web3.0

web3.0

TVL exceeded US$1.2 billion and received investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

TVL exceeded US$1.2 billion and received investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

TVL exceeded US$1.2 billion and received investment from Binance Oyi: Can StakeStone become a cross-chain rookie?

Recently, the StakeStone project has attracted attention in the blockchain circle due to its investment from Binance Labs and OKX Ventures. StakeStone is not only committed to making its STONE token the new standard for cross-chain liquid assets, but also building a new application-layer liquidity market. In this market, its full-chain LST protocol TVL (total locked value) exceeded US$1 billion on February 26, and reached an astonishing US$1.2 billion on March 26.

As a member of the liquidity provider, StakeStone’s application in DeFi and Ethereum Layer 2 solutions is particularly critical. Compared with projects such as Lido and Rocket Pool in similar arenas, StakeStone provides users with a wider range of application scenarios and revenue opportunities through its cross-chain liquidity market and innovative OPAP mechanism, demonstrating its unique market positioning.

Next, we will explore in depth StakeStone’s technical architecture and how it stands out in the highly competitive liquidity staking market.

Analysis of StakeStone’s core advantages: non-custodial and transparent liquidity staking services ensure the security of user funds

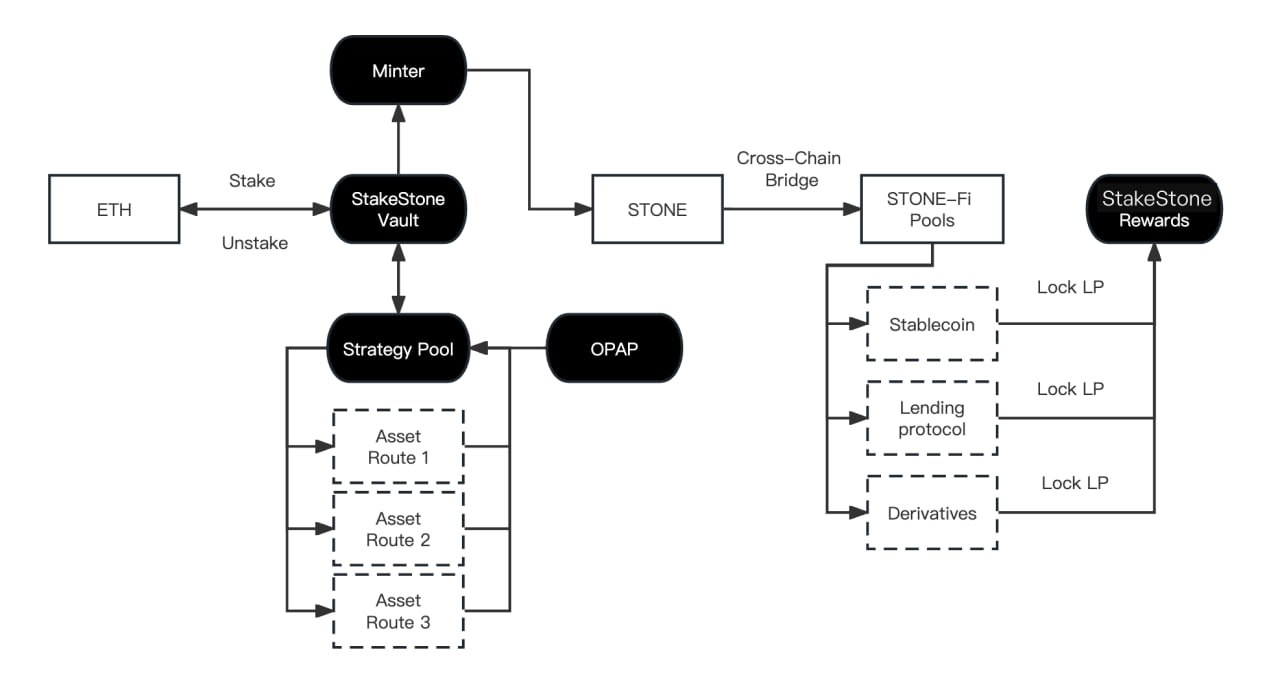

StakeStone is committed to providing innovative liquidity staking solutions for the DeFi ecosystem. By introducing the concept of Yield-bearing ETH, users are allowed to maintain the liquidity of their assets while enjoying staking benefits. Its cross-chain compatibility and automatic revenue optimization mechanism (OPAP) further enhance its application potential in multi-chain ecosystems, providing users with an efficient, flexible and revenue-maximizing staking platform.

StakeStone’s core advantage lies in its innovative technical architecture and user-first design concept. By providing non-custodial and transparent liquidity staking services, StakeStone guarantees the security of user funds and transparency of earnings. Its STONE token based on LayerZero achieves cross-chain liquidity, allowing assets to circulate freely between different blockchain networks. This not only opens up broader market opportunities for users, but also simplifies the integration process for Layer2 developers.

According to the operating principle, StakeStone allows users to pledge ETH or other supported assets into its protocol, and these assets are subsequently converted into corresponding Yield-bearing ETH or other forms of LST, representing the user’s pledge. assets and corresponding income rights. Through the OPAP mechanism, StakeStone can automatically adjust and optimize the allocation of underlying assets, respond to market changes and the performance of the pledge pool, and ensure that users obtain the best pledge returns. At the same time, the revenue distribution mechanism ensures that staking revenue (including transaction fees, governance rewards, etc.) is regularly distributed to STONE holders, whether through direct token distribution or increased STONE value.

Through its innovative solutions and technical advantages, StakeStone not only solves the problem of loss of asset liquidity when pledging crypto assets, but also provides efficient cross-chain asset management. The solution effectively promotes the development of DeFi and cross-chain liquidity.

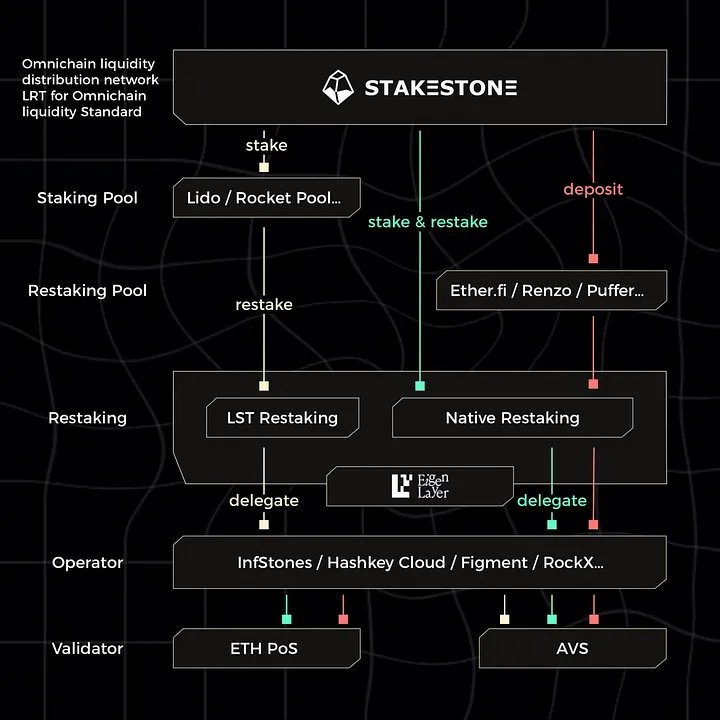

The heavy pledge strategy can fully improve StakeStone's capital operation efficiency and allow users to obtain more pledge opportunities

StakeStone is innovating the field of crypto asset pledges by introducing EigenLayer heavy pledge technology, with the goal of improving Capital efficiency and security across the entire ecosystem. By implementing solutions including LST re-staking, Beacon chain re-staking and LRT integration, StakeStone aims to provide its users and partners with a secure and efficient re-staking platform. The development of this strategy benefits from the cooperation with InfStones, which provides professional node operation services to StakeStone, while Cobo's advanced security technology provides a solid guarantee for the stability of the entire system. In addition, the underlying assets updated through the OPAP mechanism, combined with the community voting function, not only enhance the transparency of the project, but also promote community participation and governance.

The core of the heavy pledge strategy lies in its great improvement in capital efficiency. By allowing assets to participate in more staking opportunities while maintaining their original staking returns, StakeStone effectively solves the problem of limited asset liquidity in the traditional staking model. In addition, the strategy also automates the re-staking process through smart contracts, ensuring the security and efficiency of the process. For the redistribution of ETH, this strategy adopts a gradual approach to alleviate the impact of the initial cold start period on the speed of reward acquisition. The distribution mechanism of heavy staking rewards focuses on fairness, and through the EigenLayer points accumulation and distribution strategy, it ensures that participants can receive reasonable returns for their efforts.

However, the heavy-staking strategy also brings some challenges, especially in the withdrawal mechanism. Due to the technical and process complexity involved, withdrawal request processing times may be extended, especially during times of high pressure on the system. In order to deal with this problem, StakeStone is developing more flexible and efficient solutions to reduce withdrawal waiting times while ensuring the liquidity and stability of the entire system.

Through these innovative measures, StakeStone not only improves the capital efficiency of pledged assets, but also brings a new development direction to the crypto asset pledge field. As technology continues to improve and community participation deepens, StakeStone is expected to play a greater role in promoting crypto-asset liquidity and staking revenue optimization.

Take a look at the details of the StakeStone Carnival and see if there are any wealth opportunities of your own?

StakeStone announced the launch of the full-chain carnival series of events, aiming to promote community participation by rewarding more than 6.5% of the total supply. The activity is divided into several stages. The first wave of the activity lasts for four days and provides an additional 15% reward to early account activators.

The above is the detailed content of TVL exceeded US$1.2 billion and received investment from Binance Oyi: Can StakeStone become a cross-chain rookie?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

Top 10 popular web3 digital currency trading software download app

Mar 31, 2025 pm 08:00 PM

This article provides download methods for the top ten popular Web3 digital currency trading software APPs, including OKX, Binance, Gate.io, Coinbase, Huobi (now HTX), KuCoin, Kraken, Bitget, MEXC and Bybit. Users can search for download links by visiting the official websites of each platform, or search for platform names in mainstream application stores to download and install. The article introduces the download methods of each APP in detail, so that users can quickly and conveniently find the appropriate download method. Download the Web3 trading software you need now and start your digital currency investment journey!

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.