What is ASI Coin? ASI currency market analysis

What is ASI? Will ASI become a big hit? I believe everyone knows that the AI sector is very popular. Yesterday, unexpected news appeared in the AI sector. Three AI projects were merged into ASI. Will the ASI coin become popular? Is ASI worth holding for the long term? What is the future of ASI? Below, please learn more about it with the editor of this site!

What is ASI coin?

Yesterday, three companies that have been developing the AI sector for many years, Fetch.ai, SingularityNET and Ocean Protocol, announced that they will create a decentralized artificial intelligence alliance and use their tokens $FET, $AGIX, $ OCEAN merged into $ASI.

Previously, as three AI projects that have been listed on the Binance trading platform, $FET, $AGIX, and $OCEAN have become important targets for market investment in the field of AI. Affected by the news, SingularityNET (AGIX) briefly rose by 12.56%, Fetch.ai (FET) rose by 14.7% in 24 hours; Ocean Protocol (OCEAN) rose by as much as 35% in a short period of time.

There may be room for arbitrage in token conversion

For such "Big News", the community's first and most concern is how to convert the original tokens held by investors?

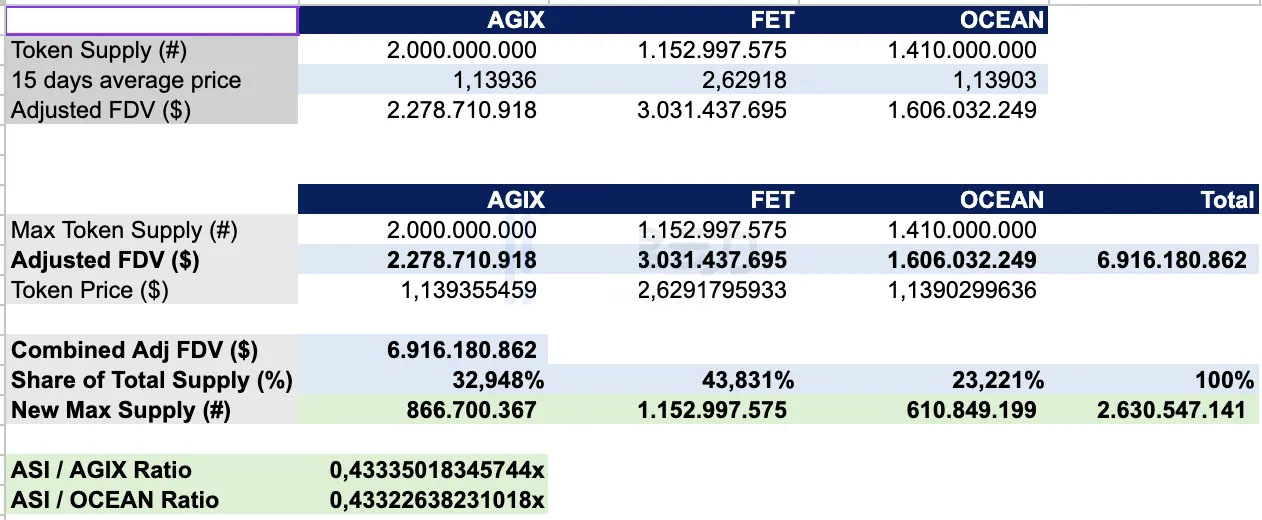

According to reports, Fetch.ai’s token $FET will be converted into $ASI at a ratio of 1:1, and SingularityNET’s $AGIX and Ocean Protocol’s $OCEAN will be converted into $ASI at a ratio of approximately 1:0.433.

$FET, as the basic token of the alliance, will be directly renamed to $ASI, and an additional 1.48 billion tokens will be minted, of which 867 million $ASI will be allocated to $AGIX holders and 611 million $ASI will be allocated to $OCEAN token holders. The total supply of $ASI tokens will be 2.63 billion tokens, and based on today’s price estimates on March 26, $ASI’s total FDV will be $7.6 billion.

Since the exchange ratio remains unchanged, there will be a price difference in the final converted $ASI based on the different prices of the three tokens. As a result, the community took note of the arbitrage potential here. Multiply the $FET price by 0.433 and $AGIX and $OCEAN are a buy if the price is below the resulting number and a sell if above.

Currently, three projects are cooperating with centralized trading platforms. Users holding these three tokens on centralized trading platforms do not need to perform any operations.

What are the expectations after the merger?

