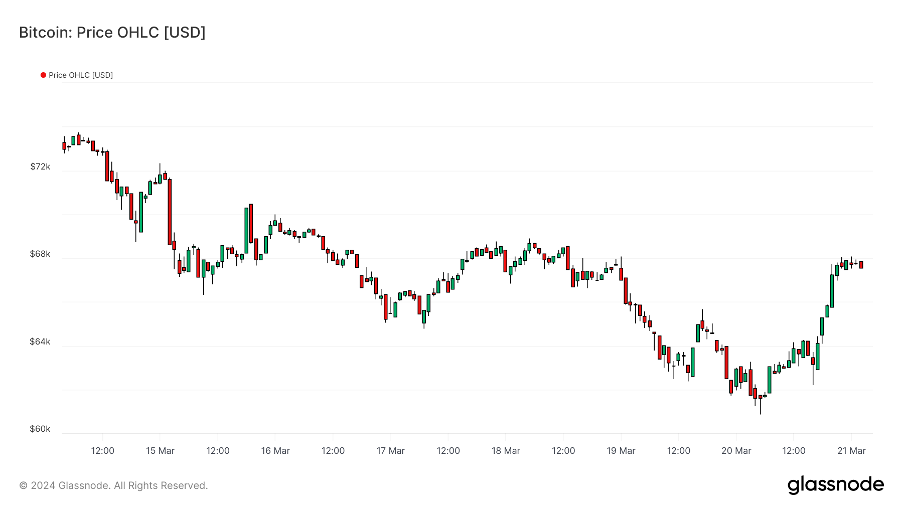

3) Spot market

BTC has experienced a turbulent week, with a sharp correction after reaching a new high. Contract rates returned to healthier levels as excess leveraged funds were liquidated. Historically, bull markets have experienced an average of 7 major corrections, averaging 20-30%. After BTC experiences its first major correction, funds usually flow from BTC to altcoins, and altcoins are expected to perform better in the future.

