Dogecoin, PEPE, and WIF lead the way as meme coin demand reaches 2021 levels

Meme coins such as Dogecoin, PEPE, and WIF continue to see increased acceptance, with recent data showing that demand for them has hit new highs.

This certainly reinforces predictions that this category of crypto tokens will become one of the dominant narratives in the market cycle.

Dogecoin, PEPE and WIF lead the demand for Meme coins

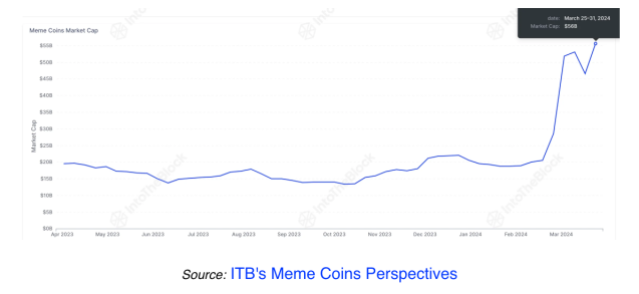

Market intelligence platform IntoTheBlock recently revealed that demand for Meme coins reached its highest level since 2021 in the first quarter of this year.

Additionally, increased demand led to the launch of new meme coins, driving the crypto category’s market capitalization to its highest level in two years.

They are currently valued at more than $56 billion, meaning their total value has almost tripled this year.

Dogecoin (DOGE), Pepe (PEPE), and Shiba Inu (SHIB) have been leading the way. The price of Dogecoin has already doubled in 2024, while PEPE and SHIB have recorded increases of 5x and 2.5x respectively.

Meanwhile, the newly established Dogwifhat (WIF) has also won a place, with a full-year return of 20% and rising to become the third largest Meme coin by market capitalization. WIF’s growth is largely attributed to its “rabid community,” which includes prominent crypto influencer Ansem.

IntoTheBlock further revealed that Meme coins are thriving in the low-fee ecosystem, and Solana has surpassed Ethereum in terms of transaction volume for many consecutive days since the beginning of this year. Due to this meme coin craze, Solana has also seen an increase in network activity, and Bitcoinist reports that Solana is currently facing unprecedented congestion.

Meme coins will continue to exist

IntoTheBlock noted that Meme Coin was able to achieve this record despite interest rates remaining high and no “stimulus checks” being sent out. The platform further speculated on possible reasons for the increased demand for crypto tokens, which have been widely criticized for lacking any real-life utility.

Regardless of the reasons, one thing has become clear, which is that meme coins have become one of the main topics in the crypto space over the past few months.

Ethereum founder Vitalik Buterin also recently published an article in which he acknowledged this fact and declared that the best approach is to determine how these crypto tokens gain practical utility.

Despite their perceived lack of utility, the buzz surrounding Meme coins could be a boon to the cryptocurrency space due to their ability to attract a new wave of cryptocurrency users.

Cryptocurrency expert Scott Melker recently highlighted how the hype surrounding DOGE ushered in mainstream demand for the crypto token during the 2021 bull run, and the same thing is likely to happen during this market cycle.

The above is the detailed content of Dogecoin, PEPE, and WIF lead the way as meme coin demand reaches 2021 levels. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1387

1387

52

52

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

What are the advantages of Bijie.com's layout of crypto finance and AaaS services?

Apr 21, 2025 am 10:51 AM

The advantages of Bijie.com in the fields of crypto finance and AaaS business include: 1. Crypto finance: ① Professional investment and research team, ② high-quality content ecology, ③ secure platform guarantee, and ④ rich product services. 2. AaaS business areas: ①Technical innovation capabilities, ②Data advantages, ③User base and demand insights.

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Gate.io Sesame Open Exchange Tips for Buying and Selling Coins (Guide to Novice)

Apr 21, 2025 am 11:51 AM

Tips for buying and selling coins on Gate.io include: 1. Make research plans before buying coins to understand the market and risks; 2. Choose trading pairs with high liquidity such as BTC/USDT; 3. Use limit orders to control the buying cost; 4. Pay attention to market trends and analyze price trends; 5. Set stop-profit and stop-loss when selling coins, and manage risks; 6. Use batch selling strategies to balance returns and risks; 7. Combine market sentiment and judge the selling timing; 8. Pay attention to macroeconomic and policy changes, and adjust strategies in a timely manner.

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

How to avoid losses after ETH upgrade

Apr 21, 2025 am 10:03 AM

After ETH upgrade, novices should adopt the following strategies to avoid losses: 1. Do their homework and understand the basic knowledge and upgrade content of ETH; 2. Control positions, test the waters in small amounts and diversify investment; 3. Make a trading plan, clarify goals and set stop loss points; 4. Profil rationally and avoid emotional decision-making; 5. Choose a formal and reliable trading platform; 6. Consider long-term holding to avoid the impact of short-term fluctuations.

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance officially announced: On April 11, the collateral rate of multiple cryptocurrencies will be adjusted again

Apr 21, 2025 am 11:21 AM

Binance has adjusted the collateral ratio of several assets, involving FLOW, COMP, etc., which has generally declined. 1. FLOW and COMP have been reduced from 80% to 70%. 2. 1INCH dropped from 70% to 65%. The move is designed to manage risks and ensure market stability, and investors need to adjust their positions to cope with increased margin requirements and potential forced closing risks.

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

Top 11 list of Bitcoin Exchange Rate Conversion Global (Updated in 2025)

Apr 21, 2025 am 11:27 AM

The exchange rate of Bitcoin to currencies of various countries is as follows: 1. USD: at 7:20 on April 9, the exchange rate is 10,152.53. 2. Domestic: at 2:2 on April 9, 1 Bitcoin = 149,688.2954 yuan. 3. Swedish Krona: At 12:30 on April 9, the exchange rate was 758,541.05.

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

A list of top 10 global leading virtual currency trading apps in 2025

Apr 21, 2025 pm 12:06 PM

The top ten leading virtual currency trading apps in the world in 2025 are: 1. Binance, 2. Gate.io, 3. OKX, 4. Huobi Global, 5. Bybit, 6. Kraken, 7. FTX, 8. KuCoin, 9. Coinbase, 10. Crypto.com.

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

Recommended top ten digital currency APPs in the world (authoritative release in 2025)

Apr 21, 2025 pm 12:09 PM

The world's leading ten digital currency apps include: 1. OKX, 2. Binance, 3. Huobi, 4. Matcha (MXC), 5. Bitget, 6. BitMEX, 7. Pionex, 8. Deribit, 9. Bybit, 10. Kraken. These platforms have their own characteristics in security, transaction services, technical architecture, risk control team, user experience and ecosystem.

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

Keep up with the pace of Coinjie.com: What is the investment prospect of crypto finance and AaaS business

Apr 21, 2025 am 10:42 AM

The investment prospects of crypto finance and AaaS businesses are analyzed as follows: 1. Opportunities of crypto finance include market size growth, gradual clear regulation and expansion of application scenarios, but face market volatility and technical security challenges. 2. The opportunities of AaaS business lie in the promotion of technological innovation, data value mining and rich application scenarios, but the challenges include technical complexity and market acceptance.