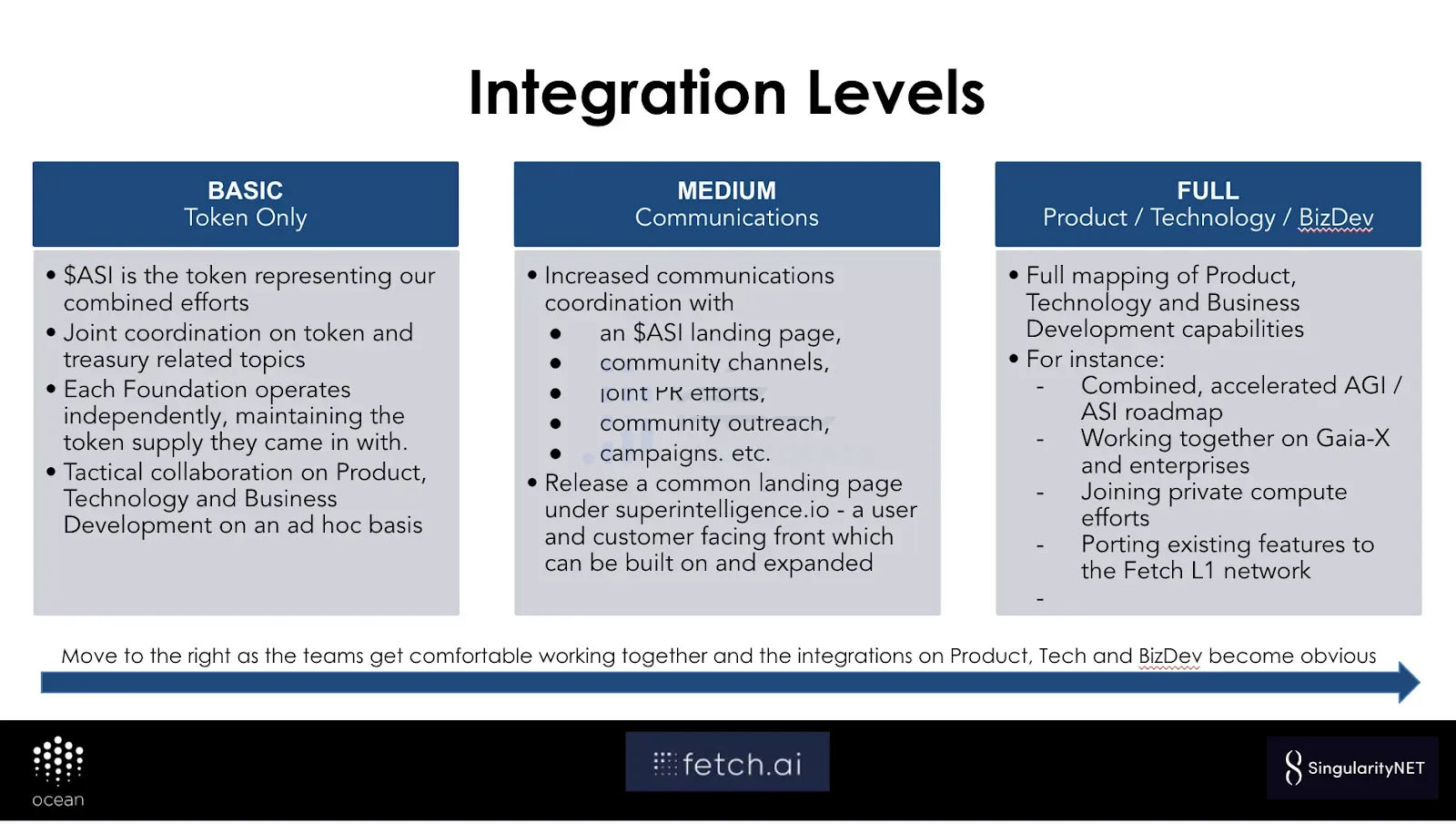

After the merger of the three projects, a team called Superintelligence Collective will be established, and the CEO will be Ben Goertzel, founder of SingularityNET. Fetch.ai, Ocean Protocol Foundation and SingularityNET Foundation will continue to operate as independent entities but will work closely together in the operations of the shared ASI token ecosystem and the Superintelligence Collective.

In the merger announcement issued by the three teams, they did not introduce much about the new businesses that will be launched after the merger. According to Ben Goertzel on his social platform, after the merger, the future work direction will focus on AGI and ASI, which is why the merged token is named ASI.

As of the time of writing, Fetch.AI has a market value of US$3.246 billion, ranking third in the AI sector, second only to Render Networ ($RNDR) and Bittensor ($TAO ). SingularityNET has a market capitalization of $1.628 billion and Ocean Protocol has a market capitalization of $804 million. If the merger is successful, ASI's market value will exceed US$7 billion in the future, making it one of the top 25 projects in the encryption field and the AI sector project with the highest market value.

Prior to this, Fetch.ai already had relatively mature experience in AI agents. On February 20, Deutsche Telekom announced a cooperation with the Fetch.ai Foundation and became Fetch.ai’s first corporate ally. At the same time, Deutsche Telekom subsidiary MMS will also serve as a Fetch.ai verifier. Fetch also announced the launch of a $100 million infrastructure investment project "Fetch Compute" earlier this month, which will deploy Nvidia H200, H100 and A100 GPUs to create a platform for developers and users to leverage computing power.

