Written by: Kaori, BlockBeats

On March 27, the U.S. District Court for the Southern District of New York rejected Coinbase’s motion to dismiss, which was a case filed by the SEC against Coinbase for failing to register as a securities business. This ruling has a significant impact on the cryptocurrency market.

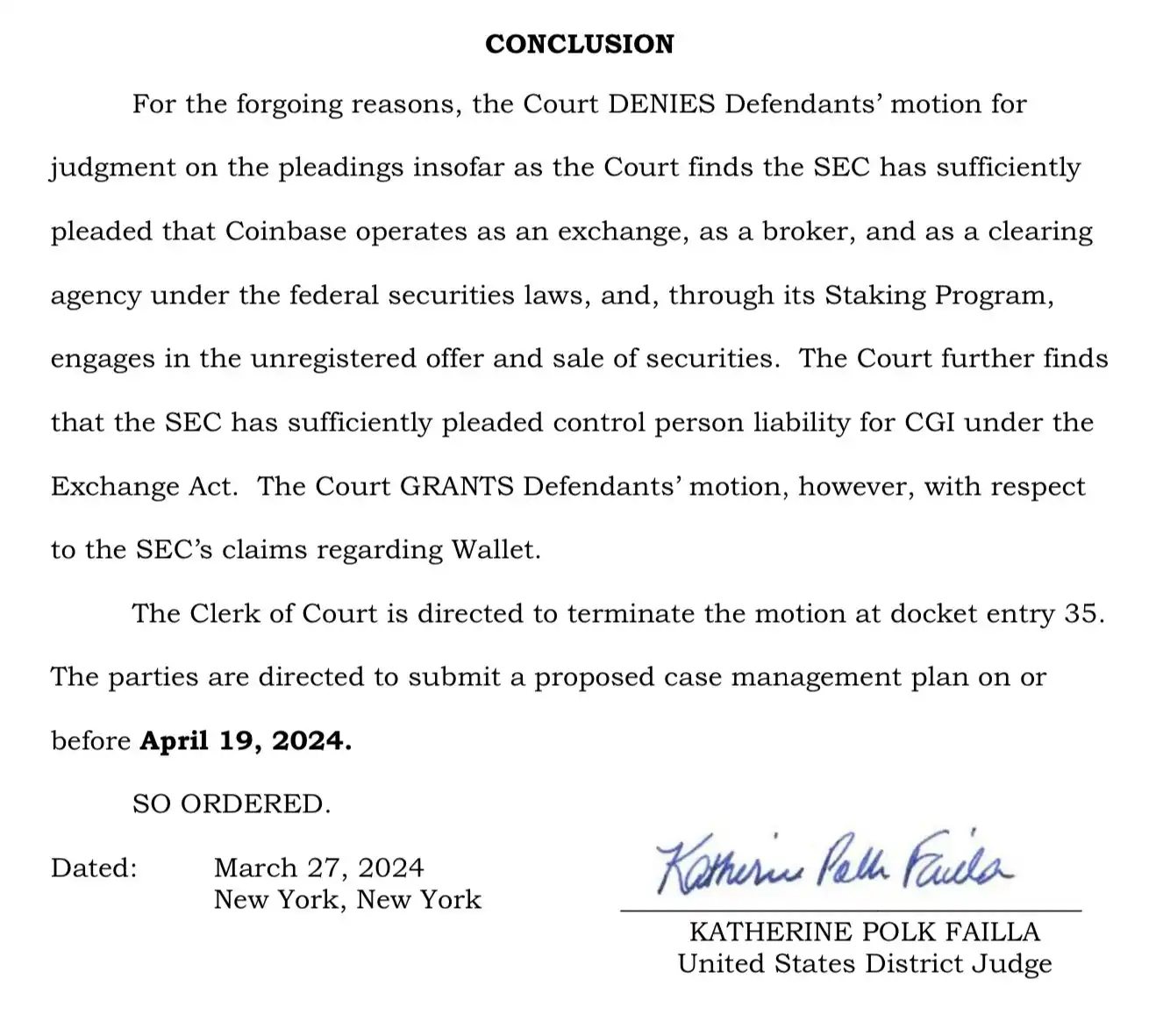

U.S. District Judge Katherine Failla wrote a ruling that the SEC made "reasonable" charges against Coinbase and allowed the SEC to continue to accuse Coinbase of operating as an unregistered trading platform, broker, clearing agency, and It "engaged in the issuance and sale of unregistered securities" through its pledge program and set an April 19 deadline for the parties to agree on a plan to arrange the case.

After the news was announced, Coinbase’s stock price fell by more than 10% as of writing.

In June last year, the SEC filed a lawsuit against Coinbase, accusing it of providing trading and staking services to the public and refuting federal securities laws. At the same time, the SEC also sued Binance, but the lawsuit was settled at the end of last year.

Coinbase filed a response document and a petition seeking to dismiss the case in its lawsuit against the SEC, responding to the regulator’s accusations that it illegally operated an unregistered stock exchange.

Coinbase Chief Legal Officer Paul Grewal has said that the company has completed its review with the SEC in early 2021, which marks Coinbase’s official response to the legal dispute and heralds the beginning of a long legal battle. . While the company has unlisted securities, it has conducted a comprehensive and consistent review with the SEC on the process used to list the tokens.

What happened last night is another key development in the battle between Coinbase and the SEC. Paul Grewal spoke yesterday evening, saying, “Today, the court decided that our SEC case will continue to advance most of the claims, but dismissed the claims against Coinbase Wallet. We are prepared for this and look forward to learning more about the SEC’s encryption Internal views and discussions on currency regulation.”

Meanwhile, an SEC spokesperson said, “We are pleased that another court has confirmed that while the term ‘cryptocurrency’ may be relatively Newer, but the framework that courts have used to identify securities for nearly 80 years still applies."

However, this is not entirely negative news for Coinbase or even cryptocurrencies.

In March of this year, during opening arguments submitted by the Third Circuit Court of Appeals, Coinbase asked the appeals court to direct the SEC to begin drafting cryptocurrency rules. Coinbase said the SEC violated the Administrative Procedure Act because it did not conduct a rulemaking and did not elaborate on why it rejected Coinbase’s rulemaking petition.

"The SEC does not have the legal authority to extend the current securities regime to digital assets, but if the SEC insists on moving forward without congressional authorization, the decision must be made and enforced through forward-looking rulemaking" Coinbase express.

Therefore, yesterday’s ruling is conducive to promoting clarity in cryptocurrency rulemaking. Like the Binance case, the judge may side with the SEC on specific cases and impose a fine on Coinbase. However, courts will challenge the lack of regulatory transparency and registration capabilities, pushing the SEC to seek more concrete solutions, which would be a boon for Coinbase.

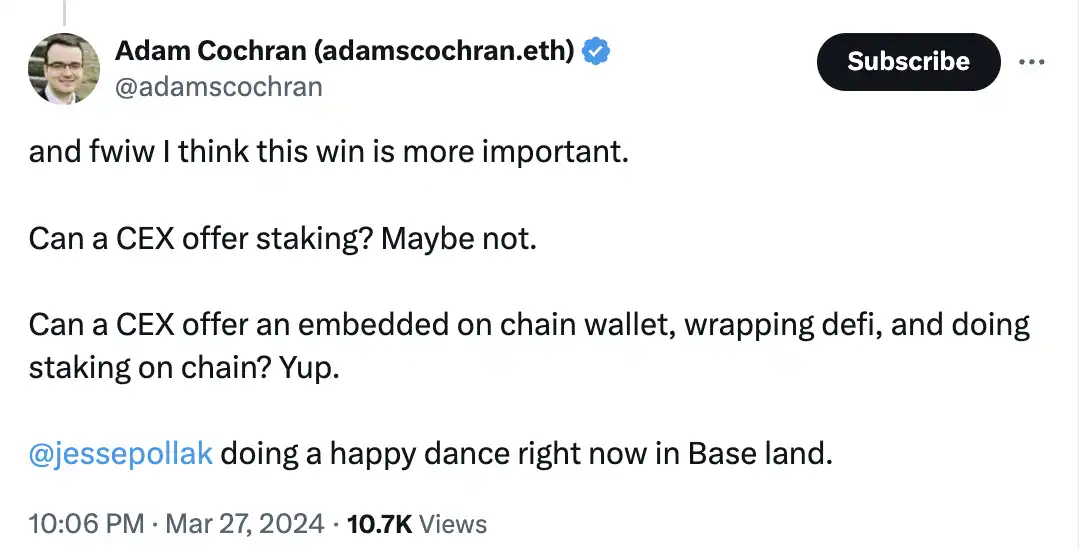

At the same time, there is another point worthy of attention in yesterday's court ruling, and the market also gave a good response, that is, in the ruling, Judge Failla dismissed SEC claims that Coinbase acted as an unregistered broker through its wallet app.

Coinbase believes that Wallet does not "conduct routing activities", "has no control over users' crypto assets or transactions conducted through Wallet", and that users "are the sole decision-makers for transactions" and Wallet "only provides users with access to the market." Technical infrastructure for arranging transactions on other DEXs." This ruling is a real endorsement of the technology discussed here, and therefore opens up more market possibilities for Base as well as on-chain DeFi.

Coinbase announced the launch of two new wallet solutions – smart wallets and embedded wallets – in late February this year, designed to make it easier for new users to get on-chain and overcome the user experience barriers to creating a crypto wallet. A solution will be added to the Coinbase Wallet SDK, allowing users to create and use wallets without the need for long seed phrases. And one of Base’s goals in its 2024 roadmap is to make smart wallets the default option.

After this ruling came out, the encryption KOL even bluntly stated that "Jesse (the person in charge of the Base protocol) is dancing a happy dance on Base."

On March 27, Max Branzburg, Vice President of Coinbase, posted on social media, “In the future, Coinbase will store more corporate and customer USDC balances on Base. This enables Coinbase to deliver lower fees and faster transactions. Settlement time management and protection of customer funds without impacting the Coinbase user experience. Coinbase is excited to continue moving operations on-chain and hopes other companies will follow Coinbase's lead."

With the entire Base ecosystem TVL As well as Coinbase's strong support for Base, the market is generally optimistic about the outcome of this case, believing that Coinbase will eventually win, and this is a catalyst for Base's narrative.

The above is the detailed content of US judge 'chooses side' SEC in Coinbase lawsuit, will it benefit Base ecology?. For more information, please follow other related articles on the PHP Chinese website!

Formal digital currency trading platform

Formal digital currency trading platform

Top ten digital currency exchanges

Top ten digital currency exchanges

What is cryptocurrency kol

What is cryptocurrency kol

The most promising coin in 2024

The most promising coin in 2024

Check out the top ten cryptocurrencies worth investing in

Check out the top ten cryptocurrencies worth investing in

What exchange is EDX?

What exchange is EDX?

How to define variables in golang

How to define variables in golang

The difference between a++ and ++a

The difference between a++ and ++a

Usage of MySQL datediff function

Usage of MySQL datediff function