web3.0

web3.0

How to play the virtual currency perpetual contract? Tutorial for beginners on how to play the perpetual contract

How to play the virtual currency perpetual contract? Tutorial for beginners on how to play the perpetual contract

How to play the virtual currency perpetual contract? Tutorial for beginners on how to play the perpetual contract

The virtual currency perpetual contract is one of the most famous derivatives in the virtual currency market. In the perpetual contract, traders can hold long or short positions and bet that the price will be higher or lower than the current level. Although it is provided Additional leverage, but does not involve the immediate exchange of the underlying assets, is also one of the important reasons why it is popular with investors. And as long as investors can maintain the necessary margin for a perpetual contract, the contract can always be maintained. But as a novice, I still don’t know how to play the virtual currency perpetual contract? In fact, it is not complicated. It can currently be carried out on exchanges such as Ethereum and Binance. The following editor will introduce to you how to play the virtual currency perpetual contract.

How to play the virtual currency perpetual contract?

Virtual currency perpetual contract trading is relatively complex, and different exchanges such as Oyi, Binance, and Huobi all provide this service. Below is a brief introduction to how to trade perpetual contracts on Eureka Exchange.

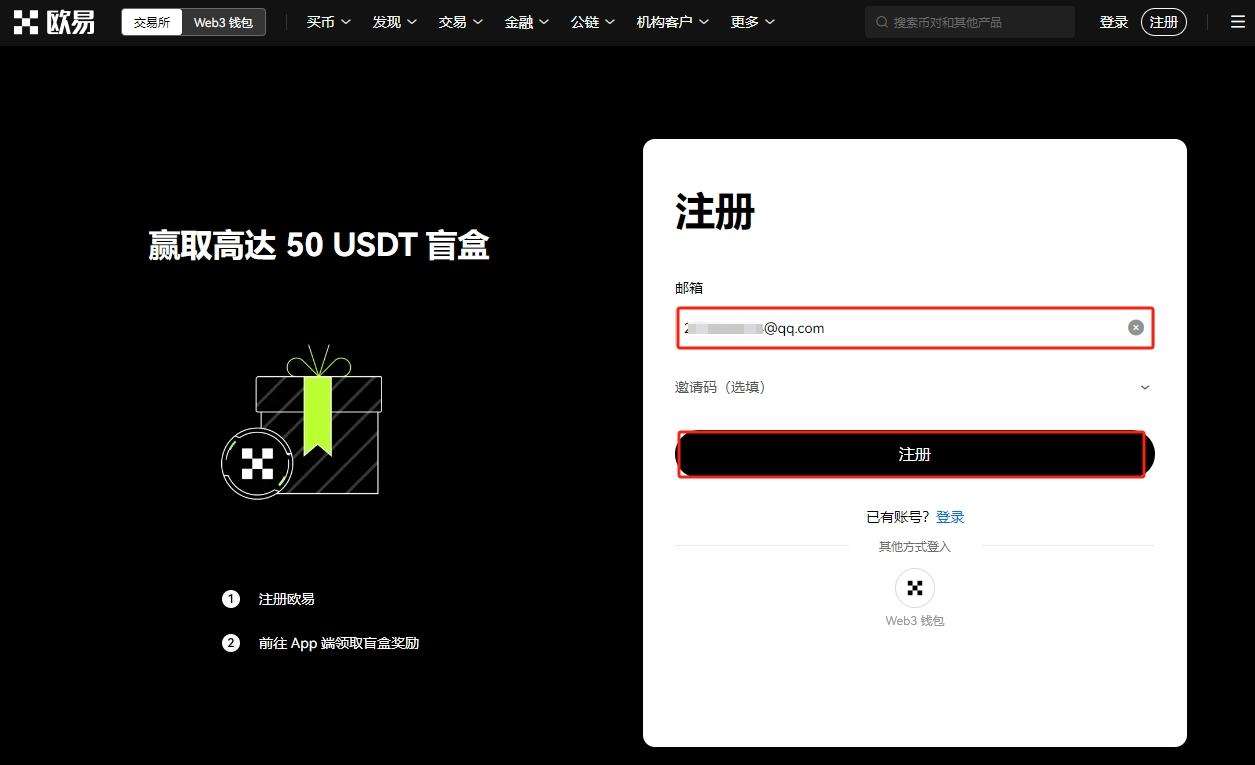

1. Open the official website of OKX Exchange (click here to register), enter your email address on the homepage, click "Register", slide the slider to the right, complete the puzzle for verification, and then enter the verification code received by email , the verification code is valid for 10 minutes

2. Then enter the mobile phone number, click "Verify Now", enter the six-digit verification code received by the mobile phone, the validity time is the same 10 minutes

3. Select your country/region of residence and check the Terms of Service, "Risk and Compliance Disclosure" and Privacy Policy and Statement

4. When creating a password, you need to have a length of 8-32 characters, 1 lowercase letter, 1 uppercase letter, 1 number, 1 symbol, such as: !@ # $ %, etc.

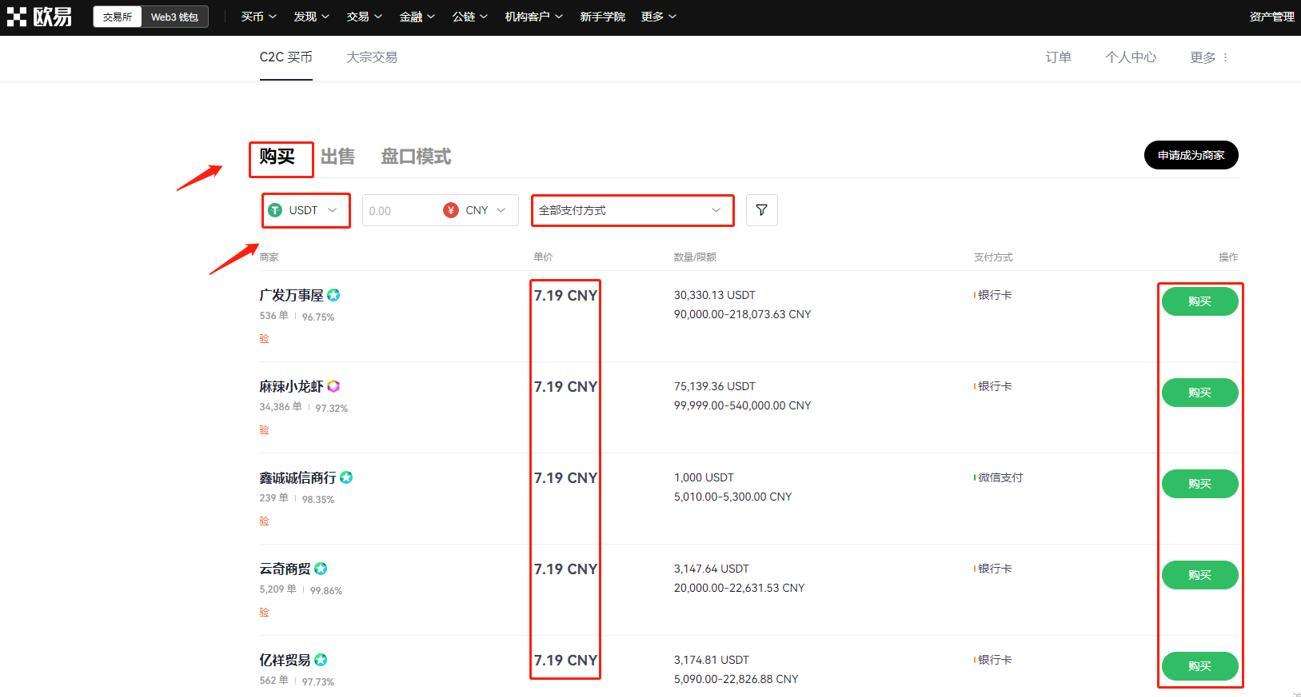

5. After completing the identity authentication, you can conduct transactions and find "Buy Coins" on the homepage - "C2C Buy Coins"

