In-depth analysis: How did Solana get blocked?

Why are current transactions on Solana always failing?

Let’s start with the most basic concepts and analyze them step by step.

From a user perspective, when we trade on Solana, there are essentially three potential outcomes:

Transaction execution successful, everything is normal;

Transaction execution failed, the user has paid the gas fee, but the execution result returned an error. This happens when the conditions for the transaction are not met, such as the token the user is trying to buy is sold out, or the price moves too fast (beyond the preset slippage), etc.;

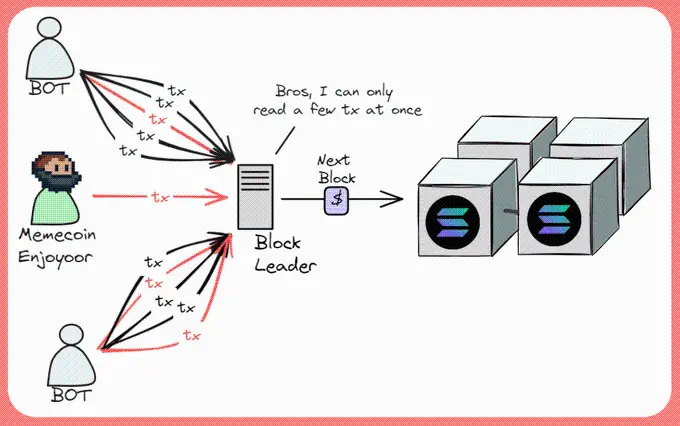

Transaction Lost (Dropped) : The transaction has no trace, that is, the transaction failed to reach the "block leader node" (Odaily Note: every 4 blocks A duty node that takes one turn). This is the situation that most users are currently encountering. Essentially, this is a network layer problem, not a consensus layer or execution layer problem.

Execution issues are not the main cause of congestion

Now you may ask, what is the network layer? Why are transactions lost? Why are they the main cause of current congestion in Solana?

Let’s put aside these most important issues for the time being and first look at those transactions that failed to execute (i.e. the second case) and explain why Says failed transactions are not the main cause of congestion.

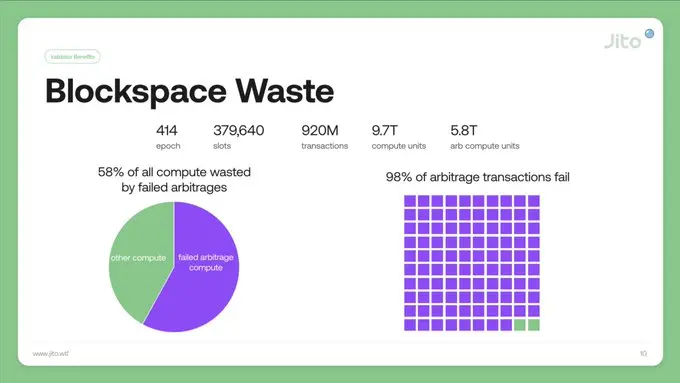

Combining the data on the chain, it can be seen that of all transactions that failed to be executed, only about 8% were submitted by real users, and the rest were arbitrage transactions initiated by robots on the chain.

The reason why arbitrageurs continue to initiate "junk" transactions is because compared with the potential profits that can be obtained from successful arbitrage, frequent arbitrage transactions Transaction costs can be said to be minimal.

Specifically, arbitrageurs can continuously initiate transactions within a day. The cost of doing so is about a few hundred dollars per day (because Solana’s network fees are low), but as long as they can succeed With just one transaction, you can earn hundreds of thousands of dollars in profit.

It should be noted that these failed transactions do not mean that the Solana network has failed and the blockchain is still running normally. These are just some robot transactions that failed because the conditions were not met. This is not the main reason for Solana’s current bad experience.

