web3.0

web3.0

TVL exceeds US$1.2 billion and receives investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

TVL exceeds US$1.2 billion and receives investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

TVL exceeds US$1.2 billion and receives investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

Analysis of the core advantages of StakeStone: non-custodial and transparent liquidity staking service ensures the safety of user funds

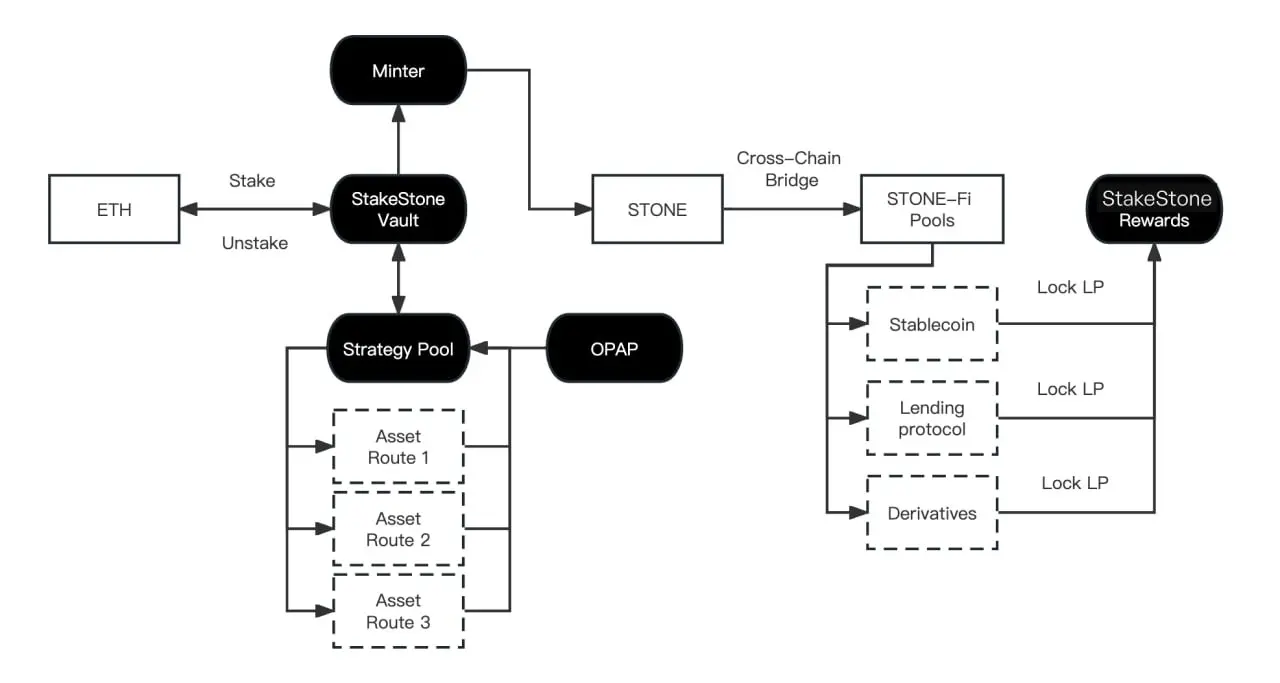

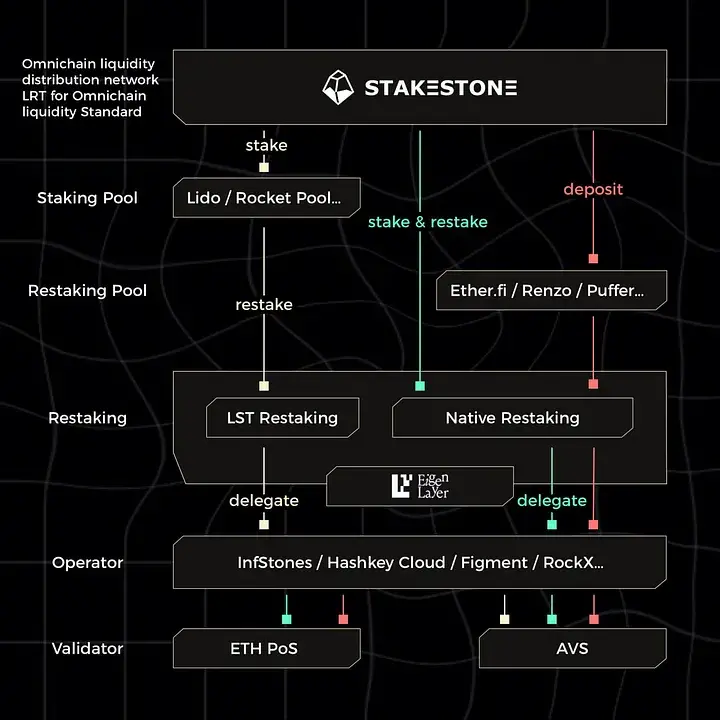

##StakeStone Aims to provide innovative liquidity staking solutions for the decentralized finance (DeFi) ecosystem. By introducing the concept of Yield-bearing ETH, StakeStone allows users to maintain the liquidity of their assets while enjoying staking benefits. Its cross-chain compatibility and automatic revenue optimization mechanism (OPAP) further enhance its application potential in multi-chain ecosystems, providing users with an efficient, flexible and revenue-maximizing staking platform. The core advantage of StakeStone lies in its innovative technical architecture and user-first design philosophy. By providing non-custodial and transparent liquidity staking services, StakeStone guarantees the security of user funds and transparency of earnings. Its STONE token based on LayerZero achieves cross-chain liquidity, allowing assets to circulate freely between different blockchain networks. This not only opens up broader market opportunities for users, but also simplifies the integration process for Layer2 developers. In terms of how it works, StakeStone allows users to pledge ETH or other supported assets into its protocol, and these assets are subsequently converted into corresponding yield-bearing ETH or other forms of LST. Represents the user's pledged assets and corresponding income rights. Through the OPAP mechanism, StakeStone can automatically adjust and optimize the allocation of underlying assets, respond to market changes and the performance of the pledge pool, and ensure that users obtain the best pledge returns. At the same time, the revenue distribution mechanism ensures that staking revenue (including transaction fees, governance rewards, etc.) is regularly distributed to STONE holders, whether through direct token distribution or increased STONE value.