6. Select the "Purchase" option, pay attention to select the purchase currency, and click "All Payment Methods" to filter the payment method

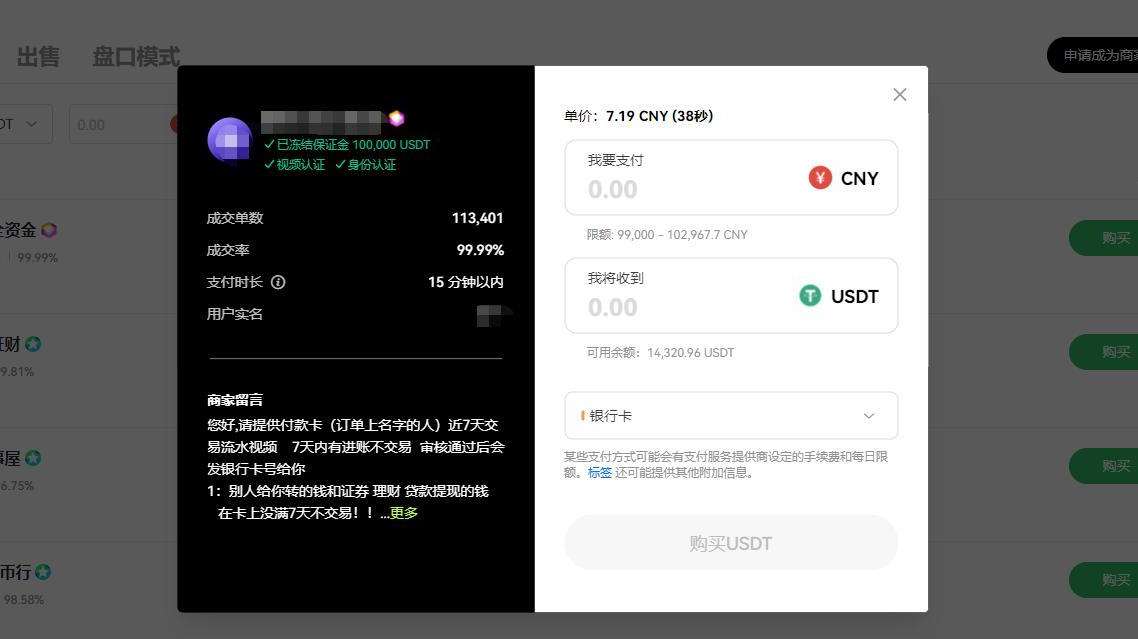

7. After selecting the merchant, follow the merchant's message, then enter the purchase amount, click "Buy USDT" to make the payment and wait for the merchant to release the coins (if the coins are not received after payment) After negotiating with the merchant to no avail, you can click on the page Need help>Others>Get help>Initiate a complaint)

