web3.0

web3.0

As the bull market replenishes 'ammunition', the two major stablecoins issued an additional US$10 billion in 30 days

As the bull market replenishes 'ammunition', the two major stablecoins issued an additional US$10 billion in 30 days

As the bull market replenishes 'ammunition', the two major stablecoins issued an additional US$10 billion in 30 days

Author: Mary Liu, BitpushNews

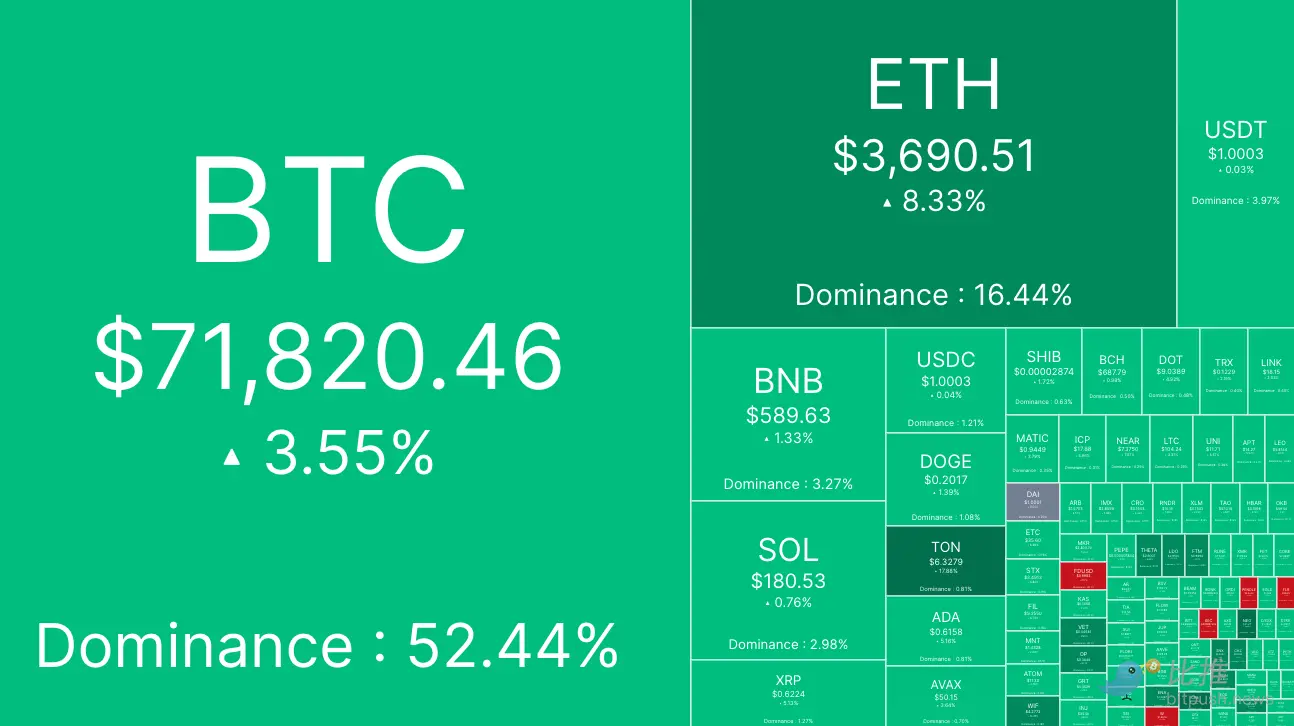

As the halving approaches, Bitcoin started the week strong, surging to over $72,000 in early trading on Monday, well shy of its all-time high Less than 3% points to $73,750. After trading near $69,400 over the weekend, Bitcoin bulls started moving higher in the early hours of Monday morning, breaking through the $71,000 resistance and hitting a high of $72,780 shortly after 8 a.m. ET, market data showed. At press time, Bitcoin was trading at $71,845, up 3.5% in 24 hours.

Other coins rising on Monday include Ethereum (up 8%), meme coin Dogwifhat (up 18%) and Pepe (up 10%).

# Digital asset investment products recorded $646 million in inflows last week, data released by Coinshares showed on Monday. Bitcoin-related investment products remained in focus, with inflows totaling $663 million, while those betting against Bitcoin saw outflows total $9.5 million for the third consecutive week, signaling a slight capitulation among bearish investors.