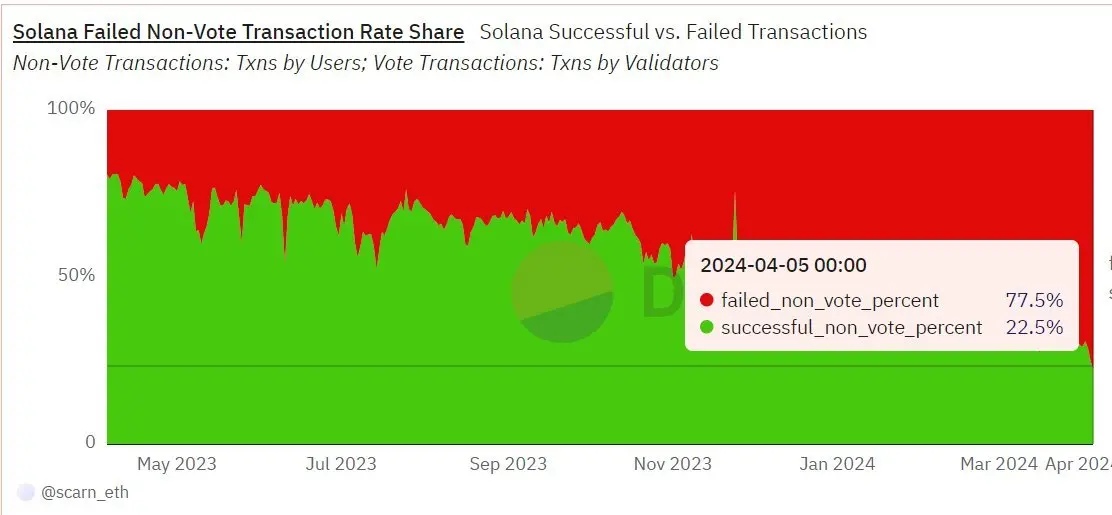

In fact, Solana’s deal failure rate has remained around 50% since November.

The real reason: Transactions were dropped at the network layer

Now,Let’s discuss the real reason for Solana’s congestion over the past few days. The main reason - "transaction lost".

As mentioned above, these are transactions that failed to reach the "block leader node", and the reason why the transactions failed to arrive is because they were discarded in the network layer .

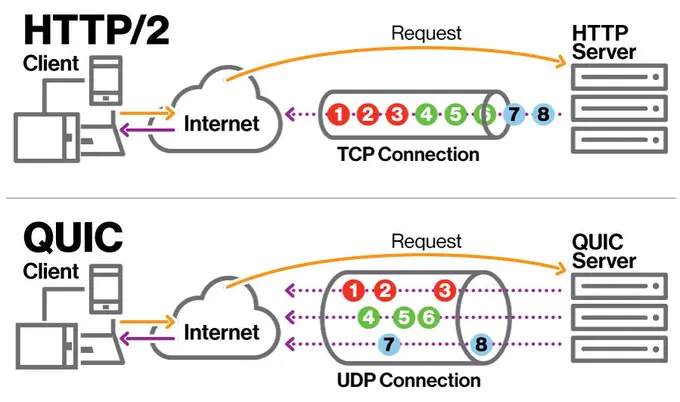

The network layer is the communication layer of the Internet. It is used to send data packets from one endpoint to another. Common network layer protocols include TCP, UDP, QUIC (developed by Google), etc. wait. Solana previously upgraded its network layer protocol to QUIC, which helps establish connections between users and "block leader nodes".

Since Solana adopts a continuous block generation mechanism and there is no mempool to temporarily store unconfirmed transactions, this means that once the connection is lost, the transaction will never be included again. within a certain block.

The advantage of the QUIC protocol is that the "block leader node" can obtain a new function: Cut a block according to specific criteria some users' connections, or limit their data transfer rates.

The significance of this function is that when the network demand peak occurs, the "block leader node" can actively cut off certain connections, thereby preventing Solana from being affected by the network Increased activity and complete outage.

You may be wondering again, if the design of the QUIC protocol is so perfect, why is Solana still so blocked now?

The real problem is that although "block leader nodes" can now choose to actively regulate certain connections, the logic of deciding which connections need to be regulated is problematic.

