web3.0

web3.0

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.

This site (120bTC.coM) synthesizes the US dollar stable currency protocol Ethena and issues the US dollar stable currency USDe with its "Delta Neutral" mechanism. The original composition behind this mechanism is based on Ethena. The value of spot ETH and ETH futures short positions are hedged to become a "Delta neutral" stable asset. Today (4th), in view of the unprecedented growth of USDe, with the current market value exceeding US$2 billion, Ethena officially announced that Bitcoin will be included as a reserve asset of USDe to support the further expansion of the scale of USDe.

Reason for inclusion in Bitcoin

Ethena noted that hedging transactions conducted by Ethena have accounted for one-fifth of the value of all Ethereum open interest (OI) currently on the market so far. one. As the size of USDe continues to expand, the existing Ethereum open interest constraints in the market may not be sufficient for Ethena to perform sufficient hedging operations. Therefore, the introduction of Bitcoin as a reserve asset has become a crucial decision. Ethena said that every $25 billion of Bitcoin open interest constraints allows Ethena to perform delta hedging, which allows the potential size of USDe to be expanded by more than 2.5 times.

Over the past year, Bitcoin’s open interest on major exchanges (excluding CME) has surged 150% to $25 billion, while Ethereum’s growth rate has been 100%, unflattering The volume of open positions reached US$10 billion. In this regard, Ethereum stated: The rapid growth of the Bitcoin derivatives market exceeds that of Ethereum, but Delta hedging transactions provide better scalability and liquidity.

In addition, Ethena also mentioned that compared to Ethereum liquidity pledged tokens, Bitcoin has greater advantages in liquidity and term characteristics.

Will Bitcoin’s lack of staking income affect USDe APY?

The original USDe income mainly comes from "Ethereum PoS pledge income" and "funding rate for contract short position holdings". However, since Bitcoin does not have the native staking income like staking ETH, this change may have an impact on USDe's income. However, Ethena pointed out that during the bull market, when the funding rate exceeds 30%, the staking income of 3~4% is actually capped, and the current market conditions are extremely suitable to increase the scale and scalability of USDe.

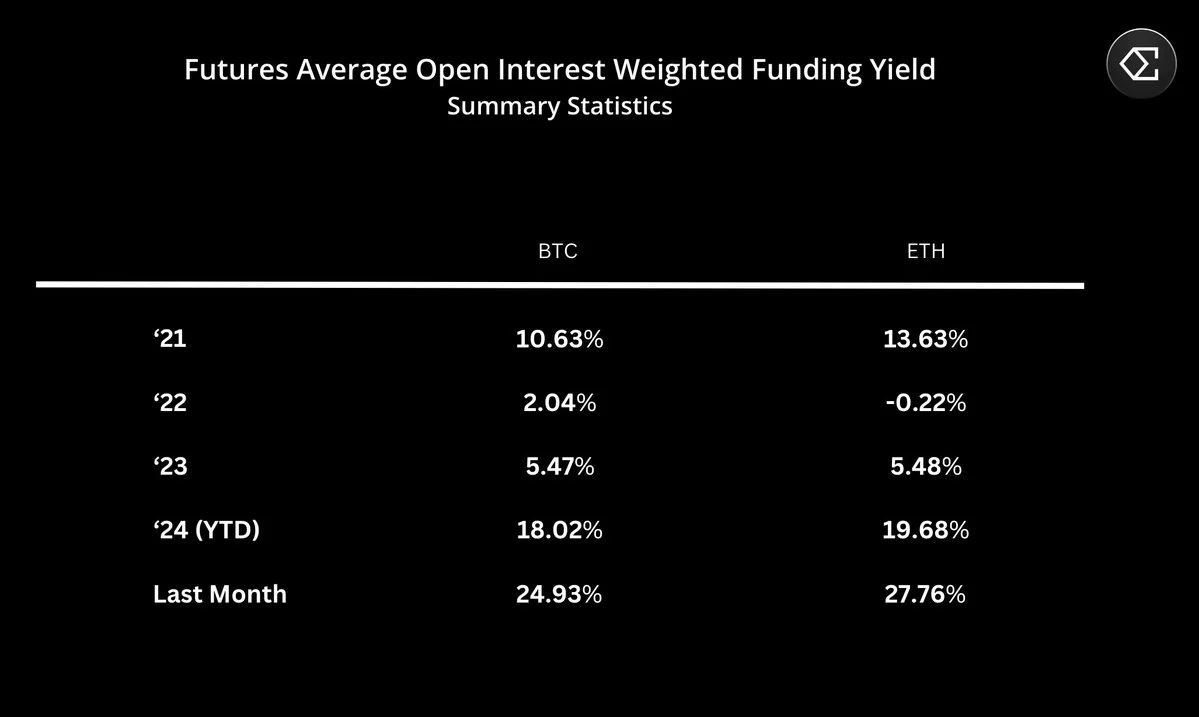

According to Ethena statistics, Bitcoin’s funding rate in 2021 is comparable to Ethereum. But in the bear market of 2022, Bitcoin’s funding rate gains exceeded those of Ethereum, at 2% and 0% respectively. During bull markets, Ethereum’s funding rate often exceeds that of Bitcoin.

Currently, users can view USDe’s mortgage asset portfolio through Ethena’s official website. Although it has not yet been shown that Bitcoin has been included, the mortgage assets already include USD 736 million worth of USDT and USD 870 million in ETH, respectively. Accounting for 38% and 44% of the total value of all USDe mortgage assets.

Bitcoin and Ethereum funding rate comparison table

The above is the detailed content of Ethena Reserve into Bitcoin! It is said that USDe's current scale of 2 billion can be expanded by 2.5 times.. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1386

1386

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

gate.io latest registration tutorial for beginners

Mar 31, 2025 pm 11:12 PM

This article provides newbies with detailed Gate.io registration tutorials, guiding them to gradually complete the registration process, including accessing the official website, filling in information, identity verification, etc., and emphasizes the security settings after registration. In addition, the article also mentioned other exchanges such as Binance, Ouyi and Sesame Open Door. It is recommended that novices choose the right platform according to their own needs, and remind readers that digital asset investment is risky and should invest rationally.

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

The latest registration tutorial for gate.io web version

Mar 31, 2025 pm 11:15 PM

This article provides a detailed Gate.io web version latest registration tutorial to help users easily get started with digital asset trading. The tutorial covers every step from accessing the official website to completing registration, and emphasizes security settings after registration. The article also briefly introduces other trading platforms such as Binance, Ouyi and Sesame Open Door. It is recommended that users choose the right platform according to their own needs and pay attention to investment risks.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

XBIT Decentralized Exchange APP download recommendation

Mar 31, 2025 pm 08:21 PM

This article introduces in detail the download and installation steps of the XBIT Exchange mobile APP, including four steps: accessing the official website (https://www.xbit.com/), downloading the installation package of the corresponding operating system (iOS or Android), installing software (including the installation methods of iOS and Android systems), and finally opening the app and registering/logging in. Please be careful to visit the official website to avoid malware and phishing websites, and select the installation package according to your own system version. If you have any questions, please contact XBIT Exchange online customer service.