B. Market data

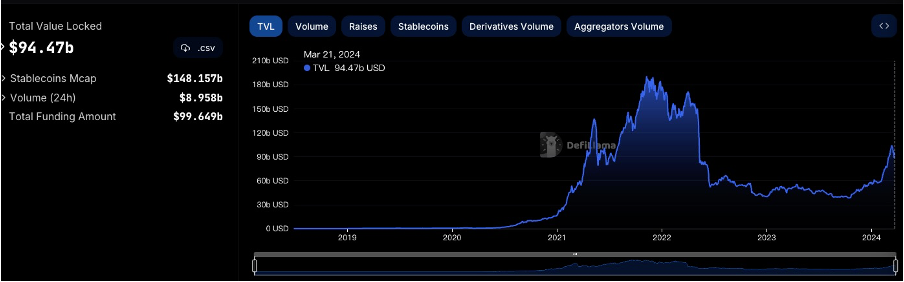

1. Total lock-up volume of the public chain

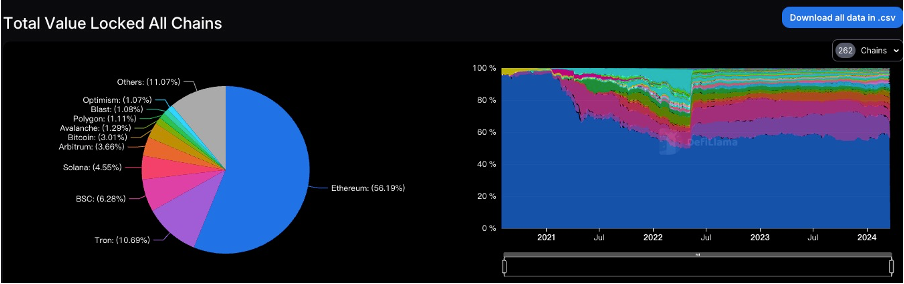

2. TVL proportion of each public chain

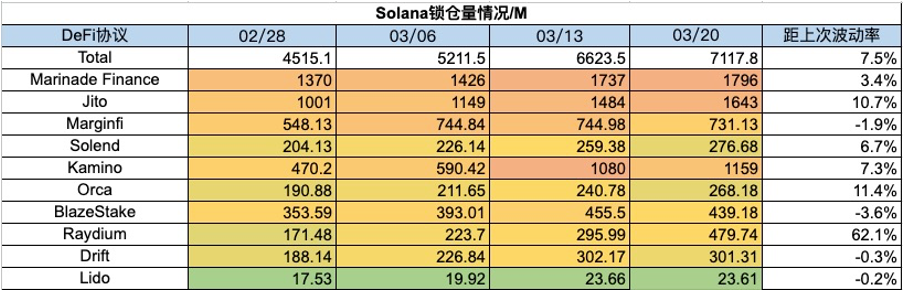

The total TVL this week was 94.5 billion US dollars, an overall decrease of 8.4 billion, a decrease of 8.2 %. BTC's correction this week was close to 20%, successfully holding on to the 60,000 level, and its upward momentum is also relatively strong. This week, all mainstream public chains TVL, except the SOLANA chain, fell sharply. The most popular public chain recently must be the SOLANA chain, which has risen by 6% in the past week and 85% in the past month. In addition, the performance of the ETH chain has been relatively sluggish recently. This week, the ETH chain fell by 14%, the POLYGON chain fell by 15%, and the OP chain, BLAST chain, and ARB chain all fell by about 9%. The BSC chain fell by 7%, and the TRON chain fell by 8%.

