In the rapidly evolving world of investing, diversification has always been a key strategy for reducing risk and increasing returns. With the emergence of cryptocurrencies, especially Bitcoin, investors have found a new asset class to add to their portfolios. This article delves into the implications of incorporating Bitcoin into a traditional 60/40 stock and bond portfolio.

By taking a closer look at various numerical indicators, we dive into the impact of different Bitcoin allocation levels on overall portfolio performance, risk, and return. From gradually increasing Bitcoin holdings to large-scale inclusion of Bitcoin in investment portfolios, we reveal the subtle relationship between risk and reward in the Bitcoin investment environment.

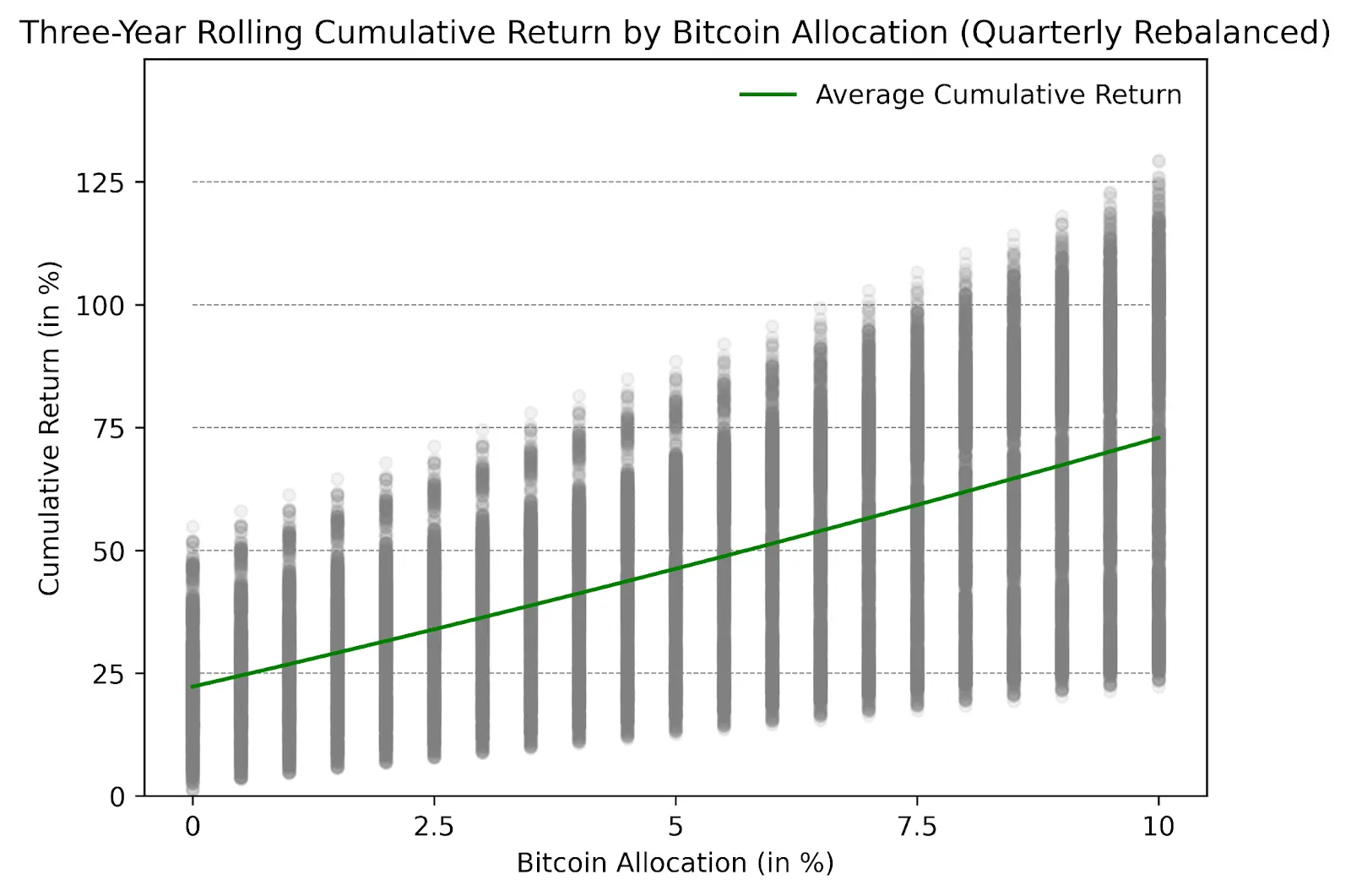

In the chart, the first column on the left shows the situation without Bitcoin in the portfolio, while subsequent columns show gradual increases in Bitcoin holdings (up to 10%) situation at the time. These columns do not change over time and simply represent the number of Bitcoins held. It is worth noting that according to historical data, as the allocation of Bitcoin increases, the return on investment will increase accordingly.

Figure 1: Three-year rolling cumulative return of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

