Bitcoin and Ethereum trade sideways, AI concept coins lead gains

On Wednesday, trading activity in the cryptocurrency market cooled slightly. As of the close of U.S. stocks that day, the total market value of crypto fell 1.2% to $2.6 trillion. Bitcoin and Ethereum face resistance at key levels.

The current price of Bitcoin is US$71,754, which was later lowered to US$69,793, a decrease of 1.2%. Ethereum is trading at $3,516, down 1.35% in the past 24 hours.

In the altcoin market, the native tokens of blockchain AI concept projects Fetch.ai, SingularityNET and Ocean Protocol are soaring amid the proposed merger plan. The proposed merger is called the "Artificial Super Intelligence Alliance". These projects The token will be named Artificial Superintelligence (ASI).

The cryptocurrency prices corresponding to these messages have fluctuated significantly. Fetch.ai (FET) is up 15%, SingularityNET (AGIX) is up 12%, and Ocean Protocol’s token OCEAN is the biggest gainer, up more than 36%. The three projects submitted integration proposals to their respective governance communities today and plan to launch a 14-day consultation period, with proposal voting expected to take place between April 2 and April 16.

Base The meme trend continues, with the hottest BRETT, inspired by a cartoon drawn by artist Matt Furie, up 11% in the past 24 hours Character, the market value was once close to 500 million US dollars. “It is now clear that memecoins have evolved from a cultural movement into a key tool in driving the adoption of new blockchains,” Coingecko wrote in a newsletter.

In this case, the hype campaign It has attracted the attention of regulatory agencies. The British Financial Conduct Authority (FCA) issued a document warning KOLs to pay attention to "misleading" encryption meme projects. Paid promotions must obtain regulatory approval to avoid potential criminal charges. The FCA will "emoticon" Packages” items were listed as key areas for online breaches.

Cryptocurrency market "is in the middle of a bull market"

Based on a recent report from Grayscale, market cycle indicators show that the cryptocurrency market "is in the middle of a bull run" on the back of strong fundamentals and technical factors. We are currently in the middle of a bull market.”

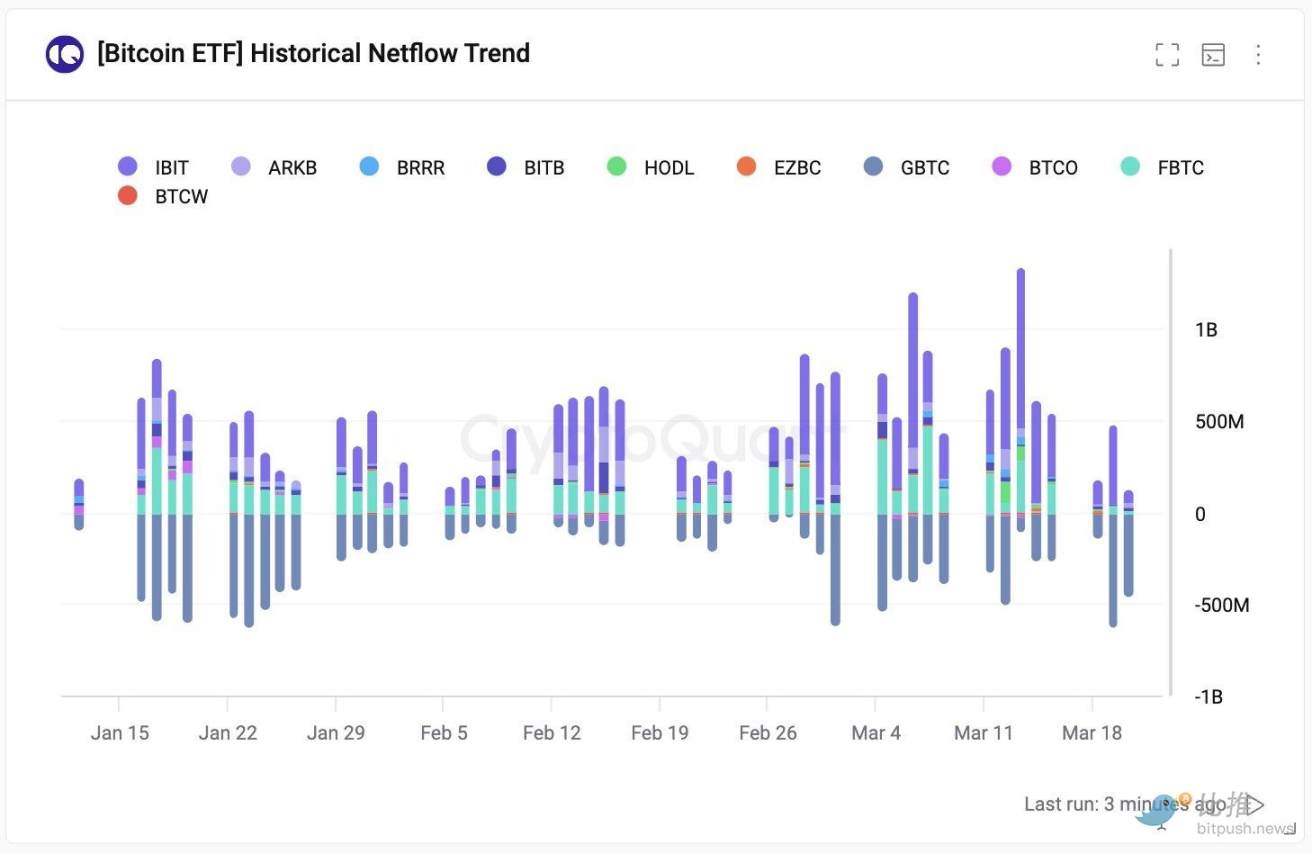

Despite Bitcoin rising from $63,800 to $70,000 in the five days leading up to March 27, only $151 million of leveraged short positions were liquidated in the BTC futures market. This suggests that bears remain cautious despite a whopping $888 million in net withdrawals from U.S. Bitcoin spot ETFs last week.

On the positive side, Bitcoin has shown resilience, falling from $73,757 on March 14 to $60,795 on March 20 without causing panic among spot ETF investors. Spot ETF flows reversed course this week, recording net inflows totaling $418 million on March 26.

In addition, Grayscale reported that exchanges held significantly less Bitcoin, “a 7% decrease since the local Bitcoin supply peak in May 2023.” This suggests that supply is tight in part as spot Bitcoin ETFs move BTC into custodial cold wallets for long-term storage as investors anticipate future price increases.

Is the pre-halving correction in BTC over?

Analyst Rekt Capital said on the The previous correction occurred as expected. Now Bitcoin is back near $70,000."

Rekt Capital said in a video analysis yesterday that if the all-time high of $69,000 turns As a support level, Bitcoin prices may break through all-time highs. He said: "Bitcoin has broken through all-time highs and may be ready for the end of the correction before halving."

According to Bitfinex analysts According to a research report, last week’s Bitcoin price adjustment indicates that the price has formed or is close to forming a local bottom. Analysts said: “We believe that Bitcoin’s correction last week from the current all-time high of $73,666 is equivalent to approximately 17.5%. The correction shows that we are close to establishing a local bottom, and in fact the market has begun to follow this pattern."

The above is the detailed content of Bitcoin and Ethereum trade sideways, AI concept coins lead gains. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!