web3.0

web3.0

The financial renaissance of BTC has begun. L2 Network Mirror Staking Protocol aims to solve the pain points of the BTC Restaking track.

The financial renaissance of BTC has begun. L2 Network Mirror Staking Protocol aims to solve the pain points of the BTC Restaking track.

The financial renaissance of BTC has begun. L2 Network Mirror Staking Protocol aims to solve the pain points of the BTC Restaking track.

For a long time, Bitcoin has been used as an innovative payment method and value storage method. Its ecosystem cannot reproduce the diverse applications and gameplay like Ethereum due to reasons such as not supporting smart contract functions and high handling fees. It was not until the explosion of protocols such as Ordinals and the opening of the mainstream funding floodgates by Bitcoin spot ETFs that the gears of fate of the Bitcoin ecosystem were turned, and it became a key narrative in today's encryption market.

However, as problems such as large-scale network congestion, low transaction speed, and insufficient application expansion have become increasingly prominent, the Bitcoin L2 expansion plan came into being. In this hundred-team battle of Bitcoin L2, Mirror Staking Protocol has taken a different approach and positioned itself as Bitcoin L2 staking infrastructure. In this article, PANews will explain the operating mechanism and differentiated advantages behind the Mirror Staking Protocol.

L2 revitalizes the Bitcoin economy, Mirror uses multi-signature grouping algorithm to break the staking dilemma

The important driving force of the Bitcoin ecosystem including the Layer2 expansion plan has become a track for key funds to ambush, and is presented A blowout burst of kinetic energy. For Bitcoin, the introduction of Layer 2 can not only improve scalability and efficiency, but the programmability of its smart contracts also provides greater possibilities for ecological explosion.

The low staking efficiency and asset security risks faced by the pledge track are restricting the development of the Bitcoin L2 track. In response to such market pain points, Mirror Staking Protocol can provide Bitcoin L2 with a completely decentralized and trustless Bitcoin staking solution to ensure that Bitcoin is 100% securely transferred to L2 and shared with Bitcoin L2.

In reality, since various Bitcoin L2 projects have different asset pledge implementation routes, they also have different differences in pledge efficiency and security. For example, there is an inevitable triangulation problem when bridging Bitcoin L1 to L2 native assets through a multi-signature mechanism. If the number of multi-signature nodes is reduced to improve efficiency, it will be difficult to ensure the risk of evil caused by centralization. For example, Merlin Chain uses Cobo's MPC wallet solution to bridge multiple native assets from Bitcoin L1 to L2. Although the MPC wallet is more secure than ordinary wallets, the smaller number of signers and the lack of a penalty mechanism also make it ineffective. There is a certain gap in security; if you want to maximize the decentralization of asset custody, having enough nodes will bring inefficiency. For example, Stacks requires at least 70% of the node signature power to obtain a valid signature. .

Use remote staking solutions such as Babylon’s Bitcoin staking protocol that allows Bitcoin holders to stake without bridging Bitcoin to a PoS chain, through cryptography, consensus protocol innovation and optimization using Bitcoin scripts Language is used to create a remote staking environment. Although it is more secure and reliable than bridging, it has the risk of Bitcoin asset lock-in and cannot directly access the DApps of the EVM ecosystem. In addition, projects like BounceBit directly host assets to centralized custody service platforms with compliance qualifications such as Mainnet Digital and Ceffu, which builds user trust in the asset transparency and financial audit of these institutions.

Mirror Staking Protocol is a protocol based on the multi-signature node mechanism. It effectively balances Bitcoin staking efficiency, security and decentralization issues by creating a multi-signature group (MSG) algorithm. To make a symbolic metaphor, "If the Bitcoin L2 project is compared to an electric car manufacturer, Mirror provides battery packs; and if the BTC L2 project is a large-scale language model (LLMs), the Mirror protocol is a GPU cloud computing center."

Mirror divides nodes from hundreds to thousands into groups. Each node can form a group with any other 4 nodes, and each group consists of any 5 nodes. , any 3 nodes among the 5 nodes in the group can multi-sign the assets in the group. Each node is also required to stake 1 mBTC in the designated smart contract. Once the node does evil, the money will be confiscated. For example, if there are 1000 nodes, then 3000 record groups are generated. If the number of nodes reaches 1,000 Bitcoins, then each group can host 1 Bitcoin. If a node wants to do evil, then 3 nodes in any group must collectively act maliciously to achieve this, and 3 mBTC must be paid.

At present, the node election has been officially launched. Any user who has made active contributions to the protocol can participate. The node will be selected in four rounds of voting by the community. To ensure security, the protocol requires nodes to stake at least 1 BTC into the Mirror contract and act as decentralized network custodians for 12 months. Once successfully selected for the stage, users will receive MIRR token subscription rights worth up to $120,000, and the winner of the node election will also receive a call option of 1 million $MIRR with an execution price of $0.12. According to the latest official disclosure, since the node election was launched on March 5, 2024, the Mirror Staking Protocol has attracted more than 200 KOLs and more than 50 project institutions to participate in the election on social media such as X in less than 3 weeks. At the same time, more than 50,000 users have participated in voting in this election, with the total number of votes exceeding 3 million.