James Butterfill, head of research at Coinshares, said: "Funds so far this year have reached an all-time high of $13.8 billion, currently well above the $10.6 billion in 2021."

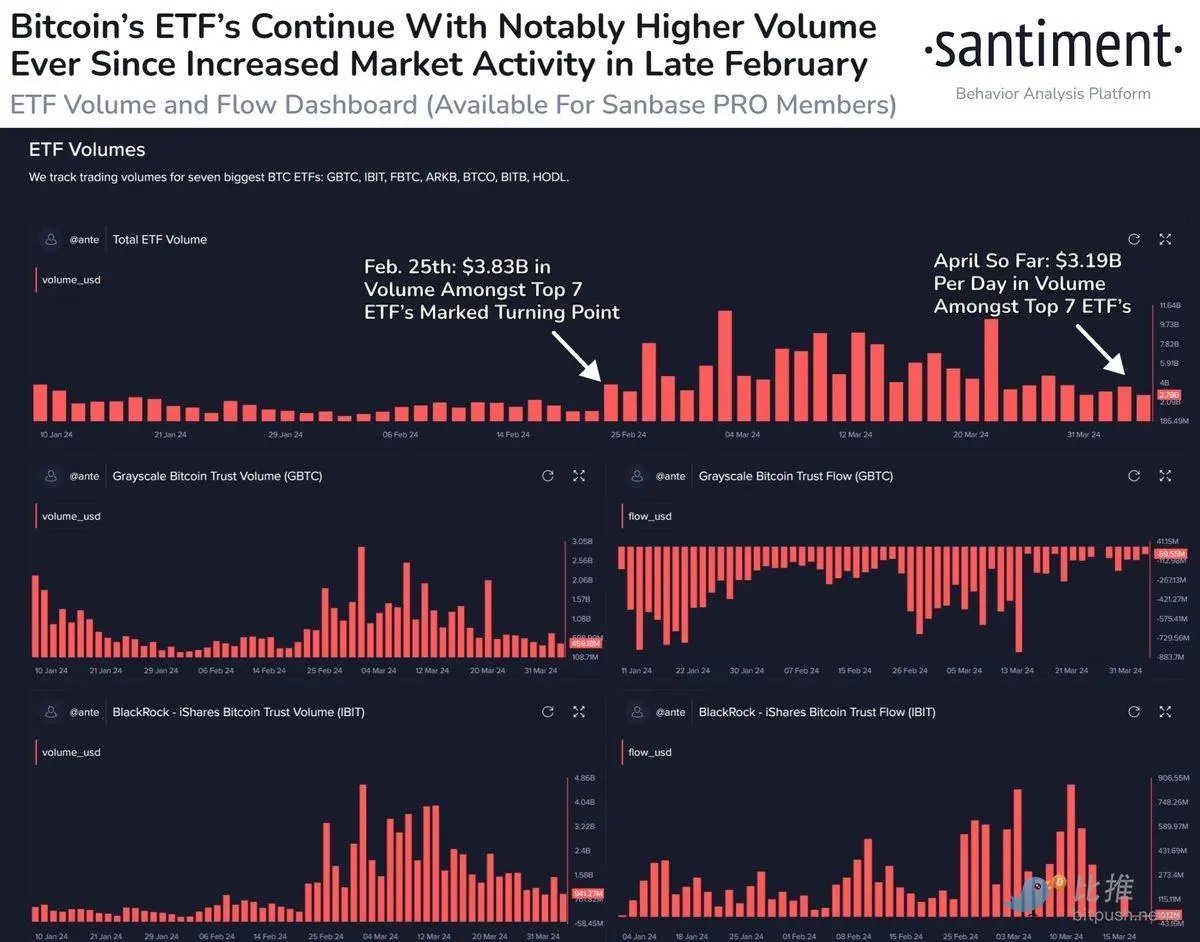

On-chain analytics company Santiment believes that ETF trading activity remains at a relatively active level. Analysts at the company said: "Bitcoin ETF trading volume has not slowed down four weeks after BTC broke through new highs. In G BTC, IBIT, F BTC, ARKB, BTC O, BITB and HODL, trader activity remains significantly higher than The turning point started after retail trading began to pour in at the end of February."

