web3.0

web3.0

Notes from the Federal Reserve's interest rate meeting: Don't panic about inflation, interest rates will fall (March 2024)

Notes from the Federal Reserve's interest rate meeting: Don't panic about inflation, interest rates will fall (March 2024)

Notes from the Federal Reserve's interest rate meeting: Don't panic about inflation, interest rates will fall (March 2024)

Summary

At this meeting, the Federal Reserve kept interest rates unchanged.

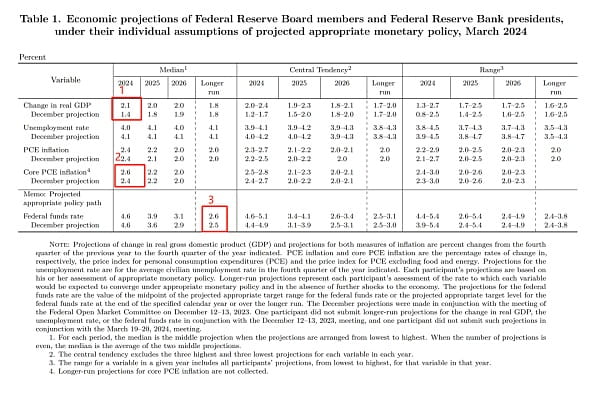

The meeting announced new economic forecasts and raised the GDP growth forecast and inflation forecast for this year.

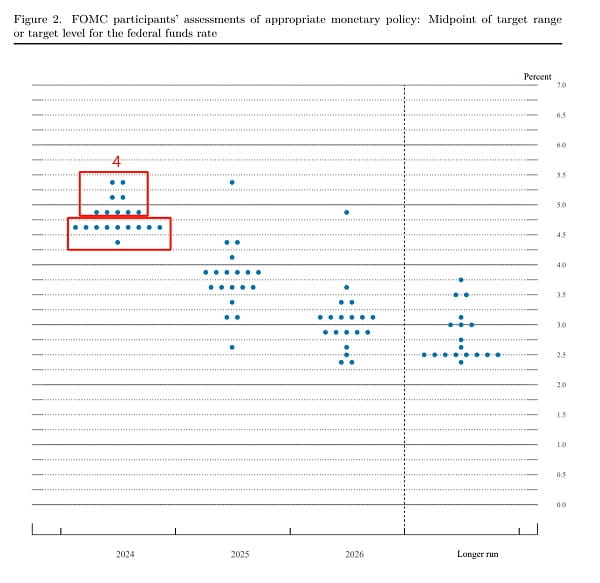

The dot plot changes are anxious, with three interest rate cuts expected in 2024 (10 members). The number of interest rate cuts in the next two years will also decrease, but it is in line with expectations.

Conference: Powell reiterated that interest rates have peaked in this cycle and confirmed that it is appropriate to start cutting interest rates this year.

Powell remained optimistic about CPI data for January and February, noting that the FOMC had anticipated that the fall in inflation could be volatile.

Regarding the strong performance of the labor market, Powell appeared "unreserved" and emphasized that excessive employment will not affect the decision to cut interest rates.

Powell said he was not sure about the specific level of long-term interest rate forecasts for the first rise in nearly five years, but he did not expect them to be as low as before the epidemic.

For QT Taper, the Fed has begun to discuss the structural issues of the balance sheet, with Powell emphasizing the "distribution" issue of liquidity.

This meeting sent almost no hawkish signal, and the market’s concerns about secondary inflation risks were not confirmed in the FOMC discussion.

The author believes that the "risk management" and "risk balancing" postures established by the Federal Reserve at the annual meeting were biased at this meeting, downplaying the risk of inflation and deepening the focus on Optimistic expectations for growth.

Risk assets continued to rise, the 10-year U.S. bond yield fell after rising, and the dollar fell.

Original statement (only the first paragraph has negligible minor changes)

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

Recent indicators indicate that economic activity is expanding at a solid pace. Job growth remains strong and unemployment remains low. Inflation has slowed over the past year but remains stubbornly high.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain , and the Committee remains highly attentive to inflation risks.

The Committee is committed to achieving full employment and an inflation rate of 2% in the long run. The Committee believes that risks to achieving the employment and inflation objectives are moving toward a better balance. The economic outlook is uncertain, and the Committee remains highly concerned about inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In order to support As part of its objective, the Committee decided to maintain the target range for the federal funds rate at a range of 5.25% to 5.5%. In considering any changes to the target range for the federal funds rate, the Committee will carefully evaluate the latest data, the evolving outlook, and the balance of risks. The Committee expects that lowering the target range will not be appropriate until greater confidence is gained that inflation is moving toward sustainable growth of 2 percent. Additionally, the Committee will continue to reduce its holdings of Treasury securities, agency debt, and agency mortgage-backed securities in accordance with its previously announced plan. The Committee remains firmly committed to returning inflation to its 2% target.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

In assessing monetary policy The Committee will continue to monitor information regarding the economic outlook as appropriate. The Committee will be prepared to adjust the stance of monetary policy as appropriate if risks arise that may impede the achievement of the Committee's objectives. The Committee's assessment will take into account a wide range of information, including labor market conditions, inflationary pressures and inflation expectations, and financial and international developments.

Dot Plot and Economic Forecast Details

- ##The economic forecast has been revised upward, this is fast It is almost the same as the forecast of Goldman Sachs (optimist)

- The inflation forecast has been slightly raised, showing that the path to de-inflation is not smooth.

- The long-term interest rate forecast slightly increased by 10bp, the first time since the epidemic.

Judging from the dot plot, there are actually 9 members who believe that the interest rate will be cut within two times, and 10 members who believe that the interest rate will be cut more than twice. The number of interest rate cuts carries the risk of further reductions.

The above is the detailed content of Notes from the Federal Reserve's interest rate meeting: Don't panic about inflation, interest rates will fall (March 2024). For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Qubetics ($TICS): The Revolutionizing AI Crypto

Mar 23, 2025 am 10:08 AM

Cryptocurrency has always been a realm where the cutting edge of technology meets bold ambition, and it's only getting more exciting in the future. As artificial intelligence continues to grow in influence, there are a handful of digital assets that

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network (PI) Price Falls Despite Successful PiFest 2025 Event

Apr 03, 2025 am 10:08 AM

Pi Network recently held PiFest 2025, an event aimed at increasing the token's adoption. Over 125,000 sellers and 58,000 merchants participated

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Where to download the genuine Ouyi? Official website download. Global

Mar 31, 2025 pm 02:09 PM

Ouyi usually refers to Ouyi OKX. The global way to download Ouyi OKX APP is as follows: 1. Android device: Download the APK file through the official website and install it. 2. iOS device: access the official website through the browser and directly download the APP.

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

In Celebration of Pi Day, a Community of Pi Network Enthusiasts Held a Bartering Event in Muntinlupa City

Mar 22, 2025 am 10:02 AM

Pi Network Celebrates Pi Day with a Bartering and Merchant Orientation Event in the Philippines

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

RUVI AI (RUVI) Token Presale Might 20X After an Explosive Launch

Apr 03, 2025 am 11:08 AM

The crypto market continues to face turbulence, with Cardano (ADA) dropping 12% to $0.64, prompting concern across the altcoin sector.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

BlockDAG Launches Beta Testnet With $200M Raised, Ethereum Approaches $2,000 & Tether Expands Into Media

Apr 03, 2025 am 10:34 AM

Ethereum (ETH) price edges toward resistance, Tether news reveals a €10M media deal, and BlockDAG reaches new milestones with Beta Testnet and growing adoption.