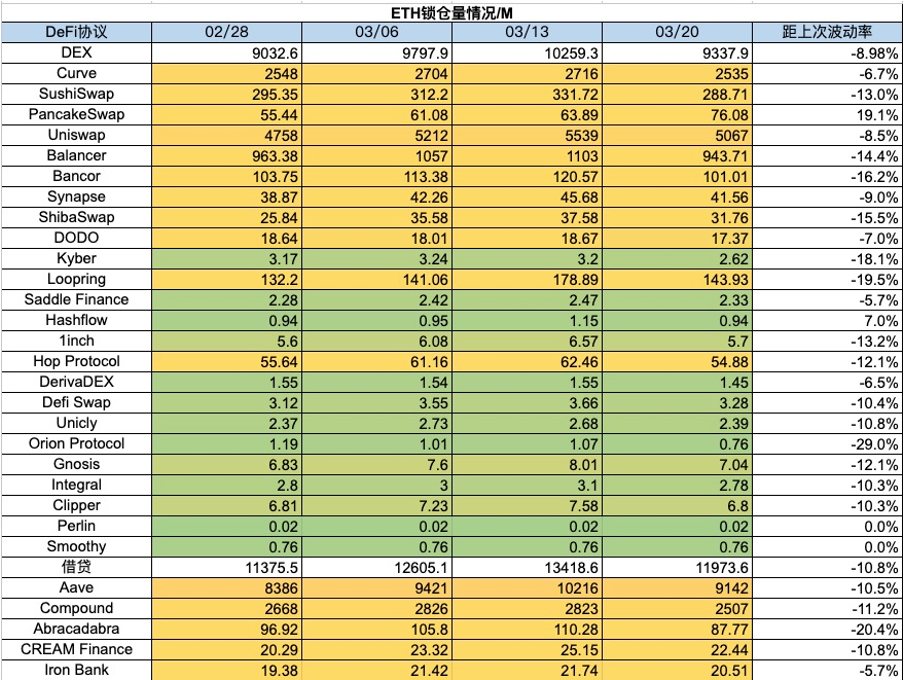

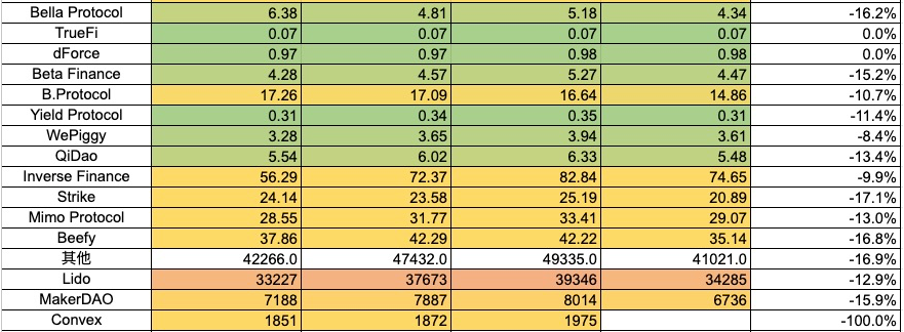

3. The lock-up amount of each chain protocol 1) The lock-up amount of ETH

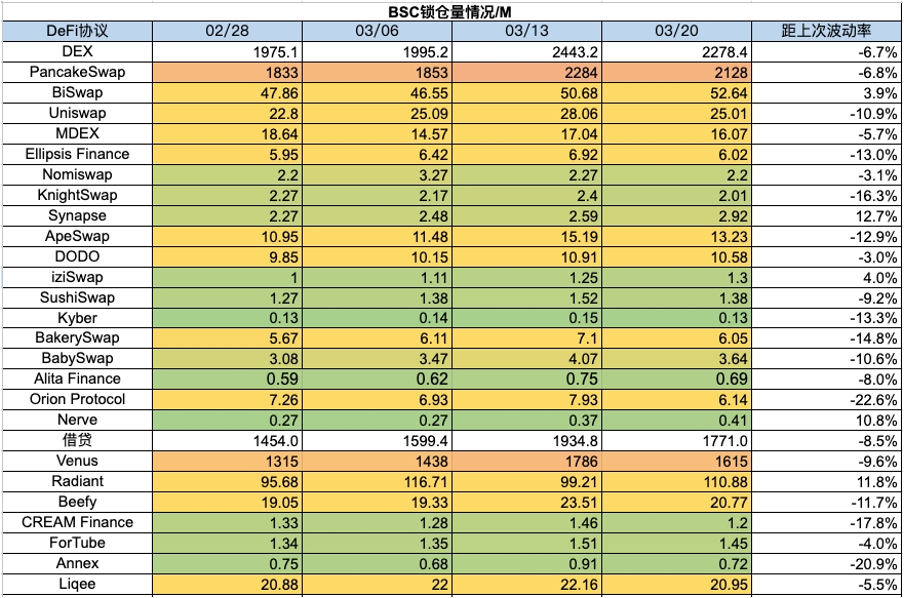

2) The lock-up amount of BSC

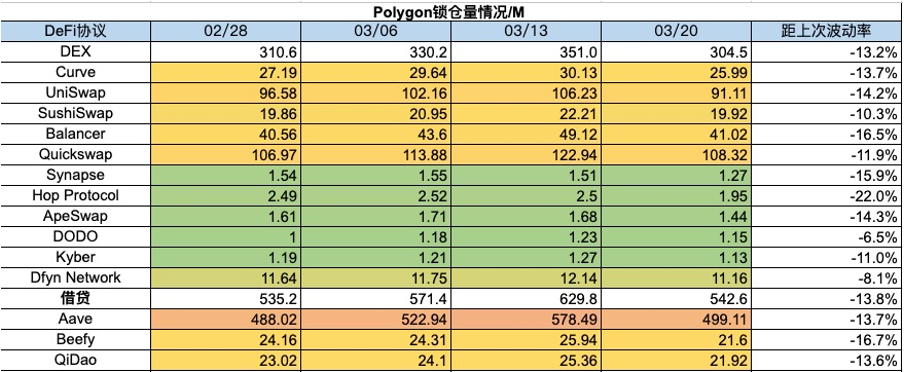

3) Polygon lock-up volume

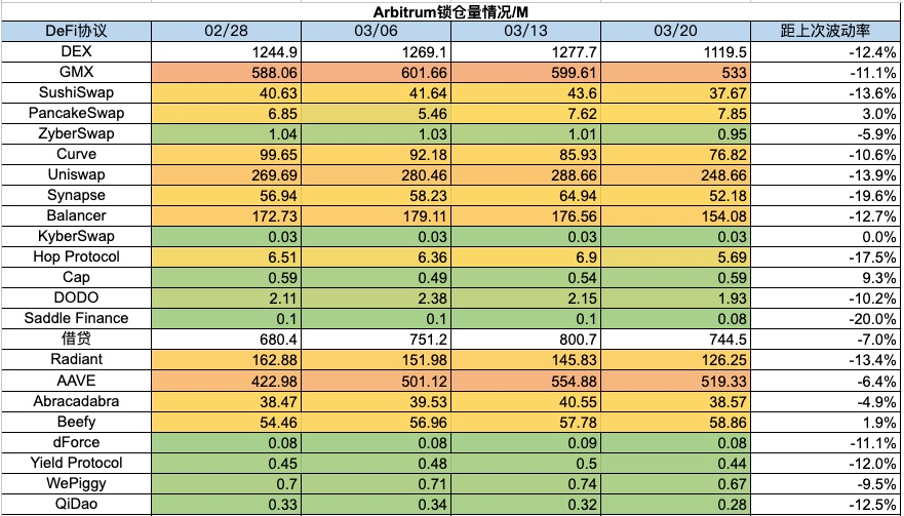

4)Arbitrum lock-up volume

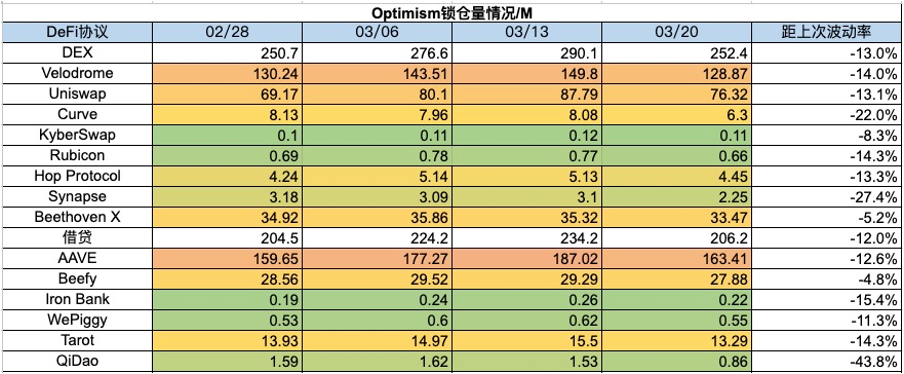

5) Optimism lock-up amount

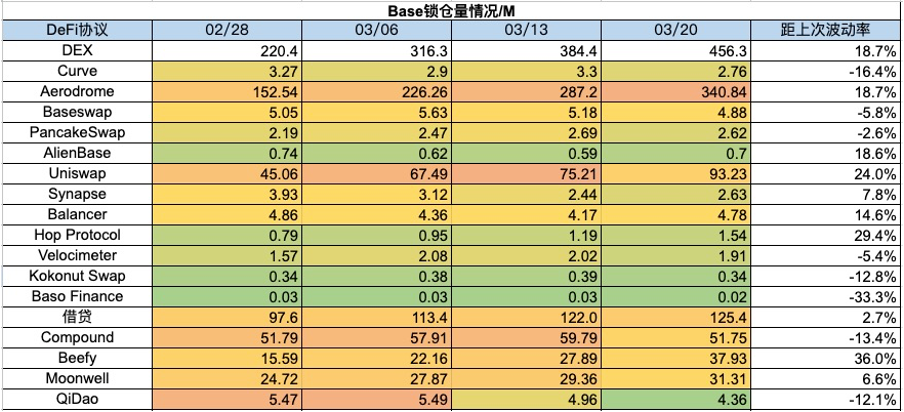

6) Base lock-up amount

7) Solana lock-up volume

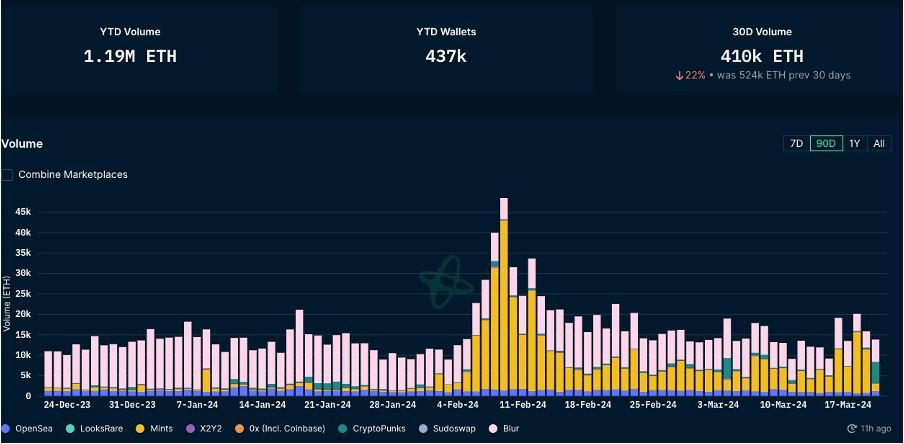

4. Changes in NFT market data

1) NFT-500 index

2) NFT market situation

3) NFT trading market share

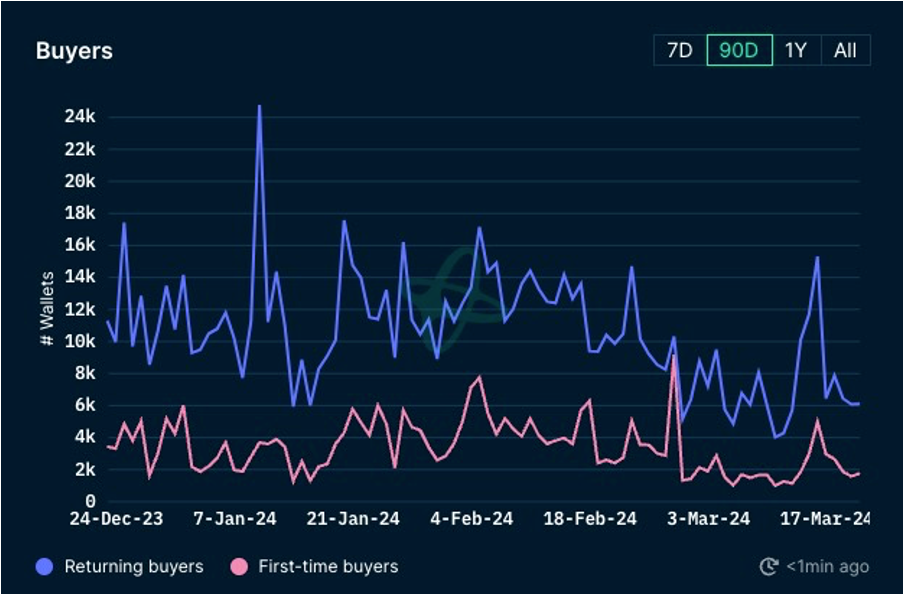

4) Analysis of NFT buyers

The floor prices of blue-chip projects in the NFT market have risen and fallen this week, but the fluctuations are not large. .BAYC is down 4%, MAYC is up 2%, CryptoPunks is up 7%, Azuki is up nearly 3%, Pandora is down 2%, and Milady is up 6%. The NF market continued to fall this week and has reached its lowest point in the past year. The total transaction volume of the NFT market has rebounded slightly this week, but the number of first-time NFT buyers and repeat buyers still has not improved. With the arrival of the bull market, the downturn in the NFT market continues.