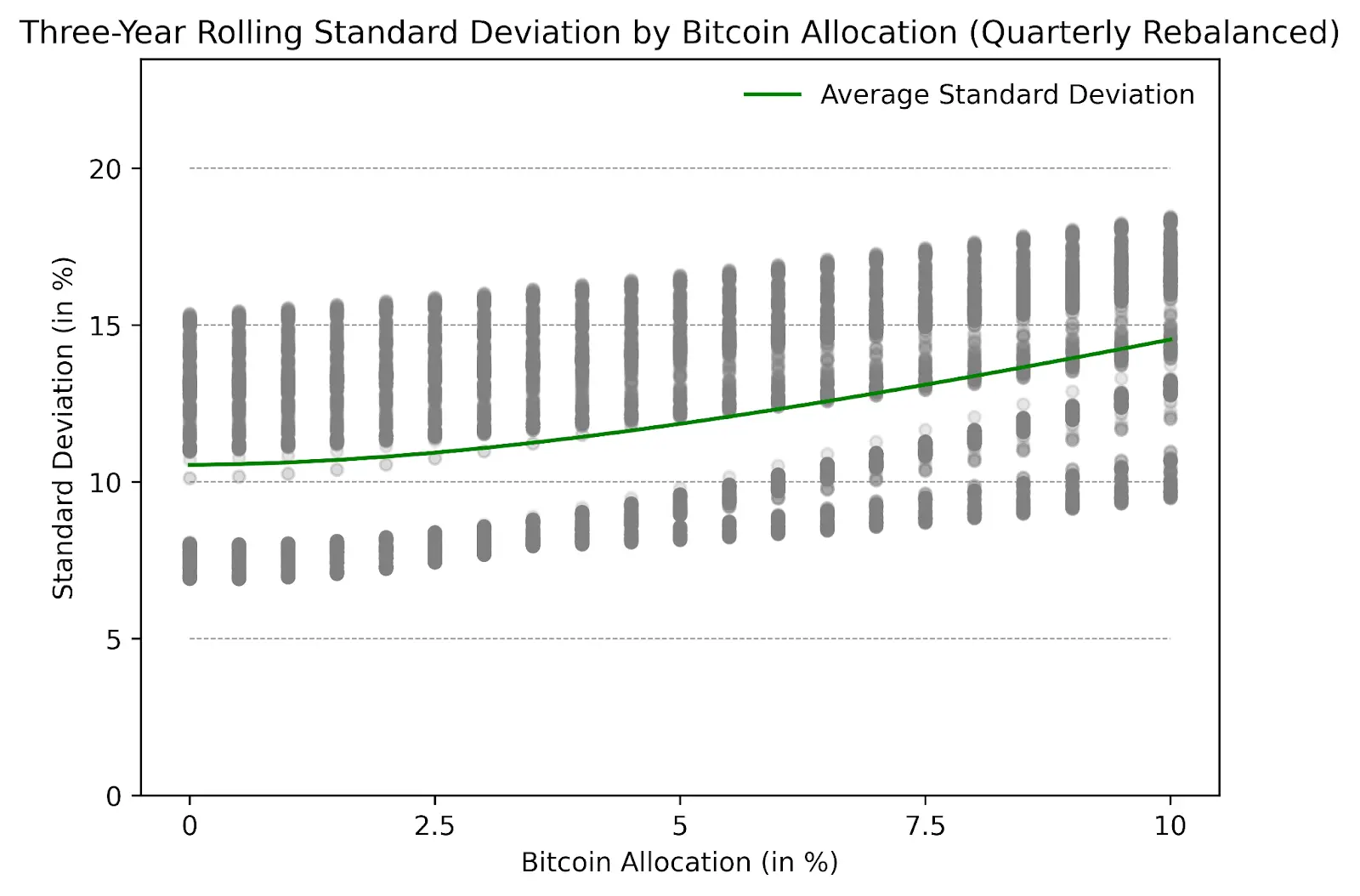

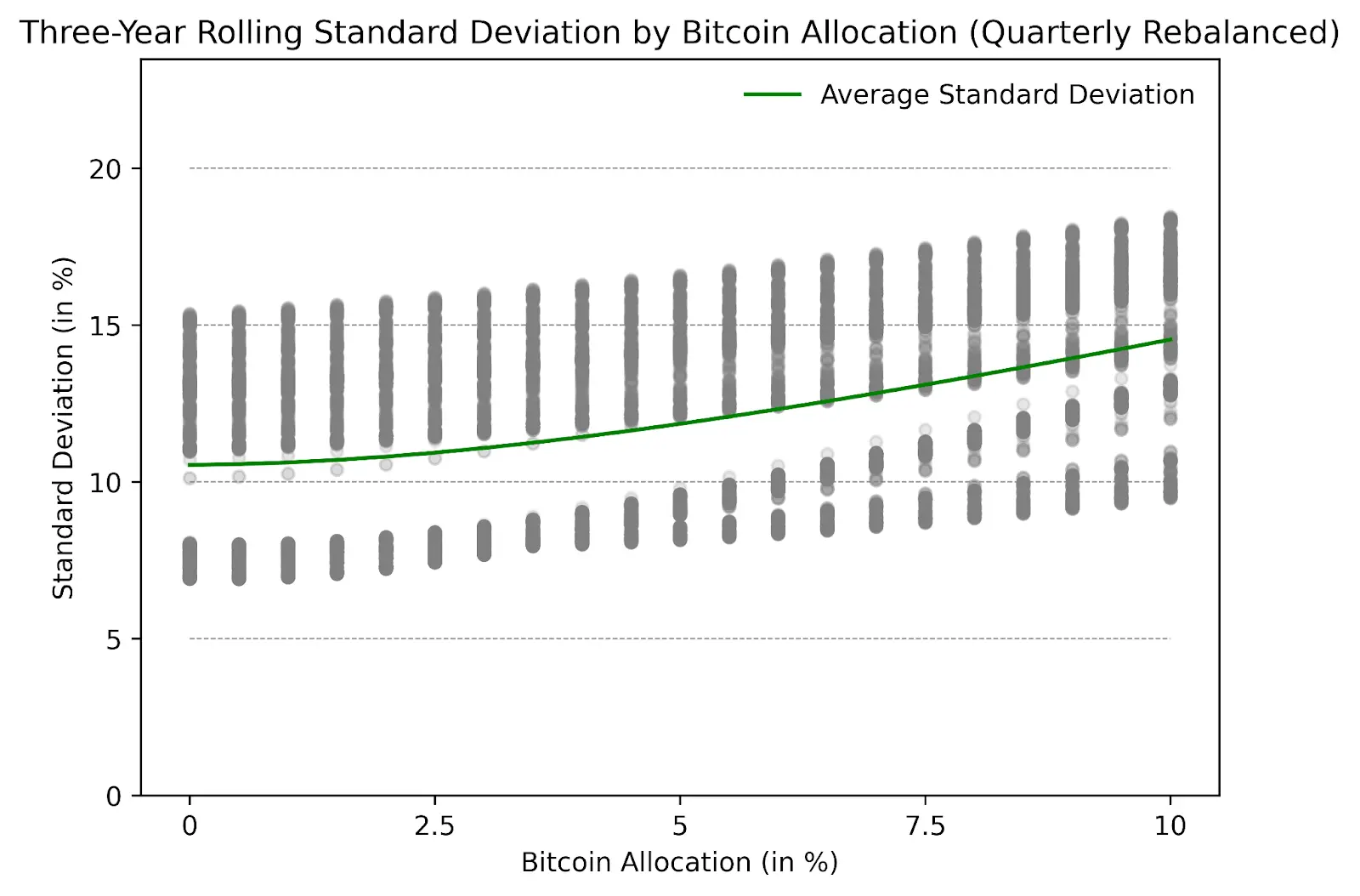

While adding Bitcoin to a 60/40 stock and bond portfolio will increase cumulative returns, there's a catch: it may also increase uncertainty and risk. Figure 2 shows the change in volatility after allocating to Bitcoin. While the risk has increased, it hasn't been in a straight line. Instead, the line has a curvature. This means that if you add just a little bit of Bitcoin, say between 0.5% and 2%, it doesn't make your investment much riskier. But as you add more Bitcoins, things quickly become unpredictable.

Figure 2: Three-year rolling standard deviation of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

Figure 2: Three-year rolling standard deviation of Bitcoin allocation (rebalanced quarterly), Source: Cointelegraph Research

In Figure 3, we combine the information from Figure 1 to look at the Sharpe ratio of the portfolio. The shape of the graph is very interesting: it rises quickly at first, then levels off as you put more Bitcoin into your investment. The chart shows that when you add some Bitcoin to your investment, it usually means you will receive more returns to make up for the risk you take. But there’s no such thing as a free lunch: once you start adding more and more Bitcoins, especially after around 5% of your total investment, the increased risks outweigh the benefits. Therefore, allocating a small amount of Bitcoin may help, but after a certain point, the cost of allocating more Bitcoins is significantly increased risk. Based on historical returns and mean-variance optimization, the optimal proportion of Bitcoin to add to a portfolio is between 3% and 5%.

Figure 3: Three-year rolling Sharpe ratio of Bitcoin allocations (rebalanced quarterly), Source: Cointelegraph Research

Figure 3: Three-year rolling Sharpe ratio of Bitcoin allocations (rebalanced quarterly), Source: Cointelegraph Research

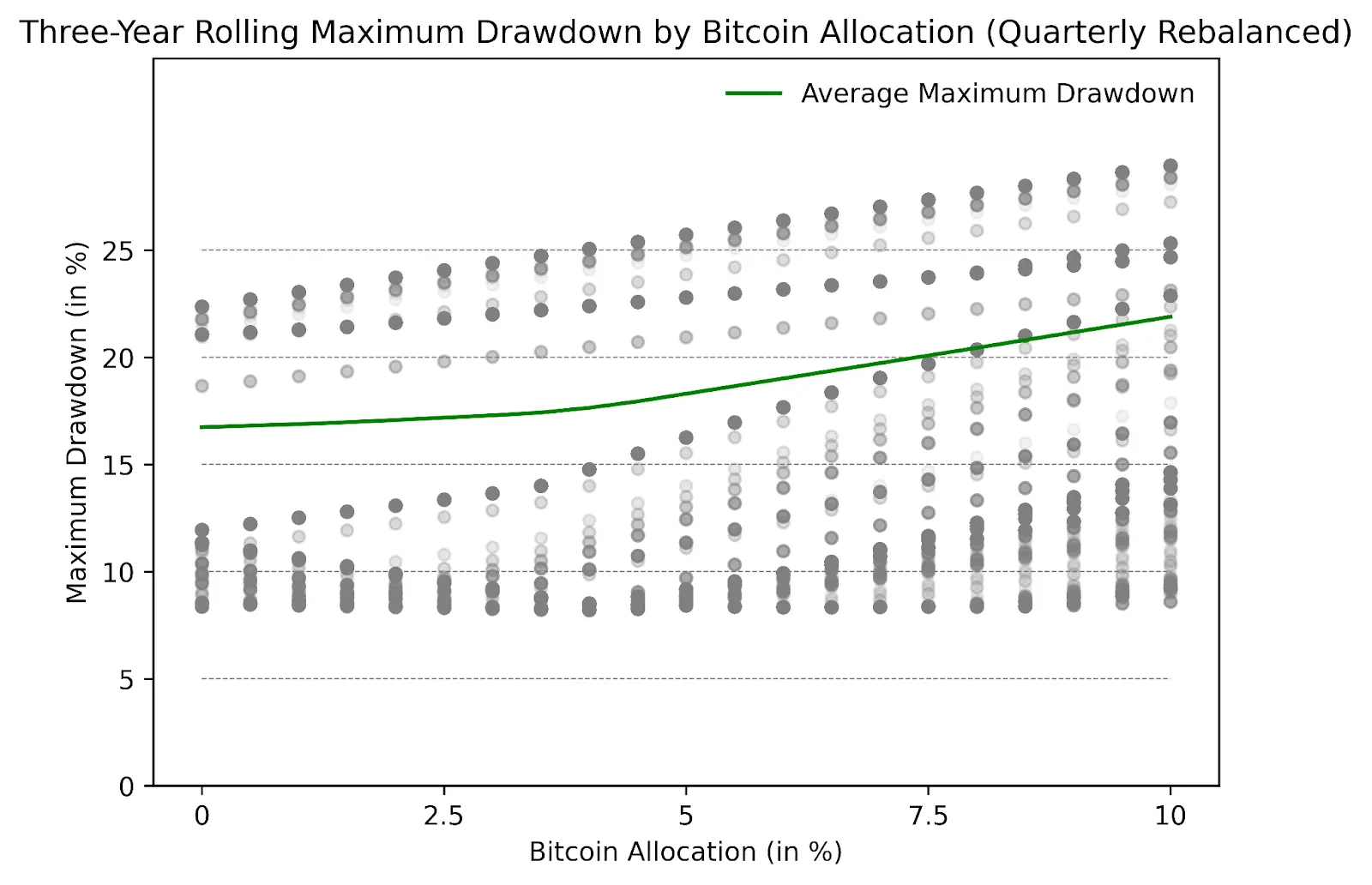

Figure 4 shows how different amounts of Bitcoin affect the “maximum drawdown” of investment value. Similar to the Sharpe ratio, the green line on the chart shows that a small allocation to Bitcoin (say, 0.5% to 4.5%) in a 60/40 stock and bond portfolio would not have much of an impact on the maximum drawdown over three years. If the allocation exceeds 5%, the impact on the maximum drawdown starts to increase significantly. For institutional investors with a lower risk appetite, keeping Bitcoin holdings at or below 5% of total investments may be the best option from a risk-adjusted and maximum drawdown perspective.

Figure 4: Bitcoin allocation three-year rolling maximum drawdown (rebalanced quarterly), Source: Cointelegraph Research

Figure 4: Bitcoin allocation three-year rolling maximum drawdown (rebalanced quarterly), Source: Cointelegraph Research

In summary, exploring Bitcoin as part of a diversified portfolio reveals the delicate balance between risk and reward. The results, presented across a variety of data, highlight the potential to increase cumulative returns by strategically increasing Bitcoin holdings, with a consequent increase in volatility. Based on historical data and mean-variance optimization, the optimal strategy is to allocate 3% to 5% of your total investment to Bitcoin.

Above this threshold, the risk-reward trade-off becomes unfavorable, highlighting the importance of careful and informed decision-making when incorporating Bitcoin into an investment strategy.

The above is the detailed content of If traditional institutions enter Bitcoin, what is the appropriate position?. For more information, please follow other related articles on the PHP Chinese website!