The heavy staking strategy can fully improve the capital operation efficiency of StakeStone and allow users to obtain more staking opportunities

Take a look at the details of the StakeStone Carnival and see if there are any wealth opportunities of your own?

A series of processes seem to be going smoothly, but the subsequent development of StakeStone still needs to be carefully watched

The above is the detailed content of TVL exceeds US$1.2 billion and receives investment from Binance Oyi: Can StakeStone become a cross-chain rookie?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1392

1392

52

52

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

Recommended essential software for currency contract parties

Apr 21, 2025 pm 11:21 PM

The top ten cryptocurrency contract exchange platforms in 2025 are: 1. Binance Futures, 2. OKX Futures, 3. Gate.io, 4. Huobi Futures, 5. BitMEX, 6. Bybit, 7. Deribit, 8. Bitfinex, 9. CoinFLEX, 10. Phemex, these platforms are widely recognized for their high liquidity, diversified trading functions and strict security measures.

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

What is a quantum chain? What are the quantum chain transactions?

Apr 21, 2025 pm 11:51 PM

Quantum Chain (Qtum) is an open source decentralized smart contract platform and value transmission protocol. 1. Technical features: BIP-compatible POS smart contract platform, combining the advantages of Bitcoin and Ethereum, introduces off-chain factors and enhances the flexibility of consensus mechanisms. 2. Design principle: realize on-chain and off-chain data interaction through main control contracts, be compatible with different blockchain technologies, flexible consensus mechanisms, and consider industry compliance. 3. Team and Development: An international team led by Shuai Chu, 80% of the quantum coins are used in the community, and 20% rewards the team and investors. Quantum chains are traded on Binance, Gate.io, OKX, Bithumb and Matcha exchanges.

