web3.0

web3.0

ENA's market value exceeds US$1 billion, but some people worry that it is creating the next black swan

ENA's market value exceeds US$1 billion, but some people worry that it is creating the next black swan

ENA's market value exceeds US$1 billion, but some people worry that it is creating the next black swan

Perhaps the hottest thing in the DeFi field yesterday was the Ethena airdrop. After the airdrop token application was opened, Binance’s financial management, flash swap, leverage, and contracts were launched on Ethena (ENA). The amount of investment exceeded 19 million BNB within one hour of opening. The ENA token rose by more than 30% in one day, directly entering the billions Market capitalization ranks.

According to Ethena’s announcement that the second season “Sats” event Epoch 1 has started, users can deposit USDe to earn Sats. The new Pendle pool on Mantle has a cap of $100 million and will receive additional Eigenlayer points. The existing USDe Pendle pool on the ETH mainnet is also capped at US$100 million, and existing users who deposit funds into the pool will receive an additional 20% reward.

Rune Christensen (@RuneKek), the founder of MakerDAO, recently deposited 566 million USDT into Ethena and created 565.5 million USDe. This marks Rune's first collaboration with Ethena. Additionally, MakerDAO is considering distributing 6 billion DAI through USDe and partnering with Morpho Labs to guarantee the quality of sUSDe loans in the DeFi lending agreement.

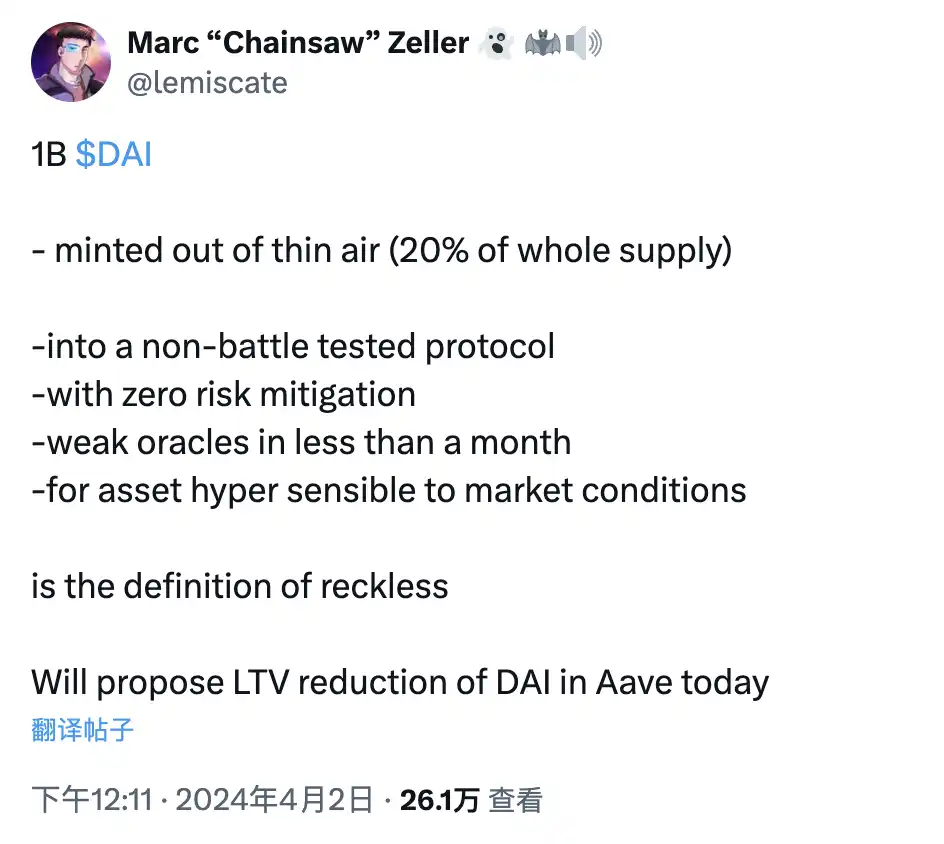

Some different voices were found within the community. Aavechan founder Marc (@lemiscate) published a tweet criticizing the recklessness of certain DeFi practices, specifically pointing out that putting $100 million of DAI, which represents 20% of its total supply, into a platform that has not yet been empirically proven protocol (Ethena) and there are no issues with taking any risk mitigation measures. Marc believes this approach to an asset that is highly susceptible to market terms is extremely reckless, and announced a proposal to lower the borrowing and lending rates on DAI at Aave.