They added: "High activity should continue before the halving on April 19, but ETF trading volume and on-chain trading volume It will be interesting to see whether it drops directly after the halving."

Stablecoin activity suggests bulls are preparing for a rebound

10x Research Research director Markus Thielen said that while Bitcoin price has been trading sideways and consolidating since early March, it could resume its climb soon.

Analysts said in a market update on Monday: "After being sharply bullish since January 25, we became cautious a month ago (March 8) as the market's technical set-up was far away. Returns seem unpredictable over time, trading (cryptocurrency) is about risk reward and knowing when to bet big/small, and the past thirty days have truly been a time for small bets. But that will change soon."

Thielen pointed out: "Bitcoin traded in a symmetrical triangle pattern last month, and according to some historical analysis, 75% of triangle patterns will see a (bull market) continuation pattern and higher prices."

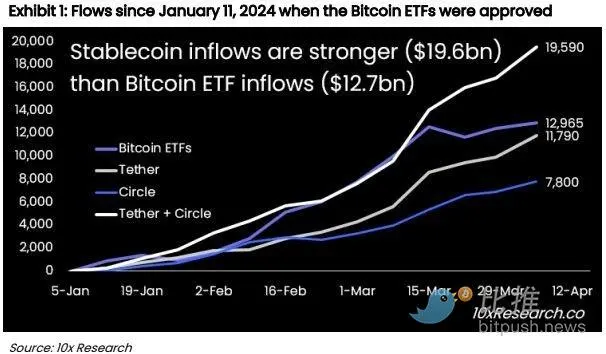

Thielen said stablecoin trading volumes can be a better predictor of future conditions, rather than just focusing on ETF flows or futures data.

He said: "In the past 30 days, we have seen ETFs record net inflows of approximately US$5 billion, and what is more noteworthy is that Tether has a net inflow Of $6.9 billion, Circle minted approximately $3 billion, for a total of $10 billion in new money coming in through stablecoins. While Bitcoin ETF flows have attracted media attention, as opposed to ETFs, stablecoin minting volumes are two times, and may only go long. We recommend paying less attention to Bitcoin ETF flows. Stablecoin issuers are objects to watch and will drive this market higher."

Thielen concluded: "Although we express Concerns about weak ETF flows have been lifted, but the baton has been passed to stablecoins. Tether records a seven-day mint signal of $2.4 billion, one of the highest since the start of this bull run, and fiat is accelerating into crypto In the field, with the symmetrical triangle breakout imminent, we hope to be bullish."

Thielen's analysis shows that based on the current formation, the triangle line pattern "met" on April 18. If it is a bullish breakout, Bitcoin may With the price climbing above $80,000 in the coming weeks, buying at 69,280 with a stop at 65,000 seems "appropriate".

Many cryptocurrency traders expect the Bitcoin halving event to be a pivotal moment in 2024, with a significant impact on the cryptocurrency market. However, analysts at Steno Research expect this to be a "buy the rumor, sell the news" affair. Steno Research predicts that the value of BTC will surge ahead of the halving event. However, within the first 90 days after the halving, its value may “fall below the halving price.”

With only 11 days left until Bitcoin’s halving, sentiment in the crypto ecosystem remains in “extreme greed” territory, according to data provided by Alternative. The overall cryptocurrency market capitalization is currently $2.69 trillion, with Bitcoin’s dominance rate at 52.4%.

The above is the detailed content of As the bull market replenishes 'ammunition', the two major stablecoins issued an additional US$10 billion in 30 days. For more information, please follow other related articles on the PHP Chinese website!

