Recently, due to the emergence of BOME, Solana has set off a wave of hype. In 27 pre-sales, more than 655,000 SOL were raised, and the activity on the chain increased sharply. .

Source: https://analytics.step.finance

Despite the hot weather these days, market sentiment has declined, and most Meme has entered a high The state of opening low and moving is mostly a wave situation. There are very few stocks that can really outperform.

Despite this, the development of Solana cannot be ignored. Some people even compare the development of this BTC ecosystem and Solana ecosystem with the ecological development of the previous round of ETH and BSC (there is a premise here, that is, the current It is still in the bull market stage, and the market as a whole will continue to rise). So, today, we will briefly take stock of the Solana ecosystem.

Before taking stock of the ecosystem, we need to briefly analyze why the Solana ecosystem is so popular?

Internal reasons:

I have excellent performance, low cost, low latency and high throughput. When large traffic comes in, I can handle it. The essence of finance is trading, and the real craze in the crypto market is all related to trading. Solana, as a platform, is constantly improving its speed and fluency technically.

2) Solana itself performed well in this round, from a low of $8 to a high of $210, and its short-term market value broke to fourth. The rise of Solana allows holders to reap dividends, and naturally some resources will flow to the ecosystem.

3) When the overall market heats up, the Solana ecology has not fallen behind, and both have performed well. Representative projects have been produced in both the Inscription craze and the Meme craze.

4) There is constant hot money on the chain. After Solana’s copycats came out, there are many companies with market values exceeding 10 million and 100 million. On the Ethereum side, the involution is severe, and some of them have good concepts. , but the market value has stretched upwards, and it is difficult to even reach 10 million. If Solana's chain is compared to simple mode, then Ethereum's side is hell mode.

External reasons:

As the most active chain on the chain, Ethereum has recently completed the Cancun upgrade, but there has been no improvement to the main chain. And because the market has improved recently, the more expensive Ethereum is, the higher the transaction costs on the chain are, making it prohibitive. The handling fee for a transaction ranges from tens to hundreds of dollars. Every time, 20% of the funds are gone, causing everyone to turn to other chains, and the one who benefits the most is Solana.

Recently, the community has also been wildly circulating emoticons about Ethereum, which shows everyone’s disappointment in Ethereum.

Solana is so popular now. I believe that at this point, the market cannot end like this. Let’s take stock of which projects in the Solana ecosystem are worthy of attention. Screening criteria: There is a certain degree of popularity, or it is used a lot, and this industry likes to speculate on the new rather than the old. The last round of bull-bear projects will be skipped.

The Meme track is an important track in this round of market. Some people think that this round of market is due to lack of innovation, so they turn to simple and crude Meme. In this round of the market, the Meme market has experienced at least three waves of popularity. Pepe has brought about one wave, BRC20 has brought about another wave, and SOL ecology has brought about another wave.

Although the popularity of Memes in the SOL ecosystem has dropped recently and is already in a state of being in a state of turmoil, but so far, the Memes of the SOL ecosystem have gone through two waves, such as Pepe and BRC20, so the Memes in the SOL ecosystem are still worthy of attention. As for how to operate, please do your own research.

1) WIF

At the end of 2019, some KOLs started adding various logos and images to woolen hats and used these images as their profiles on Twitter. Dogwifhat, on the other hand, puts a woolen hat on the dog. The image of the Dogwifhat was born under this circumstance. The process of issuing Tokens by WIF, the Dogwifhat, was silent. The market price shows that WIF was issued at US$0.00016 on November 20, 2023. Prices opened, but the first official tweet was on December 29th. The emergence of WIF and its current market value can be said to be in a tepid state. When everyone paid attention to it, it had already risen.

2) Bonk

Bonk is the first native dog project in the Solana ecosystem. Officials conducted a large-scale Airdrop event on December 25, 2022, 50% of which was distributed to Solana community members, including holders of projects such as LamportDAO, Famous Fox Federation, etc. This event aims to promote community interaction and rewards Participants, the purpose is to oppose "Alameda"-style token economics and restore confidence in the Solana ecosystem and SOL holders after the FTX incident.