In order to understand this problem more concretely, we can imagine a situation where each "block leader node" has X A connection that can communicate, but when the network demand peak occurs, the connection requests received by the node are 10 to 100 times its carrying capacity...At this time, the Nodes need to choose to cut off certain connections. However, the current situation is that there is no set standard for how to select the connections to be cut off (such as cutting off all connections with a cost lower than xxx), and whether all connections will be cut off is random... …

At the end of the day, if you want a transaction to be confirmed in the current situation, all you can do is send more transaction requests, but since there are many robots that are constantly sending requests to the network By sending a large number of connection requests, it becomes increasingly difficult for the average user to establish a connection and complete a transaction.

How to fix? how long it takes?

This is the problem Solana faces now.

Currently, Jump (Firedancer client development team), Anza (Agave client development team), Solana Labs and other teams are working on repairing the network layer. Fixes will be rolled out gradually this week, and some heavyweight updates are expected to be released in the coming weeks.

Can this effectively solve the problem? Will Solana "to da moon" again... there's no absolute answer.

There are three main reasons why there are still many uncertainties:

First, no one can guarantee whether the upcoming repair patch will take effect. Only after it actually works can we see what actually happens.

The second is that the Firedancer client developed by Jump seems to be able to solve the problem, but it will not be officially released until the end of this year.

The third issue is about "junk" transactions. Solana's economic mechanism makes it difficult for the network to prevent malicious actors from continuing to conduct "junk" transaction attacks on the chain.

#Finally, I want to appeal to everyone to realize one thing: I believe Solana is making the right trade-offs (Odaily Note: Because it refers to setting reasonable Connect Segmentation Standard) and fight, just like Ethereum has been free of many problems, Solana will eventually be free of these problems.

The above is the detailed content of In-depth analysis: How did Solana get blocked?. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1378

1378

52

52

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

How to roll positions in digital currency? What are the digital currency rolling platforms?

Mar 31, 2025 pm 07:36 PM

Digital currency rolling positions is an investment strategy that uses lending to amplify trading leverage to increase returns. This article explains the digital currency rolling process in detail, including key steps such as selecting trading platforms that support rolling (such as Binance, OKEx, gate.io, Huobi, Bybit, etc.), opening a leverage account, setting a leverage multiple, borrowing funds for trading, and real-time monitoring of the market and adjusting positions or adding margin to avoid liquidation. However, rolling position trading is extremely risky, and investors need to operate with caution and formulate complete risk management strategies. To learn more about digital currency rolling tips, please continue reading.

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

Tutorial on how to register, use and cancel Ouyi okex account

Mar 31, 2025 pm 04:21 PM

This article introduces in detail the registration, use and cancellation procedures of Ouyi OKEx account. To register, you need to download the APP, enter your mobile phone number or email address to register, and complete real-name authentication. The usage covers the operation steps such as login, recharge and withdrawal, transaction and security settings. To cancel an account, you need to contact Ouyi OKEx customer service, provide necessary information and wait for processing, and finally obtain the account cancellation confirmation. Through this article, users can easily master the complete life cycle management of Ouyi OKEx account and conduct digital asset transactions safely and conveniently.

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

Currency Trading Network Official Website Collection 2025

Mar 31, 2025 pm 03:57 PM

It ranks among the top in the world, supports all categories of transactions such as spot, contracts, and Web3 wallets. It has high security and low handling fees. A comprehensive trading platform with a long history, known for its compliance and high liquidity, supports multilingual services. The industry leader covers currency trading, leverage, options, etc., with strong liquidity and supports BNB deduction fees.

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

On which platform is web3 transaction?

Mar 31, 2025 pm 07:54 PM

This article lists the top ten well-known Web3 trading platforms, including Binance, OKX, Gate.io, Kraken, Bybit, Coinbase, KuCoin, Bitget, Gemini and Bitstamp. The article compares the characteristics of each platform in detail, such as the number of currencies, trading types (spot, futures, options, NFT, etc.), handling fees, security, compliance, user groups, etc., aiming to help investors choose the most suitable trading platform. Whether it is high-frequency traders, contract trading enthusiasts, or investors who focus on compliance and security, they can find reference information from it.