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

Recommend several apps to buy mainstream coins in 2025 latest release

Apr 21, 2025 pm 11:54 PM

APP software that can purchase mainstream coins includes: 1. Binance, the world's leading, large transaction volume and fast speed; 2. OKX, innovative products, low fees, high security; 3. Gate.io, a variety of assets and trading options, focusing on security; 4. Huobi (HTX), low fees, good user experience; 5. Coinbase, suitable for novices, high security; 6. Kraken, safe and compliant, providing a variety of services; 7. KuCoin, low fees, suitable for professional traders; 8. Gemini, emphasizes compliance, and provides custodial services; 9. Crypto.com, providing a variety of offers and services; 10. Bitstamp, an old exchange, strong liquidity,

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

Ranking of leveraged exchanges in the currency circle The latest recommendations of the top ten leveraged exchanges in the currency circle

Apr 21, 2025 pm 11:24 PM

The platforms that have outstanding performance in leveraged trading, security and user experience in 2025 are: 1. OKX, suitable for high-frequency traders, providing up to 100 times leverage; 2. Binance, suitable for multi-currency traders around the world, providing 125 times high leverage; 3. Gate.io, suitable for professional derivatives players, providing 100 times leverage; 4. Bitget, suitable for novices and social traders, providing up to 100 times leverage; 5. Kraken, suitable for steady investors, providing 5 times leverage; 6. Bybit, suitable for altcoin explorers, providing 20 times leverage; 7. KuCoin, suitable for low-cost traders, providing 10 times leverage; 8. Bitfinex, suitable for senior play

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

How to trade quantum chains

Apr 21, 2025 pm 11:42 PM

The quantum chain (Qtum) transaction process includes three stages: preliminary preparation, purchase and sale. 1. Preparation: Select a compliant exchange, register an account, perform identity verification, and set up a wallet. 2. Purchase quantum chains: recharge funds, find trading pairs, place orders (market orders or limit orders), and confirm transactions. 3. Sell quantum chains: Enter the trading page, select the trading pair and order type (market order or limit order), confirm the transaction and withdraw cash.

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

What does cross-chain transaction mean? What are the cross-chain transactions?

Apr 21, 2025 pm 11:39 PM

Exchanges that support cross-chain transactions: 1. Binance, 2. Uniswap, 3. SushiSwap, 4. Curve Finance, 5. Thorchain, 6. 1inch Exchange, 7. DLN Trade, these platforms support multi-chain asset transactions through various technologies.

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum Chain Exchange Ranking Top 10 Recommended (Updated in 2025)

Apr 21, 2025 pm 11:48 PM

Quantum chains can be traded on the following exchanges: 1. Binance: One of the world's largest exchanges, with large trading volume, rich currency and high security. 2. Sesame Open Door (Gate.io): a large exchange, providing a variety of digital currency transactions, with good trading depth. 3. Ouyi (OKX): operated by OK Group, with strong comprehensive strength, large transaction volume, and complete safety measures. 4. Bitget: Fast development, provides quantum chain transactions, and improves security. 5. Bithumb: operated in Japan, supports transactions of multiple mainstream virtual currencies, and is safe and reliable. 6. Matcha Exchange: a well-known exchange with a friendly interface and supports quantum chain trading. 7. Huobi: a large exchange that provides quantum chain trading,

What are the quantum chain trading platforms?

Apr 21, 2025 pm 11:45 PM

What are the quantum chain trading platforms?

Apr 21, 2025 pm 11:45 PM

Platforms that support Qtum trading are: 1. Binance, 2. OKX Ouyi, 3. Huobi, 4. Gate.io Sesame Open Door, 5. Siren, 6. Coinku, 7. Bit stamp, 8. Coinku, 9. Bybit, 10. Gemini, these platforms have their own characteristics and advantages.