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Dreamweaver CS6

Visual web development tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Hot Topics

1382

1382

52

52

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

okx Ouyi Exchange web version enter link click to enter

Mar 31, 2025 pm 06:21 PM

1. Enter the web version of okx Euyi Exchange ☜☜☜☜☜☜ Click to save 2. Click the link of okx Euyi Exchange app ☜☜☜☜ Click to save 3. After entering the official website, the clear interface provides a login and registration portal. Users can choose to log in to an existing account or register a new account according to their own situation. Whether it is viewing real-time market conditions, conducting transactions, or managing assets, the OKX web version provides a simple and smooth operating experience, suitable for beginners and veterans. Visit OKX official website now for easy experience

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

What is Ouyi for? What is Ouyi

Apr 01, 2025 pm 03:18 PM

OKX is a global digital asset trading platform. Its main functions include: 1. Buying and selling digital assets (spot trading), 2. Trading between digital assets, 3. Providing market conditions and data, 4. Providing diversified trading products (such as derivatives), 5. Providing asset value-added services, 6. Convenient asset management.

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

gate.io registration tutorial

Mar 31, 2025 pm 11:09 PM

This article provides a detailed Gate.io registration tutorial, covering every step from accessing the official website to completing registration, including filling in registration information, verifying, reading user agreements, etc. The article also emphasizes security measures after successful registration, such as setting up secondary verification and completing real-name authentication, and gives tips from beginners to help users safely start their digital asset trading journey.

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

ok official portal web version ok exchange official web version login portal

Mar 31, 2025 pm 06:24 PM

This article details how to use the official web version of OK exchange to log in. Users only need to search for "OK Exchange Official Web Version" in their browser, click the login button in the upper right corner after entering the official website, and enter the user name and password to log in. Registered users can easily manage assets, conduct transactions, deposit and withdraw funds, etc. The official website interface is simple and easy to use, and provides complete customer service support to ensure that users have a smooth digital asset trading experience. What are you waiting for? Visit the official website of OK Exchange now to start your digital asset journey!

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

How to calculate the transaction fee of gate.io trading platform?

Mar 31, 2025 pm 09:15 PM

The handling fees of the Gate.io trading platform vary according to factors such as transaction type, transaction pair, and user VIP level. The default fee rate for spot trading is 0.15% (VIP0 level, Maker and Taker), but the VIP level will be adjusted based on the user's 30-day trading volume and GT position. The higher the level, the lower the fee rate will be. It supports GT platform coin deduction, and you can enjoy a minimum discount of 55% off. The default rate for contract transactions is Maker 0.02%, Taker 0.05% (VIP0 level), which is also affected by VIP level, and different contract types and leverages

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

Binance binance computer version entrance Binance binance computer version PC official website login entrance

Mar 31, 2025 pm 04:36 PM

This article provides a complete guide to login and registration on Binance PC version. First, we explained in detail the steps for logging in Binance PC version: search for "Binance Official Website" in the browser, click the login button, enter the email and password (enable 2FA to enter the verification code) to log in. Secondly, the article explains the registration process: click the "Register" button, fill in the email address, set a strong password, and verify the email address to complete the registration. Finally, the article also emphasizes account security, reminding users to pay attention to the official domain name, network environment, and regularly updating passwords to ensure account security and better use of various functions provided by Binance PC version, such as viewing market conditions, conducting transactions and managing assets.

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

What are the recommended websites for virtual currency app software?

Mar 31, 2025 pm 09:06 PM

This article recommends ten well-known virtual currency-related APP recommendation websites, including Binance Academy, OKX Learn, CoinGecko, CryptoSlate, CoinDesk, Investopedia, CoinMarketCap, Huobi University, Coinbase Learn and CryptoCompare. These websites not only provide information such as virtual currency market data, price trend analysis, etc., but also provide rich learning resources, including basic blockchain knowledge, trading strategies, and tutorials and reviews of various trading platform APPs, helping users better understand and make use of them

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

Official website entrance of major digital currency trading platforms 2025

Mar 31, 2025 pm 05:33 PM

This article recommends ten mainstream cryptocurrency exchanges, including Binance, OKX, Sesame Door (gate.io), Coinbase, Kraken, Bitstamp, Gemini, Bittrex, KuCoin and Bitfinex. These exchanges have their own advantages, such as Binance is known for its largest trading volume and rich currency selection in the world; OKX provides innovative tools such as grid trading and a variety of derivatives; Coinbase focuses on US compliance; Kraken attracts users for its high security and pledge returns; other exchanges have their own characteristics in different aspects such as fiat currency trading, altcoin trading, high-frequency trading tools, etc. Choose an exchange that suits you, and you need to use your own investment experience