3)Bome

Artist Darkfarms launched a pre-sale event on March 13. Users can participate by sending SOL to the designated Solana address. Token distribution is determined based on the proportion of donated SOL. After raising 10,131 SOL, Darkfarms added all SOL to the liquidity pool, which aroused heated discussion in the market. In just three days, the market value soared from 4 million to 100 million, and was listed on BN, setting off a chain reaction in a short time. On the craze.

4) Slerf

During the craze, SLERF was also one of them, but due to a mistake by the founder of SLERF, 54583 SOL LP and Airdrop reserved tokens were destroyed because no one had it. Token, SLERF is completely out of the control of the project party, completely decentralized, forming a new Meme concept, and is highly sought after by market users. Recently, officials are raising funds to compensate for the losses of users who participated in the interaction before. Although many CEXs have also launched donation activities, most of them are just to gain popularity without substantial spending. The current donation activities are not ideal.

Analogous to the explosion of BRC20 some time ago, to the recent Bitcoin ecological infrastructure, institutions have begun to invest in the Bitcoin ecosystem. The popularity of Solana Meme will eventually extend to the entire Solana on infrastructure.

1) Jupiter (dex)

Jupiter is an aggregated DEX on Solana. Its goal is to continuously optimize and update to enhance users’ trading experience and provide users with the best exchange rate. It achieves this goal by integrating major liquidity markets on Solana, such as Orca, Raydium, Serum, etc.

Jupiter launches its own native Token JUP and distributes Tokens to community members through Airdrop and Token sales. Among them, 40% of JUP Tokens will be distributed to approximately 955,000 qualified users in the Jupiter Exchange community via Airdrop. Another 20% will be distributed through token sales, and the remaining 40% will be reserved for internal personnel and strategic reserves.

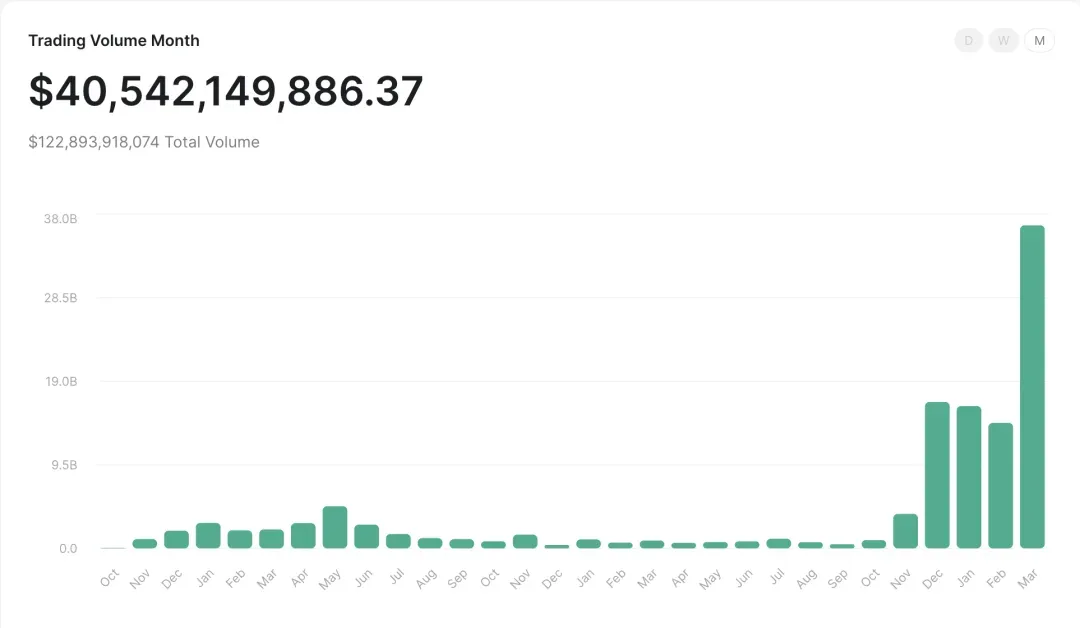

As of March 24, Jupiter’s total transaction volume exceeded US$120 billion, accounting for over 80% of Solana DEX’s organic transaction volume, making it the preferred platform for transactions on Solana.

https://station.jup.ag

2) Pyth Network (Oracle)

Pyth Network is the oracle on Solana. Pyth Network obtains financial market data by connecting more than 350 information sources (including major CEX/DEX and market makers such as BN, OKX, Bybit, etc.) and transmits these data to 45 blockchains to provide users with real-time Market prices and financial data.

