web3.0

web3.0

In-depth analysis of the relationship between the first quarter airdrop of ether.fi and Loyalty Point (analysis data link included)

In-depth analysis of the relationship between the first quarter airdrop of ether.fi and Loyalty Point (analysis data link included)

In-depth analysis of the relationship between the first quarter airdrop of ether.fi and Loyalty Point (analysis data link included)

Data link:

- EtherFi participates in address analysis Thegraph: https://api.thegraph.com/subgraphs/name/web3mario/etherfi_airdrop_analyze

- All accounts receive airdrop results: https://cf-ipfs.com/ipfs/QmP2tgnrAyUGwRs1o6B8YGzHmnecyZrVhY5QiFCESxUsBv

In the previous article, the author discussed challenging users through Loyalty Point in the Web3 era. In this article, we choose a practical case to further demonstrate this point.

On March 18, 2024, Ether.Fi, the leader in the Restaking track, took the lead in TGE and conducted the first round of airdrops of its ETHFI tokens, bringing The wealth effect is not small. As of the time of writing, the price of $ETHFI has reached $5.54, and the fully stable market value has reached 5.5 billion US dollars. This valuation is very impressive for an early project whose core business has not yet been launched. This reflects investors’ recognition of the project’s prospects.

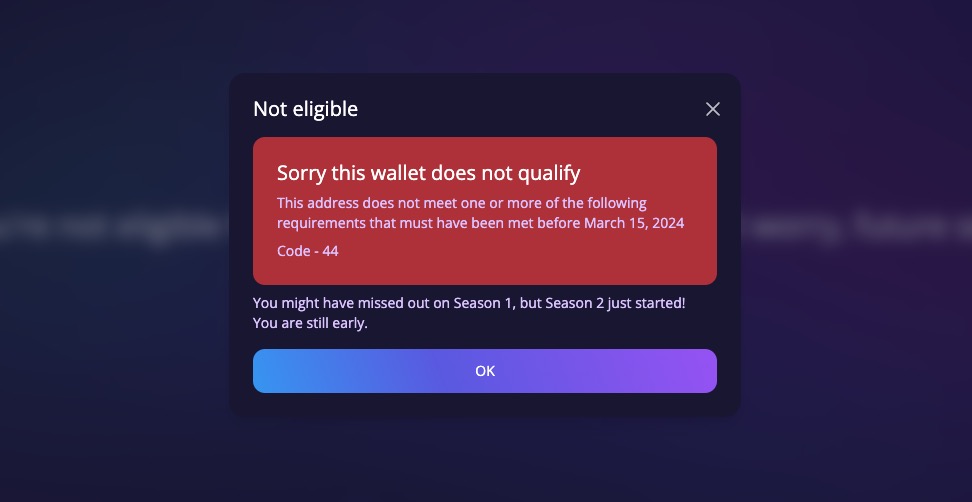

However, users have quite criticized the results of this round of airdrops, because for a long time in the past, EtherFi’s promotion focus and incentive mechanism have been around EtherFi Loyalty Point. Naturally, users would There is an association between receiving airdrops and accumulating Points. However, after the airdrop results were announced, many users found that there seemed to be no necessary relationship between the two. Many loyal users who had accumulated a lot of Points had similar rewards to some "lightly involved" users. They also found that many giant whales quickly took advantage of their financial advantages. A big airdrop allocation.

Since the author has spent some time analyzing the design ideas of the project side in this round of airdrop activities in detail from the data side, and locating the biggest beneficiaries of this round of airdrops, I hope it can help readers optimize their subsequent participation in similar airdrop competitions. strategy, and finally look forward to the possible design direction of EtherFi’s airdrop rules for the second quarter and estimate potential benefits. Therefore, the author spent some time analyzing the design ideas of the project side in this round of airdrop activities in detail from the data side, and locating the biggest beneficiaries of this round of airdrops. I hope it can help readers optimize their subsequent participation in similar airdrop competition strategies, and in Finally, we look forward to the possible design direction of EtherFi’s airdrop rules for the second quarter and estimate the potential benefits.

Review of EtherFi Season 1 Airdrop

First of all, let us review the officially disclosed rules of EtherFi Season 1 Airdrop:

- EAP: You participated in the Early Adopter Program

- ether.fan:You are the holder of ether.fan NFT

- Solo Staker:You are the ether.fi Solo Staker

- eETH / weETH:You hold eETH or weETH

- DeFi rewards: You participate in eETH or weETH DeFi pool or vault

- Badges: You unlock one or more ether.fi badges

- Referrals: You invite One or more new users participated in ether.fi

There is no direct description related to Loyalty Point, and the specific calculation algorithm is not clear. However, after our analysis of all the data, You can still find a fixed pattern from it.

TheGraph will implement EtherFi’s deployment of Liquidity Pool smart contracts starting from July 10, 2023, and the contract will last until March 18, 2024. Any participant can view all user addresses via TheGraph Query Link. We obtained these addresses through a Python crawler to obtain the airdrop situation, and have uploaded the results to IPFS. We hope that interested friends can analyze them by themselves. The analysis results are as follows:

- A total of 82,102 participating addresses, of which a total of 71,380 addresses received airdrops;

- Among all users who received airdrops, each user has an average of 536,444 Loyalty Points. , on average, each user receives 702 ETHFI airdrops;

- On average, each user needs to accumulate 755 LoyaltyPoints to obtain 1 $ETHFI, that is, the $ETHFI conversion rate is 755 Loyalty Points/ETHFI.

