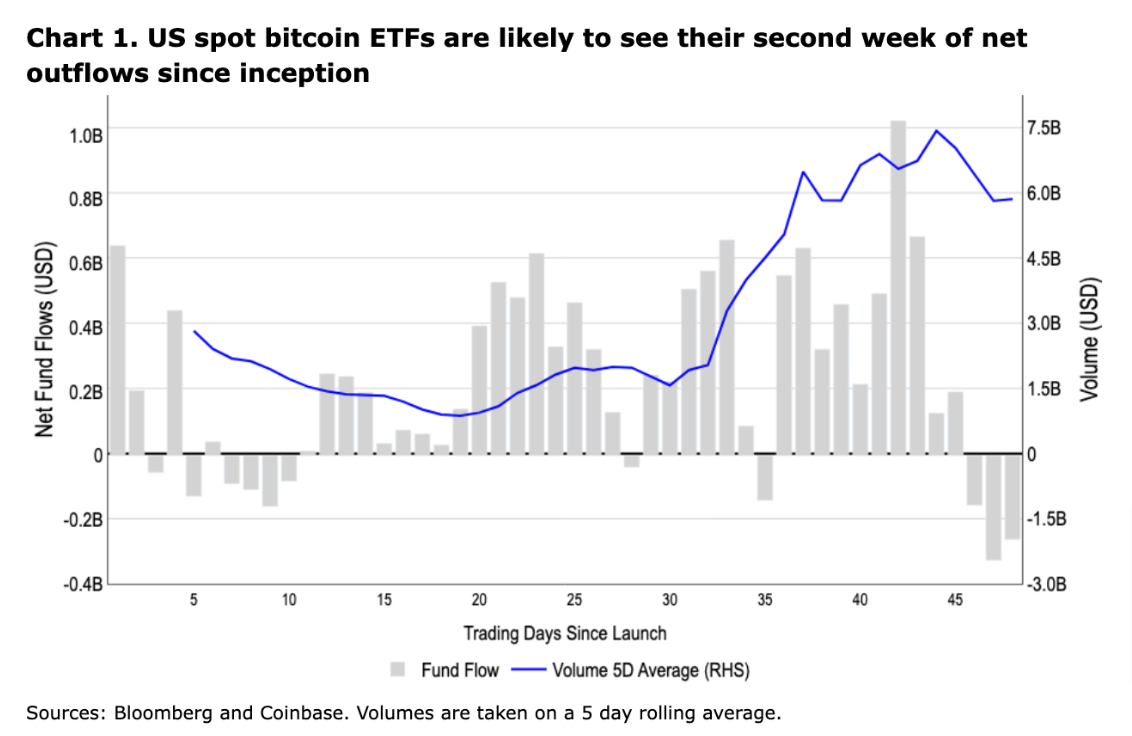

The Bitcoin spot ETF has experienced net outflows for five consecutive days for the first time since its listing two months ago. Data shows that from March 18 to March 22, a total of more than 888 million US dollars was traded. Outflow of funds. At the same time, the price of Bitcoin also experienced a significant correction last week, falling to a low of less than $60,000 on the 20th. This is also widely regarded by the market as one of the main reasons for the net outflow of spot ETFs.

Coinbase pointed out in its weekly report published on the 23rd that although the cryptocurrency market is still concerned about the capital flow of the Bitcoin spot ETF, the spot ETF has experienced its first weekly net outflow in two months. Especially between March 18 and March 21, Grayscale’s GBTC outflow reached US$1.83 billion, accounting for the largest proportion. This phenomenon shows that investors pay more attention to liquidity rather than fundamental factors.

Although the specific cause of the net outflow cannot yet be determined, David Duong, director of institutional research at Coinbase, believes that the selling pressure on GBTC may stem from the liquidation of bankrupt crypto lender Genesis. Additionally, net inflows in previous weeks may have been due to inflows from other spot ETFs offsetting GBTC outflows, suggesting that some degree of capital rotation may have occurred at that time.

Fund flow trend of Bitcoin spot ETF since its listing

Recent GBTC selling pressure may stem from Genesis bankruptcy liquidation

U.S. bankruptcy The court has approved Genesis on February 14 to liquidate the Grayscale trust assets it holds to repay creditors, including 35.93 million GBTC shares now worth more than US$2.2 billion, which has been regarded by the market as a known potential risk for GBTC. Source of selling pressure. Previously, the Wall Street Journal reported on March 18 that an incomplete creditor-backed bankruptcy repayment plan for Genesis could return 77% of customer assets in kind.

In addition, the Coinbase report also stated that the above-mentioned 35.93 million shares are separate from the 30.9 million GBTC shares that Genesis borrowed US$1.2 billion as collateral from 232,000 Gemini Earn users in the third quarter of 2022. Gemini has recently reached a settlement with Genesis, which will return 100% of all assets in kind, 97% of which will be paid within a few weeks. The settlement agreement is still pending court approval.

Coinbase pointed out: It is unclear whether the recent GBTC fund outflows are related to these sales. At present, we can only infer that the size and scope of GBTC share changes are consistent with the latest developments in Genesis’ payment obligations. What’s more, given that most creditor payments will be in the form of physical cryptocurrencies rather than cash, we believe the impact on the Bitcoin market should ultimately be neutral.

Bloomberg Analyst: Bitcoin selling pressure does not come from spot ETFs

Coinbase analysts’ views are similar to those of Bloomberg senior ETF analyst Eric Balchunas, who said on Saturday that he believes Bitcoin The recent selling pressure has come from other Bitcoin owners, not spot ETFs.

"There is indeed an outflow of GBTC, but it is mainly Genesis selling GBTC for spot BTC, so this is a neutral event. All in all, ETFs have been net buyers of BTC, and there will be more inflows ."

Spot ETFs got rid of net outflows on Monday

As for the capital flow of Bitcoin spot ETFs on Monday (25), it also broke the five consecutive days of net outflows last week. Sosovalue data shows that the net inflow of funds in a single day on March 25 was US$15.7 million.

Bitcoin also hit $71,150 this morning and was temporarily trading at $70,436 as of press time, up 4.5% in the past 24 hours.

The above is the detailed content of Coinbase: Bitcoin's recent selling pressure may be due to Genesis liquidation of GBTC. For more information, please follow other related articles on the PHP Chinese website!