Cryptocurrency fever is sweeping the world, and more and more people are getting involved. As the number of users increases, they also have certain requirements for the flexibility of these assets. In order to solve The best solution to this problem is to add a flow pool. Liquidity pools allow users to quickly trade cryptocurrencies on demand without having to wait for long transaction settlement times. However, for users, compared to the trading time, they are also concerned about whether the currency price has increased or decreased after adding a liquidity pool. ? This issue will rise or fall depending on the amount of funds provided and the size of the existing liquidity pool. Next, the editor will talk about it in detail.

Both cryptocurrencies and financial markets share a reliance on liquidity. A lack of sufficient liquidity will make converting assets into cash difficult and time-consuming. Sufficient liquidity means being able to convert assets into cash quickly and efficiently while protecting against sudden price fluctuations.

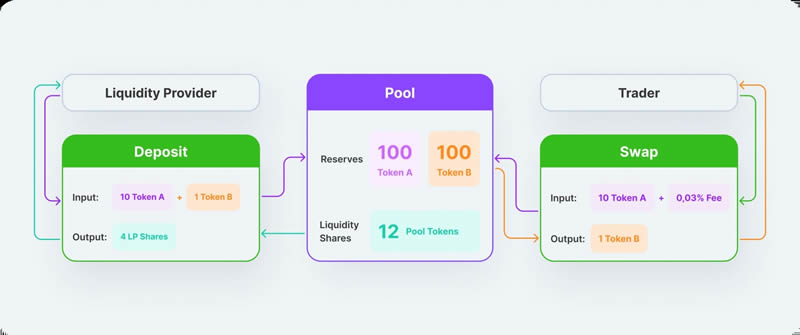

Liquidity pools play an important role in creating decentralized finance (DeFi) systems, which are becoming increasingly popular in the crypto space.

To better understand how such a system works in the real world, let's look at the following example. Let's say you're waiting in line to order something at a store. In this case, mobility is equivalent to having a large number of employees working for you. This will speed up orders and transactions, keeping customers happy. On the other hand, in the case of illiquid markets, we can compare it to having only one worker and a large number of customers. Obviously, this situation leads to slower orders, less efficient work, and ultimately unhappy customers.

In traditional finance, the buying and selling of assets often relies on liquidity in the market, which is provided by both buyers and sellers. However, DeFi relies more on the mechanism of liquidity pools. Without liquidity, decentralized exchanges, or DEXs, will have difficulty maintaining operations. Therefore, DEX must always be connected to a sufficient liquidity pool to ensure smooth trading.

A liquidity pool is a digital supply of cryptocurrencies secured by smart contracts. As a result, liquidity is generated, allowing for faster transactions.

Automated market makers (AMMs) are a key component of liquidity pools. In a decentralized exchange (DEX), assets are priced based on algorithms rather than relying on order books like traditional exchanges. Simply put, an AMM is an automated protocol used to provide pricing for assets.

Liquidity pools maintain liquidity on the network by rewarding users who provide assets to the pool. As a reward, these users receive liquidity pool tokens, which are a share of the trading fees within the pool. These tokens have multiple uses on DeFi networks, such as being used on exchanges or other smart contracts. On the Ethereum network (ERC-20), common DeFi exchanges include Uniswap and SushiSwap, while those using BEP-20 tokens on the BNB chain include PancakeSwap.

Whether the currency price rises or falls after adding a liquidity pool mainly depends on the amount of funds provided and the size of the existing liquidity pool. The following is what may happen:

If Less liquidity and greater transaction demand may cause currency prices to rise. This is because when users buy and sell assets in a liquidity pool, their transactions can affect the asset price. If there is insufficient liquidity, some transactions may cause large price fluctuations, causing the currency price to rise.

If the added liquidity is large and the transaction demand is relatively low, it may cause the currency price to fall. A large amount of liquidity may lead to stable trading prices, because even large transactions are unlikely to cause violent price fluctuations.

It should be noted that changes in currency prices are affected by various factors such as market supply and demand, transaction scale, and liquidity provider trends. In decentralized financial platforms, since the market is relatively small, a single liquidity provider may have a larger impact on the price.