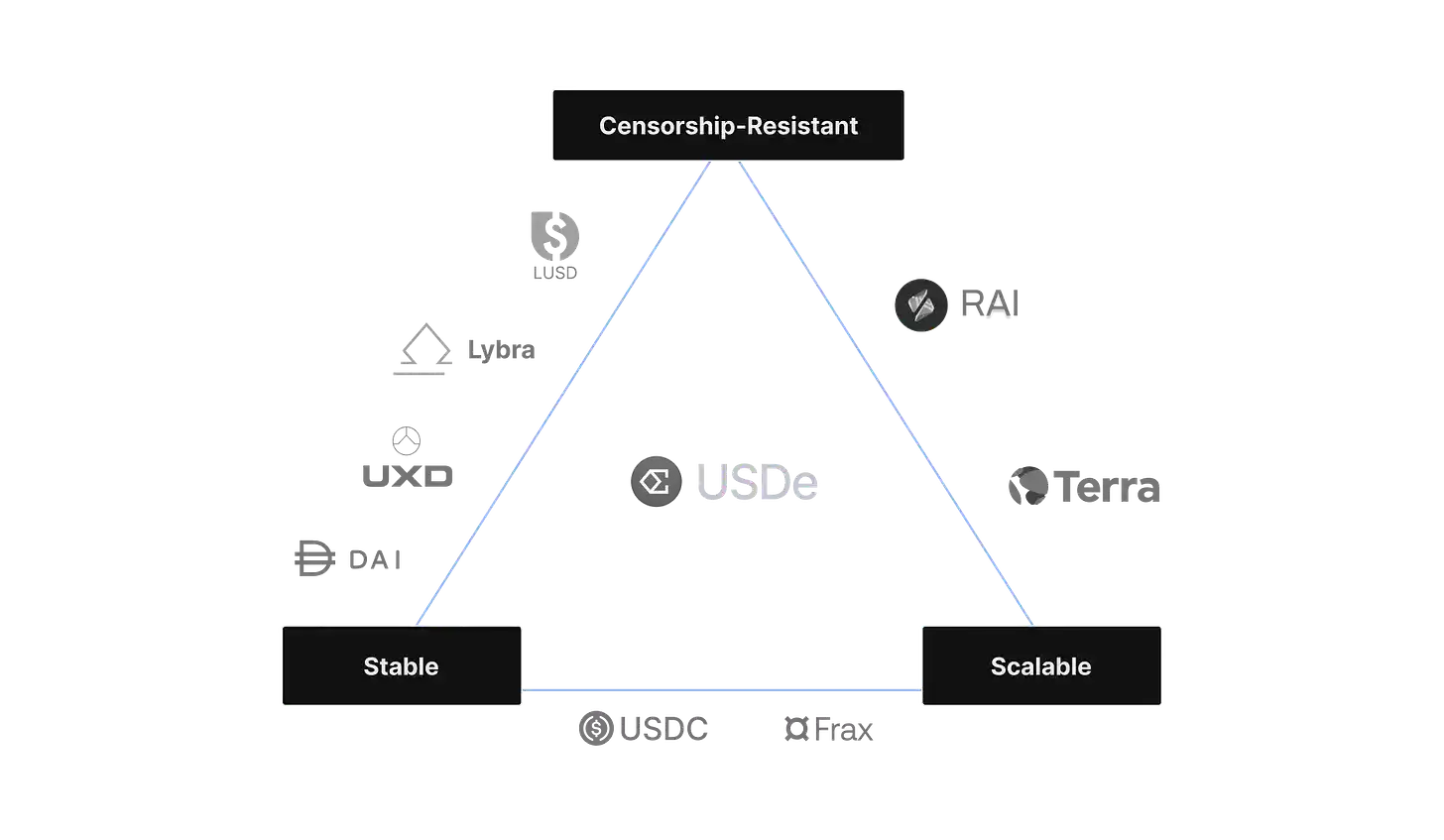

We all know that in the cryptocurrency world, stablecoins are considered one of the most important tools. Whether it is a centralized or decentralized trading platform, whether it is a spot or futures market, most transactions are priced in stablecoins. Stablecoins have completed more than 12 trillion US dollars in settlement on the chain, becoming one of the top five assets in the DeFi field, accounting for more than 40% of the total value locked (TVL), and are by far the most widely used in the decentralized currency market. assets.

USDe is a stablecoin that hopes to provide scalability to improve capital utilization through the use of derivatives. By Ethena's design, USDe is able to scale while maintaining capital efficiency because the staked ETH assets are perfectly hedged through equivalent short positions, requiring only a 1:1 "collateral" to create USD.

Marc offered an analogy to explain the importance of risk management when using USDe: If you add 5 cl of gin to a cocktail party, you might Makes for a great night; but if you drink 3 bottles of gin, you might end up "with the toilet." This metaphor emphasizes proper risk management and setting reasonable caps in DeFi projects. importance.