In addition, in addition to improving asset security through technical solutions, Mirror Staking Protocol has also passed the security audit of the well-known security company SlowMist.

It is worth mentioning that the mBTC generated by the Mirror Staking Protocol and anchored 1:1 with Bitcoin is compatible with EVM and can increase the income potential of pledged assets through the ReStaking mechanism.

Has completed seed round financing and plans to launch the mainnet in May this year

Although the market competition among L2 heroes has entered a fierce stage, Bitcoin L2, which has just gained momentum, has still become the most active capital Higher popular sections. Many popular Bitcoin L2s have not only achieved high financing amounts at high valuations, but also have TVLs of hundreds of millions or billions, which directly reflects the strong market demand. The market's expectations for the ecological development of Bitcoin are high because its huge amount of precipitated assets are in urgent need of being mined. In particular, spot ETFs are driving strong demand for Bitcoin. Judging from the market size of Ethereum, Bitcoin L2 also has great potential for development. Whether Bitcoin’s market value is three times that of Ethereum, or the former’s 296 million global users far exceed the latter’s 124 million. All can give a glimpse of the growth space of this track.

As a builder of the Bitcoin ecosystem, Mirror Staking Protocol has also been recognized by capital. In March this year, Mirror Staking Protocol announced the completion of its first round of financing from UTXO (Bitcoin Magazine’s investment arm), Conflux and IMO Ventures. Among them, Bitcoin Magazine once published that the Bitcoin L2 standard must meet three conditions, including using Bitcoin as a native asset; using Bitcoin as a settlement mechanism to enforce transactions; and demonstrating functional dependence on Bitcoin. Judging from these standards, Mirror Staking Protocol fully meets them.

Its innovative technical solutions are a demonstration of the strength of the team. In addition to coming from the Web3 Native project, the team members of Mirror Staking Protocol also have rich experience in well-known Web2 companies, including Microsoft, Google, MIT, Yao Ban of Tsinghua University, Samsung, Hyundai, Conflux and Decus, etc.

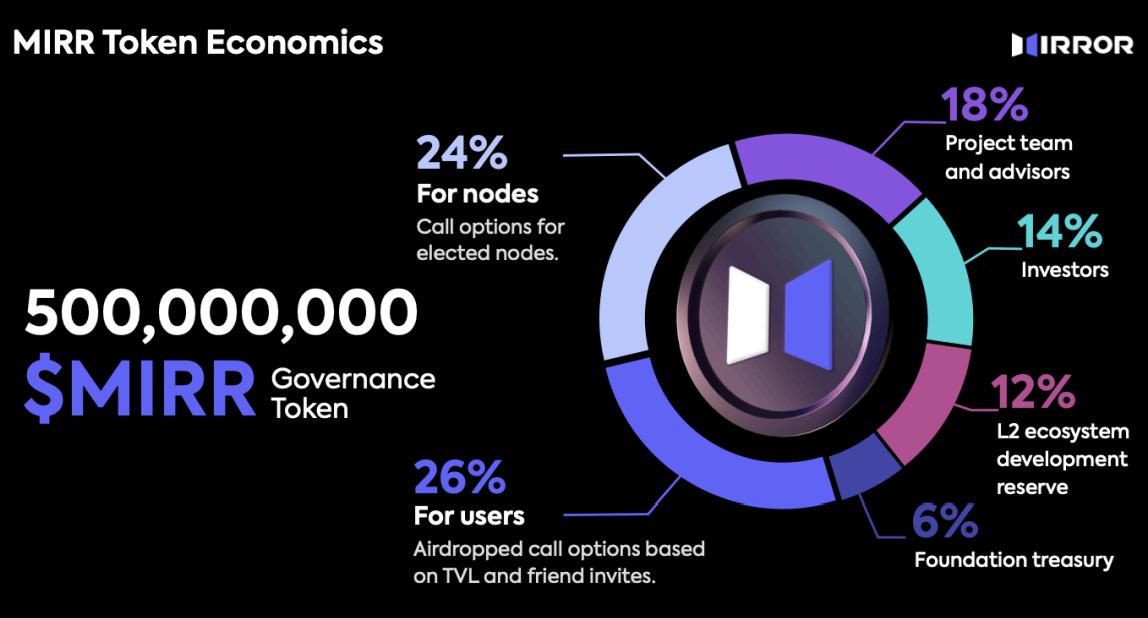

In addition, sustainable token economics is also an important indicator for measuring projects. MIRR is the governance token of Mirror Staking Protocol, with a total supply of 1 billion, of which 24% is used for node election and tokens will be issued within 12 months; 26% is used for user airdrops, which can be determined based on the amount of Bitcoin pledged and invitations The points earned by friends will be rewarded and will be divided into 10 quarters; 14% will be allocated to investors. The seed round investor quota will be unlocked within 12 months, and the institutional round investor quota will be unlocked within 24 months; 18% will be allocated to the project For the team and consultants, 6% will be allocated to the foundation, and the remaining 12% will be used for L2 ecological development.