Ocean Prtocol has built many module services in decentralized data sharing, access control and payment. According to reports, its Predictoor product has sold more than $800 million in six months since its launch.

SingularityNET was the one that explored the most AGI direction among the three projects before the merger. Its AGI team and partners TrueAGI and the OpenCog community have been focusing on developing the AGI framework OpenCog Hyperon since 2020. SingularityNET will also launch this year Launching a decentralized artificial intelligence platform with the purpose of creating a basic environment suitable for running AGI systems.

It is worth mentioning that this is not the first time that powerful projects have merged in the crypto field. During the 2020 DeFi Summer, Yearn.finance founder Andre Cronje (AC) launched a series of acquisitions and mergers , but in the end its DeFi empire failed to materialize as expected.

The above is the detailed content of What is ASI Coin? ASI currency market analysis. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

What are the free market viewing software websites? Ranking of the top ten free market viewing software in the currency circle

Apr 22, 2025 am 10:57 AM

The top three top ten free market viewing software in the currency circle are OKX, Binance and gate.io. 1. OKX provides a simple interface and real-time data, supporting a variety of charts and market analysis. 2. Binance has powerful functions, accurate data, and is suitable for all kinds of traders. 3. gate.io is known for its stability and comprehensiveness, and is suitable for long-term and short-term investors.

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

Reliable and easy-to-use virtual currency exchange app recommendations The latest ranking of the top ten exchanges in the currency circle

Apr 22, 2025 pm 01:21 PM

The reliable and easy-to-use virtual currency exchange apps are: 1. Binance, 2. OKX, 3. Gate.io, 4. Coinbase, 5. Kraken, 6. Huobi Global, 7. Bitfinex, 8. KuCoin, 9. Bittrex, 10. Poloniex. These platforms were selected as the best for their transaction volume, user experience and security, and all offer registration, verification, deposit, withdrawal and transaction operations.

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

Top 10 Digital Virtual Currency Apps Rankings: Top 10 Digital Currency Exchanges in Currency Circle Trading

Apr 22, 2025 pm 03:00 PM

The top ten digital virtual currency apps are: 1. OKX, 2. Binance, 3. gate.io, 4. Coinbase, 5. Kraken, 6. Huobi, 7. KuCoin, 8. Bitfinex, 9. Bitstamp, 10. Poloniex. These exchanges are selected based on factors such as transaction volume, user experience and security, and all provide a variety of digital currency trading services and an efficient trading experience.

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

What are the digital currency trading platforms in 2025? The latest rankings of the top ten digital currency apps

Apr 22, 2025 pm 03:09 PM

Recommended apps for the top ten virtual currency viewing platforms: 1. OKX, 2. Binance, 3. Gate.io, 4. Huobi, 5. Coinbase, 6. Kraken, 7. Bitfinex, 8. KuCoin, 9. Bybit, 10. Bitstamp, these platforms provide real-time market trends, technical analysis tools and user-friendly interfaces to help investors make effective market analysis and trading decisions.

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Top 10 digital currency exchange app recommendations, top ten virtual currency exchanges in the currency circle

Apr 22, 2025 pm 03:03 PM

Recommended apps on top ten digital currency exchanges: 1. OKX, 2. Binance, 3. gate.io, 4. Huobi, 5. Coinbase, 6. KuCoin, 7. Kraken, 8. Bitfinex, 9. Bybit, 10. Bitstamp, these apps provide real-time market trends, technical analysis and price reminders to help users monitor market dynamics in real time and make informed investment decisions.

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

gate.io sesame door latest official app address

Apr 22, 2025 pm 01:03 PM

The official Gate.io APP can be downloaded in the following ways: 1. Visit the official website gate.io to download; 2. Search "Gate.io" on the App Store or Google Play to download. Be sure to download it through the official channel to ensure safety.

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

A list of top ten virtual currency trading platforms that support multiple currencies

Apr 22, 2025 am 08:15 AM

Priority is given to compliant platforms such as OKX and Coinbase, enabling multi-factor verification, and asset self-custody can reduce dependencies: 1. Select an exchange with a regulated license; 2. Turn on the whitelist of 2FA and withdrawals; 3. Use a hardware wallet or a platform that supports self-custody.

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Top 10 virtual currency trading platforms with the lowest handling fee

Apr 22, 2025 am 08:30 AM

Binance spot trading fee is 0.1%, and holding BNB can be reduced to 0.025%; OKX rate is 0.1%-0.2%, with a minimum of 0.02%; Gate.io rate is 0.2%, with a minimum of 0.10%; FTX rate is 0.02%-0.05%, but has filed for bankruptcy; Coinbase Pro rate is as low as 0.05%, ordinary users; Kraken rate is 0.16%-0.26%, with a minimum of 0.10%; Bitfinex rate is 0.1%-0.2%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%; Bithumb rate is 0.15%, with a minimum of 0.02%; Huobi rate is 0.2%, with a minimum of 0.02%; KuCoin rate is 0.1%, with a minimum of 0.02%;