Cryptocurrency liquidity pools offer many advantages to users, making them the first choice for many traders in the global cryptocurrency market. Cryptocurrency liquidity pools are increasingly popular among experienced traders and institutional investors as they increase cost-effectiveness, speed and security, and reduce the chance of slippage. Let’s take a closer look at some of the key benefits of leveraging cryptocurrency liquidity pools.

1. Improve liquidity:

Trading on cryptocurrency liquidity pools gives users access to a variety of digital assets and markets, allowing them to trade quickly and efficiently. Because the pool is shared among many participants, it can provide larger order amounts than a single trader or institution. This increases efficiency and reduces transaction costs, making it attractive to traders looking to open large positions in volatile markets.

2. Reduce the risk of slippage:

Since there are no centralized intermediaries, cryptocurrency liquidity pools eliminate the risk of slippage during the transaction process. This is because trades are completed immediately at market prices, rather than relying on a third party to match orders. Since prices are always up to date, orders can be processed quickly, which greatly reduces the risk of missing out when trading large amounts of digital currencies.

3. Improved security:

Due to its decentralized structure, cryptocurrency liquidity pools also provide consumers with greater security. Because transactions are completed directly between participants, there is no need for a centralized intermediary or third party to process transactions, reducing the potential for fraud or manipulation when using a centralized platform. Additionally, cryptocurrency liquidity pools offer greater anonymity as all transaction information is kept private within the pool.

4. Improve cost-effectiveness:

Trading on a cryptocurrency liquidity pool often results in cost savings compared to traditional exchanges because there are no middlemen taking a cut of each trade, meaning users benefit from lower trading fees and lower Benefit from the spread. Additionally, cryptocurrency trading platforms that offer liquidity pools typically have higher liquidity, which can translate into greater cost-effectiveness.

Cryptocurrency liquidity pools also offer unique opportunities to generate passive income. By providing liquidity to the pool, users can earn interest from other traders who execute trades against their positions, which provides additional benefits for those looking to profit in the cryptocurrency market without actively trading or investing. sources of income.

5. Improve speed and efficiency:

Cryptocurrency liquidity pools can also improve the speed and efficiency when users execute transactions. Because orders are filled instantly at market prices, there is no need for a third party to match buyers and sellers, speeding up order execution. This eliminates the delays associated with traditional exchanges, allowing traders to act faster in volatile markets.

A typical liquidity pool encourages and compensates its members for depositing digital assets into the pool. Rewards could be in the form of cryptocurrency or a portion of trading commissions paid by the exchange where they aggregate their assets.

Let’s illustrate it with an example where a specific trader using SushiSwap invested $1000 in the BTC-USDC pair.

First, you need to visit a specific website. In this case, it will be Sushiswap. Find liquidity pools for BTC and USDC. Add BTC and USDC to the BTC-USDC liquidity pool at a 50/50 ratio, in our case $500 per asset, which means you will receive your tokens based on the current exchange rate. After an agreed upon amount of time, you will receive the SUSHI tokens you promised to keep safe. It can last for a period of time, such as a week or several months.

Liquidity pools offer the following benefits to their users:

The main benefit is that you don’t have to worry about finding a trading partner who shares your interest in cryptocurrencies, Because all exchanges in the liquidity pool happen automatically using smart contracts.

If you have ever tried to trade cryptocurrencies, you may have experienced the temptation to sell your holdings at ridiculously high prices or at low prices People who buy. To be successful, you need excellent bargaining skills and a strong moral character. However, not everyone has these. The good news is that liquidity pools modify the value of cryptocurrencies based on market rates.

Users of crypto exchanges will not receive assets through trading. They acquire assets from liquidity pools that are already funded. These are generated by exchange rates. So the process is cyclical.

It is worth noting that the market impact is minimal. Thanks to the liquidity pool, there are no longer suppliers demanding twice the market price or buyers willing to pay below-average discounts. As a result, transactions go more smoothly. Since a liquidity pool is a collection of assets secured by smart contracts, their value is constantly updated based on the exchange rate.

