WhalesMarket is an over-the-counter trading platform. Users can conduct token OTC transactions, airdrop shares, and points on the platform. NFT whitelist transactions will also be launched in the future. These functions have a certain market foundation in the encryption market. There have been dApps targeting specific functions in the past, or they were directly implemented on private social platforms such as WeChat. But WhalesMarket aims to address the inherent risks of peer-to-peer cryptocurrency trading. Briefly introduce what WhalesMarket is? Some people may still not understand. Let me introduce the OTC trading platform Whales Market to you in detail.

WhalesMarket is an over-the-counter (OTC) platform built within the Solana ecosystem. It leverages smart contract technology to provide a secure, trustless environment for trading TGE’s previous allocations, tokens and NFTs.

Whales Market uses smart contracts and cross-chain technology to trade asset certificates on multiple chains, thereby building a transparent and credible over-the-counter trading platform. In addition to trading, WhalesMarket will also launch a WHALES staking function. When users pledge WHALES, they will receive xWHALES, and xWHALES can receive platform revenue share and be used as collateral for all OTC trading markets. WhaleMarket has also launched a points trading market, which is also conducted in the form of point-to-point trading with pending orders, providing a pricing venue while meeting users' needs to lock in profits in advance.

OTC transactions are usually made by both buyers and sellers to the middleman. The funds are deposited with the middleman before the transaction is officially completed, and there is a risk of the middleman running away. Whales Market solves this problem by launching a series of trading platforms, supporting pre-market trading before popular tokens are listed on exchanges, as well as OTC trading of Solana ecological tokens. Buyers and sellers execute peer-to-peer transactions on the chain, and the margin is locked in the smart contract and is only released to the parties after the transaction is successfully settled. This simplifies the transaction process and also significantly reduces the risk of financial losses due to fraudulent practices.

Whales Market currently mainly includes three major functions, namely pre-market trading (Pre-Market), OTC trading (OTC Market) and points trading (PointsMarket). It also plans to launch NFT whitelist trading in the future. These three functions are described in detail below.

Pre-market trading can be called airdrop market share trading. In the previous ALT, MANTA, WEN, and now JUP, users with airdrop market share can submit seller's orders by pledging USDC, and those who buy houses can also pledge USDC to take orders.

Once the airdrop begins, the seller’s collateral will ensure a timely supply of tokens after they are released. If the seller fails to close the deal by the closing date, the buyer will receive the collateral as compensation.

Another highlight of WhalesMarket is the launch of points trading following market trends. Nowadays, many projects have launched a points system, and points with potential airdrops can be obtained through on-chain operations. However, these points currently have no liquidity. For the encryption market that emphasizes wealth effects and transaction efficiency, Point is a bit strange. But now you can trade points on WhalesMarket.

Whales Market currently supports points transactions on Base chain social product Friend.Tech, LRT product Eigenlayer and DEX platform Hyperliquid, as well as dozens of projects such as MarginFi, Kamino, Blur, Blast, Grass, etc. But currently there are only the first three points items available for trading.

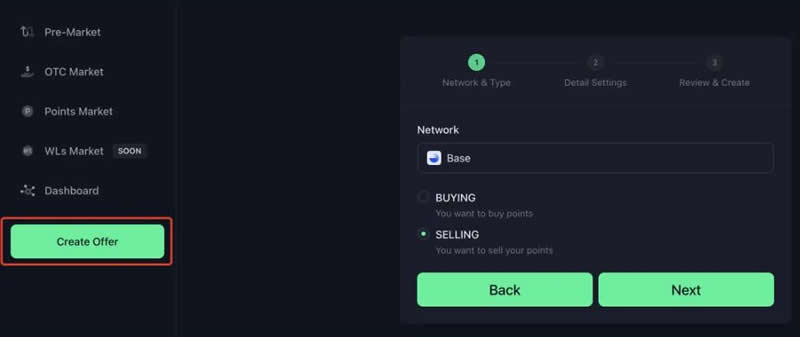

Take Friend.Tech as an example. Friend.Tech users who have points can click Create Offer on the left side of the WhalesMarket homepage to select the points market and transaction type;

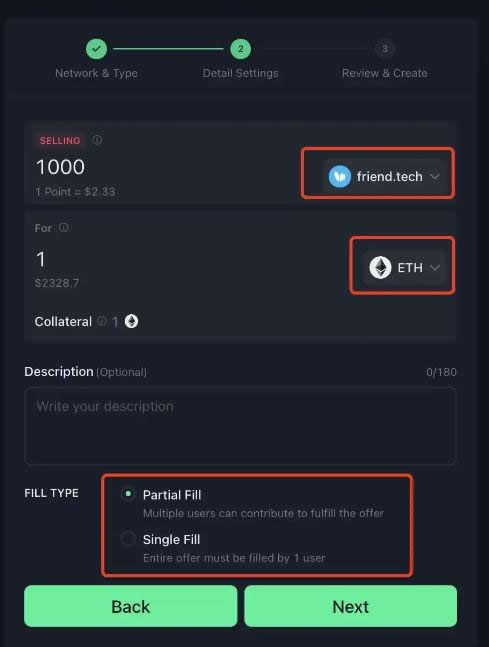

Select the Friend.Tech protocol, enter the number of points you want to sell and the amount of ETH you want to obtain, and then select whether the offer can be purchased by multiple people or can only be purchased by one person;

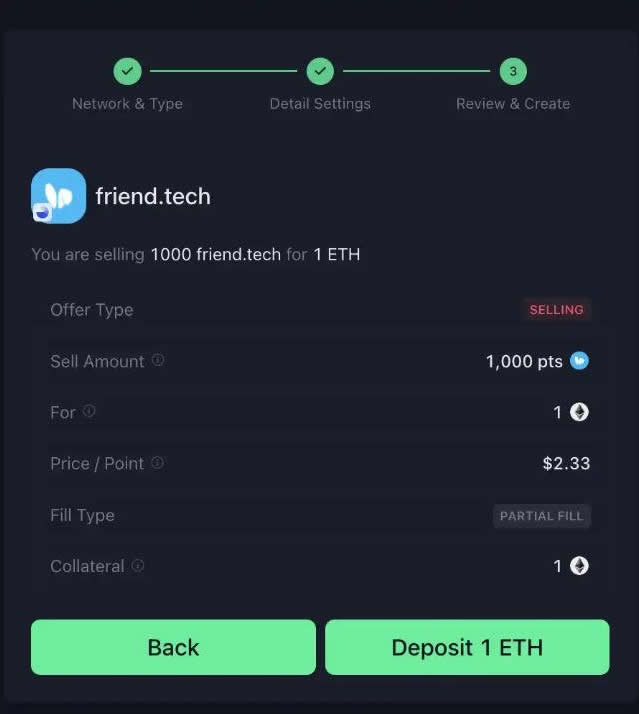

Click Next. Users need to pledge the same amount of ETH to complete the order. The same applies to purchasing points. The seller loses the buyer's collateral if he fails to meet his end of the deal. When Friend.Tech releases an airdrop in the future, the custodian will initiate the conversion of points into tokens.

The third function is the OTC market, but currently only the Solana ecosystem is available for OTC transactions on the Whales Market The project’s token.

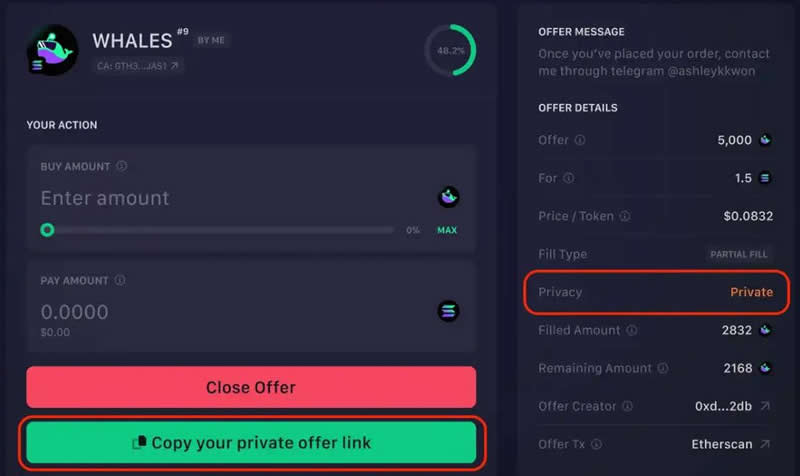

It’s worth mentioning that to increase flexibility for buyers and sellers, WhalesMarket offers offer creators the option to keep their offers private, a feature that allows them to share offer access exclusively with the individuals who are negotiating the deal. Link. Private offers do not appear on the public marketplace and are only accessible through a unique offer link provided by the offer creator.

The above is the detailed content of What is Whales Market? Introduction to OTC trading platform Whales Market. For more information, please follow other related articles on the PHP Chinese website!