- The Matthew effect of the project is extremely obvious. Among all users who have received airdrops:

- The top 20% of Loyalty Point users have received 94% of the total Loyalty Points. The airdrop volume accounted for 77.5% of the total airdrop volume;

- Loyalty Point top 10% of users received Loyalty Point accounted for 87.8% of the total Loyalty Point volume, and the airdrop volume obtained accounted for 87.8% of the total airdrop volume. The proportion of Loyalty Points obtained by the top 5% of Loyalty Point users is 72.2%;

- The proportion of Loyalty Points obtained by the top 5% of the total Loyalty Points is 79.2%, and the airdrop volume obtained accounts for 65.6% of the total airdrop volume;

- The airdrop allocation mechanism of the project is more conducive to "lightly involved" users and "heavy loyal" users (usually whale users).

First of all, let’s take a look at the distribution of Loyalty Points obtained by users, as shown in Figure 1. The horizontal axis is the user’s Loyalty Point ranking, and the vertical axis is the amount of Loyalty Points held by the user. We can see The average amount of Loyalty Points obtained by each user is 536444, but at this time only the top 7588 users can reach such a standard. Compared with 82102 participants, this is a relatively small range, which means that giant whales Holds a large amount of Loyalty Points.

Next, let’s take a look at the distribution of the number of airdrops received by users. As shown in Figure 2, the horizontal axis is the user's Loyalty Point ranking, and the vertical axis is the $ETHFI airdrop amount received by the user. We can see that the average airdrop amount received by each user is 636. At this time, the top 6500 users can To achieve this standard, compared to the distribution of Loyalty Point, the distribution of airdrop numbers is more concentrated among top-ranked users.

Finally, let’s explore the scatter plot of the user’s Loyalty Points and the number of airdrops, as shown in Figure 3. The horizontal axis represents the user’s Loyalty Point amount, and the vertical axis represents the The user's $ETHFI airdrop conversion rate, that is, how many Loyalty Points are required to hold for each $ETHFI airdrop. We can find that Loyalty Point and airdrop conversion rate present an approximate rule of piecewise function. In the first piecewise function, the user’s airdrop acquisition rate is roughly proportional to Loyalty Point. The more Loyalty Points held, the corresponding The greater the airdrop conversion rate, this means that the Loyalty Points required to obtain a unit of $ETHFI airdrop will become higher and it will become more difficult to obtain them. When the Loyalty Points held by the user exceed approximately 200,000, the entire segmentation function enters the second part. This period reaches the peak, when the user's airdrop conversion rate is approximately 1140, which means that at this stage, the more Loyalty Points you hold will not further increase the difficulty of obtaining airdrops, which is more friendly to giant whales.

In order to better reflect this relationship, as shown in Figure 4, we transform the horizontal axis into the user's Loyalty Point ranking. The higher the user's ranking from left to right, The larger the value, the fewer Loyalty Points held. The vertical axis is the user’s $ETHFI airdrop conversion rate. The relationship is more obvious at this time. When the user's Loyalty Point ranking is around 14,500, the piecewise function is at a critical point.

Looking ahead to EtherFi’s second quarter airdrop

Next, let’s look ahead to EtherFi’s second quarter airdrop, which has already disclosed the relevant information about Season 2: StakeRank Details:

- StakeRank is a grading system with 8 levels or "tiers"

- Every 100 hours a user stakes ETH on ether.fi will increase by 1 level

- Each level has a progressively higher loyalty point rate increase

- Your staking balance needs to be higher than 0.1 eETH to continue to improve the ranking

- Users participating in the first season will start from the ranking II starts

- The ranking improvement range is 1x-2x (subject to change)

- Ether.Fan NFT holders are automatically upgraded to Rank III

- Each NFT Holders are only eligible once

- During the transition to Season 2, the protocol is designed to recognize Season 1 participants without disproportionally allocating Season 2 airdrops to them. To achieve this, everyone’s loyalty points accrual rate will increase by 10x. While this will dilute old points, they are still valid, subject to the following conditions.

- All eETH and weETH, whether held or DeFi positions, including Liquid, will be treated equally by StakeRank.

- If by the end of Season 2 your points total means 70% of it comes from points you accumulated in S1, then you are not eligible. However, the base rate of loyalty points will increase 10x in S2. Staking in S2 means your new points balance should be significantly greater than the amount collected in S1. That said, Season 1's Pledgers were recognized in Season 1. Season 2 will recognize stakers who were active in Season 2.