Currently, Mirror Staking Protocol has completed the test network deployment and will soon open the public beta phase to all network users. According to the roadmap, Mirror Staking Protocol is expected to be launched on the mainnet in May this year, which will allow users to pledge and bridge Bitcoin L1 assets to the L2 network; at the same time, the protocol also plans to cooperate with other Bitcoin L2s and launch "once "Pledge Double Token Revenue" activities, expand ecological applications and launch ecosystem funds to support builders and developers, etc.

The Bitcoin ecosystem is booming. As L2s with technology iterations and upgrades continue to conquer the city, low operating efficiency and lack of application scenarios will gradually become a thing of the past, and they will be activated with the leverage effect of LSD/Restaking. The high liquidity and composability of assets will further unlock more potential of the Bitcoin economy. From the perspective of L2 builders such as Mirror Staking Protocol, compared to "showing off skills", providing a more friendly and secure asset environment and shouldering the heavy responsibility of ecological construction are becoming the key to gaining strong consensus and support from users.

The above is the detailed content of The financial renaissance of BTC has begun. L2 Network Mirror Staking Protocol aims to solve the pain points of the BTC Restaking track.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

How to build the redis cluster mode

Apr 10, 2025 pm 10:15 PM

How to build the redis cluster mode

Apr 10, 2025 pm 10:15 PM

Redis cluster mode deploys Redis instances to multiple servers through sharding, improving scalability and availability. The construction steps are as follows: Create odd Redis instances with different ports; Create 3 sentinel instances, monitor Redis instances and failover; configure sentinel configuration files, add monitoring Redis instance information and failover settings; configure Redis instance configuration files, enable cluster mode and specify the cluster information file path; create nodes.conf file, containing information of each Redis instance; start the cluster, execute the create command to create a cluster and specify the number of replicas; log in to the cluster to execute the CLUSTER INFO command to verify the cluster status; make

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Top 10 of the formal Web3 trading platform APP rankings (authoritatively released in 2025)

Mar 31, 2025 pm 08:09 PM

Based on market data and common evaluation criteria, this article lists the top ten formal Web3 trading platform APPs in 2025. The list covers well-known platforms such as Binance, OKX, Gate.io, Huobi (now known as HTX), Crypto.com, Coinbase, Kraken, Gemini, BitMEX and Bybit. These platforms have their own advantages in user scale, transaction volume, security, compliance, product innovation, etc. For example, Binance is known for its huge user base and rich product services, while Coinbase focuses on security and compliance. Choosing a suitable platform requires comprehensive consideration based on your own needs and risk tolerance.

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

gate official website login address gateio web version login portal address

Mar 31, 2025 pm 01:15 PM

Gate.io not only provides basic buying, selling and trading functions, but also launches a variety of innovative trading models and services to meet the needs of different users. The platform also provides a wealth of trading tools and analysis functions to help users make smarter investment decisions. Users can pledge their holdings to the platform, participate in mining activities, and obtain additional benefits.

Matcha Exchange eth transfer tutorial

Mar 31, 2025 pm 12:39 PM

Matcha Exchange eth transfer tutorial

Mar 31, 2025 pm 12:39 PM

The steps for transferring ETH from the Matcha Exchange are as follows: 1. Preparation: Register and authenticate with real name to ensure that there is enough ETH, and download and install TP Wallet. 2. Get the ETH address of the TP Wallet. 3. Log in to the Matcha Exchange. 4. Find the Assets or Package options. 5. Select ETH and click "Extract" or "Extract". 6. Fill in the withdrawal information, paste the ETH address and enter the amount. 7. Complete security verification. 8. Confirm the funds to arrive.

Sesame Open Door Gate Official Website PC Login Entrance

Mar 31, 2025 pm 06:15 PM

Sesame Open Door Gate Official Website PC Login Entrance

Mar 31, 2025 pm 06:15 PM

The PC login portal of Sesame Open Door Gate official website is convenient and efficient. Users can log in in only three steps: First, open the browser and search for "Sesame Open Door Gate official website" and enter the official website; second, click the "Login" button on the homepage of the official website, enter the user name and password to log in; finally, after successfully logging in, you can enter the personal account management interface. To ensure account security, it is recommended to log in under a secure network environment to avoid operating under public WiFi. If you have any questions, please contact the platform customer service for help.