While liquidity pools clearly offer many advantages and high-quality applications, they also have significant disadvantages.

The following are some risks associated with liquidity pools:

Ignoring the dangers associated with smart contracts can result in significant losses. Once you provide your assets, the liquidity pool acquires your assets. Even though there is no middleman managing your funds, the contract itself acts as a custodian. Therefore, if a systemic error occurs (such as flash loans), you may lose your funds permanently.

When you provide AMM liquidity, you may experience rapid losses. In contrast to "hodling", this type of damage results in monetary loss. It can fluctuate between small and large capacities. Be sure to complete thorough research before investing in a two-sided liquidity pool.

Note that designers can modify the pool rules items in any way they want. Developers can use execution code or other special access to smart contract code. This may give them the opportunity to cause harm, such as confiscating the pool's money.

The procedure for accessing liquidity pools usually differs on each platform. Some of them are user-friendly and interactive to make the experience as easy as possible, while others are more complex and require additional knowledge.

Now, when you want to participate in a crypto liquidity pool, you must first register an account on the platform of your choice and link the appropriate cryptocurrency wallet to the smart contract-enabled platform. You need to decide which cryptocurrency pairs and liquidity pools you want to put your crypto assets into.

You will then need to confirm that you have enough money for the two assets you intend to deposit. In order to receive your tokens, you must deposit both assets.

Now, let’s take a look at the three most used crypto liquidity pools as of 2022 and describe their main characteristics.

Uniswap – Given its high trading volume, Uniswap is always at the top of any list of available liquidity pools. The decentralized ERC-20 token exchange supports matching ERC-20 token contracts with Ethereum contracts at a 1:1 ratio. Decentralized transactions involving Ethereum and any other ERC-20 token type are also enabled. The fact that Uniswap operates an open-source exchange gives it an edge over its competitors. Anyone can use the open source exchange to set up a new crypto liquidity pool for any coin without paying any fees.

Its lowest transaction fees are another feature that makes Uniswap one of the best liquidity pools. Liquidity providers receive a portion of transaction fees as compensation for joining the liquidity pool. You simply deposit crypto assets in exchange for UNI tokens to provide liquidity to the network.

Curve Finance – Your quest for the best liquidity pool will also lead you to reputable options like Curve. It is essentially a decentralized liquidity pool based on Ethereum principles that provides favorable trading conditions for stablecoins. The value advantage of Curve Finance becomes apparent because stablecoins are non-volatile and therefore have less slippage.

However, Curve is less common as it does not yet have a native token, although that may be coming soon. As such, it offers the ability to redeem multiple stablecoins and crypto asset pools such as Compound, BUSD, and more. There are seven separate pools on the platform, each with a unique ERC-20 pool pair.

Kyber Network – Kyber has ranked among the best liquidity pools, thanks in large part to its improved user interface. DApps can provide liquidity thanks to the on-chain liquidity mechanism based on Ethereum. As a result, businesses can quickly help consumers pay, exchange, or receive various tokens in a single transaction.

Kyber Network’s native token KNC is the basis of its liquidity pool. The KNC token is a key component of Kyber ecosystem control and the rewards provided by the Kyber network. As a result, consumers can stake their KNC tokens, participate in ecosystem governance, and receive rewards according to the terms of the smart contract.

The above is the detailed content of What is a liquidity pool? Did the currency price increase or decrease after adding the liquidity pool?. For more information, please follow other related articles on the PHP Chinese website!

Formal digital currency trading platform

Formal digital currency trading platform

Top ten digital currency exchanges

Top ten digital currency exchanges

What is cryptocurrency kol

What is cryptocurrency kol

Top 30 global digital currencies

Top 30 global digital currencies

Digital currency quantitative trading

Digital currency quantitative trading

Top 10 most secure digital currency exchanges in 2024

Top 10 most secure digital currency exchanges in 2024

Introduction to dex concept digital currency

Introduction to dex concept digital currency

Ranking of the top ten digital currency exchanges

Ranking of the top ten digital currency exchanges