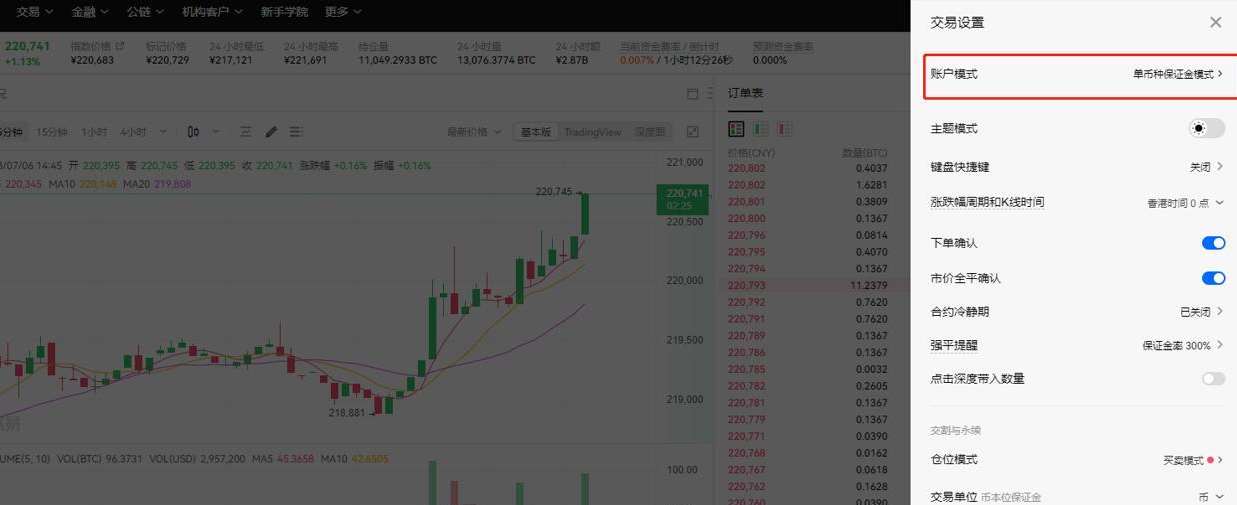

8. If you want to conduct contract transactions, you need to Open the account mode and set it to single-currency margin mode or cross-currency margin mode.

9. You can continue to set up the contract, personalize the trading unit and order mode.

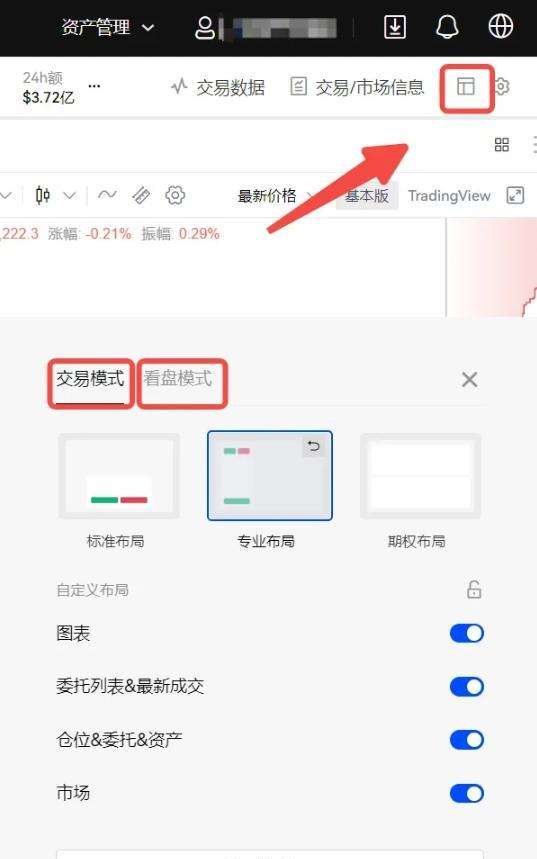

#10. You can customize the trading mode and Kanban mode. Select the professional layout here.

11. Perpetual contracts are divided into USDT margin perpetual contracts and currency-margined perpetual contracts. Here we take the USDT margin perpetual contract as an example. Similarly, transfer our digital assets from the capital account to the trading account. If it has been completed, no additional transfer operations are required.

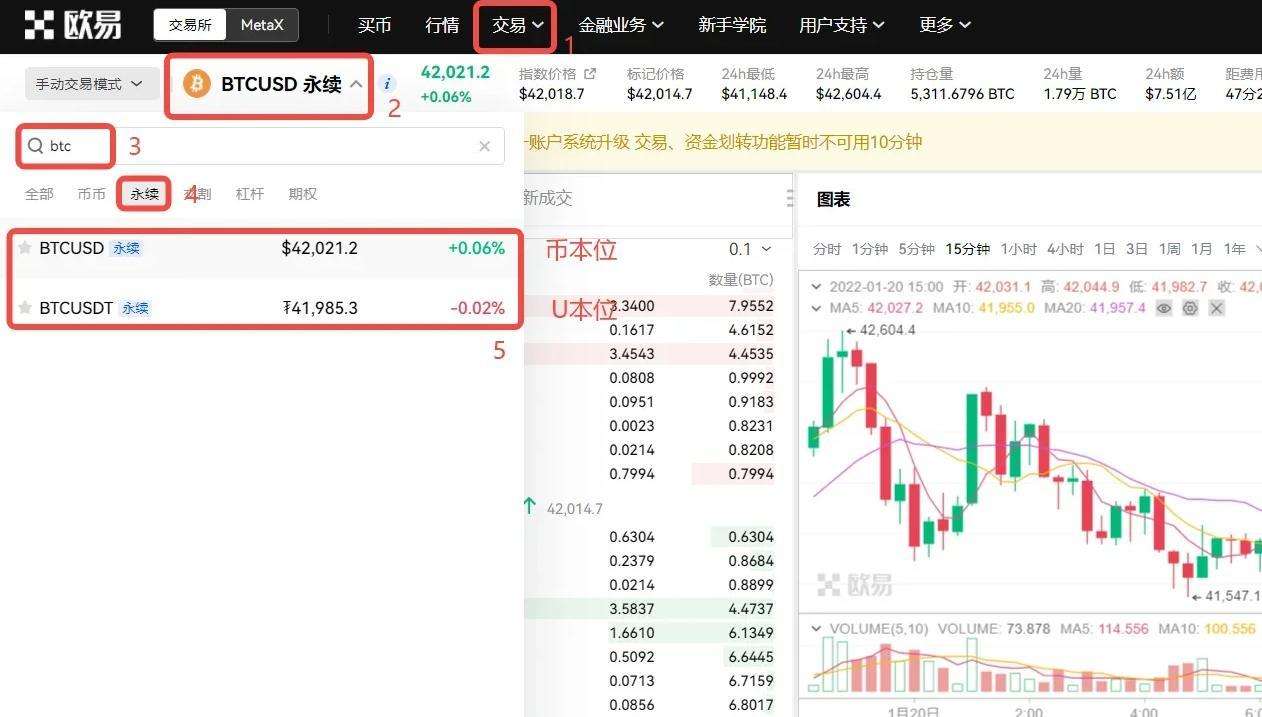

12. On the trading page, click the drop-down button on the right side of the currency pair, enter the currency in the search box, select Perpetual in the margin transaction, and select the currency corresponding to the currency. Standard/U-based contracts. Here we take the U-based contract as an example

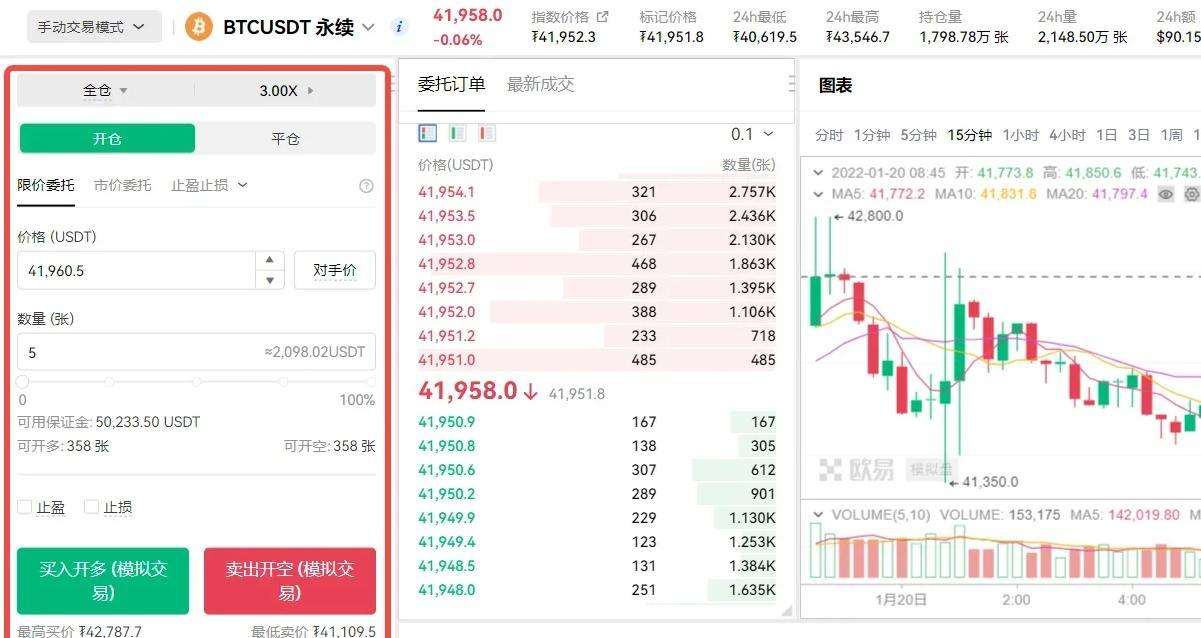

13. Select the account mode, order type, enter the price and quantity, and click Buy to open long (bullish) or Sell to open short ( bearish). For unfilled pending orders, you can click Cancel to cancel the order. Here we take opening a short position as an example.

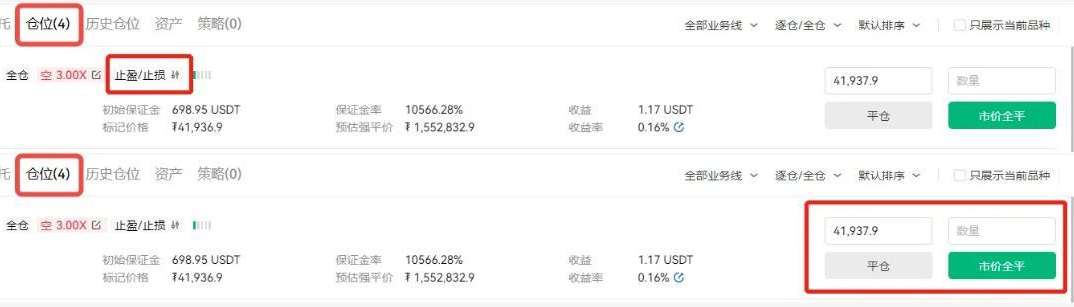

14. After the pending order is completed, you can view the relevant data of the order in the position interface, such as margin, income, rate of return, estimated liquidation price, etc.

15. You can set stop-profit and stop-loss on the position interface. You can also choose to close the position. Enter the closing price and quantity to confirm the closing, or select the full market price. Complete the position closing operation.

What is the difference between virtual currency perpetual contract and leverage?

Virtual currency perpetual contracts and leverage trading are two different trading methods. Their differences mainly reflect three aspects: contract type, settlement method and risk management. The following is a detailed analysis:

1. Contract type

Perpetual contract is a futures contract that has no expiration date and can be traded continuously. The price of a perpetual contract will usually remain close to the spot price of the underlying asset, but there may be a certain spread (basis).

Leveraged trading can be conducted in the spot market or the derivatives market. In leveraged trading, traders can borrow funds to enlarge their trading positions to achieve greater profits or losses.

2. Settlement method

The settlement of the perpetual contract is carried out through the funding rate. The funding rate will be adjusted according to the difference between the contract price and the spot price of the underlying asset. If the contract price is higher than the spot price, the long position will pay a funding rate to the short position; conversely, if the contract price is lower than the spot price, the short position will pay a funding rate to the long position.

The settlement of leveraged transactions is usually based on actual fund settlement. For example, when conducting leverage trading on an exchange, the trader's account funds will increase or decrease based on the actual profit and loss.

3. Risk Management

In perpetual contracts, since there is no expiration date, traders need to pay close attention to changes in funding rates and position margins, as well as the difference between the contract price and the spot price. basis to effectively manage risks.

In leveraged trading, traders can manage risks by setting stop-loss orders, limit orders, etc. to control the extent of losses.

Perpetual contracts can be traded on both centralized and decentralized exchanges, often using self-hosted crypto wallets. For example, a trader might open a long position in a Bitcoin perpetual futures contract at $30,000 with 5x leverage. This leverage amplifies potential profits or losses, and traders are required to maintain at least 5% of the notional value as collateral, with funding rates paid every 8 hours. It should be noted that cryptocurrency perpetual contracts provide traders with a flexible trading method, allowing them to conduct leveraged transactions in the cryptocurrency market, but since leveraged trading carries higher risks, traders need to operate with caution and Make sure you understand and accept the risks involved.

The above is the detailed content of How to play the virtual currency perpetual contract? Tutorial for beginners on how to play the perpetual contract. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

Musk boldly predicts that AI will surpass humans in all respects by 2030!

Apr 13, 2025 pm 11:03 PM

Musk boldly predicts that AI will surpass humans in all respects by 2030!

Apr 13, 2025 pm 11:03 PM

Elon Musk recently made bold predictions on the future development of artificial intelligence (AI) on social platforms. He pointed out that AI technology is developing at an unprecedented rate, while humans' understanding of this is relatively lagging behind. Musk predicts that by the end of 2025, the intelligence level of AI will exceed any single human being; between 2027 and 2028, the overall intelligence of AI will surpass all human beings. Musk further stressed that the trend of AI surpassing human intelligence will become increasingly significant and is expected to be close to 100% by 2030. This indicates the arrival of a new era in which AI completely surpasses human intelligence. The emergence of ChatGPT has triggered a global investment boom in the field of artificial intelligence. CBInsights data shows risk last year

Cryptocurrency shakes again! More than 100,000 people have lost their positions, with a total amount of over 400 million US dollars

Apr 13, 2025 pm 10:45 PM

Cryptocurrency shakes again! More than 100,000 people have lost their positions, with a total amount of over 400 million US dollars

Apr 13, 2025 pm 10:45 PM

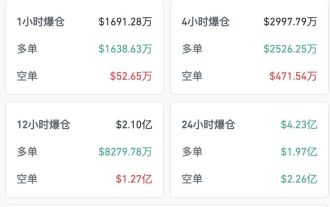

During the trading session of the US stock market, the price of Bitcoin exceeded US$107,000, setting a record high! As of now, the price has fallen slightly, maintaining around US$106,000. Coinglass data shows that in the past 24 hours, the number of people in the cryptocurrency market has reached 113,000, with a total amount of up to US$423 million. Among them, the long positions were liquidated by US$197 million and the short positions were liquidated by US$226 million. Affected by this, cryptocurrency concept stocks have generally risen. RiotPlatforms shares rose more than 8%, Bitdeer Technologies rose more than 10%, Canaan Technology rose more than 8%, and Coinbase shares rose 1.52%.

When the front-end passes data to the back-end, the back-end displays that the obtained data is NULL. How to solve it?

Apr 19, 2025 pm 09:15 PM

When the front-end passes data to the back-end, the back-end displays that the obtained data is NULL. How to solve it?

Apr 19, 2025 pm 09:15 PM

Problem description: During the development process using Ruoyi separate version, when the front-end passes data to the back-end, the back-end displays that the obtained data is NULL. The following are...

Top 10 virtual currency trading app rankings Top 10 virtual currency exchange rankings

Apr 21, 2025 am 09:21 AM

Top 10 virtual currency trading app rankings Top 10 virtual currency exchange rankings

Apr 21, 2025 am 09:21 AM

This article publishes the latest top ten virtual currency trading app rankings and top ten virtual currency exchange rankings in 2024, including platforms such as Binance, Ouyi and Sesame Open. The article emphasizes that when choosing a platform and APP, factors such as security, transaction experience, and compliance should be considered, and investors should be reminded to pay attention to the risks of virtual currency transactions.