In addition, Pyth Network supports more than 230 applications, including DEX, borrowing protocols, and derivatives platforms. Its infrastructure can achieve more than 65 million updates per day, improving the accuracy and security of smart contract operations.

Pyth Network has conducted three rounds of financing in total, with investment institutions including Delphi digital, KuCoin Labs, etc., and has also received 40,000 OP grants from the OP Foundation. Among them, members of the Pyth Data Association include heavyweight institutions on Wall Street, such as Jump, SBF’s old owner Jane Street Capital, SIG and market maker Virtu Financial.

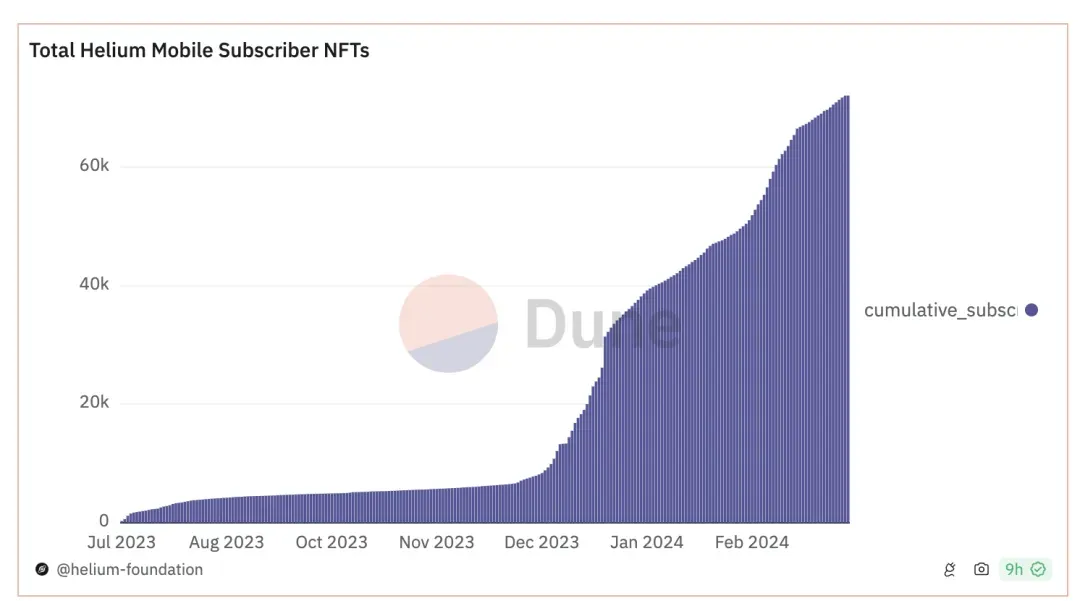

3) Helium Mobile (Depin)

Helium Mobile is a decentralized 5G operator. Helium Mobile uses Token Mobile incentives to encourage individuals to purchase devices similar to routing hotspots (Hostpot ), and deploy these hotspots in various indoor and outdoor environments to establish a decentralized wireless network. Through this model, costs can be reduced, coverage expanded, and user fees reduced.

To put it simply, it is similar to digging kuang. You first pay 20 US dollars per month to purchase the service, and then receive Token rewards while providing map data every day.

Currently, the number of Helium Mobile users has exceeded 70k.

4) iot.net (Depin AI)

io.net is a cloud computing project that provides a decentralized GPU network designed to solve the AI computing shortage problem, aiming to provide users with high-performance, cost-effective computing capabilities and simplify the management and utilization of GPU resources.

io.net leverages GPU resources around the world, which can be deployed and utilized with simple clicks. It provides high-performance computing capabilities that can be used to build distributed GPU networks, conduct inference and model serving workflows, and supports distributed computing libraries to orchestrate and batch training jobs.

In addition, io.net also supports the deployment of clusters on decentralized physical infrastructure networks and provides fast and secure Solana on-chain payments. The platform also provides a fair pricing mechanism and the ability to convert GPUs into revenue, allowing users to rent out their GPU resources and earn revenue.

In March this year, io.net announced the completion of a $30 million Series A financing, with participation from Solana Labs, Mult1C0in Capital, Animoca Brands and other institutions.

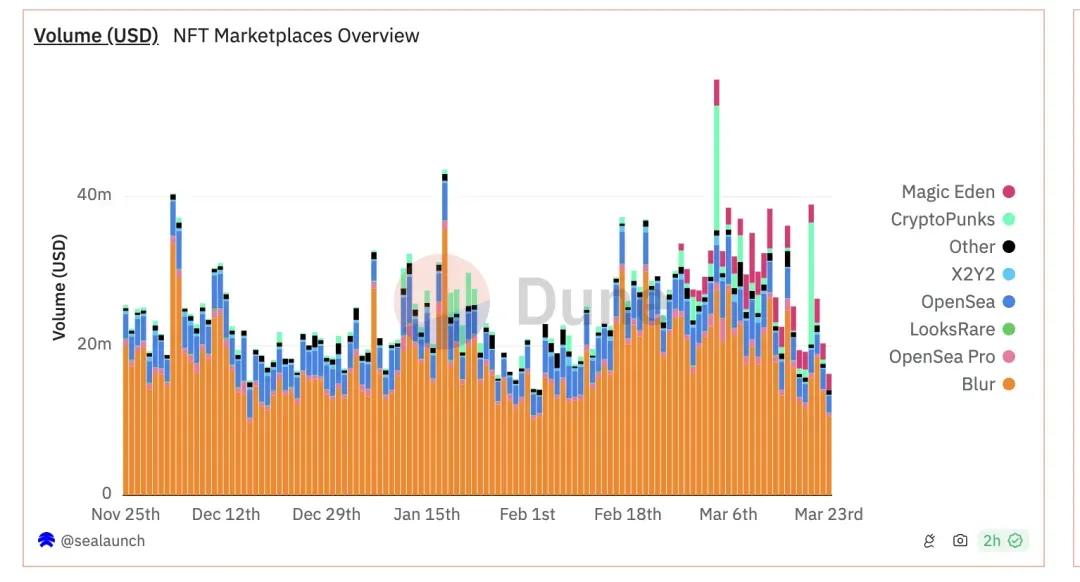

5) Magic Eden (NFT Market)

Magic Eden is the largest NFT market on Solana. It currently supports the NFT market of four chains: Solana, Bitcoin, Ethereum, and Polygon. As an early supporter of Bitcoin NFT, Magic Eden received a wave of market dividends during the explosion of the Bitcoin ecosystem last year.

Magic Eden 推出了“奖励计划”,用户参与市场交易可以获得钻石奖励,后续发Token应该会与钻石挂钩。另外,Magic Eden 也在近期推出了自己钱包。

MagicEden 完成三轮融资,总融资额超 1.7 亿美金,投资机构包括 Coinbase、红杉资本、Polygon Ventures、Paradigm 等。

NFT市场交易量占比,来源:https://dune.com

6)Backpack生态

Backpack是由Solana开发框架Anchor的开发商Coral团队打造的一个CEX/DEX和多链钱包。项目由前FTX高管发起,并且得益于与FTX高管的关系,该平台获得了迪拜虚拟资产监管局(VARA)颁发的许可证,允许公司向迪拜的合格投资者和机构客户提供加密服务。目前,BackPack 共推出了三款产品,分别为 Backpack CEX、Backpack 钱包以及 MadLads NFT 项目。

其中 Mad Lads 是一个带有可执行程式脚本的NFT,由团队2023年4月发布,当时以6.9 SOL销售,而目前已经成为了SOL生态的NFT龙头,该NFT可以比作金铲子,已经获得好几波Airdrop。

Backpack完成2轮融资,总金额3700万美金,投资机构有FTX、Jump Crypto、Amber Group、Wintermute以及Solana 创始人等。

7)Solana Mobile Saga

Solana 首款手机 Saga 因为可以免费获得Airdrop的赋能,让第一波吃螃蟹的人赚的盆满钵满。官方开发团队 Solana Mobile 计划在25 年上半年推出第二代加密手机,2023年底开始预售,预售分为三个阶段,一次比一次贵,第一阶段价格为450美金,第二阶段价格为500美金,截止目前,已售出11万8千台,早期参与者已获得价值100刀左右的Airdrop。

The above is the detailed content of Can Solana, with its ecological explosion, disrupt Ethereum?. For more information, please follow other related articles on the PHP Chinese website!