Interpretation of IMO: Assetization of AI models, new methods of token issuance

The crypto market never lacks for new concepts.

But most new concepts are micro-innovations of old gameplay; it is this kind of micro-innovation that is more likely to bring new craze and hype.

Nothing can best reflect this than the asset issuance method.

From the hot ICO that started in 2017, to the subsequent IEO, and now to the popular IDO or LBP (liquidity startup pool)... the beginning of each wave of changes in asset issuance methods can lead to a wave of fire. New projects can also allow some Degen to gain new income.

What changes is the performance, what remains unchanged is the core.

And when time enters 24 years, when AI becomes the "new leg" of crypto narratives, asset issuance around AI becomes a possibility to create new concepts.

For example, the recently emerged "IMO" is translated as "initial model release".

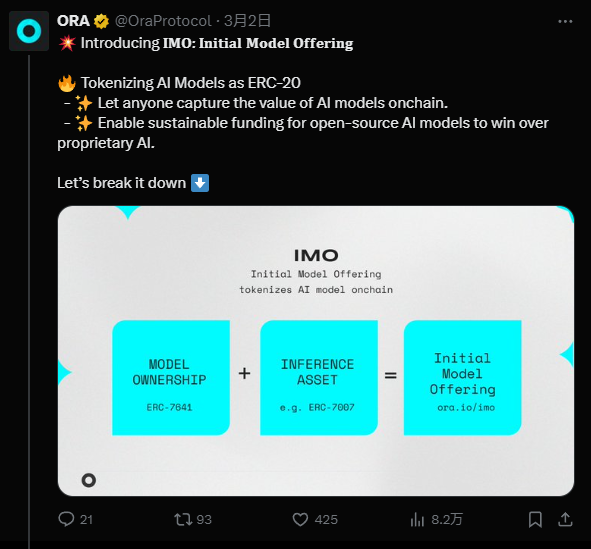

On March 2, an AI project called Ora Protocol first proposed the concept of IMO (Initial Model Offering) on its social media, and attracted a lot of attention.

The simple understanding of this idea is that since everything can be tokenized, AI models can also be tokenized and issued as an asset.

But it may not be that simple to implement IMO this set of rules.

Quickly understand the tokenized issuance of AI models

For all ICOs and variants, the core is to create a token and give the token many conditions such as quantity, release conditions, functions and functions. A market price is then formed.

The Token here does not actually correspond to the real world and can be generated out of thin air, which is commonly known as "issuing a coin".

But IMO not.

The core point of IMO is actually the monetization of AI models in reality.

Many open source AI models face challenges monetizing their contributions, resulting in contributors and organizations lacking motivation because they cannot make money. This is why today’s AI industry is dominated by closed-source, for-profit companies. For open source AI models to grow, the key is to raise more funding and build them publicly.

Therefore, the purpose of IMO is to provide a new asset issuance method to help open source AI models raise more funds to fund their development.

By analogy with some previous IXOs, you are optimistic about a certain token asset and then choose to invest in it. At the same time, the market performance of the token will also reward you, and the protocol corresponding to the token generates income. You may also share;

Now, in the IMO scenario, if you are optimistic about a certain AI model, you can choose to invest in its corresponding tokens. The AI model provider Funds have been raised for development and development; at the same time, if the model generates economic benefits in actual use in the future, you may also share it.

IMO How to implement it specifically?

If the AI model is to be expressed in the form of tokens and the benefits can be shared, then there must be at least a few key issues involved here:

- How to ensure that a certain AI model is true , and can it correspond to the token you hold?

- How to ensure that token holders can really share the benefits generated from the use of AI models?

Ora Protocol uses two different ERC protocol standards ERC-7641 and ERC-7007, combined with oracle and ZK technology to solve the above problems.

- How to ensure that a certain AI model is real and not an empty concept used to make money by issuing coins?

First of all, what we need to know is that Ora Protocol is a protocol that makes AI oracles. Its core product is called Onchain AI Oracle (OAO).

The role of this oracle The point is that the AI model can be verified and executed on the blockchain, ensuring that the deployment and operation of the AI model are completely carried out on the chain, thus ensuring the transparency and verifiability of its execution process.

