web3.0

web3.0

V God proposes a new plan: Redesign the PoS penalty mechanism to solve the centralization concerns of Ethereum

V God proposes a new plan: Redesign the PoS penalty mechanism to solve the centralization concerns of Ethereum

V God proposes a new plan: Redesign the PoS penalty mechanism to solve the centralization concerns of Ethereum

The centralization risk of Ethereum PoS staking has always been the focus of Vitalik Buterin. At the recent ETHTaipei event, he proposed the concept of “Rainbow Staking”, which aims to increase the participation of independent stakers to mitigate the centralization risk faced by the Ethereum network. This concept aims to make the network more decentralized by promoting wider participation. Vitalik Buterin believes that by encouraging more people to participate in staking, the security and stability of the network can be increased and the reliance on a few large holders can be reduced. This move is expected to make the Ethereum network more decentralized and robust.

Earlier today, Vitalik posted on Farcaster to discuss this issue again: Are validators in the same cluster (such as the same exchange, the same user) more likely to miss the certificate at the same time than unrelated validators? If so, can we adjust rewards to support decentralized staking? Probably yes.

Vitalik proposed to encourage the decentralization of Ethereum through "punishment-related behaviors"

At the same time, Vitalik published an article titled New article on "Strengthening Decentralized Staking: Implementing More Anti-Correlation Incentives". He proposed a new strategy aimed at driving better decentralization by “rewarding non-relevant behavior.”

If a validator behaves inappropriately, whether accidentally or intentionally, they will face appropriate penalties. The severity of this penalty will increase with the number of other validators misbehaving simultaneously, as measured by the total amount of ether they hold. This mechanism is designed to incentivize validators to abide by the rules and ensure the security and stability of the entire system.

To address common failure scenarios, such as the "missed proof" errors occasionally made by validators, Vitalik proposes two clearly defined scenarios: (i) network failure during normal operations, and (ii) Offline or long-term failure.

(i)Fumbles: When the verifier misses the proof in the current epoch, but proved correctly in the previous epoch

(ii)Misses : When a validator misses a proof in the current epoch and also missed a proof in the previous epoch

The probability of a validator in the cluster missing a proof is higher than that of an individual validator

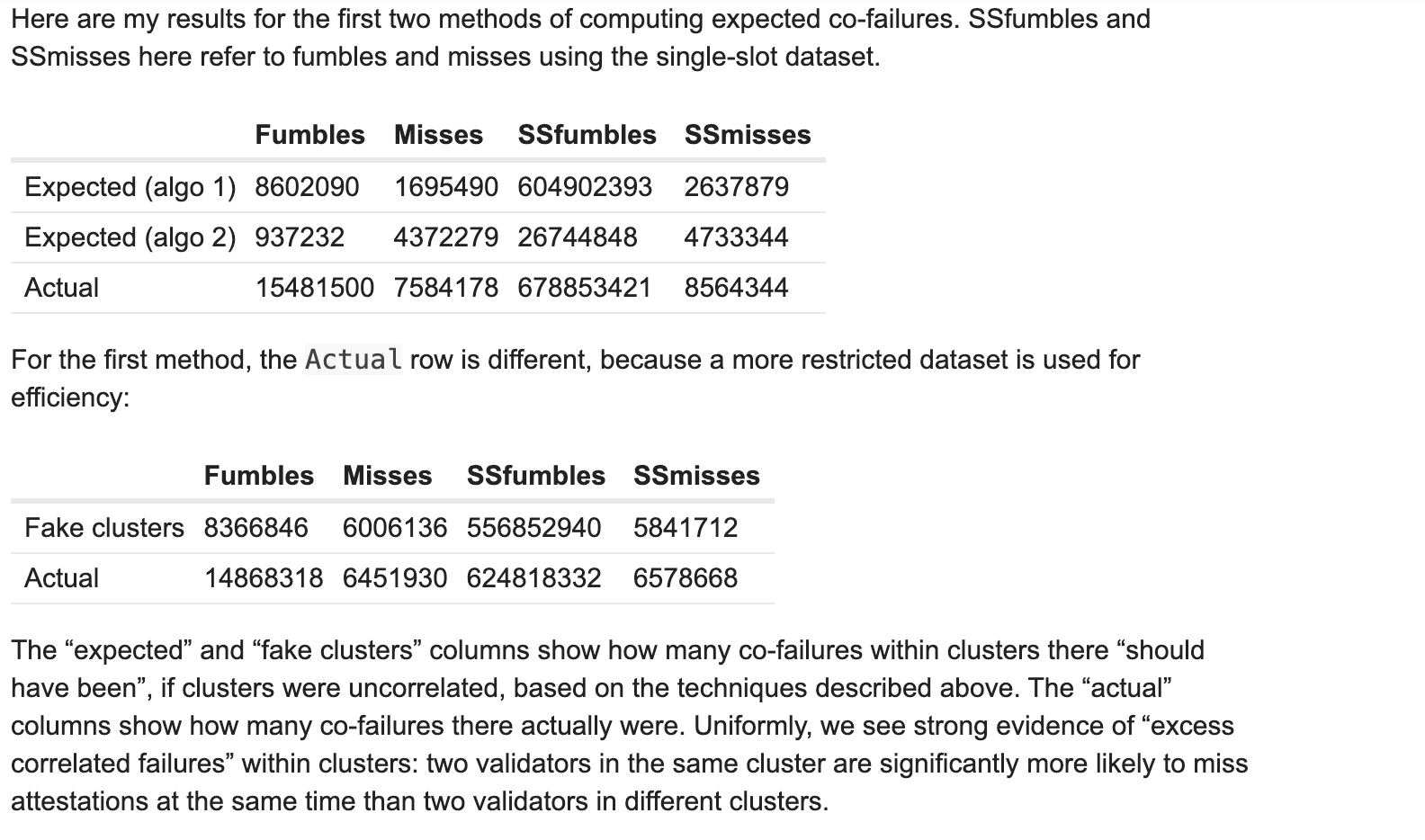

The figure below shows Vitalik calculating the expected and actual results of common failures, which includes data for "fumbles" and "misses", as well as "SSfumbles" and "SSmisses" specifically for a single time period (slot) data set.

The results show that two validators in the same cluster are significantly more likely to miss the proof at the same time than two validators in different clusters. This answers the question Vitalik asked on Farcaster above, so perhaps we can adjust rewards to support decentralized staking.

The penalty is proportional to the number of validators who missed the proof

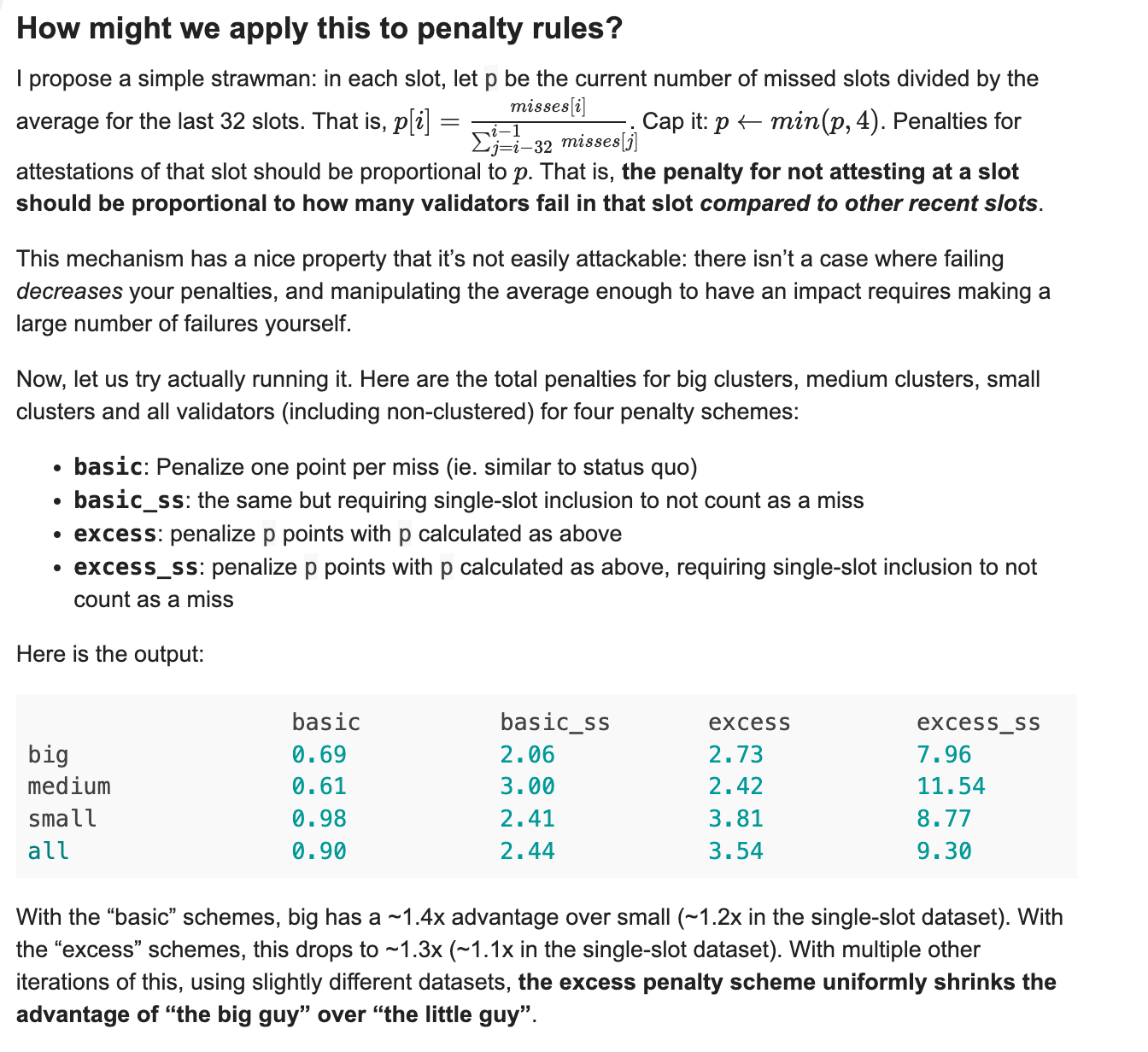

Next, Vitalik proposed the concept of a penalty rule to apply to decentralized staking scene.

“The “excess” penalty scheme is based on a simple assumption: in each period (slot), if the number of validators who miss the certification exceeds the average value in the past period, then all validators in that period will The punishment should be increased. ”

Vitalik showed the impact of four different penalty schemes on large, medium, small and all validators. The results show that the “excess” penalty scheme can reduce the advantage of large groups over small groups, thus promoting greater fairness. and a decentralized staking system.

This proposal is currently under continuous discussion, but judging from Vitalik’s multiple possible solutions, Ethereum is indeed gradually facing the problems that may be caused by over-centralization of ETH staking. .

The above is the detailed content of V God proposes a new plan: Redesign the PoS penalty mechanism to solve the centralization concerns of Ethereum. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance deletes 14 tokens from its platform from April 16

Apr 21, 2025 am 11:33 AM

Binance is about to remove 14 cryptocurrencies, causing market turmoil! Binance, the world's leading cryptocurrency exchange, announced that it will remove 14 cryptocurrencies on April 16. The move is the result of the Binance community vote and reflects the exchange's new project screening criteria, aiming to improve the overall quality of the platform. This major change marks a transformation in Binance's strategy, focusing more on the actual performance and long-term value of the project. The 14 tokens to be removed include: Badger (BADGER), Balancer (BAL), BetaFinance (BETA), CreamFinance (

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

Ranking of legal platform apps for virtual currency trading

Apr 21, 2025 am 09:27 AM

This article lists the ranking of APPs for legal platforms for virtual currency transactions, emphasizing that compliance is an important consideration for choosing a platform. The article recommends platforms such as Coinbase, Gemini, and Kraken, and reminds investors to study regulatory information and pay attention to security records when making choices. At the same time, the article emphasizes that virtual currency transactions are high-risk and investments should be cautious.

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

What to do if the USDT transfer address is incorrect? Guide for beginners

Apr 21, 2025 pm 12:12 PM

After the USDT transfer address is incorrect, first confirm that the transfer has occurred, and then take measures according to the error type. 1. Confirm the transfer: view the transaction history, obtain and query the transaction hash value on the blockchain browser. 2. Take measures: If the address does not exist, wait for the funds to be returned or contact customer service; if it is an invalid address, contact customer service and seek professional help; if it is transferred to someone else, try to contact the payee or seek legal help.

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

How to choose the blockchain asset that suits you

Apr 21, 2025 am 07:45 AM

When choosing a blockchain asset that suits you, you need to comprehensively consider the following factors: 1. Clarify investment goals and risk tolerance, short-term speculation or long-term investment determine asset choices; 2. Research project fundamentals, including team background, technological innovation and application scenarios; 3. Analyze market trends and trends, pay attention to price trends, market hotspots and macroeconomic environment; 4. Assess liquidity and transaction costs, and choose assets with good liquidity and low transaction costs.

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Why is the rise or fall of virtual currency prices? Why is the rise or fall of virtual currency prices?

Apr 21, 2025 am 08:57 AM

Factors of rising virtual currency prices include: 1. Increased market demand, 2. Decreased supply, 3. Stimulated positive news, 4. Optimistic market sentiment, 5. Macroeconomic environment; Decline factors include: 1. Decreased market demand, 2. Increased supply, 3. Strike of negative news, 4. Pessimistic market sentiment, 5. Macroeconomic environment.

Top 10 cryptocurrency exchanges ranked in the top 10 digital currency exchanges latest list

Apr 21, 2025 am 10:30 AM

Top 10 cryptocurrency exchanges ranked in the top 10 digital currency exchanges latest list

Apr 21, 2025 am 10:30 AM

The top ten cryptocurrency exchanges in 2025 are: 1. Binance, 2.Bybit, 3.OKX, 4.Coinbase, 5.Kraken, 6.HTX, 7.Gate.io, 8.KuCoin, 9.Crypto.com, 10.BitMEX. These exchanges have their own characteristics to meet the needs of different users.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.

alert! Binance adjusts the mortgage rate of multiple assets, and the crypto market may cause turmoil

Apr 21, 2025 am 11:48 AM

alert! Binance adjusts the mortgage rate of multiple assets, and the crypto market may cause turmoil

Apr 21, 2025 am 11:48 AM

Binance has adjusted the collateral ratios of several assets to manage risks and ensure market stability. 1. The mortgage ratio of FLOW and COMP has dropped from 80% to 70%, and 2. 1INCH has dropped from 70% to 65%, which may lead to a decline in market liquidity and investors' adjustment of holding strategies, but will help market stability in the long run.