The overall plan is designed around the ranking of Loyalty Point, with different layers and different boosting effects set for each level. The most important thing is about the second season airdrop. The final guidance on the redemption method focuses on diluting the impact of Points obtained in the past on the final airdrop. This means that users who have accumulated a lot of Points will have a sharp reduction in the advantage of Season 2 airdrops, and loyal users will have to restart. And more importantly, EtherFi still chose to use a vague description to express the relationship between the final airdrop volume and Loyalty Point. This also introduces considerable uncertainty. Considering that in the design of the first season airdrop, the team seems to favor shallow participating users and whale users, which seems to have a certain guiding effect for users to participate in the second season airdrop activity. But don’t forget that the airdrop in the first quarter has already distributed 6% of ETHFI’s total issuance. In the second quarter, only 5% of the total airdrop is left.

The above is the detailed content of In-depth analysis of the relationship between the first quarter airdrop of ether.fi and Loyalty Point (analysis data link included). For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1385

1385

52

52

PHP and Python: Code Examples and Comparison

Apr 15, 2025 am 12:07 AM

PHP and Python: Code Examples and Comparison

Apr 15, 2025 am 12:07 AM

PHP and Python have their own advantages and disadvantages, and the choice depends on project needs and personal preferences. 1.PHP is suitable for rapid development and maintenance of large-scale web applications. 2. Python dominates the field of data science and machine learning.

Python vs. JavaScript: Community, Libraries, and Resources

Apr 15, 2025 am 12:16 AM

Python vs. JavaScript: Community, Libraries, and Resources

Apr 15, 2025 am 12:16 AM

Python and JavaScript have their own advantages and disadvantages in terms of community, libraries and resources. 1) The Python community is friendly and suitable for beginners, but the front-end development resources are not as rich as JavaScript. 2) Python is powerful in data science and machine learning libraries, while JavaScript is better in front-end development libraries and frameworks. 3) Both have rich learning resources, but Python is suitable for starting with official documents, while JavaScript is better with MDNWebDocs. The choice should be based on project needs and personal interests.

Detailed explanation of docker principle

Apr 14, 2025 pm 11:57 PM

Detailed explanation of docker principle

Apr 14, 2025 pm 11:57 PM

Docker uses Linux kernel features to provide an efficient and isolated application running environment. Its working principle is as follows: 1. The mirror is used as a read-only template, which contains everything you need to run the application; 2. The Union File System (UnionFS) stacks multiple file systems, only storing the differences, saving space and speeding up; 3. The daemon manages the mirrors and containers, and the client uses them for interaction; 4. Namespaces and cgroups implement container isolation and resource limitations; 5. Multiple network modes support container interconnection. Only by understanding these core concepts can you better utilize Docker.

How to run programs in terminal vscode

Apr 15, 2025 pm 06:42 PM

How to run programs in terminal vscode

Apr 15, 2025 pm 06:42 PM

In VS Code, you can run the program in the terminal through the following steps: Prepare the code and open the integrated terminal to ensure that the code directory is consistent with the terminal working directory. Select the run command according to the programming language (such as Python's python your_file_name.py) to check whether it runs successfully and resolve errors. Use the debugger to improve debugging efficiency.

Python: Automation, Scripting, and Task Management

Apr 16, 2025 am 12:14 AM

Python: Automation, Scripting, and Task Management

Apr 16, 2025 am 12:14 AM

Python excels in automation, scripting, and task management. 1) Automation: File backup is realized through standard libraries such as os and shutil. 2) Script writing: Use the psutil library to monitor system resources. 3) Task management: Use the schedule library to schedule tasks. Python's ease of use and rich library support makes it the preferred tool in these areas.

What is vscode What is vscode for?

Apr 15, 2025 pm 06:45 PM

What is vscode What is vscode for?

Apr 15, 2025 pm 06:45 PM

VS Code is the full name Visual Studio Code, which is a free and open source cross-platform code editor and development environment developed by Microsoft. It supports a wide range of programming languages and provides syntax highlighting, code automatic completion, code snippets and smart prompts to improve development efficiency. Through a rich extension ecosystem, users can add extensions to specific needs and languages, such as debuggers, code formatting tools, and Git integrations. VS Code also includes an intuitive debugger that helps quickly find and resolve bugs in your code.

Is the vscode extension malicious?

Apr 15, 2025 pm 07:57 PM

Is the vscode extension malicious?

Apr 15, 2025 pm 07:57 PM

VS Code extensions pose malicious risks, such as hiding malicious code, exploiting vulnerabilities, and masturbating as legitimate extensions. Methods to identify malicious extensions include: checking publishers, reading comments, checking code, and installing with caution. Security measures also include: security awareness, good habits, regular updates and antivirus software.

How to install nginx in centos

Apr 14, 2025 pm 08:06 PM

How to install nginx in centos

Apr 14, 2025 pm 08:06 PM

CentOS Installing Nginx requires following the following steps: Installing dependencies such as development tools, pcre-devel, and openssl-devel. Download the Nginx source code package, unzip it and compile and install it, and specify the installation path as /usr/local/nginx. Create Nginx users and user groups and set permissions. Modify the configuration file nginx.conf, and configure the listening port and domain name/IP address. Start the Nginx service. Common errors need to be paid attention to, such as dependency issues, port conflicts, and configuration file errors. Performance optimization needs to be adjusted according to the specific situation, such as turning on cache and adjusting the number of worker processes.