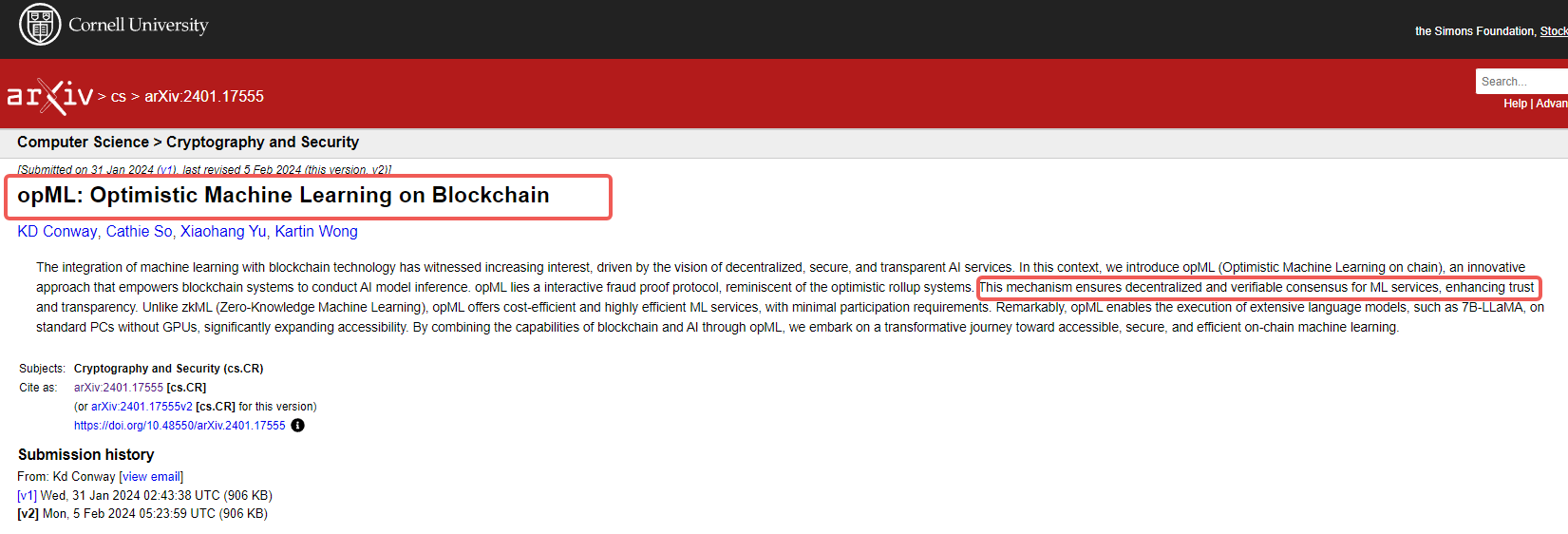

However, because AI models are often the core competitiveness, if they are exposed to everyone, they will lose their commercial competitive advantage, so Ora Protocol is also equipped with another technology---- opML ( Optimistic Machine Learning), that is, optimistic machine learning.

In layman’s terms, opML may use zero-knowledge proofs or other forms of cryptographic proofs to prove that the model’s operating results are correct without disclosing the details of the model itself. This ensures the authenticity of the model and effectiveness, while also protecting the privacy and proprietary nature of the model.

Regarding the specific implementation of opML, it is supported by the publicly published papers in the picture above. We cannot evaluate the advantages and disadvantages of its technical details, but we only need to understand the advantages and disadvantages of this technology. The effect is enough.

So far, through the AI oracle and zero-knowledge proof, we have solved the problem of "how to prove that an AI model actually exists".

- The next question is, how to ensure that the ownership of the token corresponding to this AI model is yours, and that you can share the profits from it.

Tokenizing an AI model is key IMO. Ora Porocol introduces a token standard called ERC-7641, which is compatible with ERC-20.

If a developer of an AI model feels that his model is good and wants to do IMO in the encryption market, his approach is likely to be as follows:

First, compare the AI model with a certain Each ERC-7641 asset is associated, and the total number of tokens is agreed in the smart contract of the asset;

Second, investors in the crypto market purchase the token, and based on the purchase quantity, the corresponding The ownership ratio of the AI model (equal to shareholders);

Third, after the AI model is run on the chain, once the AI model or content generates income (for example, the usage fee paid when the model is called, or the AI generated (royalties from NFT sales), the ERC-7641 protocol can pre-define the rules for revenue distribution in the contract and allow holders of tokens to automatically distribute revenue according to the proportion of tokens they hold.

Through this mechanism, the ERC-7641 token becomes a bridge between AI models and the economic value they generate and token holders, allowing contributors and investors of open source AI models to share the models long-term value.

Therefore, the ERC-7641 token is also called the Intrinsic RevShare Token, which can be interpreted as a token standard designed to share profits generated by AI models.

So the overall logic of IMO is very clear: AI model developers need to raise funds and bind the model to a certain token for IMO; buyers purchase tokens and follow the rules of the token smart contract , and enjoy the profits from the subsequent use of the AI model and the creation of works.

But at this point, there is still a key loophole:

- How do you know what is created on the chain later? Do AI works (such as NFT, pictures, videos, etc.) really come from this AI model that performs IMO, and are not forged?