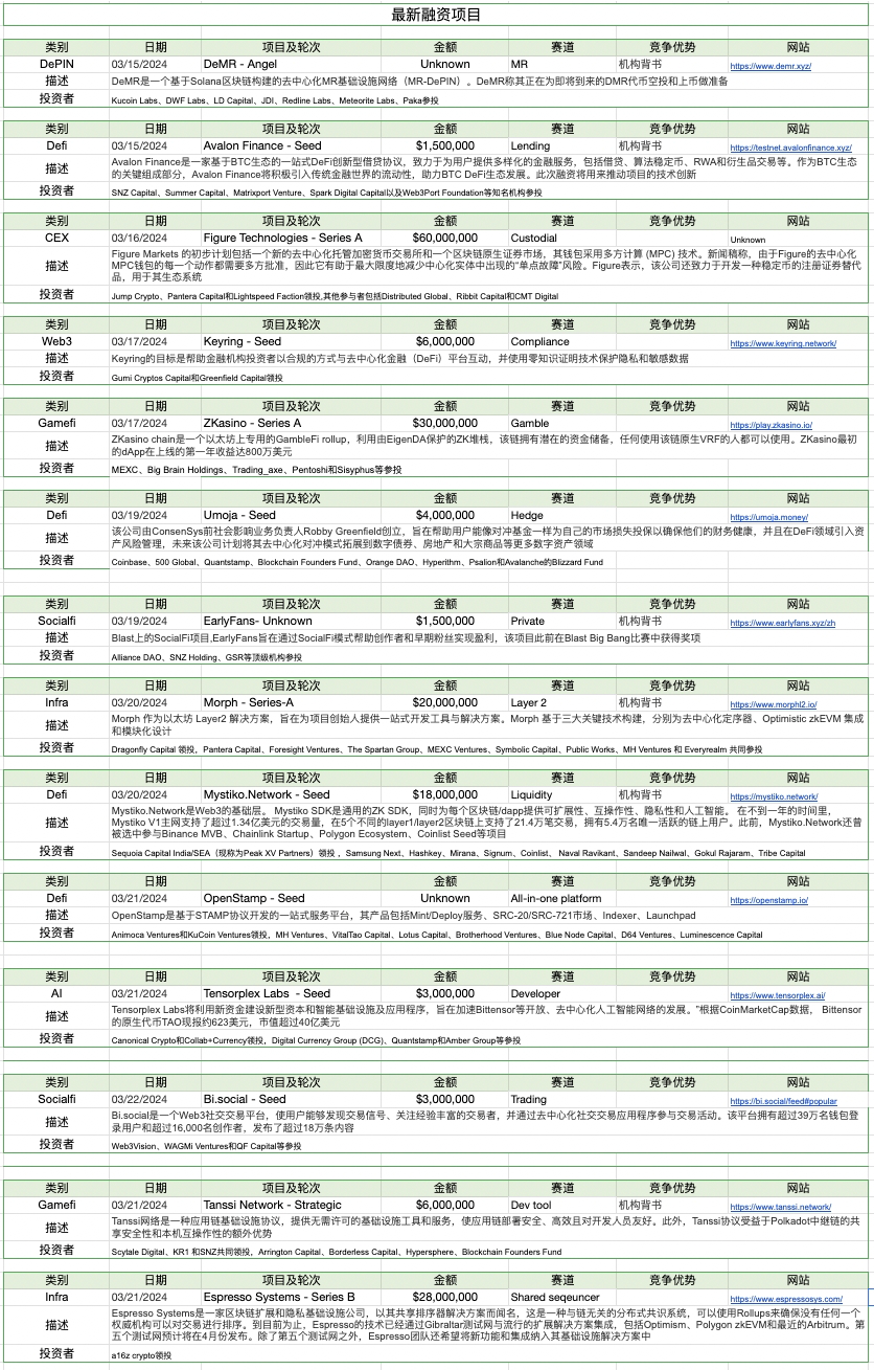

5. The latest financing situation of the project

6. Post-investment dynamics

1) Space Nation —GameFi

Space-themed Web3 MMORPG game Space Nation released a trailer for the chain game "Space Nation Online". The game will include four main factions, powered by the Unity engine, and have PvE (player versus environment) and PvP (player versus player) Function. Space Nation Online is expected to launch in closed beta on PC on April 1 this year, with a soft launch on PC later this summer, with a global release planned for PC and mobile devices this fall.

"Space Nation Online" previously stated that it plans to carry out a series of developments in the next year, including strengthening the AI Web3 universe, redefining the connection between players and MMO, using AI to create personalized stories, and providing players with Immersive interactive experience.

2) Node Guardians — Infrastructure

SNode Guardians v1 is coming soon and provides a comprehensive gamification experience for experienced smart contract developers , helping them master Solidity and Zero Knowledge DSL.

Node Guardians has worked closely with L2s such as Starknet, Aztec, Optimism and Arbitrum and has helped hundreds of developers improve their development skills.

3) Ether.fi — Non-custodial liquidity staking protocol

ETHFI has developed airdrop claims and is listed on Binance. According to the disclosed ether.fi token economic model, the total supply of ether.fi token ETHFI is 1 billion, and the circulating supply is 115.2 million. 2% of the token allocation will be used for Binance Launchpool, and 11% will be allocated to airdrops. , 32.5% is allocated to airdrop investors and advisors, 23.26% is allocated to the team, 1% is allocated to the Protocol Guild, 27.24% is allocated to the DAO Treasury, and 3% is used to provide liquidity.

The above is the detailed content of A weekly overview of the crypto market: crypto undercurrents are surging, traditional funds may enter RWA. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages