Understand the economics of Pike tokens in one article

Mar 26, 2024 am 09:46 AMPike is a universal liquidity protocol designed to increase the utility of native assets by integrating liquidity on blockchain networks. The protocol enables users to borrow and lend assets across chains without using asset bridging or packaging assets, thereby breaking the limitations of native multi-chain dApps. Currently, Pike has been launched on the mainnets of Ethereum, Arbitrum, Optimism and Base, and more chains and ecosystems are actively being built.

Pike’s goal is to become a comprehensive liquidity platform, aiming to achieve barrier-free transfer and convenient acquisition of various native assets within the ecosystem. Pike is built on Wormhole’s cross-chain data messaging and Circle’s Cross-Chain Transfer Protocol (CCTP), and fully leverages the Pyth Network’s price data.

One of Pike’s core concepts is to enable users to provide local assets on the source chain and borrow local assets on the target chain without having to interact with cross-chain bridges or deal with encapsulated assets.

Token Allocation and Issuance Schedule

Token Name: P

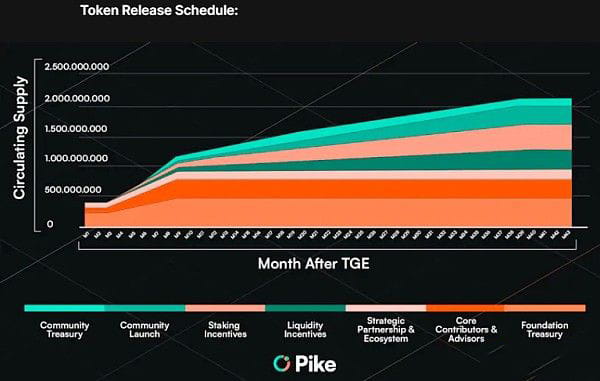

Maximum Supply: 2,140,000,000

Initial Circulation: 411,950,000

Token Format: Native ERC20 and SPL (using Wormhole’s native token transfer framework)

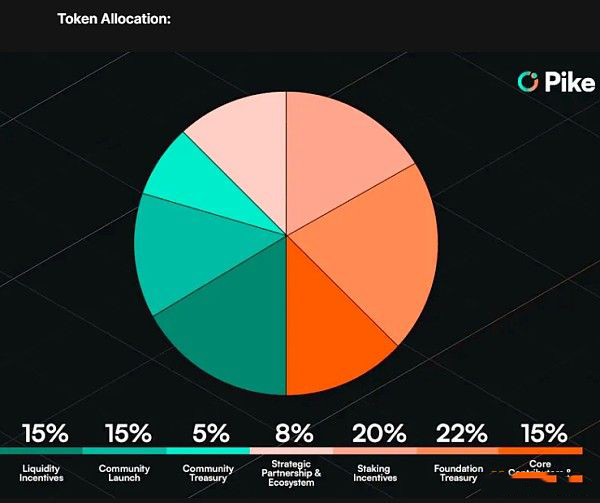

Vesting: 80.75% of P initially locked will be unlocked within 43 months of the token release schedule below The distribution of

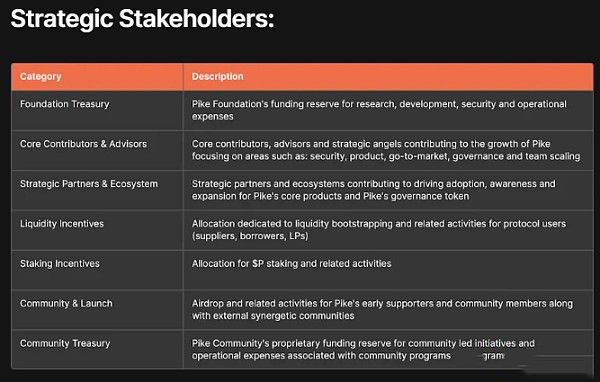

P is announced as follows:

Blockchain network expansion strategy;

Asset coverage;

Smart contract upgrade and optimization;

Protocol fee setting;

Protocol parameter setting;

Incentive setting;

Community-led initiatives;

Token utility and issuance schedule.

The above is the detailed content of Understand the economics of Pike tokens in one article. For more information, please follow other related articles on the PHP Chinese website!

Hot Article

Hot tools Tags

Hot Article

Hot Article Tags

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

ETH market breakthrough forecast after upgrading

Mar 18, 2025 pm 04:30 PM

ETH market breakthrough forecast after upgrading

Mar 18, 2025 pm 04:30 PM

ETH market breakthrough forecast after upgrading

Can ETH continue to explode after upgrading

Mar 18, 2025 pm 04:27 PM

Can ETH continue to explode after upgrading

Mar 18, 2025 pm 04:27 PM

Can ETH continue to explode after upgrading

Detailed explanation of price trends after Ethereum upgrade

Mar 18, 2025 pm 04:24 PM

Detailed explanation of price trends after Ethereum upgrade

Mar 18, 2025 pm 04:24 PM

Detailed explanation of price trends after Ethereum upgrade

How to use band profit after ETH upgrade

Mar 18, 2025 pm 04:21 PM

How to use band profit after ETH upgrade

Mar 18, 2025 pm 04:21 PM

How to use band profit after ETH upgrade

How to build positions for beginners after ETH upgrade

Mar 18, 2025 pm 04:18 PM

How to build positions for beginners after ETH upgrade

Mar 18, 2025 pm 04:18 PM

How to build positions for beginners after ETH upgrade

Will Ethereum be lonely after upgrading

Mar 18, 2025 pm 04:00 PM

Will Ethereum be lonely after upgrading

Mar 18, 2025 pm 04:00 PM

Will Ethereum be lonely after upgrading

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

Detailed explanation of the issuance price and issuance time of LOOM coins

Mar 20, 2025 pm 06:21 PM

Detailed explanation of the issuance price and issuance time of LOOM coins