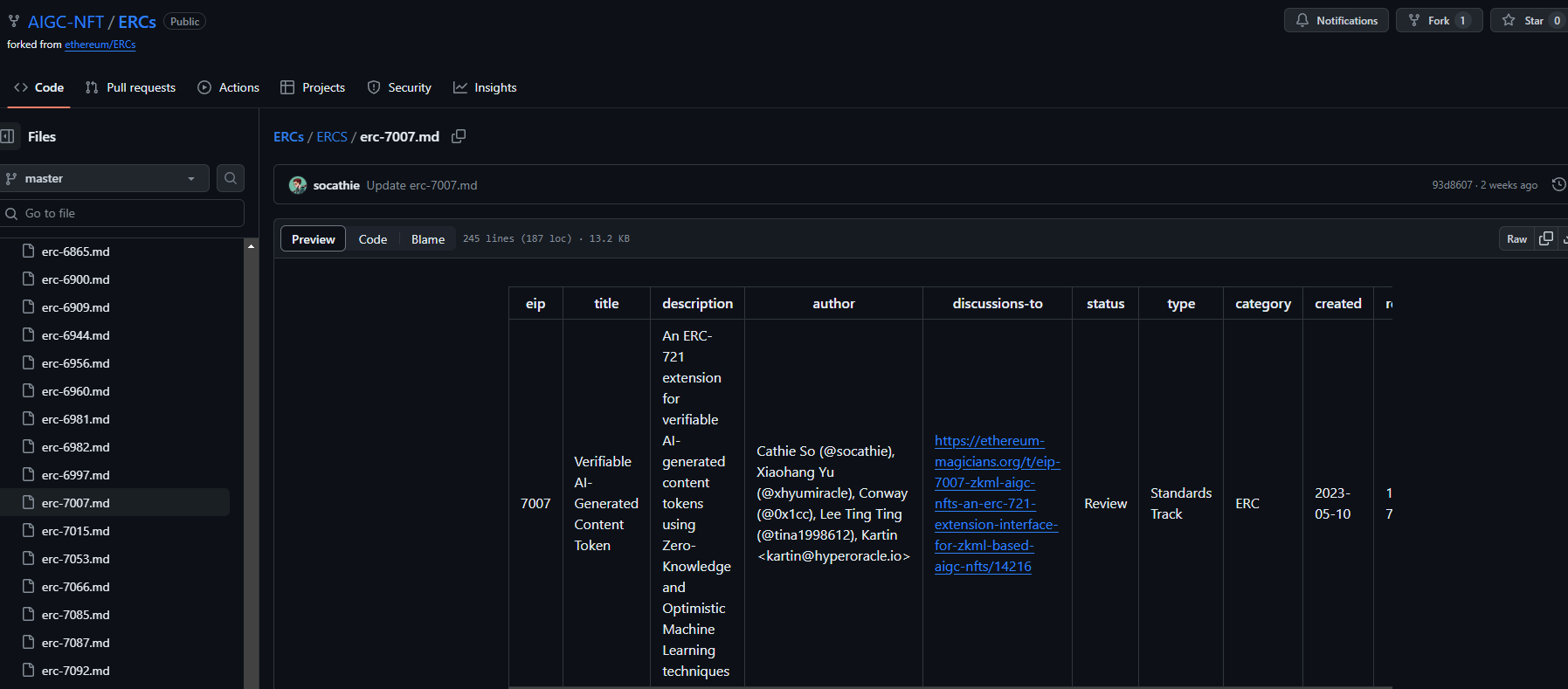

The method given by Ora Protocol is to give these AI-generated works Make a mark and implement it through ERC-7007.

Excluding the technical details, you can understand ERC-7007 as a system specially designed for AI-generated content to ensure the authenticity and source of the content. Token standard for traceability.

This standard records the metadata of AI-generated content on the blockchain (such as the AI model used to generate the content, generation time, conditions, etc.) and utilizes intelligent Contracts to automatically execute these verification logic. Developers can use zkML or opML to verify whether the AIGC data of a specific NFT actually comes from a machine learning model and specific input.

This increases the transparency of the authenticity of AIGC content. And through the non-tampering characteristics of the blockchain, it is ensured that once recorded, it cannot be changed or forged; therefore, ERC-7007 is also called "Verifiable AI-Generated Token" in the ORA protocol. Content Token)

Currently this standard has been open source and can be checked, click here.

At this point, we fully understand the logic of IMO:

Bind the AI model to tokens with income sharing function and carry out IMO

Investors use their token shares to Enjoy the revenue share of future use of the AI model and derivative works

Use a token agreement that can verify the ownership of content creation to verify whether a work is indeed created by the model and share the revenue

It’s still an asset game, not perfect

From ICO to IMO, when AI models can also be tokenized and issued, this year’s encryption boom is destined to compete with AI. Binding.

But the IMO gameplay created by Ora Protocol is not perfect.

Off-chain usage issues: Even if IMO can realize on-chain tokenization and Revenue sharing, it is still difficult to solve the problem of revenue sharing when the model is used off-chain. When AI models are used in non-blockchain applications, how the benefits of these uses are tracked and distributed to token holders is a complex issue.

Uncertainty of market demand: Although AI-generated content on the chain (such as NFT, etc.) has brought new possibilities to the creative industry, the market demand for these works is still There is great uncertainty. The market value and liquidity of AIGC's works, as well as how much people are willing to pay for these works, are unknown, and stable AI model revenue sharing is impossible to talk about.

Revenue sharing in action: In theory, revenue sharing via ERC-7641 tokens sounds like an attractive idea. However, in practice, the effectiveness and feasibility of this mechanism still need to be tested by the market. Especially given the high volatility of blockchain projects and tokens, the actual returns that token holders are able to receive may vary significantly.

In the crypto world, everyone can play with the issued assets, but few can give a preset definite answer as to whether the asset itself is useful or how many people use it.

However, the new model of asset issuance through IMO does provide an innovative framework that allows open source AI models to obtain financial support and achieve value sharing through tokenization.

This kind of framework itself is a narrative that is close to hot topics and has positive value.

In a game where there are no perfect assets, embracing the enthusiasm of AI is often more likely to lead to success.

The above is the detailed content of Interpretation of IMO: Assetization of AI models, new methods of token issuance. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1382

1382

52

52

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.

Sesame Exchange gate web version enters Sesame Exchange official web version click to enter

Mar 31, 2025 pm 06:18 PM

Sesame Exchange gate web version enters Sesame Exchange official web version click to enter

Mar 31, 2025 pm 06:18 PM

Sesame Exchange Gate.io web version is convenient to log in. Just enter "gate.io" in the browser address bar and press Enter to access the official website. The concise homepage provides clear "Login" and "Register" options, and users can choose to log in to a registered account or register a new account according to their own situation. After registering or logging in, you can enter the main trading interface to conduct cryptocurrency trading, check market conditions and account management. Gate.io has a friendly interface and is easy to operate, suitable for beginners and professional traders.