「ENA/USDe, smells like LUNA/UST」

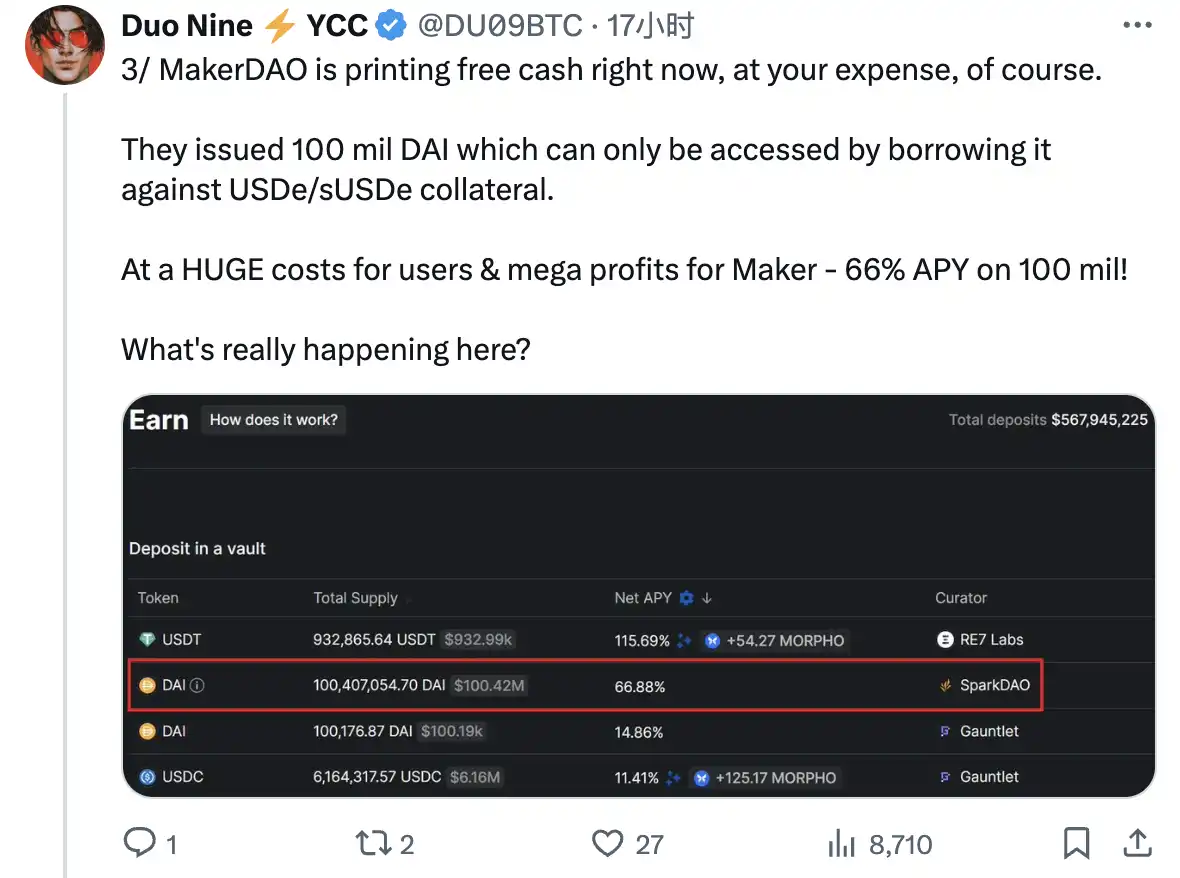

Analyst Duo Nine (@DU09BTC) further directly pointed out that MakerDAO is “printing money for free” and may eventually allow ordinary investors Pay the price: "They issued 100 million DAI, which can only be borrowed by using USDe/sUSDe as collateral. It is a huge cost for users, and a huge profit for Maker. The annualized return rate of 100 million reaches 66 %!」

#In Duo Nine’s view, it is only a matter of time before USDe becomes unanchored. The larger the bubble, the greater the probability of this happening. Ethena growing too fast could pose systemic risks to everyone. USDe, in particular, is untested in a bear market and the risks loom large once billions of dollars are involved.

"MakerDAO is exploiting the greed of users pursuing higher annualized returns on USDe. They don't care, they will fuel this greed with billions of dollars. Maker makes huge profits, and USDe's market cap will continue to grow Soaring", Duo Nine pointed out a potential pitfall in its tweet: USDe has a market capitalization of approximately US$10 billion, of which US$2 billion is Maker's Liability. If USDe breaks its anchor and panics and liquidations begin, Maker will be the first to sell USDe and recover funds to maintain their profits and principal, while those users who borrowed DAI with USDe and sUSDe on Morpho will be liquidated quickly .

As such, he calls on all the big players in Ethena to show some restraint and build for the long term.

Following Luna’s experience, the possibility of algorithmic stablecoin decoupling and the potential risks of rehypothecation have also worried some observers. And to some community members, it all looks really Luna-like. Many people are worried that the next DeFi black swan event may occur on an original stablecoin protocol that mishandles risk management, but we also hope that this prediction is wrong. After all, no one wants to experience Luna again. .

The above is the detailed content of ENA's market value exceeds US$1 billion, but some people worry that it is creating the next black swan. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages