US$15 billion options delivery is imminent, is big volatility coming?

Crypto markets rebounded slightly on Thursday, with Bitcoin climbing from an intraday low of $68,855 in the early morning hours to a high of $71,635 in the afternoon, but has since retreated and stabilized around $70,000 ahead of major options expiration on Friday. .

In terms of altcoins, Dogecoin (DOGE) surged nearly 20%, and the current trading price exceeded $0.22 for the first time since December 14, 2021. Bitcoin Cash (BCH) is expected to drop on April 4. It was up 13% before the event.

U.S. stocks continued to rise, with the S&P 500 index rising late in the session. Investors focused on the U.S. personal consumption expenditures (PCE) report. Although inflation is expected to rise slightly, due to the U.S. market The impact on the stock market will be delayed as markets are closed on Good Friday. As of the close, the S&P Index and the Dow Jones Index rose 0.11% and 0.12% respectively, while the Nasdaq fell 0.12%.

$15 Billion Options Set for Delivery

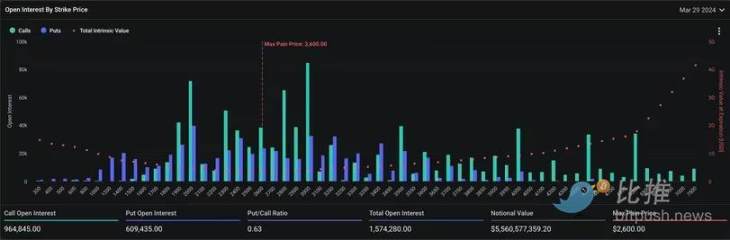

At 8am GMT on Friday, crypto exchange Deribit was valued at $15.2 billion in contract quarters, with Bitcoin options at $9.5 billion, Accounting for 62% of the total notional open interest to be settled, the remainder is Ethereum options.

Data from Deribit shows that this $15 billion expiration is the largest in the history of the exchange and will eliminate Bitcoin and Ethereum. 40% and 43% of total notional open interest.

Open Interest is the dollar value of the number of active contracts at a given time. On Deribit, one options contract represents 1 BTC and 1 ETH. The exchange holds over 85% of the global crypto options market. A call option is a financial contract that gives the buyer the right, but not the obligation, to purchase an asset at a later date at a preset price. A put option gives the seller the right, but not the obligation, to sell.

Markets fear of volatility

Deribit Chief Commercial Officer Luuk Strijers said that a large number of options will expire in the money (ITM), which may bring upward pressure or volatility to the market.

An in-the-money call option (ITM) expires with a strike price below the prevailing market interest rate on the underlying asset. Upon expiration, an ITM call option gives the buyer the right to purchase 1 BTC at a strike price (below the spot market price), thereby generating a profit. An in-the-money put option has a strike price that is higher than the prevailing market interest rate on the underlying asset.

At a market price of about $70,000, $3.9 billion worth of Bitcoin options are set to expire in-the-money, accounting for 41% of the $9.5 billion in total quarterly open interest pending settlement. Likewise, 15% of ETH’s total quarterly open interest of $5.7 billion will expire in-the-money.

#Strijers explained: “These levels are higher than usual, which can also be seen in the lower maximum pain point levels, due of course to the recent price increases. Higher "High levels of ITM expiration could result in potential upward pressure or volatility."

The biggest pain points for BTC and ETH’s quarterly expiration are $50,000 and $2,600 respectively. The biggest pain point is that option buyers lose the most money. The theory is that option sellers (sellers), usually institutions or traders with sufficient capital supplies, want to fix the price near the greatest pain point to cause the maximum loss to the option buyer.

During the last bull run, Bitcoin and Ethereum had been pulling back in the direction of their respective biggest pain points, but resumed their gains after expiration.

Strijers said similar dynamics may be at play, saying: "The market may face upward pressure as expiration removes the biggest pain points lower down the market."

Trading Hedging activities by traders or market makers will increase

David Brickell, head of international distribution at Toronto-based cryptocurrency platform FRNT Financial, said hedging activities by traders or market makers may increase volatility.

David Brickell said in a report: "However, the biggest impact came from market makers' Gamma positions in the activity. Traders were short about $50 million in Gamma, with the majority concentrated at $70,000 The strike price around $70,000. The Gamma position will get larger as expiration approaches, and the forced hedging will increase volatility around $70,000, resulting in some wild moves on both sides of that level."

Gamma measures the change in Delta and measures the sensitivity of the option to changes in the underlying asset price. In other words, Gamma shows the amount of delta hedging a market maker would need to do to keep their net exposure neutral when prices move. Market makers must maintain market-neutral exposures while creating liquidity in the order book and profiting from the bid-ask spread.

When market makers short Gamma or hold a short options position, they buy high and sell low to hedge their books, causing market volatility.

$69,000 support is most critical

Some traders are warning that if Bitcoin falls below the $69,000 level in the coming days, the entire market will correct further.

Старший рыночный аналитик FxPro Алекс Купцикевич заявил в своем отчете: «В краткосрочной перспективе трейдеры будут сосредоточены на том, сможет ли Биткойн повторно протестировать внутридневной минимум вторника около $69 500. Падение ниже этого уровня может сигнализировать о том, что это приведет к более длительным корректировкам».

Криптоаналитик Брюс Пауэрс считает, что в течение последних четырех дней Биткойн находился под давлением вблизи уровня сопротивления 78,6% уровня коррекции Фибоначчи, столкнувшись с сопротивлением на отметке 71 790 пунктов. В течение последних нескольких дней торговля оставалась выше 20-дневной скользящей средней. Восходящий тренд остается неизменным, но медвежья дивергенция RSI предполагает, что откат, возможно, продолжится. Решительный отскок выше максимума этой недели на отметке 71 290 вызовет бычье продолжение восходящего тренда с первоначальной новой максимальной целью около 77 660, целью, определяемой двумя уровнями Фибоначчи.

The above is the detailed content of US$15 billion options delivery is imminent, is big volatility coming?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1377

1377

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them