What will happen if Douyin's loan is overdue?

Late repayment on Douyin Anxin Loan will result in penalty interest, liquidated damages, bad credit record, collection harassment and legal risks. It is recommended to borrow rationally, repay on time, negotiate repayment plans in a timely manner, and protect personal credit.

Douyin Anxin Borrow Overdue Consequences

Douyin Anxin Borrow is a loan product launched by the Douyin platform. Repayment will produce a series of adverse consequences:

1. Penalty interest and liquidated damages

After the expiration date, Douyin Anxin Lending will charge penalty interest and liquidated damages. The interest rate is relatively high, and the penalty is a certain percentage of the loan principal. Penalties and liquidated damages will continue to accumulate as the overdue period increases.

2. Impact on credit record

Overdue repayment records will be uploaded to the central bank’s credit reporting system, causing bad credit. Bad credit can affect subsequent applications for loans, credit cards, and other financial products.

3. Collection harassment

After the due date, Douyin can rest assured that it will collect the money through phone calls, text messages, door-to-door visits, etc. Collection agents may use inappropriate tactics that can cause harassment and stress.

4. Legal risks

If the loan is overdue for a long time, Douyin Anxin Lending may sue the borrower in court. Once the court decides to lose the case, the borrower needs to repay the loan principal, interest, liquidated damages and litigation costs.

Suggestions to avoid overdue loans

In order to prevent Douyin from overdue loans, it is recommended that borrowers:

- Learn reasonably and act within their means.

- Repay on time and maintain good repayment habits.

- When you encounter difficulty in repaying your loan, promptly negotiate with Douyin’s customer service staff to seek an extension or installment repayment plan.

- Protect personal credit and use credit lending products with caution.

The above is the detailed content of What will happen if Douyin's loan is overdue?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

A complete collection of expression packs of foreign women

Jul 15, 2024 pm 05:48 PM

A complete collection of expression packs of foreign women

Jul 15, 2024 pm 05:48 PM

What are the emoticons of foreign women? Recently, a foreign woman's emoticon package has become very popular on the Internet. I believe many friends will encounter it when watching videos. Below, the editor will share with you some corresponding emoticon packages. If you are interested, come and take a look. A complete collection of expression packs of foreign women

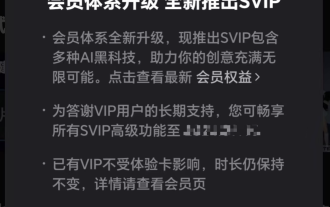

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

Bytedance Cutting launches SVIP super membership: 499 yuan for continuous annual subscription, providing a variety of AI functions

Jun 28, 2024 am 03:51 AM

This site reported on June 27 that Jianying is a video editing software developed by FaceMeng Technology, a subsidiary of ByteDance. It relies on the Douyin platform and basically produces short video content for users of the platform. It is compatible with iOS, Android, and Windows. , MacOS and other operating systems. Jianying officially announced the upgrade of its membership system and launched a new SVIP, which includes a variety of AI black technologies, such as intelligent translation, intelligent highlighting, intelligent packaging, digital human synthesis, etc. In terms of price, the monthly fee for clipping SVIP is 79 yuan, the annual fee is 599 yuan (note on this site: equivalent to 49.9 yuan per month), the continuous monthly subscription is 59 yuan per month, and the continuous annual subscription is 499 yuan per year (equivalent to 41.6 yuan per month) . In addition, the cut official also stated that in order to improve the user experience, those who have subscribed to the original VIP

I worship you, I worship you, a complete list of emoticons

Jul 15, 2024 am 11:25 AM

I worship you, I worship you, a complete list of emoticons

Jul 15, 2024 am 11:25 AM

What are some of the emoticons of "I worship you, I worship you"? The expression pack "I worship you, I worship you" originated from the "Big Brother and Little Brother Series" created by the online blogger He Diudiu Buchuudi. In this series, the elder brother helps the younger brother in time when he faces difficulties, and then the younger brother will use this line to express The extreme admiration and gratitude have formed a funny and respectful Internet meme. Let’s follow the editor to enjoy the emoticons. I worship you, I worship you, a complete list of emoticons

I have been honest and asked to let go of the meme introduction.

Jul 17, 2024 am 05:44 AM

I have been honest and asked to let go of the meme introduction.

Jul 17, 2024 am 05:44 AM

What does it mean to be honest and let go? As an Internet buzzword, "I've been honest and begging to be let go" originated from a series of humorous discussions about rising commodity prices. This expression is now mostly used in self-deprecation or ridicule situations, meaning that individuals face specific situations (such as pressure, When you are teasing or joking), you feel that you are unable to resist or argue. Let’s follow the editor to see the introduction of this meme. Source of introduction to the meme of "Already Begging to Let It Go": "Already Begging to Let It Go" originated from "If you add a punctual treasure, you will be honest", and later evolved into "If Liqun goes up by two yuan, you will be honest" and "Iced black tea will go up by one yuan. Be honest." Netizens shouted "I have been honest and asked for a price reduction", which eventually developed into "I have been honest and asked to be let go" and an emoticon package was born. Usage: Used when breaking defense, or when you have no choice, or even for yourself

Introduction to the meaning of red warm terrier

Jul 12, 2024 pm 03:39 PM

Introduction to the meaning of red warm terrier

Jul 12, 2024 pm 03:39 PM

What is red temperature? The red-warm meme originated from the e-sports circle, specifically referring to the phenomenon of former "League of Legends" professional player Uzi's face turning red when he is nervous or excited during the game. It has become an interesting expression on the Internet to describe people's faces turning red due to excitement and anxiety. The following is Let’s follow the editor to see the detailed introduction of this meme. Introduction to the meaning of the Hongwen meme "Red Wen" as an Internet meme originated from the live broadcast culture in the field of e-sports, especially the community related to "League of Legends" (League of Legends). This meme was originally used to describe a characteristic phenomenon of former professional player Uzi (Jian proudly) in the game. When Uzi is playing, his face will become extremely rosy due to nervousness, concentration or emotion. This state is jokingly likened to the in-game hero "Rambo" by the audience.

Why is there no air conditioner in the dormitory?

Jul 11, 2024 pm 07:36 PM

Why is there no air conditioner in the dormitory?

Jul 11, 2024 pm 07:36 PM

Why is there no air conditioner in the dormitory? The Internet meme "Where is the air conditioning in the dormitory?" originated from the humorous complaints made by students about the lack of air conditioning in dormitories. Through exaggeration and self-deprecation, it expresses the desire for a cool and comfortable environment in the hot summer and the realistic conditions. The contrast, let’s follow the editor to take a look at the introduction of this meme. Where is the air conditioning in the dormitory? The origin of the meme: "Where is the air conditioning in the dormitory?" This meme comes from a ridicule of campus life, especially for those school dormitories with relatively basic accommodation conditions and no air conditioning. It reflects students' desire for improved accommodation conditions, especially the need for air conditioning during the hot summer months. This meme is circulated on the Internet and is often used in communication between students to humorously express frustration and frustration with the lack of air conditioning in hot weather.

Because he is good at introductions

Jul 16, 2024 pm 08:59 PM

Because he is good at introductions

Jul 16, 2024 pm 08:59 PM

What does it mean because he is good at stalking? I believe that many friends have seen such a comment in many short video comment areas. So what does it mean because he is good? Today, the editor has brought you an introduction to the meme "because he is good". For those who don’t know yet, come and take a look. The origin of the meme “because he is good”: The meme “because he is good” originated from the Internet, especially a popular meme on short video platforms such as Douyin, and is related to a joke by the well-known cross talk actor Guo Degang. In this paragraph, Guo Degang listed several reasons not to do something in a humorous way. Each reason ended with "because he is good", forming a humorous logical closed loop. In fact, there is no direct causal relationship. , but a nonsensical and funny expression. Hot memes: For example, “I can’t do it

Align the granularity stalk introduction

Jul 16, 2024 pm 12:36 PM

Align the granularity stalk introduction

Jul 16, 2024 pm 12:36 PM

What does it mean to align the granularity? "Align the granularity" first appeared in the movie "The Annual Meeting Can't Stop!" and was proposed by actor Dapeng in an interview. Let's take a look at what happened in detail. I hope it can be helpful to everyone. Introduction to the meme "Align the granularity" [Align the granularity] is not a standard English or professional term, but a kind of workplace slang in a specific situation. The meaning of workplace slang is that the two parties synchronize information and form a common understanding. What the movie refers to is making all the details known to both parties.